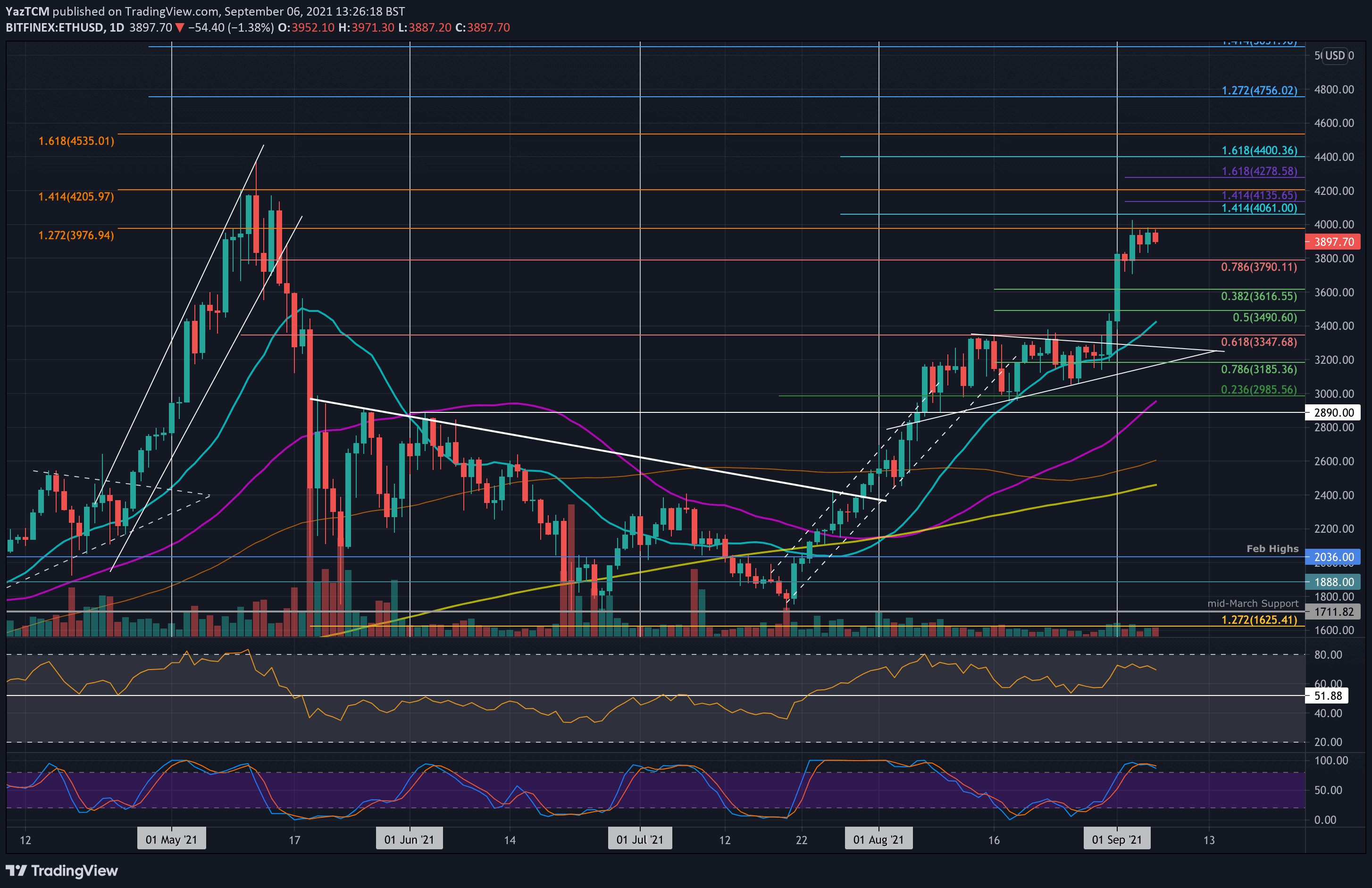

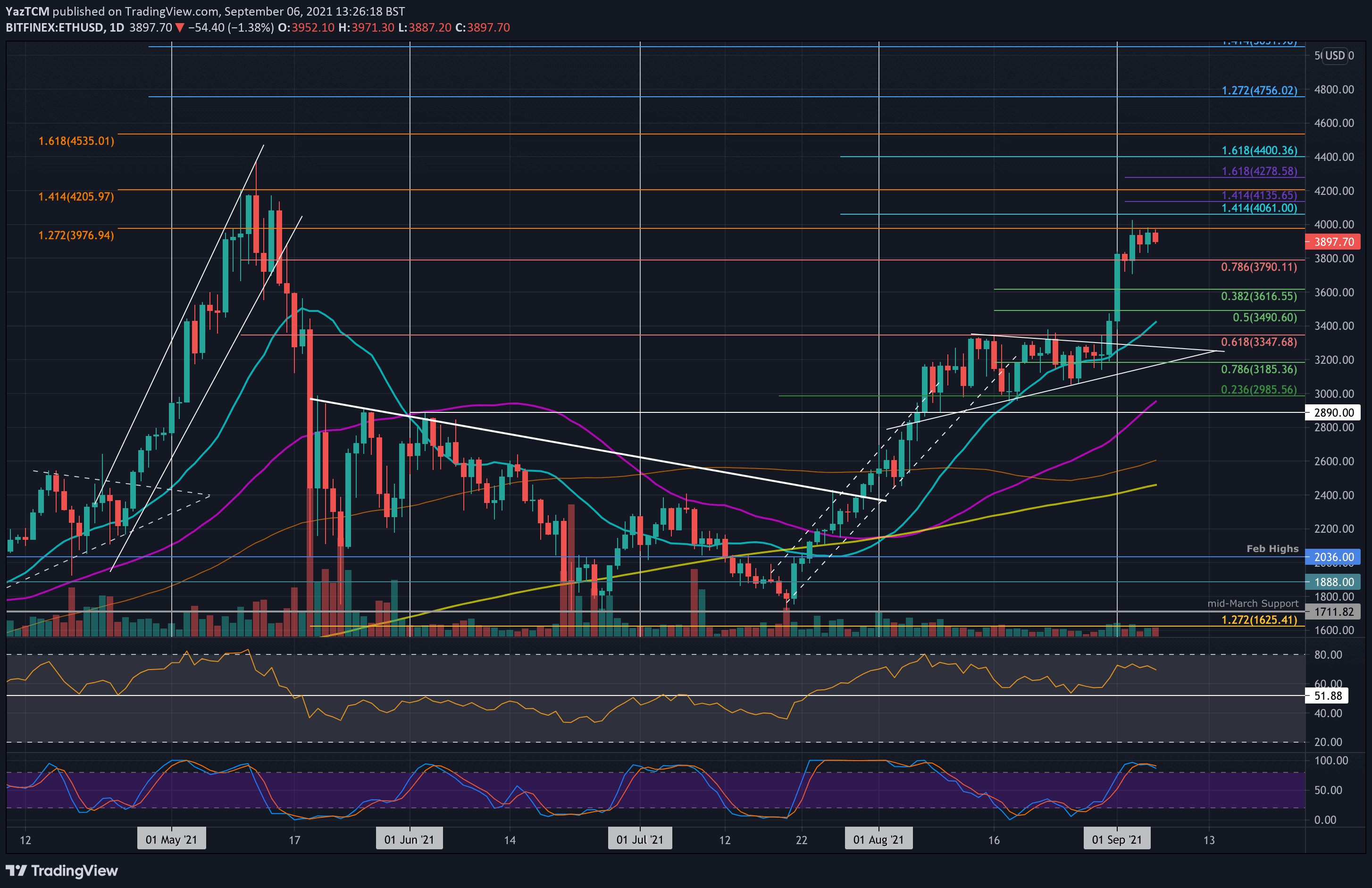

Is This Ethereum Buy Signal Real? Weekly Chart Deep Dive

Table of Contents

The cryptocurrency market is notoriously volatile, and Ethereum (ETH) is no exception. Recent price movements have sparked debate: is this a legitimate buy signal for Ethereum, or a deceptive trap for unsuspecting investors? This in-depth weekly chart analysis will dissect the current market dynamics to help you determine if now is the right time to buy Ethereum. We'll examine key indicators, external factors, and potential outcomes to provide a comprehensive assessment of the current situation.

Analyzing the Weekly Ethereum Chart: Key Indicators

Analyzing weekly charts is crucial for identifying long-term trends in volatile markets like cryptocurrency. Unlike daily charts that show short-term fluctuations, weekly charts provide a smoother picture, allowing for better identification of significant support and resistance levels and overall trends. Let's dive into some key indicators:

Moving Averages (MA):

Moving averages smooth out price data, helping to identify trends. We'll focus on the 50-week and 200-week MAs.

- Crossing of MAs: A bullish crossover occurs when the 50-week MA crosses above the 200-week MA, often signaling a potential long-term uptrend. Conversely, a bearish crossover (50-week MA crossing below the 200-week MA) can suggest a weakening trend. Currently, [insert current MA crossover status and chart visualization here – e.g., "the 50-week MA is above the 200-week MA, suggesting a bullish trend"].

- Breakouts: A strong break above the 200-week MA, confirmed by high volume (discussed below), is a very strong bullish signal, suggesting sustained upward momentum. Similarly, a decisive break below could signal a bearish trend. [insert recent chart data example here – e.g., "In the last week, ETH broke above the 200-week MA, accompanied by increased trading volume, which is a bullish indicator."]

- Limitations: It's important to remember that moving averages are lagging indicators. They react to past price movements, not future ones. Relying solely on MAs without considering other factors can be risky.

