Amundi DJIA UCITS ETF: Daily NAV Updates And Their Significance For Investors

Table of Contents

What is the Amundi DJIA UCITS ETF and its NAV?

Defining Net Asset Value (NAV):

The Net Asset Value (NAV) represents the current market value of an ETF's underlying assets, minus any liabilities, divided by the number of outstanding shares. Essentially, it's the price per share if the ETF were to be liquidated. For the Amundi DJIA UCITS ETF, the NAV reflects the collective value of the constituent companies of the Dow Jones Industrial Average. Understanding NAV is fundamental because it directly impacts your investment's worth. Daily changes in the NAV reflect the overall performance of the DJIA and, consequently, your investment.

The Amundi DJIA UCITS ETF and the Dow Jones:

The Amundi DJIA UCITS ETF aims to replicate the performance of the Dow Jones Industrial Average. This means the ETF's portfolio mirrors the DJIA's composition, allowing investors to gain diversified exposure to 30 major American companies. Daily market movements in these 30 companies directly influence the ETF's NAV. If the DJIA rises, the ETF's NAV generally rises, and vice versa. This close tracking provides a straightforward way to participate in the performance of the US blue-chip market.

- UCITS (Undertakings for Collective Investment in Transferable Securities): The UCITS designation ensures the ETF adheres to stringent EU regulatory standards, providing a layer of investor protection.

- Benefits of Investing in the Amundi DJIA UCITS ETF: This ETF offers diversification across major US sectors, low management fees compared to actively managed funds, and easy accessibility through most brokerage platforms.

- Amundi's Role: Amundi, a reputable asset management company, manages the ETF, employing professional expertise to ensure it closely tracks the DJIA.

Accessing Daily NAV Updates for the Amundi DJIA UCITS ETF:

Official Sources for NAV Information:

Reliable sources for daily NAV updates include:

- Amundi's Official Website: Check the official Amundi website for up-to-date information on the ETF's NAV. [Insert Link Here - replace with actual link if available]

- Financial News Websites: Many reputable financial news websites (e.g., Bloomberg, Yahoo Finance, Google Finance) provide real-time or delayed NAV data for ETFs.

- Brokerage Platforms: Your brokerage account will usually display the current NAV of your holdings, often with historical data as well.

Understanding NAV Reporting Time:

The NAV is typically calculated and reported at the end of each trading day. However, there may be slight delays due to factors like market closing times and data processing. These delays are usually minimal, but it's essential to be aware that the NAV you see might not be completely instantaneous.

- Bid and Offer Prices: Remember that the NAV is different from the bid and offer prices you see on trading platforms. The bid price is what a buyer is willing to pay, and the offer price is what a seller is asking. The NAV serves as a benchmark for these prices.

- Time Zone Considerations: The NAV reporting time is usually based on the primary exchange where the ETF trades. Be mindful of time zone differences if you're accessing information from a different region.

The Significance of Daily NAV Updates for Investment Decisions:

Monitoring Performance:

Daily NAV changes provide a real-time snapshot of the ETF's performance. Tracking these changes allows you to monitor how your investment is faring against the Dow Jones Industrial Average and broader market trends. Consistent upward movement indicates positive performance, while downward trends warrant attention and potentially necessitate a review of your investment strategy.

Making Informed Buy/Sell Decisions:

By monitoring the daily NAV, you can make more informed decisions about buying, selling, or holding your investment. A significant drop might signal a potential buying opportunity, while a sustained rise could suggest considering partial profit-taking. However, remember that short-term fluctuations don't necessarily dictate long-term success.

Risk Management:

Tracking the daily NAV is a vital component of effective risk management. Regular monitoring allows you to identify potential risks and adjust your portfolio accordingly. This could involve diversifying your investments or adjusting your investment timeline based on market volatility as reflected in the NAV changes.

- Example Scenarios: A sudden, sharp drop in the NAV might prompt you to reassess your risk tolerance and potentially reduce your exposure. Conversely, consistent positive NAV changes might encourage you to maintain or even increase your position (with consideration for other market factors).

