Will Minnesota Film Tax Credits Attract More Productions?

Table of Contents

Current State of Minnesota's Film Tax Credit Program

Minnesota's film tax credit program aims to incentivize film production within the state, fostering economic growth and job creation. Understanding the specifics of these Minnesota film production tax credits is crucial to assessing their effectiveness.

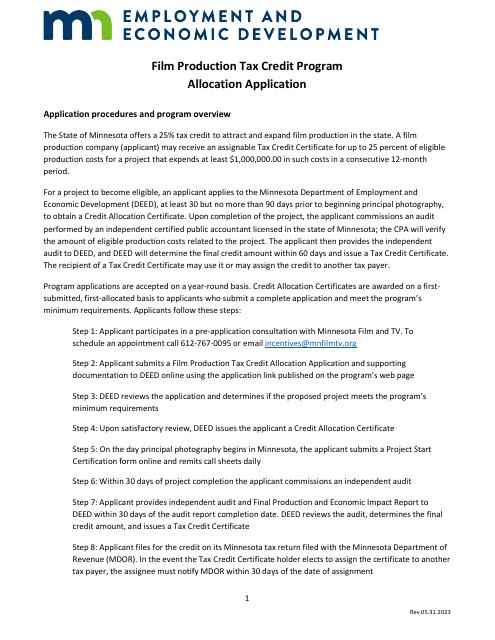

Details of the Tax Credit

The Minnesota film tax credit offers a percentage of qualifying expenses incurred during film production within the state. The exact percentage, caps, and qualifying expenses are subject to change based on legislative updates and annual budget allocations. It's essential to consult the official Minnesota Department of Employment and Economic Development (DEED) website for the most up-to-date information on the Minnesota film tax credit percentage and eligibility requirements. Generally, qualifying expenses include things like production wages, location rentals, and equipment purchases. However, careful attention must be paid to the detailed definition of "qualifying expenses" to maximize the benefit of the tax credit.

- Percentage of qualifying expenses covered: (Insert current percentage; this information needs to be verified from official sources).

- Types of productions eligible: Feature films, television series, commercials, documentaries, and other eligible forms of visual media are typically included. Specific eligibility criteria are defined within the program guidelines.

- Application process and deadlines: The application process involves submitting detailed documentation outlining qualifying expenses, production schedules, and other relevant information. Specific deadlines for applications vary.

- Restrictions or limitations: There may be caps on the total amount of tax credits awarded annually, and certain types of expenses might not be eligible for the credit. Detailed information is available from the DEED.

