Apple (AAPL) Stock: Where Will The Price Go Next?

Table of Contents

Analyzing Apple's Current Financial Performance

Apple's financial health is a primary driver of its stock price. Understanding its revenue streams, growth trajectory, and profit margins is essential for any Apple stock forecast.

Revenue and Earnings Growth

Apple's recent financial reports paint a mixed picture. While the iPhone remains a dominant revenue generator, the Services segment continues its impressive growth, demonstrating the company's success in building a recurring revenue model. Year-over-year growth varies across sectors, reflecting the cyclical nature of hardware sales and the consistent expansion of its services ecosystem.

- iPhone Sales: While iPhone sales have shown some fluctuations, they remain a significant contributor to overall revenue, particularly with the release of new models. Analyzing unit sales alongside average selling prices (ASP) provides a more comprehensive understanding of iPhone's performance.

- Services Revenue: This segment, encompassing Apple Music, iCloud, App Store, and other services, consistently demonstrates strong growth, suggesting a resilient and expanding revenue stream less susceptible to market downturns than hardware sales.

- Wearables, Home, and Accessories: This segment continues to demonstrate healthy growth, showcasing Apple's successful expansion into adjacent markets.

- Earnings Per Share (EPS): Analyzing EPS provides insights into the profitability of Apple on a per-share basis, offering a vital metric for investors evaluating the Apple stock price. Comparing year-over-year EPS changes helps in gauging the company's financial health and predicting future earnings.

Innovation and New Product Launches

Apple's consistent innovation is key to its long-term success and a major influence on the AAPL stock price. The pipeline of upcoming products and services, particularly in areas like augmented reality (AR) and virtual reality (VR), holds significant potential.

- New iPhones: Annual iPhone releases remain a major catalyst for Apple stock movements. Anticipation and demand for new models significantly impact short-term stock price fluctuations.

- AR/VR Headset: The potential launch of an Apple-branded AR/VR headset could be a game-changer, potentially opening a new market and driving substantial revenue growth. However, the success of this venture will hinge on product acceptance and market adoption.

- Apple Silicon and Mac Transition: The ongoing transition to Apple Silicon chips for Macs continues to deliver performance improvements and enhances Apple's control over its hardware and software ecosystems, which is positive for the Apple stock prediction.

Supply Chain and Manufacturing

Geopolitical events and global supply chain disruptions can impact Apple's production and delivery times, subsequently influencing the AAPL investment outlook.

- Manufacturing Base: Apple's reliance on manufacturing hubs in China makes it vulnerable to geopolitical risks and potential disruptions to production. Diversifying its manufacturing base is a critical long-term consideration.

- Component Shortages: The impact of global chip shortages and other supply chain bottlenecks on Apple's production capacity needs to be carefully monitored as this directly impacts the Apple stock price.

- Logistics and Transportation: Efficient logistics and transportation networks are vital for Apple's timely delivery of products to consumers worldwide. Any disruptions in these areas can impact sales and profitability.

Assessing Market Conditions and External Factors

Beyond Apple's internal performance, external factors significantly affect the AAPL stock price.

Macroeconomic Trends

Global economic conditions heavily influence investor sentiment and market performance.

- Interest Rates: Rising interest rates can increase borrowing costs for companies and reduce consumer spending, potentially impacting Apple's sales and profitability. This influences the Apple stock prediction.

- Inflation: High inflation erodes consumer purchasing power, potentially affecting demand for Apple products and services.

- Recession Risks: The possibility of a global recession significantly impacts investor confidence and can lead to decreased investment in riskier assets, such as Apple stock.

Competitive Landscape

Apple faces stiff competition in various market segments.

- Smartphone Market: Samsung and other Android manufacturers remain formidable competitors, vying for market share. Apple’s pricing strategies and innovative features are crucial for maintaining its competitive edge.

- Wearables Market: Companies like Fitbit, Garmin, and Samsung pose significant competition in the wearables market, demanding continuous innovation from Apple to retain its market leadership.

- Services Market: Google and other tech giants compete fiercely in the cloud storage, music streaming, and app store markets, requiring Apple to continually enhance its services offerings to stay competitive.

Investor Sentiment and Market Volatility

Investor sentiment and overall market volatility play a significant role in shaping the Apple stock price.

- Analyst Ratings: Tracking analyst ratings and price targets provides insights into the market's overall view on Apple's future performance and can impact investment decisions.

