1,500% Bitcoin Growth: Is This Realistic Investment Potential?

Table of Contents

Historical Bitcoin Price Performance and Volatility

Bitcoin's price history is characterized by extreme volatility. Analyzing past Bitcoin price movements reveals periods of explosive growth interspersed with sharp corrections. Understanding these Bitcoin market cycles is critical for assessing the likelihood of a 1,500% surge.

Past Growth and Corrections

The following chart visually represents Bitcoin's price history, clearly showing periods of significant growth followed by substantial drops. (Insert a chart or graph here showing Bitcoin's price history)

- Bitcoin price history: Reveals a pattern of boom-and-bust cycles.

- Bitcoin volatility chart: Illustrates the significant price swings, highlighting the inherent risk.

- Bitcoin market cycles: These cycles are influenced by various factors, including technological advancements, regulatory changes, and investor sentiment.

Bullet Points:

- Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation roughly every four years, has historically been followed by periods of price appreciation. This is due to the reduced supply impacting market dynamics.

- Key Milestones: Events like the Mt. Gox collapse (a major Bitcoin exchange hack) caused significant price drops, while institutional adoption by companies like MicroStrategy has been linked to price increases.

- Inherent Volatility: The inherent volatility of Bitcoin is a double-edged sword. It presents the possibility of enormous returns, but also the risk of substantial losses. A 1,500% increase requires exceptionally bullish market conditions and is unlikely to be a smooth, linear progression.

Factors Potentially Driving a 1,500% Bitcoin Growth

While a 1,500% Bitcoin growth is ambitious, several factors could potentially contribute to a significant price surge:

Increased Institutional Adoption

Major financial institutions are increasingly showing interest in Bitcoin, viewing it as a potential asset class or a hedge against inflation.

- Bitcoin institutional investment: Grayscale Bitcoin Trust and other institutional vehicles are accumulating significant amounts of Bitcoin.

- Corporate Treasury Holdings: Companies like MicroStrategy are holding Bitcoin as a reserve asset, showing confidence in its long-term value.

- Impact on Price: This increased demand from institutional investors could significantly push up the price of Bitcoin.

Global Economic Uncertainty and Inflation

Periods of economic instability and high inflation often drive investors towards alternative assets, including Bitcoin.

- Bitcoin inflation hedge: Some investors view Bitcoin as a hedge against inflation, as its supply is capped at 21 million coins.

- Geopolitical Instability: Global uncertainty can lead to increased demand for Bitcoin as a safe haven asset.

- Flight to Safety: Investors might move capital from traditional markets to Bitcoin during times of economic stress.

Technological Advancements and Network Upgrades

Continuous development and upgrades to the Bitcoin network enhance scalability, security, and usability.

- Bitcoin scalability: The Lightning Network aims to improve transaction speeds and reduce fees.

- Bitcoin technological advancements: Ongoing development ensures the network remains robust and efficient.

- Increased Adoption: These improvements can lead to wider adoption and increased demand.

Factors That Could Limit 1,500% Bitcoin Growth

Several factors could hinder Bitcoin's price from reaching a 1,500% increase:

Regulatory Uncertainty and Government Intervention

Governments worldwide are still developing their regulatory frameworks for cryptocurrencies.

- Bitcoin regulation: Uncertain or unfavorable regulations could negatively impact Bitcoin's price.

- Government intervention: Government actions, such as bans or restrictions, could severely limit Bitcoin's growth.

- Regulatory uncertainty: This uncertainty creates volatility and can deter investors.

Competition from Other Cryptocurrencies

Bitcoin faces competition from other cryptocurrencies with potentially superior technology or features.

- Cryptocurrency competition: Ethereum, Solana, and other altcoins compete for market share.

- Innovation in the crypto space: New cryptocurrencies could disrupt Bitcoin's dominance.

- Market Share Dynamics: Competition can limit Bitcoin's price growth potential.