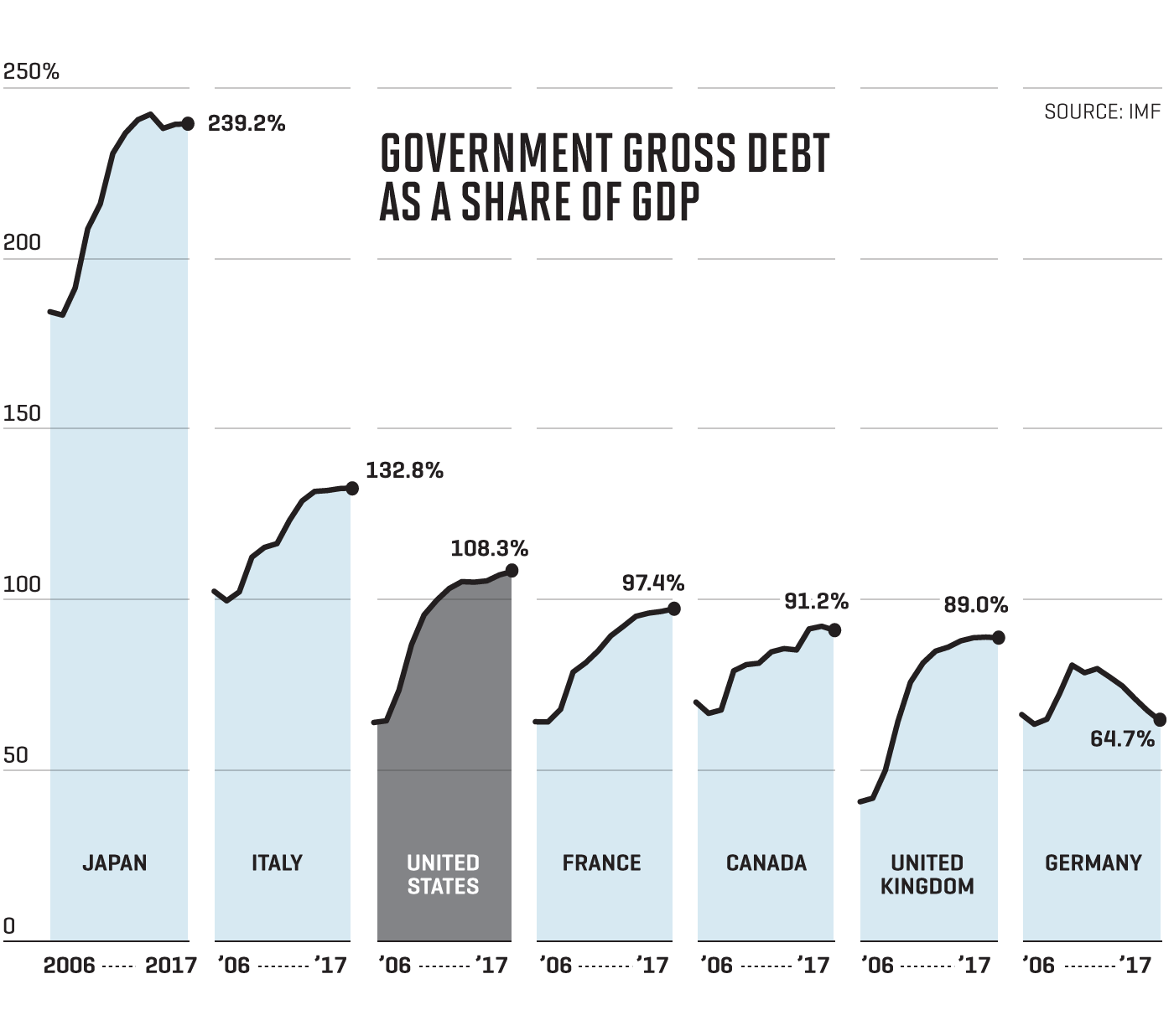

Comparison with Other States' Incentives

To effectively assess the competitiveness of Minnesota's film tax credits, a comparison with other states' film production incentives is necessary. This analysis is crucial in understanding the position of Minnesota within the wider Midwest film incentives landscape.

Competitive Landscape

Minnesota's film tax credit program faces competition from other states with potentially more generous incentives, such as Georgia, California, and New York. However, it's also important to evaluate the programs in neighboring states like Wisconsin, Iowa, and North Dakota to understand the regional competition for movie production Minnesota.

- Comparative analysis of tax credit percentages: (This section requires a comparative table showcasing the tax credit percentages offered by various states. Data should be sourced from official state government websites.)

- Advantages and disadvantages of Minnesota's program: While Minnesota offers a tax credit, its percentage may be lower than that offered by some competing states. However, other factors, such as access to skilled labor, infrastructure, and location-specific advantages, can influence a production company's decision.

- Additional incentives offered by competing states: Some states provide additional incentives beyond tax credits, such as grants, workforce development programs, or infrastructure investments dedicated to supporting film productions. This comprehensive support structure may increase their overall attractiveness.

Impact on the Minnesota Economy

The potential economic impact of a thriving Minnesota film industry is significant, reaching far beyond direct revenue from film productions. Attracting more productions can lead to substantial economic benefits.

Economic Benefits of Film Production

Increased film production in Minnesota could generate substantial economic benefits for the state. The economic impact of film is multifaceted, including both direct and indirect effects.

- Job creation potential (direct and indirect): Film productions create jobs not only for actors and crew but also for supporting industries such as catering, transportation, and hospitality. Economic modeling can estimate the total number of jobs generated by attracting a certain amount of film production spending.

- Projected revenue increase from film tourism: Successful films can boost tourism, with locations featured in movies becoming popular destinations for fans. This can positively impact local businesses, particularly in the hospitality sector.

- Impact on local businesses: Hotels, restaurants, equipment rental companies, and other local businesses benefit directly from the increased spending by film crews and cast during productions.

Challenges and Opportunities

While Minnesota's film tax credits hold promise, several challenges and opportunities must be addressed to fully maximize their potential to attract more productions.

Obstacles to Overcome

Several factors could hinder Minnesota's ability to attract more film productions, despite its tax credit program.

- Shortage of skilled crew members: A sufficient supply of skilled crew is essential for successful film productions. Addressing any workforce gaps requires investment in training and education programs.

- Lack of sufficient studio space or sound stages: Adequate studio space and sound stages are vital for large-scale productions. The lack of such infrastructure can deter filmmakers from choosing Minnesota.

- Competition from other states: Minnesota's tax credits must be competitive with those offered by other states to attract productions.

Future Prospects

To enhance the effectiveness of Minnesota film tax credits and attract more productions, several improvements are crucial.

- Increasing the percentage of tax credits offered: Increasing the percentage of qualifying expenses covered by the tax credit could make Minnesota a more attractive filming location.

- Expanding the types of productions eligible for incentives: Broadening the range of eligible productions could incentivize a wider variety of filmmaking activities.

- Investing in film infrastructure (studios, sound stages): Investing in modern and well-equipped studio space would address a critical infrastructure gap.

- Improving workforce training programs: Strengthening training programs to develop a skilled workforce would make Minnesota a more desirable location for film productions.

Conclusion

Will Minnesota film tax credits attract more productions? The answer depends on several factors. While the current program offers an incentive, its competitiveness compared to other states, the availability of skilled labor, and the state's film infrastructure are all crucial. The potential economic benefits are significant, including job creation and tourism revenue. However, to truly boost the Minnesota film industry and grow Minnesota film production, continued investment in the program and addressing the identified challenges are essential. Invest in Minnesota film by contacting your representatives and advocating for improvements to the film tax credit program, ensuring its competitiveness and maximizing its impact on the state's economy. Let's work together to boost the Minnesota film industry!

Featured Posts

-

Europe On High Alert Analyzing Recent Russian Military Moves

Apr 29, 2025

Europe On High Alert Analyzing Recent Russian Military Moves

Apr 29, 2025 -

The Evolving Chinese Automotive Landscape A Look At Bmw Porsche And The Future

Apr 29, 2025

The Evolving Chinese Automotive Landscape A Look At Bmw Porsche And The Future

Apr 29, 2025 -

Identifying The Countrys Fastest Growing Business Areas

Apr 29, 2025

Identifying The Countrys Fastest Growing Business Areas

Apr 29, 2025 -

Texas Woman Dies In Wrong Way Collision Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Dies In Wrong Way Collision Near Minnesota North Dakota Border

Apr 29, 2025 -

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025

Latest Posts

-

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025

Analysis Factors Threatening Trumps Proposed Tax Legislation

Apr 29, 2025 -

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025

Will Republican Divisions Sink Trumps Tax Bill

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Market Cap Decline

Apr 29, 2025 -

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025

The Impact Of Zombie Buildings On Chicagos Office Real Estate Market

Apr 29, 2025 -

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025

Republican Resistance To Trumps Tax Plan Key Groups And Obstacles

Apr 29, 2025