Are $67 Million In Ethereum Liquidations A Sign Of Further Price Drops?

Table of Contents

Understanding Ethereum Liquidations

Before analyzing the specific $67 million event, it's crucial to understand what Ethereum liquidations are. In simple terms, a liquidation occurs when a trader's position on a cryptocurrency exchange is automatically closed due to insufficient collateral. This typically happens when using leverage, magnifying both potential profits and losses. A margin call is issued when the value of the collateral falls below a certain threshold, triggering the liquidation to prevent further losses for the exchange.

- Definition of liquidation in the context of crypto trading: Forced closure of a leveraged position due to insufficient collateral.

- How leverage amplifies both profits and losses: Leverage allows traders to control larger positions with smaller amounts of capital, amplifying returns but also dramatically increasing risk.

- The role of margin calls in initiating liquidations: A margin call is a demand from the exchange for additional collateral to cover potential losses. Failure to meet the margin call results in liquidation.

- Common reasons for Ethereum liquidations: Market volatility, unexpected price drops, cascading liquidations (where one liquidation triggers others), and improper risk management.

Analyzing the $67 Million Liquidation Event

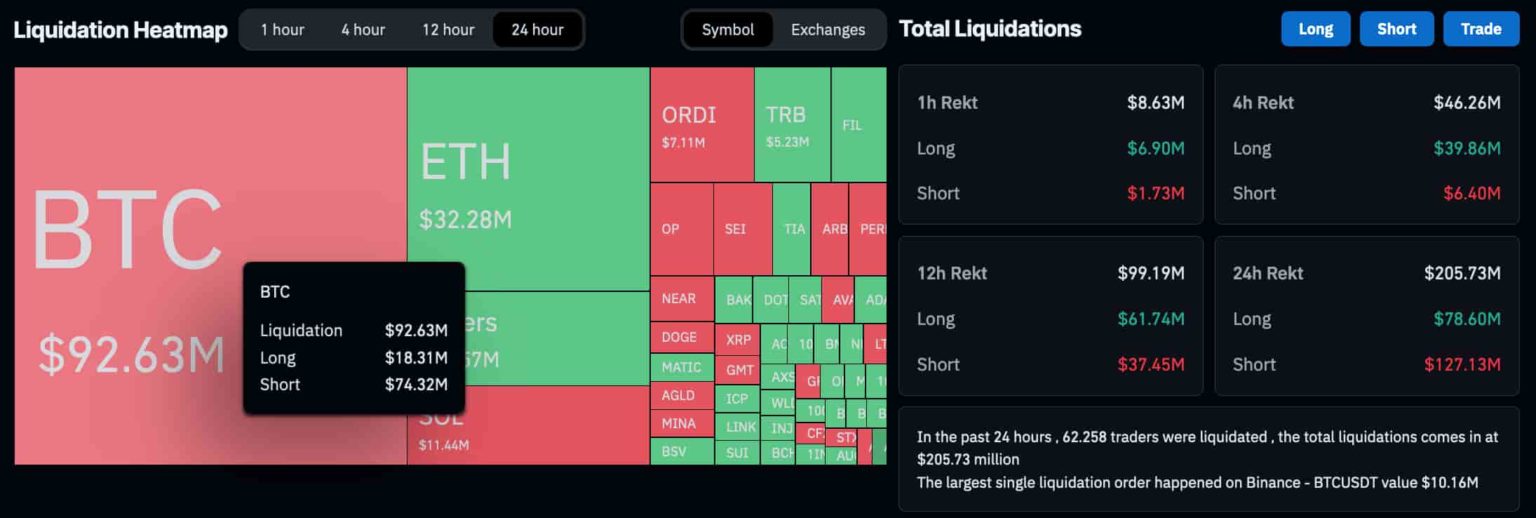

The $67 million Ethereum liquidation event, which occurred on [Insert Date and Time of Event], involved a significant volume of ETH being liquidated within a relatively short timeframe. While precise details about the involved positions remain somewhat opaque, it's likely the result of a combination of factors rather than a single massive position. The event immediately impacted the Ethereum price, causing a temporary [Insert Percentage] drop.

- Specific date and time of the liquidation event: [Insert Date and Time]

- Volume of ETH liquidated: $67 million (approximate)

- Potential contributing factors: [Mention specific market conditions, news events, or technical indicators that may have contributed, e.g., negative market sentiment surrounding regulatory uncertainty, a significant sell-off in another major cryptocurrency, a bearish trend indicated by a specific technical indicator].

- Impact on Ethereum price immediately following the event: [Describe the immediate price movement].

Indicators of Further Price Drops

While the $67 million liquidation is a significant event, it's not the sole indicator of future price movements. Several other factors need consideration:

- Analysis of on-chain metrics: Examining exchange inflows and outflows, active addresses, and transaction volumes can provide insights into overall market sentiment and potential future price movements. High exchange inflows, for instance, could suggest further selling pressure.

- Assessment of trading volume and market depth: Low trading volume can amplify price swings, making the market more susceptible to large liquidations. Shallow market depth implies a lack of buyers at key support levels, potentially leading to further price declines.

