XRP Price Prediction: Will XRP Hit $5 After SEC Lawsuit Dismissal?

Table of Contents

Ripple's Legal Victory and Market Sentiment

Impact of the SEC Lawsuit Dismissal

The SEC lawsuit dismissal significantly impacted XRP's price and investor confidence. The immediate aftermath saw a substantial surge in XRP's trading volume and a wave of positive media coverage. This positive sentiment attracted a considerable influx of new investors, many of whom had previously been hesitant due to the regulatory uncertainty. Several prominent cryptocurrency exchanges reinstated XRP trading, further bolstering its market presence.

- Increased trading volume: Post-dismissal, XRP experienced a significant increase in daily trading volume, indicating renewed investor interest.

- Positive media coverage: Major financial news outlets reported favorably on the ruling, increasing awareness and potentially attracting new investors.

- Influx of new investors: The positive outcome removed a significant barrier to entry for many investors previously wary of XRP's regulatory status.

- Potential partnerships: The legal clarity could pave the way for new partnerships with financial institutions and payment providers.

This positive market sentiment translated into a considerable increase in XRP's market capitalization and a boost in investor confidence. The ripple effect (pun intended) is still being felt, and its long-term impact remains to be seen.

Analyzing Post-Lawsuit Market Behavior

Since the ruling, XRP's price has exhibited significant volatility, reflecting the dynamic nature of the cryptocurrency market. While there have been periods of substantial gains, resistance levels have also been encountered, indicating challenges to further price appreciation. Analyzing XRP price charts reveals a complex interplay of support and resistance levels, trading patterns, and overall market sentiment.

- Price volatility: The price has fluctuated significantly, reflecting the market's reaction to various news events and overall market conditions.

- Resistance levels: The price has encountered resistance at certain price points, indicating selling pressure.

- Support levels: Conversely, support levels have provided some stability, preventing steeper price declines.

- Trading patterns: Technical analysis of trading patterns can offer insights into potential future price movements.

- Sentiment analysis: Monitoring social media and news sentiment towards XRP provides valuable insights into market psychology. Positive sentiment generally correlates with price increases.

Analyzing the XRP price chart in conjunction with other technical indicators provides a more holistic picture of market behavior, helping to assess the likelihood of XRP reaching $5.

Technological Advancements and RippleNet Adoption

RippleNet's Growth and Impact on XRP Demand

RippleNet, Ripple's payment network, plays a crucial role in XRP's utility and value. The expansion of RippleNet and its increasing adoption by financial institutions are key drivers of XRP demand. As more banks and payment providers utilize RippleNet for cross-border transactions, the demand for XRP as a bridge currency is likely to increase.

- Number of financial institutions using RippleNet: The growing number of banks and payment providers using RippleNet directly impacts XRP demand.

- Cross-border payment volume: An increase in cross-border payment volume processed through RippleNet translates to increased XRP usage.

- Partnerships with banks and payment providers: Strategic partnerships with major financial institutions can significantly boost RippleNet's adoption and XRP's utility.

The wider adoption of RippleNet is a significant positive factor for XRP's long-term price prospects.

Future Technological Developments

The XRP Ledger continues to evolve, with potential future upgrades focusing on scalability, energy efficiency, and enhanced functionalities. These improvements could further solidify XRP's position in the cryptocurrency market and contribute to its price appreciation.

- Scalability improvements: Increased transaction throughput can handle a larger volume of transactions, improving the efficiency of RippleNet.

- Energy efficiency advancements: Reducing energy consumption aligns with growing environmental concerns and enhances XRP's sustainability.

- New features and functionalities: The introduction of new features could expand the use cases for XRP and increase its demand.

These technological advancements are vital for maintaining XRP's competitiveness and attracting more users and investors.

Factors Affecting XRP's Price Beyond the Lawsuit

Overall Cryptocurrency Market Conditions

The broader cryptocurrency market significantly impacts XRP's price. Bitcoin's price movements, regulatory developments, and overall investor sentiment in the crypto space all play a role. A bullish crypto market generally benefits XRP, while a bearish market can put downward pressure on its price.

- Bitcoin's price movements: Bitcoin's price often dictates the overall trend in the cryptocurrency market, influencing altcoins like XRP.

