Analysis Of The $67 Million Ethereum Liquidation Event

Table of Contents

Understanding the $67 Million Ethereum Liquidation Event

To understand the impact of this significant event, we first need to define what a liquidation event is within the context of the cryptocurrency market, specifically focusing on Ethereum. A liquidation event occurs when a trader's position, typically leveraged, falls below a predetermined threshold, forcing the automatic sale of their collateral (usually cryptocurrency) to cover losses. This is common in decentralized finance (DeFi) platforms offering leveraged trading.

- Definition of liquidation in DeFi: In DeFi, liquidations are automated processes governed by smart contracts. When a trader's position is undercollateralized, these contracts automatically sell the collateral to repay the borrowed funds.

- Explanation of leveraged trading and its risks: Leveraged trading magnifies both profits and losses. While it can amplify gains, it also significantly increases the risk of liquidation if the market moves against the trader's position. High leverage multiplies the potential for substantial losses.

- Role of smart contracts in automated liquidations: Smart contracts are the backbone of automated liquidations in DeFi. They ensure the process is transparent, efficient, and devoid of human intervention, triggering liquidation automatically when pre-defined conditions are met.

- Specific details of the $67 million event (date, time, affected platforms): [Insert specific details here – date, time, and the specific DeFi platforms affected by the $67 million Ethereum liquidation event. This requires research to obtain accurate data.] Providing precise details strengthens the article's credibility and relevance.

Identifying the Root Causes of the Liquidation Event

Several factors likely contributed to the $67 million Ethereum liquidation event. Pinpointing the precise cause is challenging, but analyzing potential triggers is crucial for future risk mitigation.