Market Manipulation and Security Concerns

The cryptocurrency market is susceptible to manipulation, and security breaches remain a concern.

- Bitcoin security risks: Exchange hacks and other security breaches can cause price drops.

- Bitcoin market manipulation: Large players can potentially manipulate the market for their benefit.

- Impact on investor confidence: Security concerns can erode investor confidence and negatively impact the price.

Realistic Expectations and Investment Strategies

Achieving a 1,500% return on a Bitcoin investment is a high-risk, high-reward proposition. A balanced approach is crucial.

Diversification and Risk Management

Don't put all your eggs in one basket. Diversify your investment portfolio.

- Bitcoin diversification: Spread your investments across various asset classes to mitigate risk.

- Risk management strategies: Employ stop-loss orders and other risk management techniques.

- Portfolio balance: A balanced portfolio is key to minimizing potential losses.

Long-Term vs. Short-Term Investments

Long-term investments generally carry less risk than short-term trades.

- Bitcoin investment strategy: Consider a long-term holding strategy to ride out market fluctuations.

- Investment horizon: Align your investment timeline with your risk tolerance.

- Time in the market: Long-term investors tend to benefit from overall market growth.

Due Diligence and Research

Thorough research is essential before making any investment decision.

- Responsible Bitcoin investing: Understand the technology, market dynamics, and risks involved.

- Bitcoin research: Consult credible sources and experts before investing.

- Informed decisions: Make informed decisions based on your own research and risk assessment.

Conclusion

While a 1,500% Bitcoin growth remains a possibility, it’s crucial to approach Bitcoin investment with caution and a well-defined strategy. The potential for significant returns is undeniable, but the inherent volatility and risks involved cannot be ignored. Understanding the factors that could drive or limit Bitcoin's price appreciation is essential for making informed decisions. Conduct your own research and make informed decisions about your Bitcoin investment. Consider your risk tolerance carefully before investing in this volatile, yet potentially lucrative, market. Remember to diversify your portfolio and develop a robust investment strategy for achieving Bitcoin growth, and consider the potential for Bitcoin returns in relation to your overall financial goals.