- Long-Term Perspective: While daily NAV changes are informative, it's crucial to focus on long-term trends and your overall investment goals. Short-term fluctuations are common, and reacting to each minor change can be detrimental to long-term investment success.

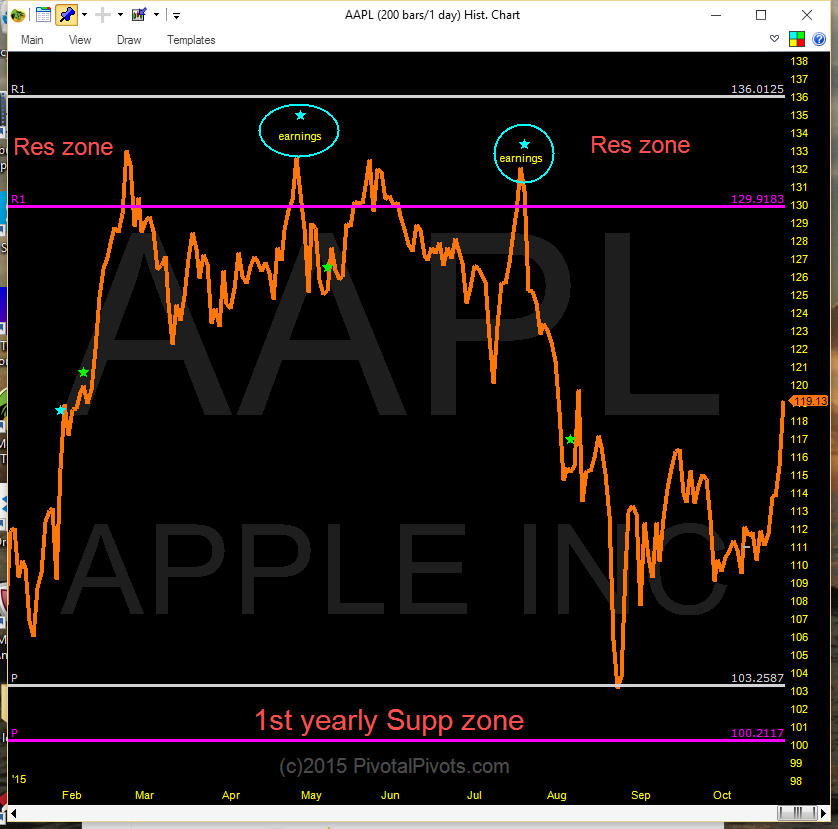

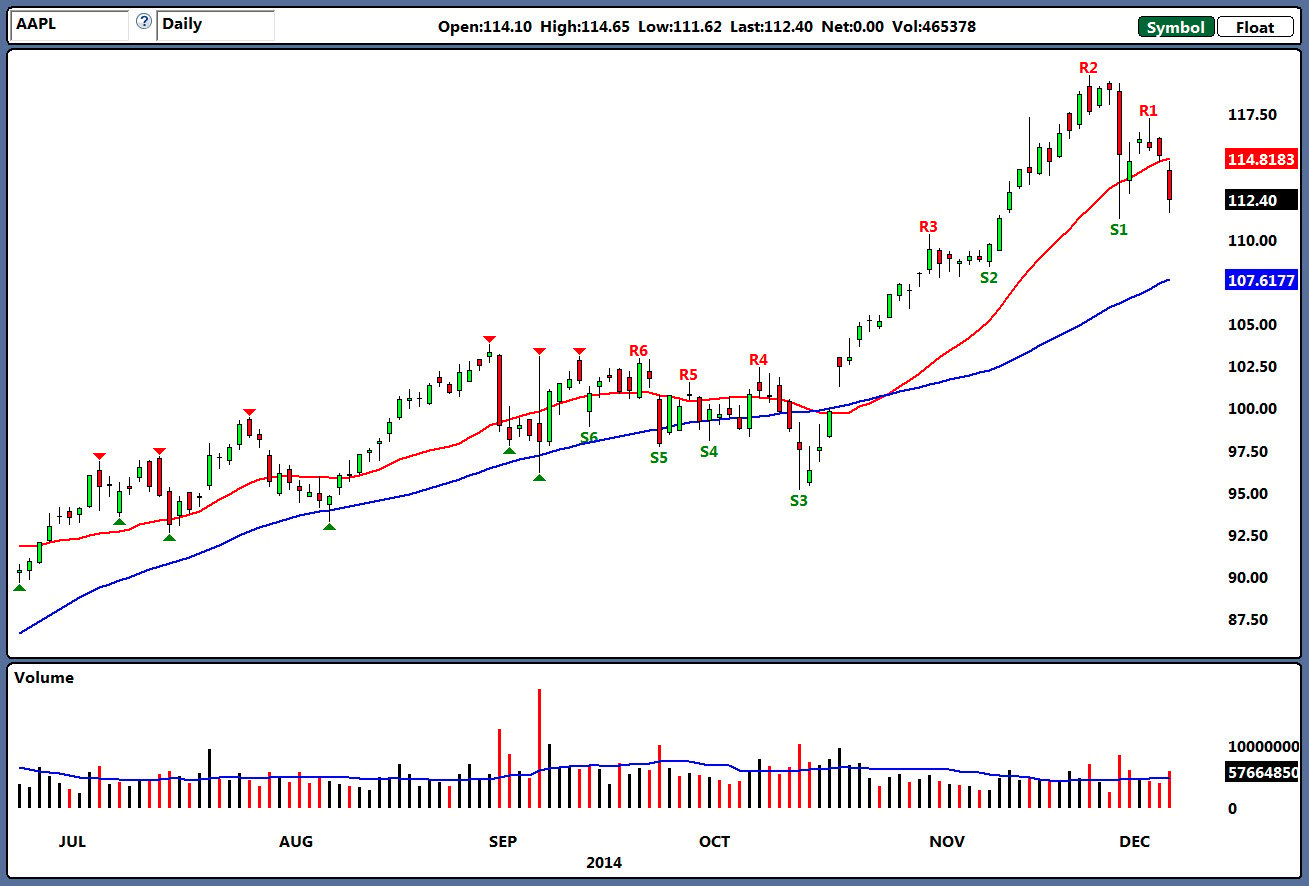

- Visualizing Trends: Utilize charts and graphs to visualize NAV trends over time. This provides a clear picture of the ETF's performance and helps in recognizing patterns and making informed investment choices.

Conclusion:

Understanding daily NAV updates for your Amundi DJIA UCITS ETF investment is vital for informed decision-making. By regularly monitoring the NAV from reliable sources, you can effectively track performance, manage risk, and make strategic buying and selling choices. Remember to consider both short-term fluctuations and long-term trends for a holistic view of your investment. Stay informed about your Amundi DJIA UCITS ETF investment by checking daily NAV updates and conducting further research into the ETF and related investment options. This proactive approach will help you optimize your portfolio and achieve your investment goals.

Featured Posts

-

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025 -

Camunda Con 2025 Amsterdam Orchestrating Your Path To Enhanced Ai And Automation

May 24, 2025

Camunda Con 2025 Amsterdam Orchestrating Your Path To Enhanced Ai And Automation

May 24, 2025 -

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Een Dieper Duik In De Oorzaken

