Apple Stock (AAPL): Predicting The Next Key Price Levels

Table of Contents

Analyzing Apple's Recent Financial Performance & Future Growth Prospects

Apple's financial health is a cornerstone of any AAPL stock forecast. Understanding its revenue streams and growth prospects is crucial for predicting future price movements.

Revenue & Earnings Growth

Examining Apple's recent quarterly and annual reports reveals key insights into its performance. Let's look at some key metrics:

- iPhone Sales: The iPhone remains the flagship product, contributing significantly to Apple's revenue. Recent sales figures, along with predictions for upcoming iPhone releases, are vital for AAPL Stock Price Prediction. Any significant decline or surge in iPhone sales directly impacts the overall Apple Stock Price Target.

- Services Revenue: Apple's services segment (including Apple Music, iCloud, Apple TV+, and App Store revenue) demonstrates consistent growth and contributes a substantial portion to overall revenue. This recurring revenue stream provides stability and is a key factor in AAPL Stock Forecast.

- Wearables, Home, and Accessories: This category, encompassing Apple Watch, AirPods, and other accessories, shows strong growth potential, further diversifying Apple's revenue streams and contributing to long-term Apple Investment potential.

- EPS and Profit Margins: Tracking earnings per share (EPS) and profit margins helps assess Apple's profitability and efficiency. Positive surprises compared to analyst expectations usually lead to a rise in the Apple Stock Price.

Any significant changes in Apple's business strategy, such as increased investment in R&D or expansion into new markets, will also impact future growth.

Innovation and New Product Launches

Apple's history of innovation is a crucial factor in any AAPL Stock Forecast. Upcoming product launches directly influence the Apple Stock Price Target.

- New iPhones: The annual iPhone release cycle is a major event for Apple, often driving significant short-term price movements. Speculation surrounding new features and technological advancements significantly affects investor sentiment.

- Macs, iPads, and other Products: Updates to Macs, iPads, and other products contribute to Apple's overall revenue and influence investor confidence in the long-term Apple Investment.

- Services Expansion: Further expansion into the services sector, such as new subscription offerings or improved existing services, can boost recurring revenue and contribute to stable growth.

- Expansion into New Markets: Apple's ability to expand into new markets and demographics will significantly influence the Apple Stock Price Prediction.

Analyzing the competitive landscape and Apple's ability to maintain its market leadership is critical for predicting future performance.

Assessing Market Sentiment & External Factors

External factors play a crucial role in influencing the Apple Stock Price.

Macroeconomic Conditions

Global economic conditions significantly impact consumer spending and, consequently, Apple's sales.

