Apple Stock (AAPL): Key Price Levels To Watch

Table of Contents

Understanding Support and Resistance Levels in Apple Stock (AAPL)

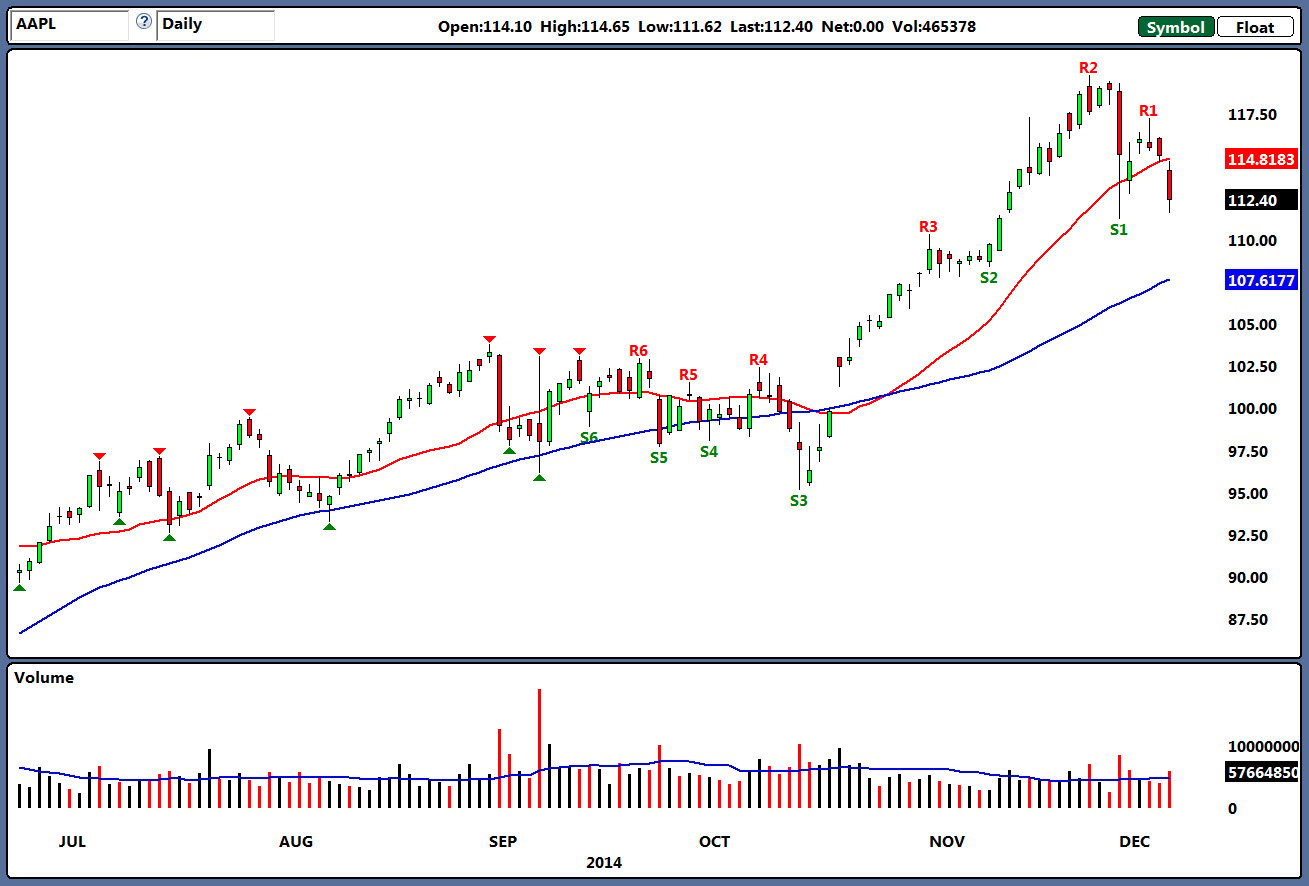

Support and resistance levels represent price zones where the Apple stock (AAPL) price has historically struggled to break through. Support levels act as a floor, where buying pressure tends to outweigh selling pressure, preventing further price declines. Conversely, resistance levels act as a ceiling, where selling pressure often overpowers buying pressure, hindering upward price movements.

Analyzing historical AAPL charts reveals several significant support and resistance levels. These levels are often formed by previous highs and lows, creating visually identifiable zones on the price chart.