May 24, 2025 -

Porsche Cayenne Gts Coupe Test I Recenzja Suv Marzen

May 24, 2025

Porsche Cayenne Gts Coupe Test I Recenzja Suv Marzen

May 24, 2025 -

Drivers Face Significant Delays On M6 Southbound After Crash

May 24, 2025

Drivers Face Significant Delays On M6 Southbound After Crash

May 24, 2025

Latest Posts

-

Apple Stock Soars I Phone Sales Exceed Expectations In Q2

May 24, 2025

Apple Stock Soars I Phone Sales Exceed Expectations In Q2

May 24, 2025 -

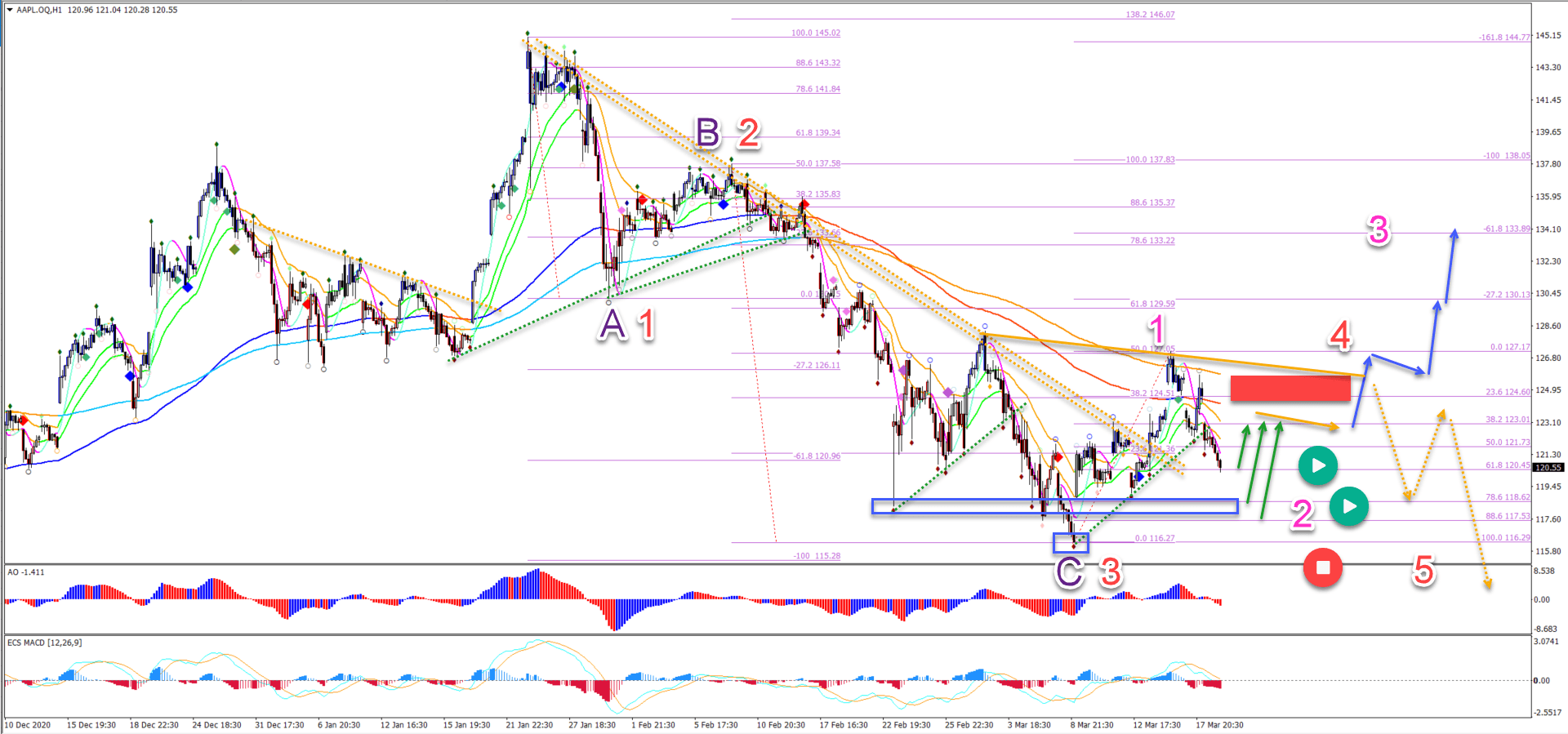

Apple Aapl Stock Where Will The Price Go Next

May 24, 2025

Apple Aapl Stock Where Will The Price Go Next

May 24, 2025 -

Aapl Stock Analysis Of Future Price Levels

May 24, 2025

Aapl Stock Analysis Of Future Price Levels

May 24, 2025 -

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025 -

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025

Apple Stock Aapl Predicting The Next Key Price Levels

May 24, 2025