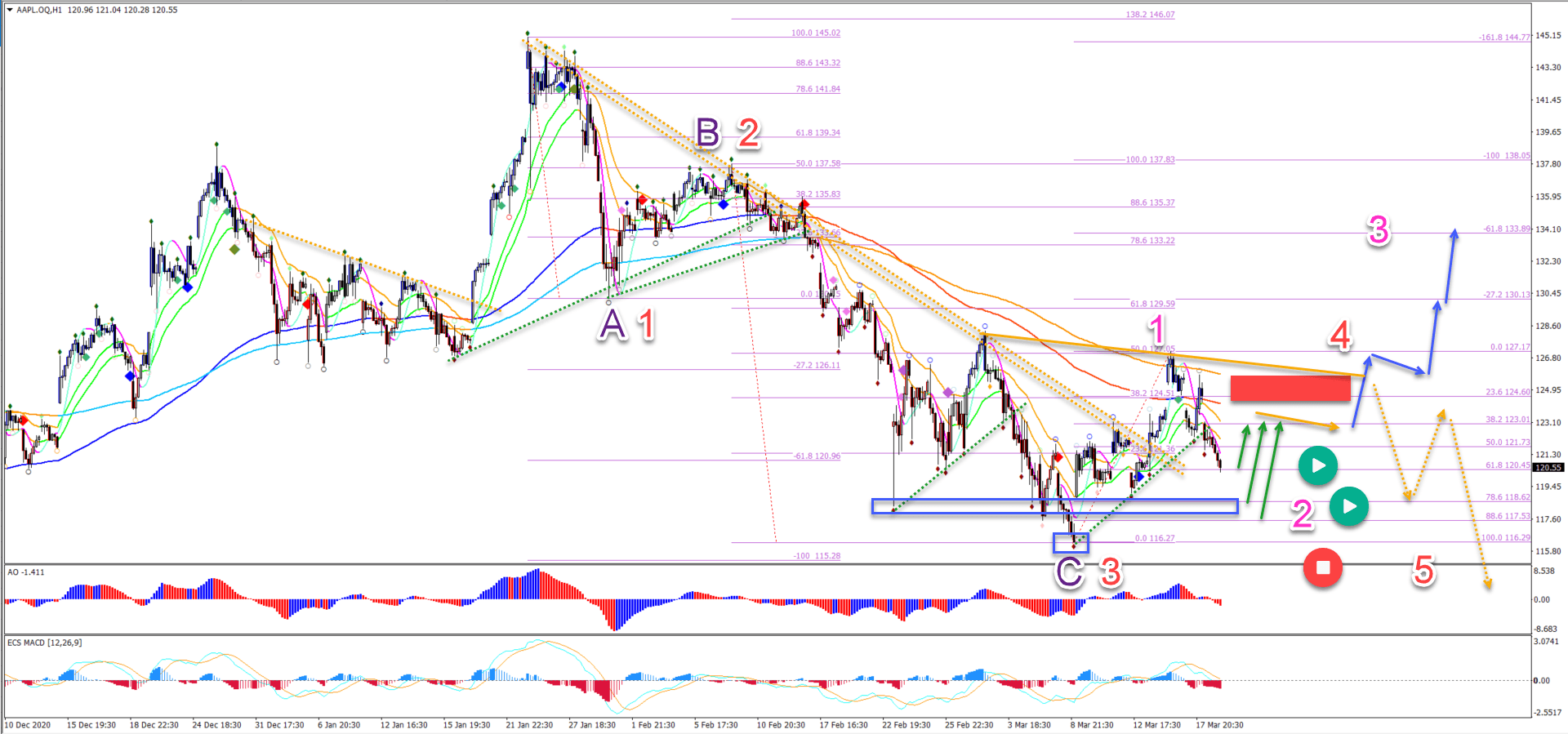

- Inflation and Interest Rates: High inflation and rising interest rates can dampen consumer spending, potentially impacting Apple's sales and the Apple Stock Price.

- Recessionary Fears: Concerns about a potential recession often lead to decreased investor confidence and can negatively affect the Apple Stock Price Target.

- Geopolitical Events: Global political instability and trade disputes can disrupt supply chains and affect Apple's operations, influencing investor sentiment and Apple Stock Price Prediction.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment is crucial for gauging the market's perception of Apple.

- Analyst Ratings: Tracking buy, sell, and hold ratings from major financial analysts provides a consensus view on Apple's stock. A shift towards more buy ratings often signals increased optimism and could push the Apple Stock Price upward.

- Social Media Sentiment: Analyzing social media discussions and news coverage can provide insights into public opinion and expectations towards Apple and its products. This contributes to a more holistic AAPL Stock Forecast.

Significant shifts in investor sentiment, either positive or negative, can drive significant price changes.