Featured Posts

-

Rogue The Savage Land 2 Preview Ka Zars Perilous Need

May 08, 2025

Rogue The Savage Land 2 Preview Ka Zars Perilous Need

May 08, 2025 -

Futbolli Luis Enrique Ben Pastrimin E Madh Te Psg

May 08, 2025

Futbolli Luis Enrique Ben Pastrimin E Madh Te Psg

May 08, 2025 -

Oklahoma City Thunder Vs Memphis Grizzlies A Tough Matchup Ahead

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Tough Matchup Ahead

May 08, 2025 -

Will Andor Season 2 Be Disneys Best Star Wars Diego Lunas Hints

May 08, 2025

Will Andor Season 2 Be Disneys Best Star Wars Diego Lunas Hints

May 08, 2025 -

Stephen Kings The Long Walk First Trailer Released

May 08, 2025

Stephen Kings The Long Walk First Trailer Released

May 08, 2025

Latest Posts

-

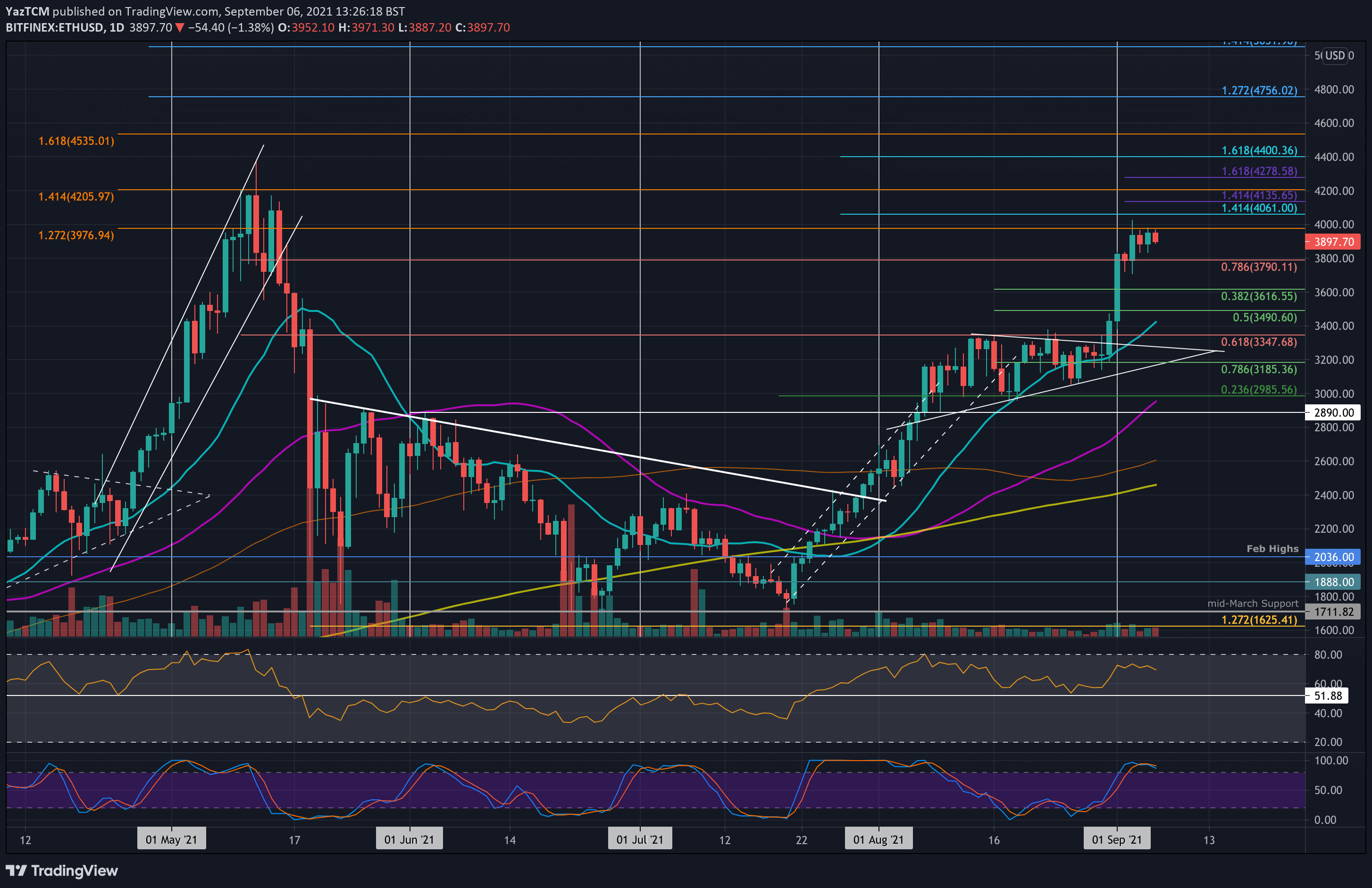

