BofA's Take: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Context

BofA's overall market outlook remains relatively positive, despite acknowledging the elevated stock market valuations. Their reasoning rests on several key pillars, all interconnected and contributing to a more nuanced perspective than simply focusing on P/E ratios alone.

The Impact of Low Interest Rates

Historically low interest rates significantly influence stock valuations and investor behavior. This is because:

- Inverse Relationship: Low interest rates make bonds less attractive, driving investors to seek higher returns in the stock market. This increased demand pushes stock prices upward, even if underlying earnings growth isn't exceptionally high.

- Higher P/E Ratios: Low interest rates justify higher Price-to-Earnings (P/E) ratios. A lower discount rate (reflecting lower interest rates) used in discounted cash flow models leads to higher valuations for future earnings streams. This means that companies can command higher stock prices relative to their earnings.

The Role of Corporate Earnings Growth

Strong corporate earnings growth plays a crucial role in supporting current valuations. Many companies are demonstrating robust performance, fueled by:

- Strong Economic Fundamentals: In many sectors, economic growth is driving revenue and profit expansion.

- Innovation and Efficiency: Companies are investing in innovation and streamlining operations, leading to improved margins and profitability. Examples include companies that have successfully adapted to the digital economy and improved supply chain efficiency.

- Future Growth Potential: Analysts project continued earnings growth for many companies in the coming years, supporting the argument that current valuations reflect future potential, not just current earnings.

Technological Innovation and its Effect on Valuations

Technological advancements and disruptive innovation contribute significantly to justifying higher valuations, particularly within the technology sector.

- Growth Leaders: Tech companies are driving substantial growth, often exhibiting significantly higher growth rates than more traditional industries.

- Long-Term Potential: The potential for long-term market disruption and sustained growth in the technology sector further supports premium valuations for these companies. Examples include artificial intelligence, cloud computing, and renewable energy.

Addressing Common Investor Concerns About High Stock Market Valuations

Many investors fear that high stock market valuations signal an imminent market crash. However, this is an oversimplification.

The Myth of an Imminent Market Crash

High valuations don't automatically predict an immediate market crash.

- Historical Context: History is replete with examples of periods with high valuations that didn't result in immediate crashes. Market corrections are normal and healthy components of market cycles.

- Long-Term Perspective: A long-term investment strategy, focused on consistent contributions and diversification, is key to weathering market fluctuations.

Diversification and Risk Management

Diversification and risk management are paramount, even in a high-valuation market.

- Asset Allocation: Diversifying across different asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk.

- Risk Tolerance: Investors should align their investment strategies with their individual risk tolerance and time horizons.

Identifying Undervalued Opportunities

Even in a market with high overall valuations, opportunities for identifying undervalued companies or sectors exist.

- Fundamental Analysis: Diligent fundamental analysis, focusing on a company's intrinsic value, can uncover potentially undervalued assets.

- Sector-Specific Opportunities: Some sectors may be undervalued relative to others, offering potential for outsized returns.

Long-Term Investment Strategies in a High-Valuation Market

Maintaining a long-term investment perspective is crucial in a potentially volatile market.

The Importance of a Long-Term Perspective

Short-term market fluctuations shouldn't dictate long-term investment decisions.

- Dollar-Cost Averaging: Regular contributions through dollar-cost averaging smooths out the impact of volatility.

- Patience and Persistence: Staying invested and maintaining a disciplined approach are vital for long-term success.

Rebalancing Your Portfolio

Regular portfolio rebalancing is a powerful risk management tool.

- Rebalancing Strategy: Periodically adjusting your portfolio's asset allocation to its target weights helps capitalize on market fluctuations.

- Asset Allocation Management: This ensures that you're not overly exposed to any single asset class or sector.

Seeking Professional Financial Advice

Seeking professional financial advice is always recommended.

- Personalized Plan: A financial advisor can help create a personalized investment plan aligned with your specific goals and risk tolerance.

- Expert Guidance: Professional expertise provides valuable insights and guidance in navigating market complexities.

Conclusion

BofA's perspective on high stock market valuations emphasizes the need for a nuanced understanding of market dynamics. Low interest rates, strong corporate earnings, and technological innovation contribute to justifying current valuations. While high stock market valuations are a factor to consider, they shouldn't necessarily deter investors from maintaining a long-term investment strategy. Don't let concerns over high stock market valuations derail your financial goals. Understand BofA's perspective and develop a well-informed, long-term investment plan tailored to your risk tolerance. Remember, a balanced approach incorporating diversification, risk management, and professional advice is crucial in navigating the complexities of high stock market valuations.

