High Stock Market Valuations: A BofA Analysis And Investor Reassurance

Table of Contents

BofA's Analysis of Current Market Valuations

BofA Securities recently published a comprehensive report analyzing current stock market valuations. Their analysis considered various key metrics to assess whether current prices accurately reflect underlying company value and future growth potential. The report doesn't offer a simple "overvalued" or "undervalued" conclusion, but rather a nuanced perspective considering numerous factors.

-

BofA's Methodology: The analysis utilized a combination of quantitative and qualitative methods, incorporating historical data, economic forecasts, and assessments of individual company performance. They examined various sectors and industries, comparing current valuations to long-term historical averages.

-

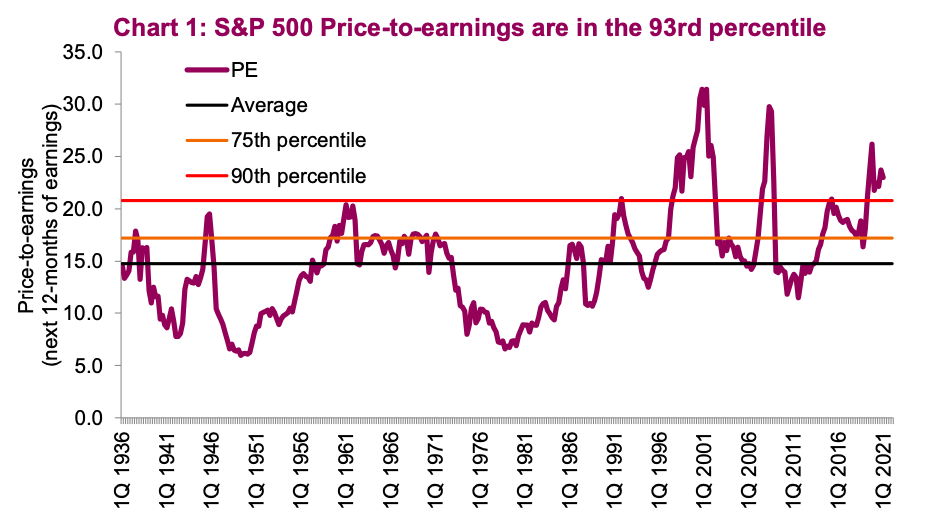

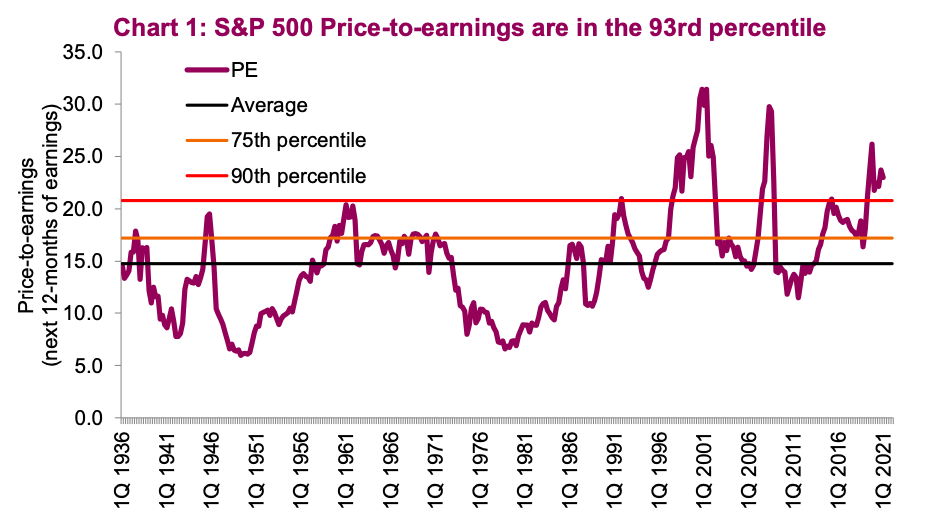

Key Valuation Metrics: BofA employed several key valuation metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and Price-to-Book (P/B) ratios. These metrics were analyzed across different market sectors to identify potential overvaluations or undervaluations.

-

Valuation Levels Compared to Historical Averages: BofA's findings indicated that while some sectors exhibit valuations higher than historical averages, others remain within a reasonable range. This suggests that blanket statements about market overvaluation are overly simplistic.

-

Specific Sectors: The report highlighted technology and consumer discretionary sectors as showing relatively higher valuations compared to historical trends, while sectors like energy and utilities showed more moderate valuations. This points to a differentiated market rather than uniform overvaluation.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the perception of high stock market valuations. Understanding these factors is crucial for informed investment decisions.

-

Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, potentially driving up valuations. This makes bonds less attractive, pushing capital into equities.

-

Strong Corporate Earnings Growth: Robust earnings growth in certain sectors, particularly technology and some consumer goods, has supported higher stock prices and contributed to elevated valuations. This positive momentum has bolstered investor confidence.

-

Investor Confidence (Mixed Signals): While some sectors show high investor confidence, others exhibit caution. This mixed sentiment reflects the complex interplay of economic factors and geopolitical uncertainties impacting valuation levels.

-

Technological Innovation and Growth Stocks: The continued growth and innovation in the technology sector have sustained demand for growth stocks, contributing significantly to market valuations. These companies often command premium valuations based on future growth potential.