Analysis Of The 67 Million Ethereum Liquidation Event

May 08, 2025

Analysis Of The 67 Million Ethereum Liquidation Event

May 08, 2025 -

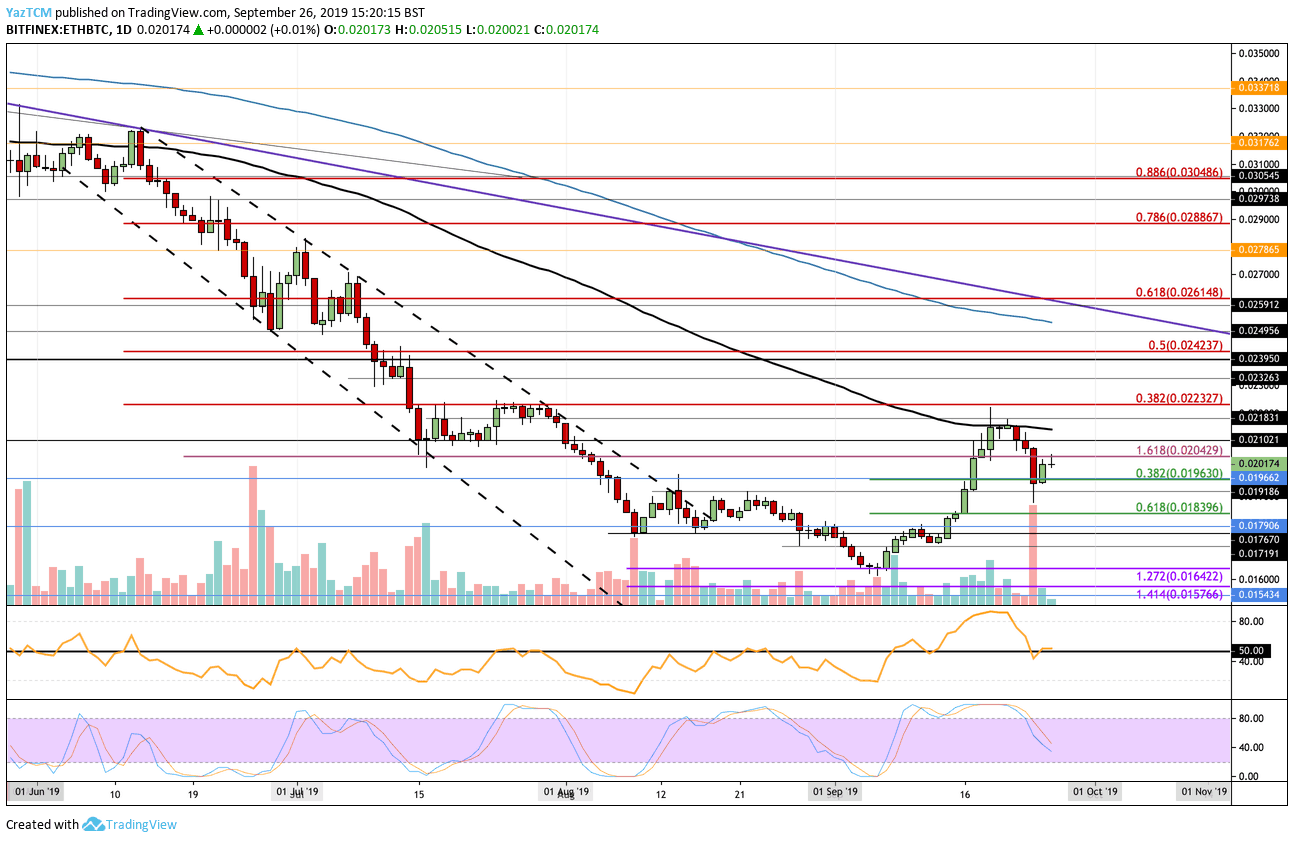

Is This Ethereum Buy Signal Real Weekly Chart Deep Dive

May 08, 2025

Is This Ethereum Buy Signal Real Weekly Chart Deep Dive

May 08, 2025 -

Ethereum Price Dip 67 Million In Liquidations Raise Concerns

May 08, 2025

Ethereum Price Dip 67 Million In Liquidations Raise Concerns

May 08, 2025 -

Are 67 Million In Ethereum Liquidations A Sign Of Further Price Drops

May 08, 2025

Are 67 Million In Ethereum Liquidations A Sign Of Further Price Drops

May 08, 2025 -

67 Million In Ethereum Liquidations Analyzing The Market Implications

May 08, 2025

67 Million In Ethereum Liquidations Analyzing The Market Implications

May 08, 2025