-

Recent Significant Support Levels: For example, let's say a previous low of $140 acted as robust support in the past. This level might again become significant should the price approach it. Another example could be the 200-day moving average, often acting as a key support zone. (Note: Actual levels require up-to-date chart analysis.)

-

Recent Significant Resistance Levels: Similarly, prior highs like $180 might function as resistance. If the price approaches this level, a significant increase in selling pressure is often observed. A major resistance level could also be a psychologically significant round number, as discussed further below. (Note: Actual levels require up-to-date chart analysis.)

-

Influence on Future Price Movements: These support and resistance levels act as potential turning points. A break above resistance often signals a bullish trend, while a break below support suggests a bearish trend. However, it is important to remember that these are not guaranteed predictions, and the context of other indicators should be considered.

(Insert Chart Here: A chart illustrating recent support and resistance levels for AAPL)

Analyzing Apple Stock (AAPL) Moving Averages

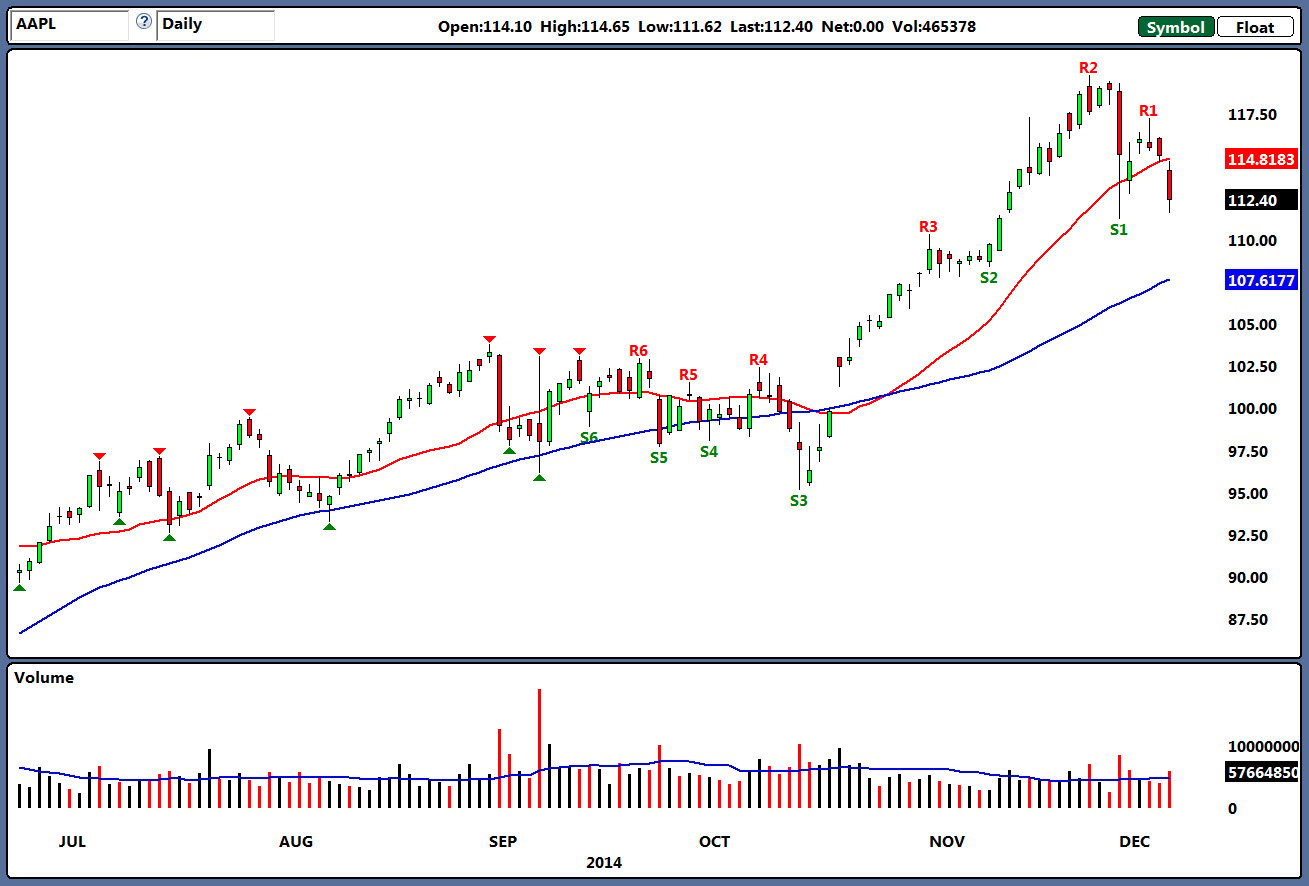

Moving averages smooth out price fluctuations, revealing underlying trends in Apple Stock (AAPL). They are calculated using a set period of past prices (e.g., 50 days or 200 days). The most commonly used are:

-

50-Day Moving Average: Provides a shorter-term trend indication.

