Apple Stock Soars: IPhone Sales Exceed Expectations In Q2

Table of Contents

Record-Breaking iPhone Sales Drive Growth

The phenomenal success of Apple's Q2 2024 was primarily driven by unexpectedly strong iPhone sales growth. iPhone demand significantly outpaced projections, contributing substantially to the overall positive financial results. Several factors contributed to this success:

- Exceeding Projections: iPhone sales surpassed projected figures by a significant margin – estimates suggest a double-digit percentage increase over the same period last year. This exceeded even the most optimistic analyst predictions, indicating a robust demand for Apple's flagship product.

- Strong Demand for New Models: The strong demand was particularly noticeable for the latest iPhone 15 Pro and iPhone 15 Pro Max models. These phones, boasting advanced features like the A17 Pro chip and improved camera systems, resonated strongly with consumers. This highlights the effectiveness of Apple's product innovation strategy in driving sales.

- Increased Consumer Spending: The robust performance is also attributable to increased consumer spending globally. A healthy global economy, despite some inflationary pressures, boosted consumer confidence, leading to increased purchases of high-value electronics like iPhones.

- Regional Sales Strength: Sales were particularly strong in North America and Asia, indicating a broad appeal across key markets. The success in these regions shows the strength of Apple's brand and its ability to adapt to diverse market conditions.

- Successful Marketing Campaigns: Apple's innovative marketing campaigns, focusing on the advanced capabilities and user experience of the new iPhone models, played a critical role in stimulating consumer demand.

Positive Impact on Overall Apple Financial Performance

The record-breaking iPhone sales had a profoundly positive impact on Apple's overall financial performance. The Q2 2024 results showcased significant growth across key financial metrics:

- Revenue Surge: Apple reported a substantial increase in total revenue compared to Q2 2023. The exact figures, to be released officially, are eagerly anticipated by investors. This revenue boost will significantly affect the Apple stock price.

- Increased Net Income: The higher revenue translated directly into a substantial increase in net income, boosting earnings per share (EPS) and enhancing shareholder value. This underlines the profitability of the iPhone sales and the overall efficiency of Apple's business model.

- Improved Profit Margin: The strong iPhone sales also positively impacted Apple's profit margin, indicating efficient cost management and pricing strategies. This is a key indicator of the company's financial health and long-term sustainability.

- Shareholder Value Enhancement: The impressive Q2 2024 results have demonstrably increased shareholder value, potentially impacting dividend payouts. This increase in value makes Apple stock even more attractive to investors.

Analyst Reactions and Future Stock Predictions

The positive Q2 earnings report has been met with overwhelmingly positive reactions from Wall Street analysts. Many have revised their Apple stock forecasts upward:

- Upward Revisions to Price Targets: Several prominent financial analysts have increased their price targets for Apple stock, reflecting their confidence in the company's future performance. This indicates a strong belief in Apple's continued growth trajectory.

- Positive Outlook: Analyst comments consistently highlight the strong demand for iPhones and the potential for continued growth in future quarters. Many predict further gains for Apple stock in the near future.

- Impact of Upcoming Product Launches: The anticipation of upcoming product launches, including potential new iPhones and other devices, further contributes to the positive outlook. These launches are expected to sustain the momentum and drive further growth in the coming quarters.

- Market Capitalization: Apple’s market capitalization has seen a significant boost following the release of the positive Q2 earnings, further cementing its position as one of the world's most valuable companies.

Risks and Considerations for Investors

While the outlook for Apple stock is currently very positive, investors should always consider potential risks:

- Market Volatility: The stock market is inherently volatile, and Apple stock is no exception. Economic downturns or broader market corrections could negatively impact the stock price. Diversification is key for mitigating risk.

- Economic Uncertainty: Global economic uncertainty, such as inflation or recession, could affect consumer spending and, consequently, iPhone sales. Monitoring macroeconomic trends is crucial for informed investing.

- Increased Competition: Apple faces increasing competition in the smartphone market. The emergence of new competitors and innovative technologies could challenge Apple's dominance. Staying aware of competitive dynamics is important.

- Supply Chain Issues: Global supply chain disruptions could potentially impact Apple's production and sales. Monitoring any potential disruptions is essential for understanding risk.

Conclusion

Apple's Q2 2024 earnings report paints a picture of robust growth, largely driven by unexpectedly high iPhone sales. This exceptional performance has significantly boosted Apple stock, prompting positive reactions from analysts and investors alike. However, investors should always consider the inherent risks associated with any stock investment. The strong financial performance coupled with positive future predictions makes Apple stock a compelling investment option, but careful research and understanding of potential risks remain crucial.

Call to Action: Stay informed about the latest developments in Apple stock and the overall tech market to make informed investment decisions. Learn more about Apple’s financial performance and future outlook to capitalize on opportunities in the dynamic world of Apple stock and its related markets, including other Apple products and services.