- Regulatory landscape: Changes in cryptocurrency regulations globally can significantly impact investor confidence and XRP's price.

- Overall investor sentiment in the crypto space: General market sentiment, whether bullish or bearish, influences the price of all cryptocurrencies.

Understanding the broader market context is crucial for accurately predicting XRP's price.

Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies, particularly in the cross-border payment space. Analyzing the competitive landscape, including market share and competitive advantages, is essential for a realistic price prediction.

- Competitors in the cross-border payment space: Several other cryptocurrencies and traditional financial solutions compete with XRP.

- Market share analysis: Assessing XRP's market share against its competitors provides valuable insights into its relative position.

- Competitive advantages of XRP: Identifying XRP's strengths, such as speed, low transaction fees, and established partnerships, is crucial for evaluating its future prospects.

XRP's ability to maintain and expand its market share will significantly influence its price.

Conclusion

The dismissal of the SEC lawsuit against Ripple represents a significant milestone for XRP, boosting investor confidence and potentially paving the way for wider adoption. Technological advancements in the XRP Ledger and the expansion of RippleNet are also positive factors. However, the overall cryptocurrency market conditions and competition from other cryptocurrencies are important considerations.

Considering these factors, predicting a precise XRP price is inherently challenging. While a $5 XRP price is ambitious, the potential for significant price appreciation exists, particularly if RippleNet adoption continues to grow and the broader cryptocurrency market remains bullish. A more realistic prediction might be a range of $3-$5 within the next few years, contingent upon continued positive developments and a favorable market environment. But remember, cryptocurrency investments are inherently risky.

Call to Action: Stay informed about the XRP price and its development. Monitor XRP's progress closely, conduct thorough research, and make informed investment decisions based on your risk tolerance and financial goals. Learn more about XRP investments and navigate the cryptocurrency market wisely.

