Ethereum Price Dip: $67 Million In Liquidations Raise Concerns

Table of Contents

Understanding the $67 Million in Ethereum Liquidations

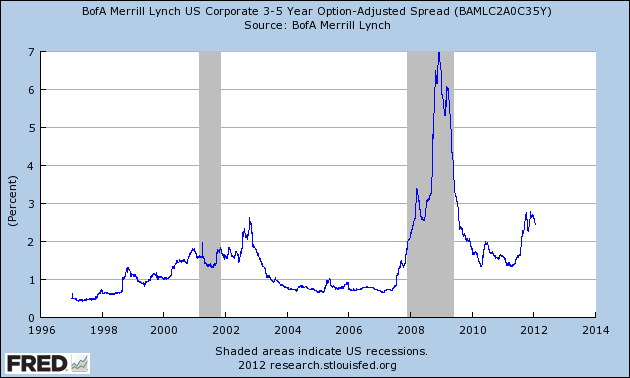

Liquidations in the cryptocurrency market occur when a trader's margin account falls below a certain threshold, forcing the exchange to sell their assets to cover losses. This typically happens when traders use leverage – borrowing funds to amplify their potential profits – and the market moves against their position. The recent $67 million in Ethereum liquidations highlight the risks associated with leveraged trading. This massive figure signifies a significant number of traders caught in a sudden ETH price decline, resulting in substantial losses.

- Number of affected traders: While the exact number remains unknown, reports suggest thousands of traders were impacted by these liquidations.

- Average liquidation size: The average size of individual liquidations likely varied, with larger positions resulting in more significant losses.

- Types of trading platforms involved: Multiple centralized exchanges and decentralized finance (DeFi) platforms were likely involved, highlighting the widespread nature of the event.

- Impact on DeFi protocols: The impact on DeFi protocols is significant, as many DeFi applications are built on Ethereum and are susceptible to volatility in the ETH price. Many DeFi liquidations occurred simultaneously, indicating the interconnectedness of the crypto market.

Factors Contributing to the Ethereum Price Dip

The recent Ethereum price drop is likely a confluence of several factors. Pinpointing a single cause is difficult, but a combination of market forces likely contributed to the decline.

- Broader market trends: The overall crypto market downturn played a significant role. A general bearish sentiment often impacts even the strongest cryptocurrencies, including Ethereum. The correlation between Bitcoin's price and Ethereum's price is undeniable, and a Bitcoin sell-off typically drags down the rest of the market.

- Specific news affecting Ethereum: Regulatory uncertainty continues to be a major factor influencing crypto prices. Any negative news concerning regulatory actions can trigger a sell-off. Furthermore, delays or complications in major Ethereum network upgrades can also negatively impact investor sentiment and price.

- Technical analysis indicators: Technical indicators, such as bearish chart patterns and decreasing trading volume, may have signaled an impending price drop to experienced traders, potentially triggering a sell-off.

- Whale activity: Large-scale selling by "whales" – individuals or entities holding significant amounts of Ethereum – can exert considerable downward pressure on the ETH price. These large sell orders can overwhelm market liquidity and accelerate price declines.

Assessing the Impact on the Ethereum Ecosystem

The consequences of this Ethereum price dip and the associated liquidations are far-reaching, impacting various aspects of the Ethereum ecosystem.

- DeFi protocols built on Ethereum: The price drop and liquidations have affected the total value locked (TVL) in many DeFi protocols, resulting in reduced liquidity and potential instability for certain projects.

- NFT markets: The NFT market, heavily reliant on Ethereum, experienced a slowdown in trading volume and lower prices for many NFTs.

- Ethereum developers and the community: While the downturn may cause temporary setbacks, it also highlights areas for improvement and innovation within the Ethereum ecosystem.

- Long-term implications for Ethereum's adoption: While volatility is a characteristic of crypto markets, sustained price drops and substantial liquidations could temporarily dampen the broader adoption of Ethereum. However, the underlying technology continues to develop and mature, suggesting that long-term adoption is likely to continue despite short-term fluctuations.

Future Outlook and Price Predictions for Ethereum (Cautious)

Predicting the future price of Ethereum is inherently speculative. While the recent dip and liquidations are concerning, it is impossible to definitively predict whether this represents a continuation of a bear market or a temporary correction. Several scenarios are possible:

- Recovery: A recovery is possible if broader market sentiment improves and positive news emerges concerning Ethereum development.

- Further decline: Continued bearish sentiment or negative news could lead to further price declines.

It's crucial to remember that cryptocurrency investment carries inherent risks. Risk management and portfolio diversification are paramount to mitigating potential losses. Avoid relying solely on speculative ETH price predictions.

Conclusion: Navigating the Volatility of the Ethereum Market

The recent Ethereum price dip and significant liquidations serve as a stark reminder of the volatility inherent in the cryptocurrency market. Understanding the risks associated with leveraged trading and the impact of broader market trends is crucial for all investors. This analysis highlights the interconnectedness of the Ethereum ecosystem and the potential consequences of price fluctuations. Stay informed about market trends, conduct thorough research, and prioritize risk management when investing in Ethereum or any other cryptocurrency. Careful analysis of Ethereum price fluctuations and ETH price volatility is essential for making informed investment decisions in this dynamic market.

Featured Posts

-

Arsenal Vs Psg Hargreaves Champions League Final Forecast

May 08, 2025

Arsenal Vs Psg Hargreaves Champions League Final Forecast

May 08, 2025 -

Psg Nantes Maci Gol Yok Heyecan Var

May 08, 2025

Psg Nantes Maci Gol Yok Heyecan Var

May 08, 2025 -

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025

Rising Taiwan Dollar Implications For Economic Policy

May 08, 2025 -

Analysis The Decline In Taiwanese Investment In Us Bond Etfs

May 08, 2025

Analysis The Decline In Taiwanese Investment In Us Bond Etfs

May 08, 2025 -

Improving Crime Control Through Swift And Decisive Directives

May 08, 2025

Improving Crime Control Through Swift And Decisive Directives

May 08, 2025