-

Inflationary Pressures: Recent inflationary pressures have created uncertainty for investors. While inflation might be a negative factor in the long term, it can also create temporary volatility and higher stock prices in the short term.

Addressing Investor Concerns Regarding High Stock Market Valuations

Many investors are understandably concerned about high stock market valuations. It's important to address these concerns to provide a balanced perspective.

-

Price vs. Value: It's crucial to distinguish between price and value. A high price doesn't necessarily mean a stock is overvalued. Intrinsic value considers a company's future earnings potential, assets, and other qualitative factors.

-

Long-Term vs. Short-Term Strategies: High valuations are less concerning for long-term investors who focus on fundamental value and can ride out short-term market fluctuations. Short-term traders, however, may need a more cautious approach.

-

Diversification and Risk Management: A diversified portfolio across different asset classes and sectors helps mitigate risk associated with high valuations in specific sectors. Careful risk management is key to protecting capital.

-

Potential for Continued Growth: Even with high valuations, the market's potential for continued growth shouldn't be disregarded. Economic expansion, technological advancements, and robust corporate earnings can still drive further gains despite high P/E ratios in certain segments.

-

Practical Advice: Regularly review your portfolio's asset allocation, conduct thorough due diligence before investing, and don't panic sell based on short-term market volatility. Consider dollar-cost averaging to mitigate risk.

Alternative Investment Strategies in a High-Valuation Market

Diversification is key when stock market valuations are high. Considering alternative investment strategies can help balance your portfolio.

-

Bond Markets: While bond yields may be lower than historical averages, bonds still offer a degree of stability and diversification away from equity markets in the current climate.

-

Real Estate and Commodities: Real estate and commodities can provide diversification benefits, acting as hedges against equity market volatility and inflation. However, these asset classes also have their own unique risks.

-

Diversification Across Asset Classes: A well-diversified portfolio including stocks, bonds, real estate, and potentially alternative assets, can better withstand market fluctuations than a portfolio solely focused on equities.

-

Defensive Stocks: During periods of uncertainty, defensive stocks, such as those in the consumer staples and utilities sectors, can offer relative stability and a lower beta, acting as a buffer to overall portfolio risk.

Conclusion

BofA's analysis reveals a complex picture regarding high stock market valuations. While some sectors show valuations above historical averages, others remain within a reasonable range. Factors such as low interest rates, strong corporate earnings in specific sectors, and technological innovation contribute to these valuations. However, investors should focus on long-term strategies, diversification, and thorough due diligence. Understanding the difference between price and value is crucial, as is the need for effective risk management. While high stock market valuations present a challenge, a thorough understanding combined with a well-diversified portfolio and a long-term investment strategy can help investors mitigate risk and potentially capitalize on opportunities. Stay informed about high stock market valuations by regularly reviewing market analyses and consulting with a financial advisor to make informed decisions.

Featured Posts

-

Kort Geding Kampen Vs Enexis Stroomvoorziening Duurzaam Schoolgebouw Vertraagd

May 01, 2025

Kort Geding Kampen Vs Enexis Stroomvoorziening Duurzaam Schoolgebouw Vertraagd

May 01, 2025 -

Malek F En Het Steekincident In De Van Mesdagkliniek Actuele Updates

May 01, 2025

Malek F En Het Steekincident In De Van Mesdagkliniek Actuele Updates

May 01, 2025 -

Spicy Shrimp Ramen Stir Fry A Delicious Asian Inspired Dish

May 01, 2025

Spicy Shrimp Ramen Stir Fry A Delicious Asian Inspired Dish

May 01, 2025 -

Will Xrp Be Classified As A Commodity The Latest On The Ripple Lawsuit

May 01, 2025

Will Xrp Be Classified As A Commodity The Latest On The Ripple Lawsuit

May 01, 2025 -

Voordelig Elektrisch Rijden Enexis Oplaadtips Voor Noord Nederland

May 01, 2025

Voordelig Elektrisch Rijden Enexis Oplaadtips Voor Noord Nederland

May 01, 2025

Latest Posts

-

Drast Halt Njah Alteawn Fy Tezyz Slslth Almmyzt Dd Alshbab

May 01, 2025

Drast Halt Njah Alteawn Fy Tezyz Slslth Almmyzt Dd Alshbab

May 01, 2025 -

Kyf Yezz Alteawn Slslth Almmyzt Fy Swq Alshbab

May 01, 2025

Kyf Yezz Alteawn Slslth Almmyzt Fy Swq Alshbab

May 01, 2025 -

Alteawn Khtt Mtynt Ltezyz Slslt Altmyz Dd Mnafst Alshbab

May 01, 2025

Alteawn Khtt Mtynt Ltezyz Slslt Altmyz Dd Mnafst Alshbab

May 01, 2025 -

Astratyjyt Alteawn Ltezyz Slslt Mmyzath Fy Mwajht Alshbab

May 01, 2025

Astratyjyt Alteawn Ltezyz Slslt Mmyzath Fy Mwajht Alshbab

May 01, 2025 -

Alteawn Yezz Slslt Mmyzth Dd Alshbab

May 01, 2025

Alteawn Yezz Slslt Mmyzth Dd Alshbab

May 01, 2025