- Overview of current market sentiment: Analyzing sentiment indicators like the Crypto Fear & Greed Index and social media sentiment can give a sense of overall market confidence. Prevalent fear often precedes further price drops.

- Mention any relevant news or events influencing the market: Regulatory announcements, major partnerships, or technological developments significantly impact market sentiment and price.

Counterarguments and Factors Suggesting Stability

It's crucial to avoid drawing hasty conclusions. The $67 million liquidation, while significant, doesn't automatically guarantee further price drops. Several factors could counteract negative trends:

- Potential for a market rebound: Following a sharp decline, a rebound is possible, especially if buying pressure increases.

- Positive developments within the Ethereum ecosystem: Upcoming upgrades, increased adoption by businesses, and positive regulatory news can boost investor confidence and support the price.

- Historical context of past liquidations and their impact: Analyzing historical data on similar events and their long-term consequences can provide perspective.

- Strong fundamentals of the Ethereum blockchain: The underlying technology and its growing ecosystem remain strong despite short-term market volatility.

Conclusion

The $67 million Ethereum liquidation event highlights the inherent volatility of the cryptocurrency market. While it raises concerns about potential further price drops, it's not the sole determinant. The interplay of various factors, including on-chain metrics, market sentiment, and broader macroeconomic conditions, will ultimately shape Ethereum's future price movements. It's vital to monitor Ethereum liquidations, track Ethereum price movements, and understand Ethereum market dynamics to make informed investment decisions. Remember, careful risk management is paramount when navigating the unpredictable landscape of cryptocurrency investing. The volatility of the crypto market underscores the need for thorough research and a well-defined investment strategy. Stay informed and make responsible choices!

Featured Posts

-

Lakers Celtics Promo Tnt Announcers Hilarious Jayson Tatum Commentary

May 08, 2025

Lakers Celtics Promo Tnt Announcers Hilarious Jayson Tatum Commentary

May 08, 2025 -

Lotto 6aus49 Vom 12 April 2025 Ueberpruefen Sie Ihre Zahlen

May 08, 2025

Lotto 6aus49 Vom 12 April 2025 Ueberpruefen Sie Ihre Zahlen

May 08, 2025 -

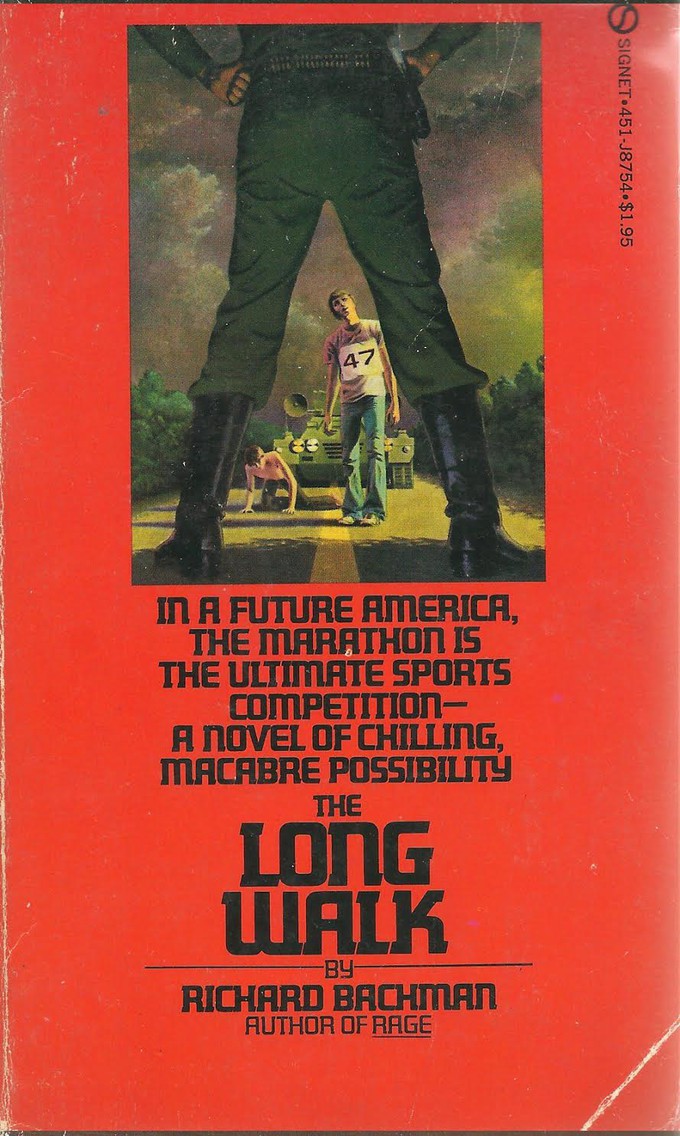

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025

Is The The Long Walk Movie Trailer A Sign Of A Successful Stephen King Adaptation

May 08, 2025 -

Six Month Trend Reversal Binance Bitcoin Buyers Outnumber Sellers

May 08, 2025

Six Month Trend Reversal Binance Bitcoin Buyers Outnumber Sellers

May 08, 2025 -

Star Wars The Planet Thats Been 48 Years In The Making

May 08, 2025

Star Wars The Planet Thats Been 48 Years In The Making

May 08, 2025