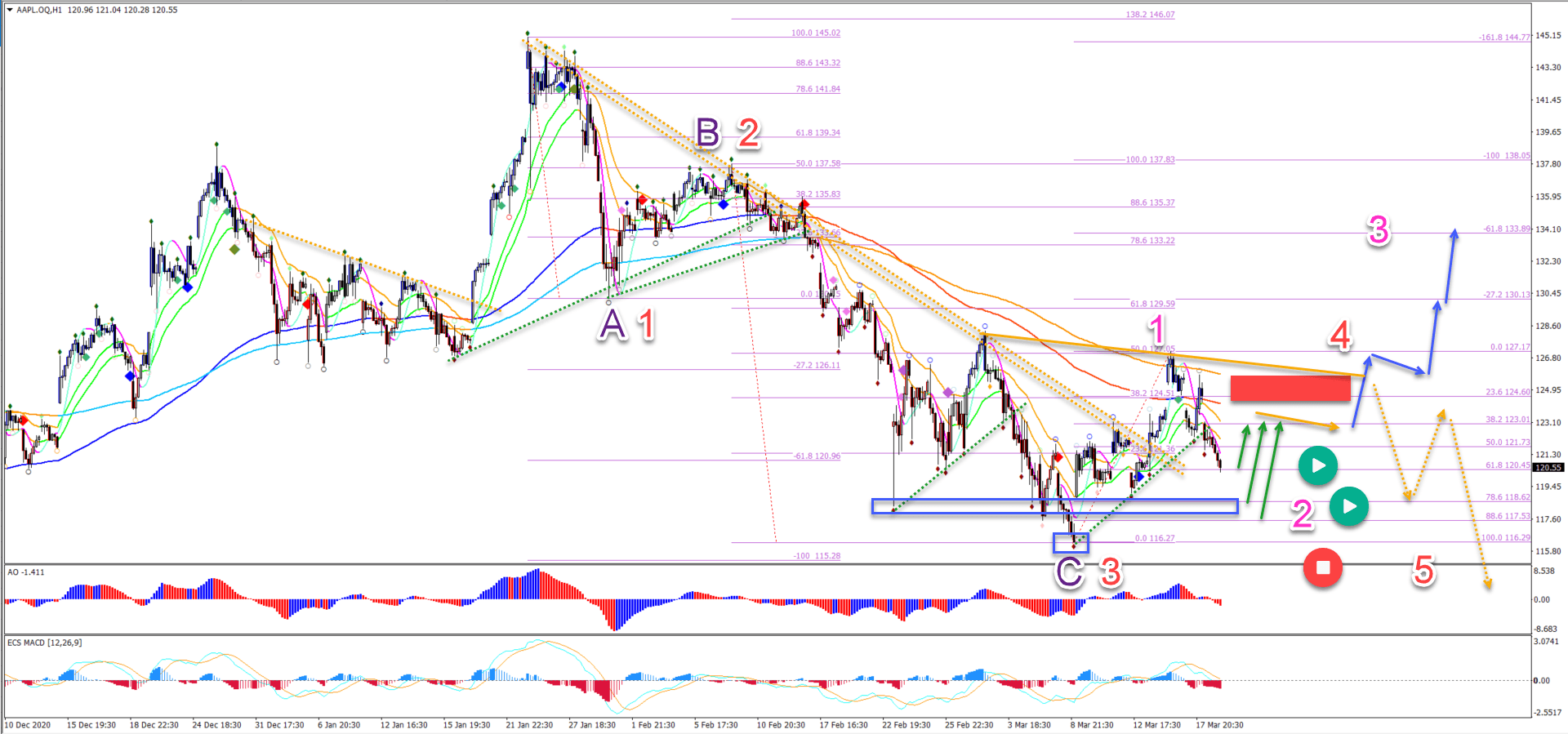

Technical Analysis of AAPL Stock Chart

Technical analysis provides another lens through which to view potential Apple Stock Price movements.

Key Support and Resistance Levels

Identifying key support and resistance levels on the AAPL stock chart helps predict potential price reversals.

- Moving Averages: Using moving averages (e.g., 50-day, 200-day) can identify trends and potential breakout points. A break above a significant resistance level often signals a bullish trend.

- Trendlines: Drawing trendlines on the chart helps identify the overall direction of the stock price and potential support/resistance levels.

- Technical Indicators: Other technical indicators like RSI, MACD, and Bollinger Bands can provide further insights into momentum and potential price reversals.

Chart Patterns and Trading Volume

Recognizing chart patterns can offer clues about future price movements.

- Head and Shoulders, Double Tops/Bottoms: These are classic chart patterns that often signal trend reversals.

- Flags and Pennants: These patterns suggest a temporary pause in a trend before a continuation.

- Trading Volume: Analyzing trading volume alongside price movements can confirm the strength of a trend. High volume during a price breakout usually indicates strong conviction.

Conclusion

Predicting the precise future price of Apple Stock (AAPL) is impossible. However, by analyzing Apple's financial performance, market sentiment, and technical indicators, we can identify potential scenarios and key price levels. While the analysis presented suggests potential areas of support and resistance, the inherent uncertainty of the market demands ongoing research and awareness. Remember, factors like unexpected news, changes in consumer behavior, and global economic shifts can impact the Apple Stock Price Target unexpectedly.

While predicting the future is inherently uncertain, the insights presented in this article offer a framework for informed decision-making regarding your Apple Stock (AAPL) investments. Continue researching and stay updated on market trends to refine your approach to AAPL stock and other tech stock investments. Remember to always conduct your own thorough research and consider consulting a financial advisor before making any investment decisions relating to Apple stock (AAPL) or any other security.

Featured Posts

-

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 24, 2025 -

Trump E L Unione Europea L Effetto Dei Dazi Del 20 Sulla Moda

May 24, 2025

Trump E L Unione Europea L Effetto Dei Dazi Del 20 Sulla Moda

May 24, 2025 -

Important Update Southwest Airlines Limits Portable Chargers In Carry Ons

May 24, 2025

Important Update Southwest Airlines Limits Portable Chargers In Carry Ons

May 24, 2025 -

Boe Rate Cut Odds Diminish Pound Gains Momentum Following Inflation Report

May 24, 2025

Boe Rate Cut Odds Diminish Pound Gains Momentum Following Inflation Report

May 24, 2025 -

Znaete Li Vy Roli Olega Basilashvili Test Na Znanie Sovetskogo Kino

May 24, 2025

Znaete Li Vy Roli Olega Basilashvili Test Na Znanie Sovetskogo Kino

May 24, 2025

Latest Posts

-

Burclar Ve Zeka En Yetenekli Burclar Hangileri

May 24, 2025

Burclar Ve Zeka En Yetenekli Burclar Hangileri

May 24, 2025 -

Nisan Da Mali Sans Zenginlesmeye Hazirlanan Burclar

May 24, 2025

Nisan Da Mali Sans Zenginlesmeye Hazirlanan Burclar

May 24, 2025 -

March 20 2025 Horoscope Predictions For 5 Powerful Zodiac Signs

May 24, 2025

March 20 2025 Horoscope Predictions For 5 Powerful Zodiac Signs

May 24, 2025 -

En Zeki Burclar Akil Ve Zeka Yetenekleri

May 24, 2025

En Zeki Burclar Akil Ve Zeka Yetenekleri

May 24, 2025 -

En Cekici Burclar Seytan Tueyue Oezellikleri

May 24, 2025

En Cekici Burclar Seytan Tueyue Oezellikleri

May 24, 2025