Relative Strength Index (RSI):

The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Oversold/Overbought: An RSI reading below 30 is generally considered oversold, suggesting potential price reversal to the upside. Conversely, a reading above 70 suggests an overbought condition, hinting at a potential price correction.

- Current RSI: The current weekly RSI for Ethereum is [insert current RSI value here]. This suggests [insert interpretation based on value - e.g., "a slightly overbought condition, which might indicate a short-term correction is possible"].

- Price/RSI Divergence: A bullish divergence occurs when the price makes lower lows, but the RSI forms higher lows. This suggests weakening bearish momentum and potential upward price reversal. The opposite (bearish divergence) can also occur. [Insert example of recent divergence, if any].

Volume Analysis:

Volume confirms price movements. High volume accompanying a price breakout strengthens the signal, while low volume suggests weak momentum and potential for a reversal.

- High Volume Breakouts: Significant volume during a price breakout above resistance or below support confirms the strength of the move and increases the probability of a sustained trend.

- Low Volume Movements: Price movements with low volume are less reliable and can easily reverse.

- Recent Volume Patterns: [Analyze recent volume patterns on the Ethereum weekly chart – e.g., "The recent breakout above the 200-week MA was accompanied by a significant increase in trading volume, strengthening the bullish signal."]

External Factors Influencing Ethereum Price

Technical analysis alone is insufficient. Macroeconomic factors significantly influence Ethereum's price.

Regulatory Landscape:

Government regulations heavily influence cryptocurrency markets.

- Regulatory Developments: Recent regulatory actions, such as [mention specific regulatory developments affecting ETH], have impacted investor sentiment and price volatility.

- Regulatory Uncertainty: Uncertainty surrounding regulations often leads to price volatility as investors react to potential changes.

Market Sentiment and News:

Market sentiment, driven by news and social media, affects Ethereum's price.

- Significant News Events: Positive news, such as [mention positive news impacting ETH price], usually boosts the price, while negative news (e.g., security breaches, regulatory crackdowns) can cause significant drops.

- Social Media Sentiment: Social media sentiment, as measured by platforms like Twitter, can be a leading indicator of price movements. Positive social media buzz often correlates with higher prices.

Technological Developments:

Ethereum's technological advancements influence its long-term value.

- Scaling Solutions: Improvements in scaling solutions like sharding aim to increase transaction speed and reduce fees, positively impacting adoption and price.

- Long-Term Implications: Continued development and upgrades to the Ethereum network, such as the transition to ETH 2.0, are major factors supporting its long-term value proposition.

Risk Assessment and Potential Outcomes

Investing in cryptocurrencies involves substantial risk. Prices can fluctuate dramatically in short periods.

Bullish Scenario:

Based on our analysis, a bullish scenario could unfold if:

- Price Targets: ETH could reach [price target] if the current upward trend continues, supported by strong volume and positive external factors.

- Potential Catalysts: Positive regulatory news, increased institutional adoption, and successful network upgrades could further propel price growth.

Bearish Scenario:

A bearish scenario is possible if:

- Support Levels: Key support levels to watch are [mention support levels]. A break below these levels could trigger further downward pressure.

- Risks: Negative regulatory developments, a broader cryptocurrency market downturn, or security vulnerabilities could significantly impact the price.

Neutral Scenario:

The price might consolidate in a sideways trend if:

- Potential Price Range: ETH might trade within the range of [price range] for [duration] while investors await further catalysts.

Conclusion

Our weekly chart analysis of Ethereum presents a mixed picture. While indicators like the MA crossover and recent volume suggest potential for further price increases, external factors and inherent market volatility introduce considerable risk. While this analysis suggests [state conclusion – bullish, bearish, or neutral leaning], it's crucial to remember this is not financial advice. Conduct thorough due diligence, consider your personal risk tolerance, and diversify your portfolio before making any investment decisions. Continue researching the Ethereum market and stay informed about potential Ethereum buy signals to make informed investment choices. Remember to always conduct your own research before investing in any cryptocurrency, including Ethereum.

Featured Posts

-

Daily Lotto Draw Tuesday April 15 2025

May 08, 2025

Daily Lotto Draw Tuesday April 15 2025

May 08, 2025 -

Jayson Tatums Ankle Injury Details And Potential Recovery Timeline

May 08, 2025

Jayson Tatums Ankle Injury Details And Potential Recovery Timeline

May 08, 2025 -

Arteta Faces Scrutiny Following Collymores Comments Arsenal News

May 08, 2025

Arteta Faces Scrutiny Following Collymores Comments Arsenal News

May 08, 2025 -

El Regreso De Neymar A La Seleccion Duelo En El Monumental Contra Messi

May 08, 2025

El Regreso De Neymar A La Seleccion Duelo En El Monumental Contra Messi

May 08, 2025 -

Path Of Exile 2 Everything You Need To Know About Rogue Exiles

May 08, 2025

Path Of Exile 2 Everything You Need To Know About Rogue Exiles

May 08, 2025