- Trading Volume: High trading volume can suggest increased investor interest and potentially greater price volatility. Conversely, low volume might indicate decreased interest.

- News Events: Significant news events, positive or negative, can trigger immediate and substantial changes in Apple stock prices.

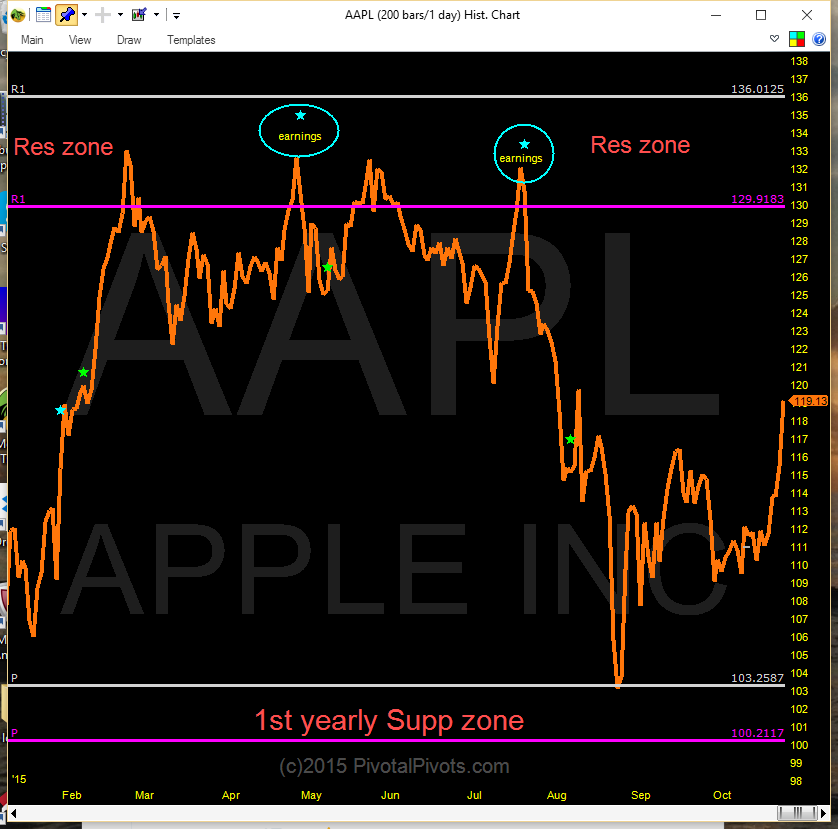

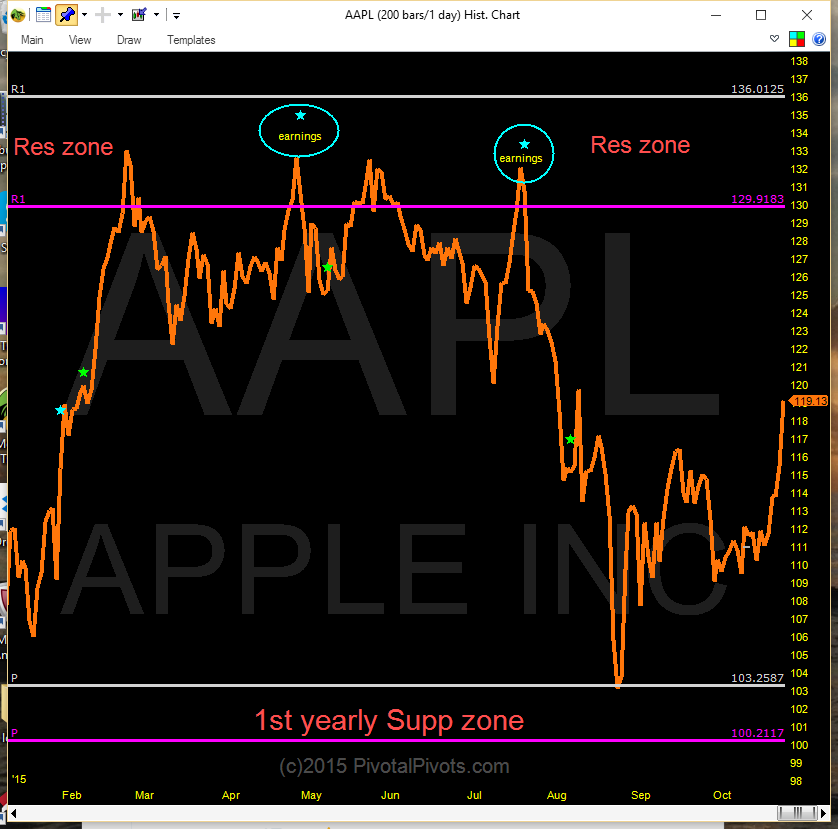

Potential Scenarios for Apple's Stock Price

Based on the factors discussed above, several scenarios are possible for Apple's stock price.