-

200-Day Moving Average: Provides a longer-term trend indication.

The interaction of these moving averages provides valuable signals:

-

Golden Cross: When the 50-day moving average crosses above the 200-day moving average, it often suggests a bullish signal.

-

Death Cross: The opposite—when the 50-day moving average crosses below the 200-day moving average—often signals a bearish trend.

-

Moving Averages and Support/Resistance: Moving averages often coincide with support and resistance levels, strengthening their significance. For instance, the 200-day moving average frequently acts as a crucial support level.

(Insert Chart Here: A chart illustrating AAPL's 50-day and 200-day moving averages.)

Key Psychological Price Levels for Apple Stock (AAPL)

Psychological price levels in Apple Stock (AAPL) are round numbers (e.g., $150, $175, $200) that hold significant psychological weight for investors. These levels often act as strong support or resistance because investors tend to place buy or sell orders at these easily recognizable numbers.

-

Current/Potential Key Psychological Levels: Determining these requires analyzing the current market context and recent price action. (Note: Actual levels require up-to-date chart analysis.)

-

Impact on Investor Sentiment: Approaching a psychological level can trigger increased trading activity, as investors react to the perceived significance of these price points.

-

Historical Examples: Observe past instances where AAPL's price reacted strongly to hitting a psychological level. (Note: This requires historical price data analysis.)

(Insert Chart Here: A chart highlighting key psychological price points for AAPL.)

Factors Influencing Apple Stock (AAPL) Price Levels

Several factors impact Apple Stock (AAPL) price levels beyond technical analysis:

-

Macroeconomic Factors: Interest rate changes, inflation, and overall economic growth significantly affect investor sentiment and market valuations.

-

Company-Specific Factors: New product releases, earnings reports, and management decisions directly impact AAPL's stock price. Positive news tends to drive prices up, while negative news can lead to declines.

-

Industry-Specific Factors: Competition from other tech companies, technological advancements, and regulatory changes within the tech sector influence AAPL's performance.

-

Impact on Analysis: These factors can shift support and resistance levels, alter moving average trajectories, and even influence investor reactions to psychological price points. Investors need to integrate these elements into their overall analysis.

Conclusion: Making Informed Decisions About Apple Stock (AAPL)

Understanding key price levels – support and resistance, moving averages, and psychological levels – is crucial for informed Apple Stock (AAPL) investing. However, remember to always consider macroeconomic, company-specific, and industry-specific factors. By carefully monitoring these key price levels and considering the influencing factors, you can develop a more robust strategy for investing in Apple Stock (AAPL). Continue researching and always practice responsible investing.

Featured Posts

-

Bbc Radio 1 Big Weekend Tickets Application Process Explained

May 24, 2025

Bbc Radio 1 Big Weekend Tickets Application Process Explained

May 24, 2025 -

Porsche

May 24, 2025

Porsche

May 24, 2025 -

Poor Glastonbury 2025 Headliners Leave Fans Furious

May 24, 2025

Poor Glastonbury 2025 Headliners Leave Fans Furious

May 24, 2025 -

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trumps Imprisonment For Deporting Venezuelan Gang Members

May 24, 2025 -

Analyse Snelle Markt Draai Europese Aandelen Toekomstige Richting

May 24, 2025

Analyse Snelle Markt Draai Europese Aandelen Toekomstige Richting

May 24, 2025

Latest Posts

-

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025

Iste En Tasarruflu 3 Burc Ve Harcama Aliskanliklari

May 24, 2025 -

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025

En Tutumlu 3 Burc Paranizi Nasil Koruyorlar

May 24, 2025 -

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025

Financial Strain Impacts Auto Theft Prevention Measures Across Canada

May 24, 2025 -

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025

Londons Odd Burger A New Vegan Option At 7 Eleven In Canada

May 24, 2025 -

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025