Featured Posts

-

Italys Little Tahiti A Beach Paradise

May 01, 2025

Italys Little Tahiti A Beach Paradise

May 01, 2025 -

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025

Xrp Price Prediction Will Xrp Hit 5 After Sec Lawsuit Dismissal

May 01, 2025 -

Road To 2025 Tonga Qualifies For Ofc U 19 Womens Championship

May 01, 2025

Road To 2025 Tonga Qualifies For Ofc U 19 Womens Championship

May 01, 2025 -

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025 -

Ramaphosas Decision A Commission For Apartheid Era Atrocities

May 01, 2025

Ramaphosas Decision A Commission For Apartheid Era Atrocities

May 01, 2025

Latest Posts

-

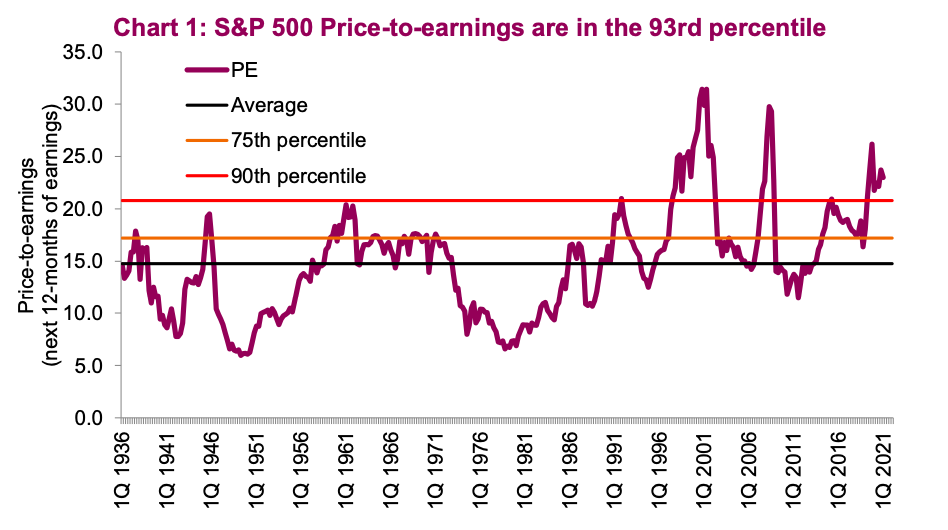

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025

High Stock Market Valuations A Bof A Analysis And Investor Reassurance

May 01, 2025 -

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025

Bof As Take Why High Stock Market Valuations Shouldnt Worry Investors

May 01, 2025 -

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025

Black Sea Oil Spill Leads To Closure Of Dozens Of Miles Of Beaches In Russia

May 01, 2025 -

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025

Environmental Emergency Oil Spill Closes Extensive Black Sea Beach Area

May 01, 2025 -

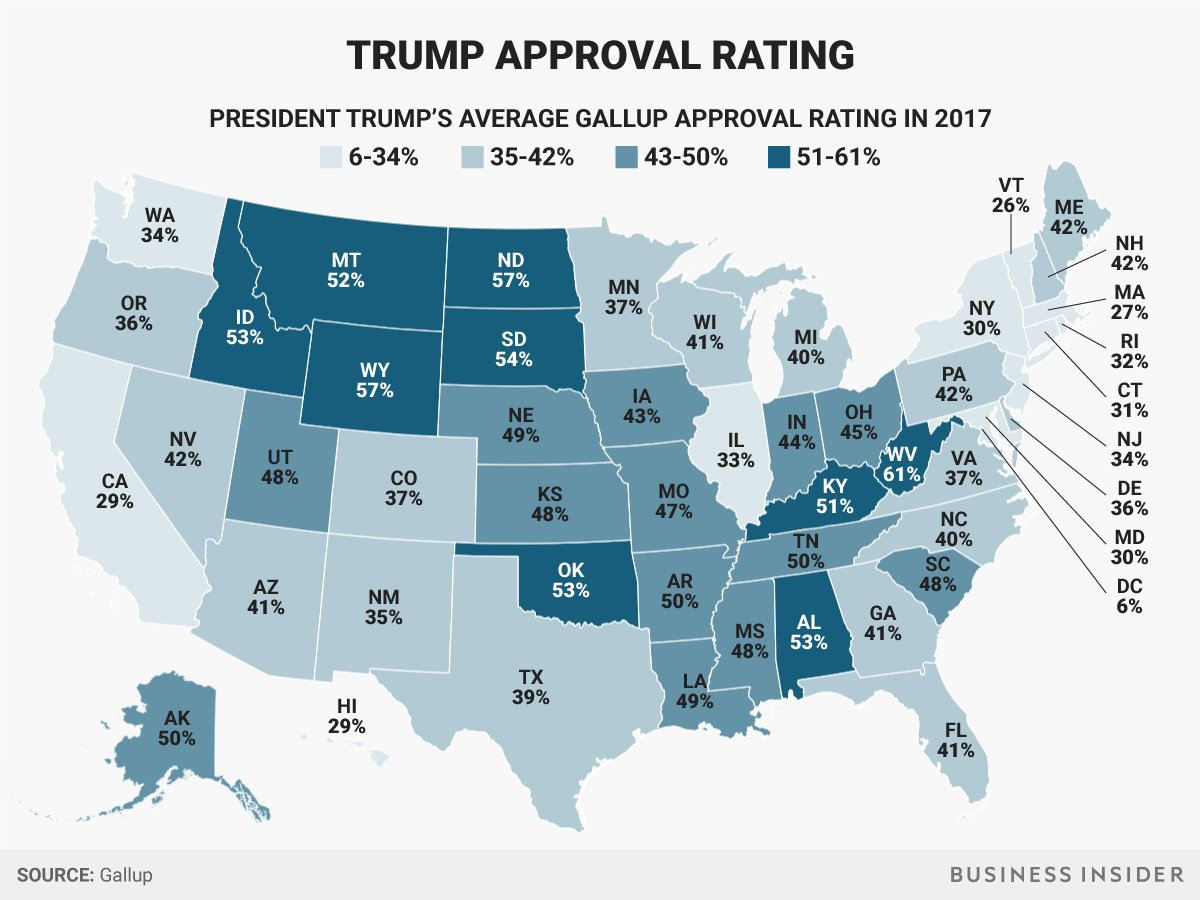

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025

President Trumps Approval Rating At 39 Factors Contributing To The Decline

May 01, 2025