Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV And Its Importance

Table of Contents

What is the Daily NAV and How is it Calculated?

The Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the daily NAV reflects the current market value of the 30 companies comprising the Dow Jones Industrial Average, held proportionally within the ETF. Calculating the daily NAV involves several key steps:

-

Bullet Point 1: Asset Valuation: The market value of each stock within the ETF's portfolio is determined at the end of each trading day based on the closing prices on the relevant stock exchange.

-

Bullet Point 2: Liability Inclusion: Any liabilities, including administrative expenses and management fees associated with the ETF, are deducted from the total asset value.

-

Bullet Point 3: Calculation Process: The total asset value, net of liabilities, is then divided by the total number of outstanding ETF shares to arrive at the NAV per share. This calculation is typically performed daily, providing investors with an up-to-date valuation of their investment. The Amundi DJIA UCITS ETF valuation is updated and made publicly available at the end of each trading day.

The Importance of Monitoring the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Regularly monitoring the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for several reasons:

-

Bullet Point 1: Performance Tracking: The daily NAV provides a clear indication of the ETF's performance relative to the Dow Jones Industrial Average. By comparing the daily NAV changes to the index's movement, investors can assess how effectively the ETF is tracking its benchmark.

-

Bullet Point 2: Informed Investment Decisions: Changes in the daily NAV can inform buy and sell decisions. A consistent upward trend might signal a strong investment, while a prolonged decline could indicate potential risks. This data, combined with your investment goals and risk tolerance, allows for better-informed choices.

-

Bullet Point 3: Risk Management and Portfolio Diversification: Tracking the NAV helps in assessing the overall risk within your investment portfolio. Understanding the volatility of the NAV allows for adjustments to your strategy to manage your risk exposure effectively. It also helps in assessing the overall diversification of the portfolio.

Where to Find the Daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF

Accessing the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information:

-

Bullet Point 1: Amundi Website: Amundi's official website ([link to Amundi's ETF information page, if available]) is a primary source for detailed information about their ETFs, including the daily NAV.

-

Bullet Point 2: Financial News Sources: Many reputable financial news websites and data providers (e.g., Bloomberg, Yahoo Finance) display real-time or end-of-day NAV data for ETFs.

-

Bullet Point 3: Brokerage Platforms: If you hold the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, the daily NAV will typically be displayed on your account statement and trading platform.

Using NAV to Compare the Amundi Dow Jones Industrial Average UCITS ETF to Competitors

Comparing the Amundi Dow Jones Industrial Average UCITS ETF's daily NAV to similar ETFs tracking the Dow Jones Industrial Average is a crucial part of due diligence. This comparison should consider several factors:

-

Bullet Point 1: Expense Ratios: ETFs have varying expense ratios (fees). Comparing the expense ratios helps identify the most cost-effective option for your investment.

-

Bullet Point 2: Performance Comparison: Review the historical performance of different Dow Jones ETFs. However, remember that past performance is not indicative of future results.

-

Bullet Point 3: Utilizing Comparison Resources: Financial comparison websites often provide comprehensive ETF data, facilitating comparisons based on NAV, expense ratios, and performance metrics.

Conclusion

Understanding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is vital for investors seeking to make informed decisions. The NAV, calculated daily by considering the market value of underlying assets and liabilities, provides a crucial indicator of the ETF's performance and helps in tracking its alignment with the Dow Jones Industrial Average. Reliable sources for accessing the daily NAV include Amundi's website, financial news sources, and brokerage platforms. By comparing the NAV with similar ETFs and considering factors like expense ratios and historical performance, investors can optimize their investment strategies. Start tracking the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF today! Learn more about managing your investment portfolio using the Amundi Dow Jones Industrial Average UCITS ETF's daily NAV and make informed investment choices.