Bullish Case

A bullish scenario for Apple stock involves sustained revenue growth driven by successful new product launches, particularly in areas such as AR/VR, continued expansion of the services segment, and positive macroeconomic conditions. Strong consumer demand and positive investor sentiment contribute to a significant increase in the AAPL stock price.

- Strong financial performance exceeding expectations.

- Successful product launches that generate significant hype and demand.

- A stable or improving global economic climate that bolsters investor confidence.

Bearish Case

A bearish scenario involves weaker-than-expected financial performance, supply chain disruptions, intensifying competition, and negative macroeconomic headwinds. Reduced consumer spending and a decline in investor confidence contribute to a drop in the AAPL share price.

- Disappointing sales figures for new products.

- Significant supply chain disruptions impacting production and delivery.

- Increased competition impacting market share and pricing.

- An economic downturn impacting consumer spending and investor confidence.

Neutral Case

A neutral outlook for the Apple stock price incorporates a blend of positive and negative factors. Moderate revenue growth, moderate competition, and stable macroeconomic conditions result in a relatively flat price movement or a modest increase within a defined range.

- Consistent financial performance in line with analyst expectations.

- Steady sales of existing products and moderate success of new product launches.

- A relatively stable global economic environment with manageable risks.

Conclusion

Predicting the future price of Apple (AAPL) stock involves carefully evaluating its financial performance, assessing the competitive landscape, and analyzing prevailing macroeconomic conditions. While a bullish scenario is possible with continued innovation and strong consumer demand, a bearish scenario cannot be ruled out given potential risks such as supply chain disruptions or a global economic downturn. A neutral case, characterized by moderate growth and stability, seems most probable. Remember, this analysis provides a framework for your own research. Conduct your own thorough due diligence, consider your personal risk tolerance and investment goals before making any investment decisions related to Apple (AAPL) stock. Explore further resources like financial news websites and analyst reports for a deeper dive into Apple stock and its future prospects. Understanding the factors influencing Apple (AAPL) stock price is key to successful investing.

Featured Posts

-

Apple Q2 Earnings Preview Stock Price Under Pressure

May 24, 2025

Apple Q2 Earnings Preview Stock Price Under Pressure

May 24, 2025 -

Olivia Rodrigo And The 1975 Join Glastonbury 2025s Star Studded Lineup

May 24, 2025

Olivia Rodrigo And The 1975 Join Glastonbury 2025s Star Studded Lineup

May 24, 2025 -

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025

Kyle Walker Peters Transfer Leeds United Initiate Contact

May 24, 2025 -

End Of The Penny Us To Stop Circulating Pennies By 2026

May 24, 2025

End Of The Penny Us To Stop Circulating Pennies By 2026

May 24, 2025 -

Conchita Wursts Esc 2025 Concert Eurovision Village With Jj

May 24, 2025

Conchita Wursts Esc 2025 Concert Eurovision Village With Jj

May 24, 2025

Latest Posts

-

16 Mart Burcu Ve Yuekselen Burc Uyumu

May 24, 2025

16 Mart Burcu Ve Yuekselen Burc Uyumu

May 24, 2025 -

Hangi Burc 16 Mart Dogum Tarihine Goere Burc Analizi

May 24, 2025

Hangi Burc 16 Mart Dogum Tarihine Goere Burc Analizi

May 24, 2025 -

Mayis Ta Ask Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025

Mayis Ta Ask Bu 3 Burc Icin Romantik Bir Ay

May 24, 2025 -

16 Mart Ta Dogmus Olanlarin Burc Oezellikleri

May 24, 2025

16 Mart Ta Dogmus Olanlarin Burc Oezellikleri

May 24, 2025 -

Ask Kapida Mayis Ayinda Romantizmi Yasayacak 3 Burc

May 24, 2025

Ask Kapida Mayis Ayinda Romantizmi Yasayacak 3 Burc

May 24, 2025