Featured Posts

-

Lady Raiders Fall To Cincinnati In Tight Home Matchup 56 59

May 01, 2025

Lady Raiders Fall To Cincinnati In Tight Home Matchup 56 59

May 01, 2025 -

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025

Rugby World Cup Dupont Leads France To Victory Against Italy

May 01, 2025 -

Ray Epps Vs Fox News A Jan 6 Defamation Lawsuit Analysis

May 01, 2025

Ray Epps Vs Fox News A Jan 6 Defamation Lawsuit Analysis

May 01, 2025 -

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025 -

Accompagnement Numerique Pour Thes Dansants Attirer Et Fideliser

May 01, 2025

Accompagnement Numerique Pour Thes Dansants Attirer Et Fideliser

May 01, 2025

Latest Posts

-

Alteawn Yezz Slslt Mmyzth Dd Alshbab

May 01, 2025

Alteawn Yezz Slslt Mmyzth Dd Alshbab

May 01, 2025 -

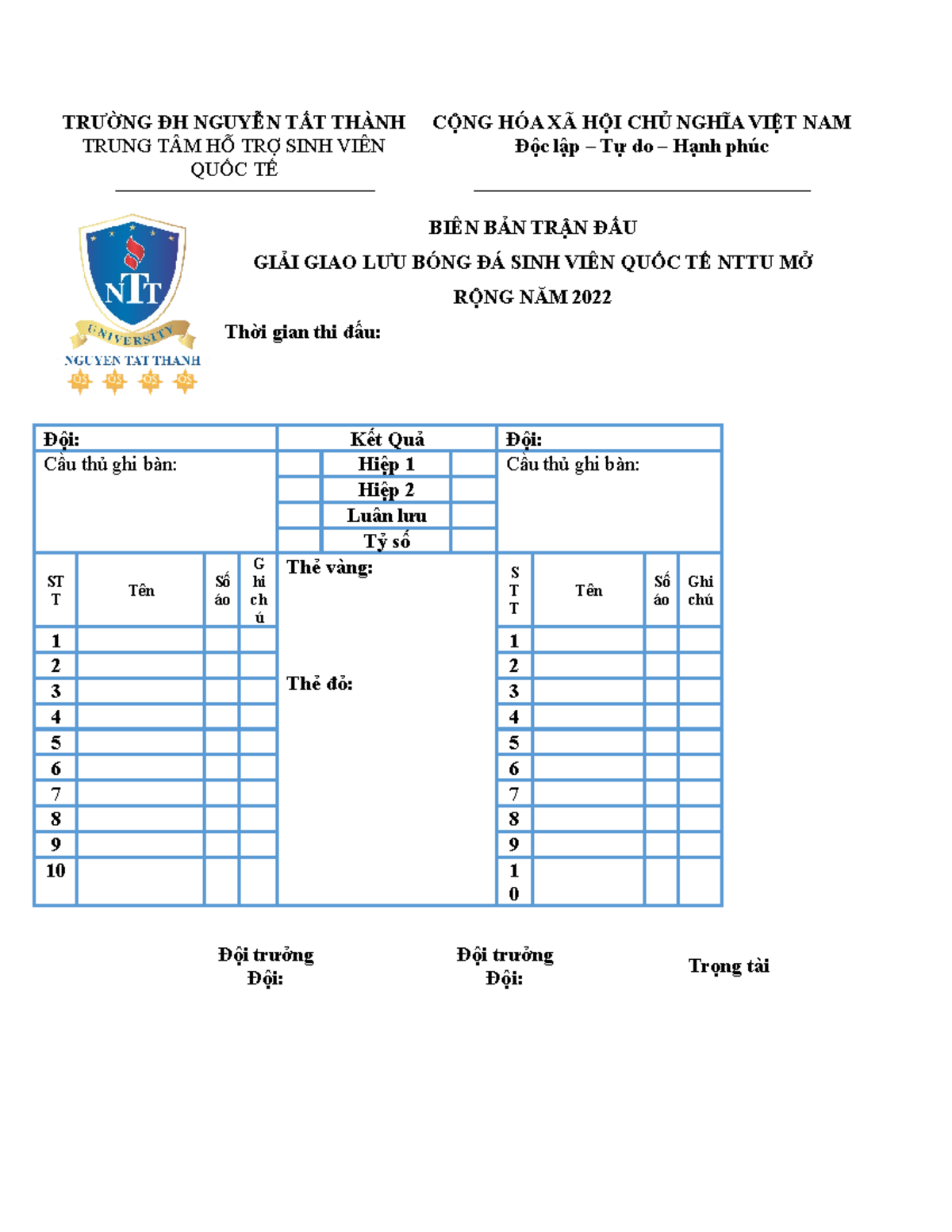

Tran Mo Man Chung Ket Bong Da Sinh Vien Nhung Pha Bong Man Nhan

May 01, 2025

Tran Mo Man Chung Ket Bong Da Sinh Vien Nhung Pha Bong Man Nhan

May 01, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Cap Nhat Ket Qua Chung Cuoc Lan Thu Vii

May 01, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Cap Nhat Ket Qua Chung Cuoc Lan Thu Vii

May 01, 2025 -

Vong Chung Ket Giai Bong Da Thanh Nien Sinh Vien Khoi Dau Day Hung Khoi

May 01, 2025

Vong Chung Ket Giai Bong Da Thanh Nien Sinh Vien Khoi Dau Day Hung Khoi

May 01, 2025 -

Ket Qua Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Ai La Nha Vo Dich

May 01, 2025

Ket Qua Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Ai La Nha Vo Dich

May 01, 2025