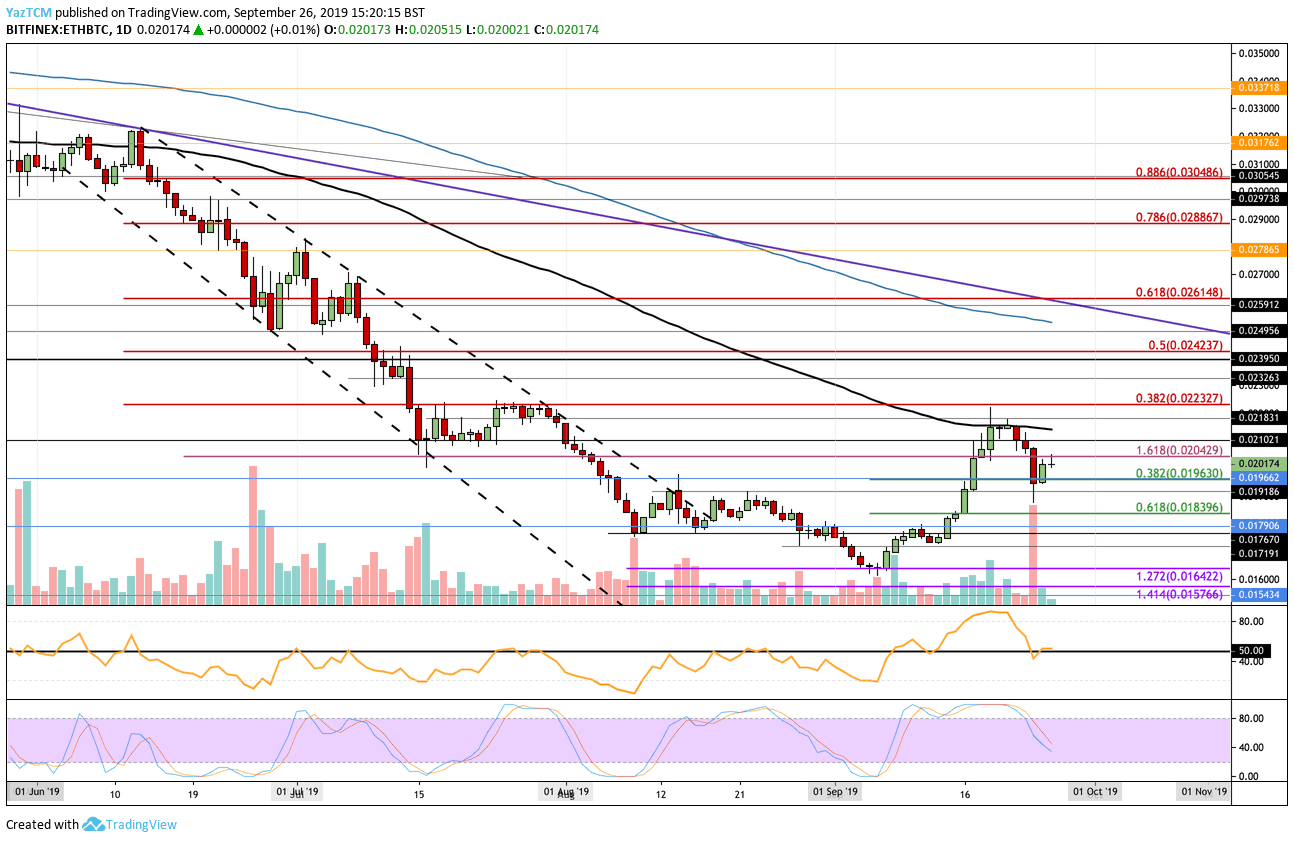

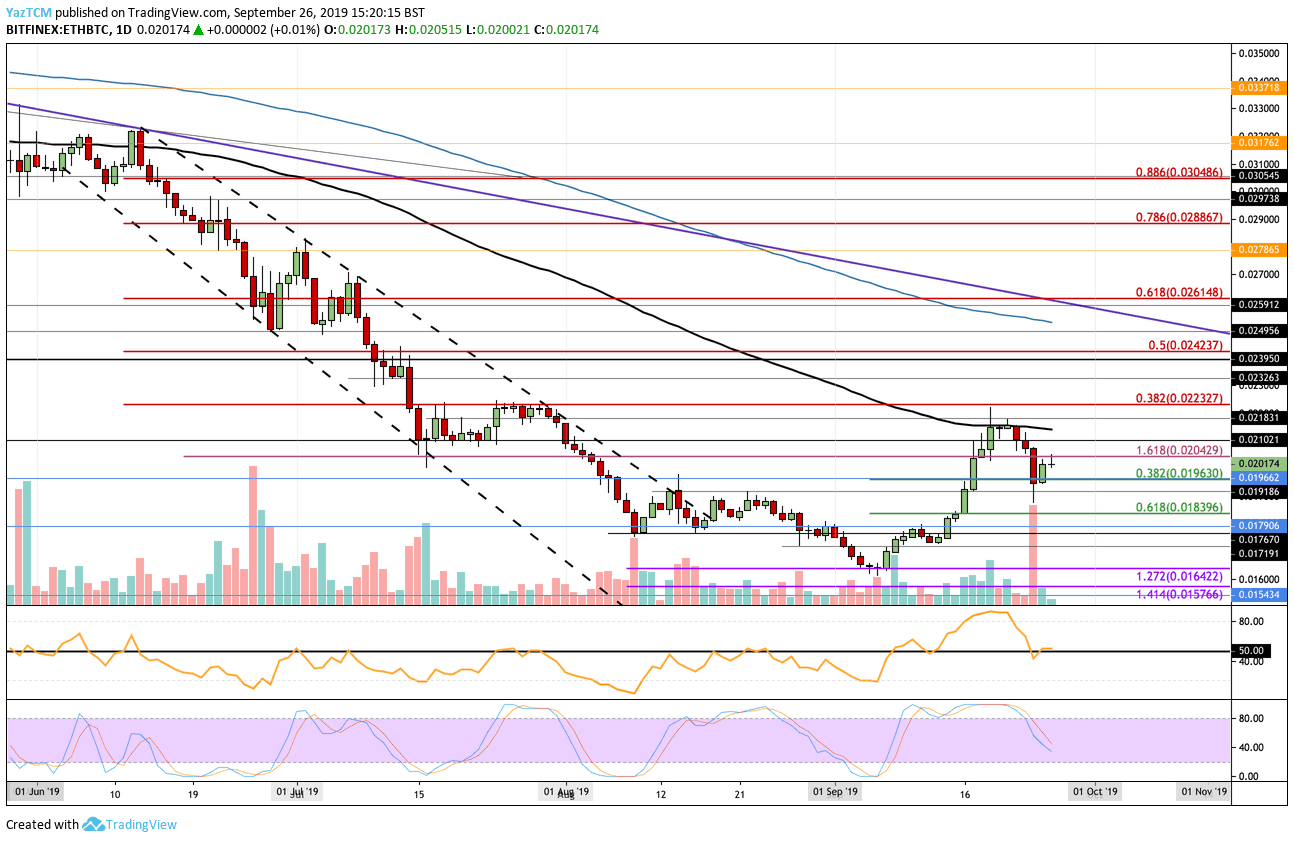

- Market movements and price fluctuations leading to the event: Sharp and unexpected price drops in ETH are the most likely primary trigger. A sudden, significant downturn can quickly push leveraged positions into liquidation territory.