Featured Posts

-

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025 -

Pertimbangan Investasi Pada Mtel And Mbma Dampak Pencatatan Msci Small Cap

May 24, 2025

Pertimbangan Investasi Pada Mtel And Mbma Dampak Pencatatan Msci Small Cap

May 24, 2025 -

Amira Al Zuhairs Stunning Walk For Zimmermann At Paris Fashion Week

May 24, 2025

Amira Al Zuhairs Stunning Walk For Zimmermann At Paris Fashion Week

May 24, 2025 -

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudby I Nyneshnyaya Zhizn

May 24, 2025

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudby I Nyneshnyaya Zhizn

May 24, 2025 -

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025

Yevrobachennya Peremozhtsi Ostannogo Desyatilittya Ta Yikhni Dosyagnennya

May 24, 2025

Latest Posts

-

Netherlands Hosts Major Bangladesh Showcase 1 500 Attendees Projected

May 24, 2025

Netherlands Hosts Major Bangladesh Showcase 1 500 Attendees Projected

May 24, 2025 -

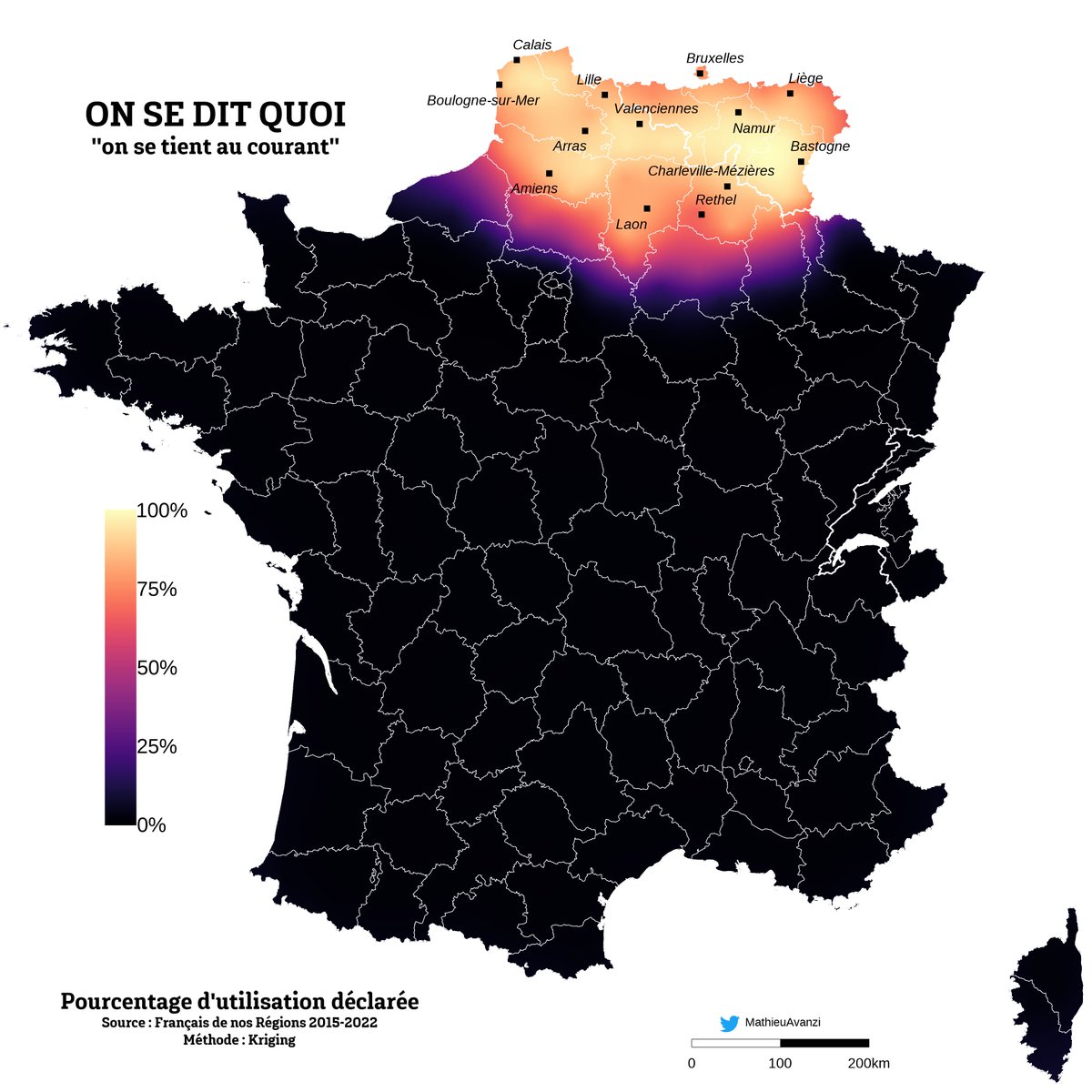

L Enseignement Du Francais Selon Mathieu Avanzi Au Dela De La Salle De Classe

May 24, 2025

L Enseignement Du Francais Selon Mathieu Avanzi Au Dela De La Salle De Classe

May 24, 2025 -

Best Of Bangladesh In Europe Driving Collaboration And Growth Through Its 2nd Edition

May 24, 2025

Best Of Bangladesh In Europe Driving Collaboration And Growth Through Its 2nd Edition

May 24, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Qui Depasse Le Cadre Scolaire

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Qui Depasse Le Cadre Scolaire

May 24, 2025