Featured Posts

-

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025 -

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025

Escape To The Country Top Destinations For A Tranquil Getaway

May 24, 2025 -

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Mia Farrow Michael Caine And An Ex Husband Behind The Scenes Drama

May 24, 2025

Mia Farrow Michael Caine And An Ex Husband Behind The Scenes Drama

May 24, 2025 -

Universal Vs Disney The 7 Billion Theme Park Thats Changing The Game

May 24, 2025

Universal Vs Disney The 7 Billion Theme Park Thats Changing The Game

May 24, 2025

Latest Posts

-

Erkek Burclari Ve Babalik Guevenilirlik Calkanti Ve Sadakat

May 24, 2025

Erkek Burclari Ve Babalik Guevenilirlik Calkanti Ve Sadakat

May 24, 2025 -

Babalikta En Zorlu Erkek Burclari Gercekler Ve Beklentiler

May 24, 2025

Babalikta En Zorlu Erkek Burclari Gercekler Ve Beklentiler

May 24, 2025 -

En Cok Yakan Erkek Burclari Babalik Rollerinde Basari Ve Zorluklar

May 24, 2025

En Cok Yakan Erkek Burclari Babalik Rollerinde Basari Ve Zorluklar

May 24, 2025 -

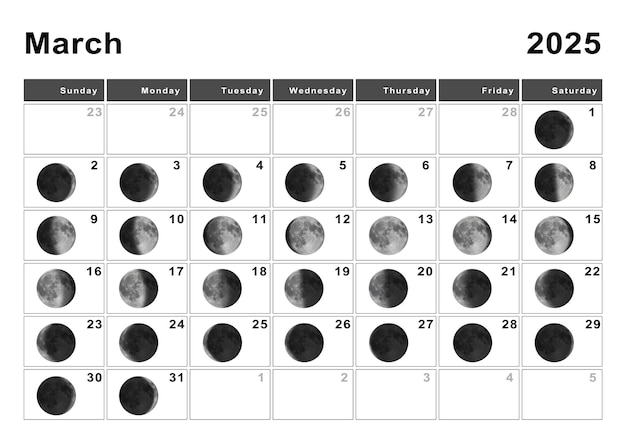

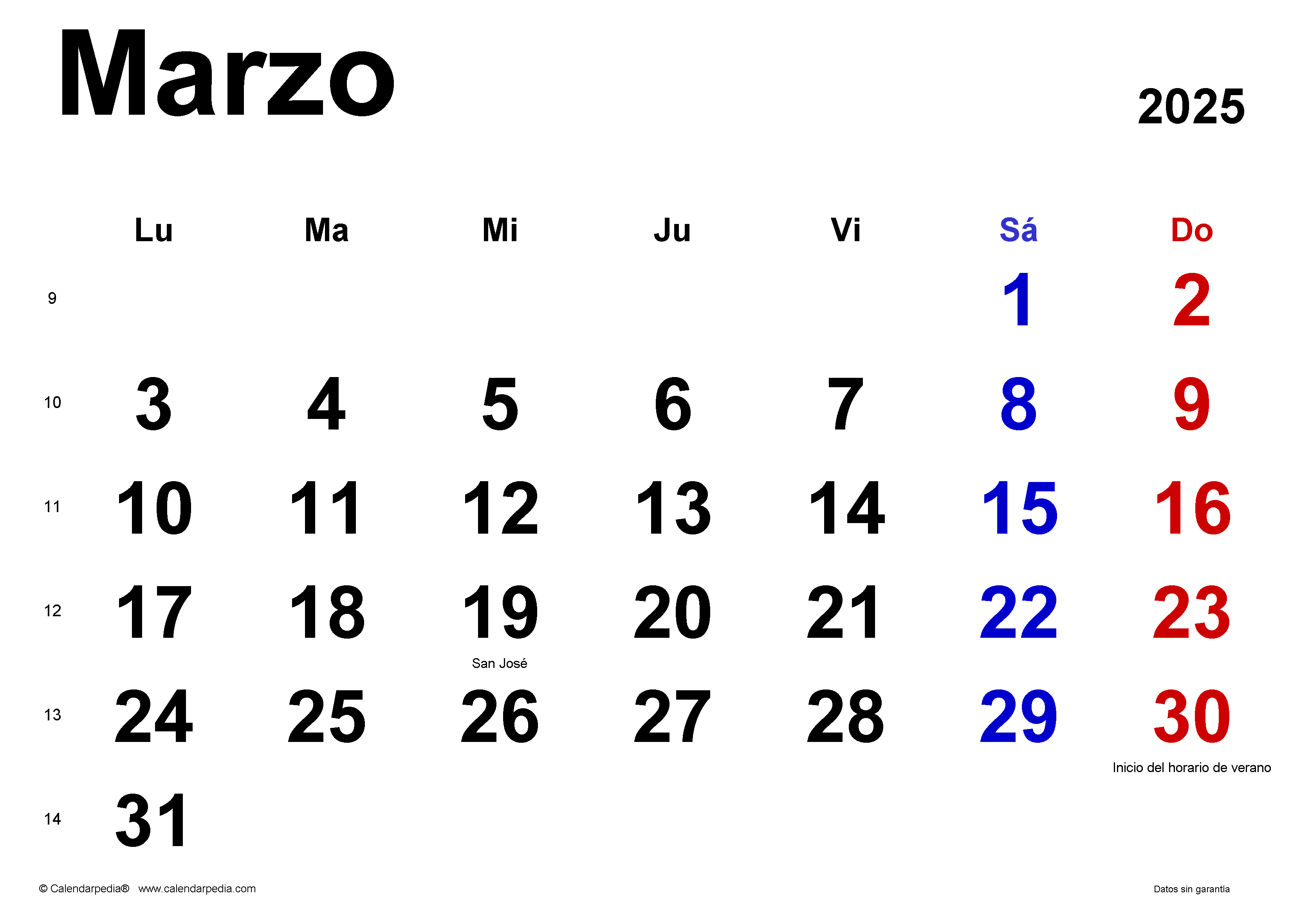

Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025 Todos Los Signos

May 24, 2025

Tu Horoscopo Semana Del 4 Al 10 De Marzo De 2025 Todos Los Signos

May 24, 2025 -

Horoscopo De La Semana Del 4 Al 10 De Marzo De 2025 Consulta Tu Signo

May 24, 2025

Horoscopo De La Semana Del 4 Al 10 De Marzo De 2025 Consulta Tu Signo

May 24, 2025