- Role of leveraged positions and high debt-to-collateral ratios: Traders with highly leveraged positions and low collateral ratios are extremely vulnerable to even minor price fluctuations. A small price movement can lead to a margin call and subsequent liquidation.

- Impact of large sell-offs or sudden price drops: Large sell-offs by institutional investors or “whales” can create a cascading effect, driving prices down rapidly and triggering a wave of liquidations.

- Possible influence of automated trading bots: Algorithmic trading bots, designed to capitalize on market volatility, may have exacerbated the situation by contributing to the rapid price decline and triggering further liquidations.

Impact and Consequences of the $67 Million Ethereum Liquidation

The $67 million Ethereum liquidation event had several notable repercussions across the broader cryptocurrency landscape.

- Short-term price impact on ETH: The event likely contributed to short-term volatility in the price of ETH, although the exact magnitude requires further analysis of market data surrounding the event.

- Effect on decentralized finance (DeFi) protocols: The event highlighted vulnerabilities within some DeFi protocols, particularly those with insufficient risk management mechanisms or susceptible to cascading liquidations.

- Impact on investor confidence and market sentiment: Such events can erode investor confidence and negatively impact overall market sentiment, leading to a period of uncertainty and caution.

- Analysis of long-term consequences for Ethereum's stability: While the event was significant, its long-term consequences on Ethereum's underlying stability are likely to be minimal, provided the protocols learn from the experience and implement appropriate improvements.

Lessons Learned and Future Mitigation Strategies

The $67 million Ethereum liquidation event offers valuable lessons for investors and developers within the DeFi ecosystem.

- Importance of diversified portfolio management: Diversification is crucial to mitigate risk. Over-reliance on a single asset or platform increases vulnerability to liquidation events.

- Strategies for minimizing leverage and managing risk: Using lower leverage ratios significantly reduces the probability of liquidation. Proper risk management strategies, including stop-loss orders, are crucial.

- Need for improved transparency and auditing in DeFi: Greater transparency in DeFi protocols and rigorous independent auditing are essential to identify and address potential vulnerabilities before they lead to large-scale liquidations.

- Potential regulatory implications and the need for stronger oversight: The event highlights the need for regulatory frameworks that address the risks associated with DeFi and leverage trading, ensuring greater investor protection.

Conclusion

The $67 million Ethereum liquidation event served as a stark reminder of the inherent risks in leveraged trading within the volatile cryptocurrency market. Understanding the causes, impacts, and lessons learned from this event is crucial for all participants in the Ethereum ecosystem. The importance of responsible risk management, diversified portfolios, and the need for improved transparency and regulatory oversight cannot be overstated. Stay informed about significant events in the cryptocurrency market, and learn how to mitigate risks in your own Ethereum investments. Further research into understanding Ethereum liquidation events and responsible trading practices will help protect your crypto holdings. Continue your learning journey with more articles on [link to related articles/resources].

Featured Posts

-

Winning Lotto Numbers Wednesday 16th April 2025

May 08, 2025

Winning Lotto Numbers Wednesday 16th April 2025

May 08, 2025 -

Six Goals Fly In Barcelona Inter Milan Champions League Semi Final Clash

May 08, 2025

Six Goals Fly In Barcelona Inter Milan Champions League Semi Final Clash

May 08, 2025 -

Lotto Results Wednesday April 16th 2025

May 08, 2025

Lotto Results Wednesday April 16th 2025

May 08, 2025 -

5 Billion Universal Credit Refund Dwp Payment Details For April And May

May 08, 2025

5 Billion Universal Credit Refund Dwp Payment Details For April And May

May 08, 2025 -

Understanding Ubers Shift To Subscription Plans For Drivers

May 08, 2025

Understanding Ubers Shift To Subscription Plans For Drivers

May 08, 2025