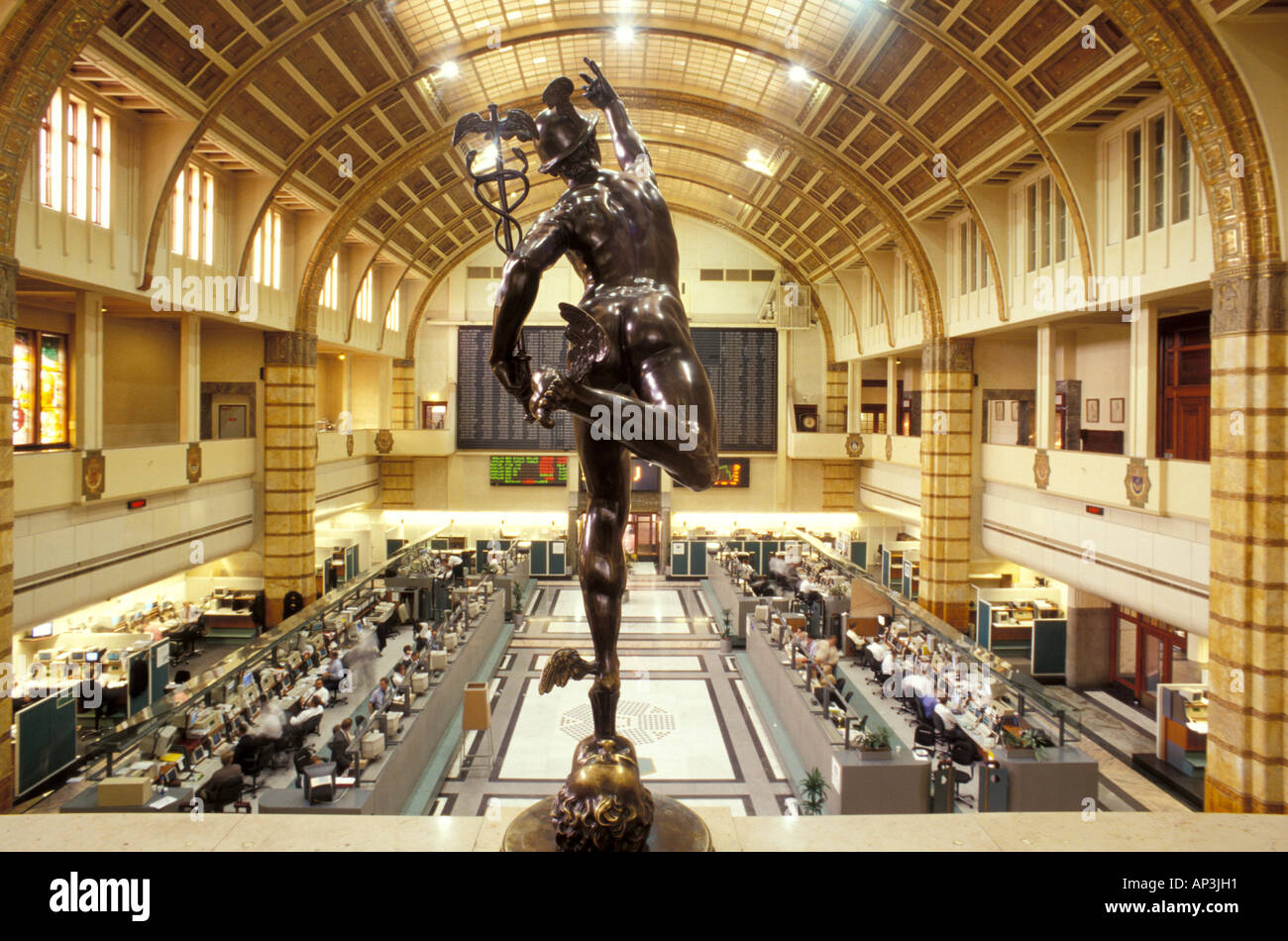

Three-Day Slump On Amsterdam Stock Exchange: Market Instability And Future Outlook

Table of Contents

Causes of the Amsterdam Stock Exchange Slump

Several interconnected factors contributed to the recent Amsterdam Stock Exchange slump. Analyzing these causes is key to understanding the market's volatility and predicting future trends.

Global Economic Uncertainty

The global economic landscape played a significant role in the Amsterdam Stock Exchange slump. Several interconnected global issues created a perfect storm of uncertainty:

- Increased inflation impacting consumer spending: High inflation rates across Europe and globally reduced consumer purchasing power, leading to decreased demand for goods and services. This impacted company profits and investor confidence.

- Rising interest rates impacting borrowing costs for businesses: Central banks worldwide raised interest rates to combat inflation. This increased borrowing costs for businesses, hindering investment and expansion plans, ultimately affecting stock prices.

- Geopolitical instability leading to investor hesitancy: Ongoing geopolitical tensions, such as the war in Ukraine and rising tensions in other regions, created a climate of uncertainty, prompting investors to seek safer havens for their investments, further exacerbating the Amsterdam Stock Exchange slump.

Sector-Specific Challenges

The slump wasn't uniform across all sectors. Certain industries felt the impact of the Amsterdam Stock Exchange slump more acutely than others:

- Analysis of the performance of individual sectors within the AEX index: The technology and energy sectors, for instance, experienced disproportionately large drops in their share prices.

- Specific examples of companies experiencing significant drops in share price: Several prominent companies within these sectors saw significant declines in their stock valuations, reflecting the broader market sentiment. Identifying these specific examples is crucial for understanding the market's vulnerability.

- Potential reasons for the underperformance of these sectors: The energy sector's downturn was partly due to fluctuating oil prices, while the technology sector's decline was influenced by concerns about rising interest rates and reduced investor appetite for riskier assets.

Investor Sentiment and Market Psychology

Market psychology played a crucial role in the Amsterdam Stock Exchange slump. Fear, uncertainty, and doubt (FUD) spread rapidly, triggering a sell-off:

- Discussion on the herd mentality and its impact on market trends: The "herd mentality," where investors mimic the actions of others, amplified the downturn as sell-offs became contagious.

- Analysis of social media sentiment and news coverage: Negative news coverage and social media sentiment fueled panic and exacerbated the sell-off, leading to a self-fulfilling prophecy.

- The impact of sell-offs and panic selling: Rapid sell-offs, driven by fear, further depressed prices and contributed significantly to the depth of the Amsterdam Stock Exchange slump.

Impact of the Amsterdam Stock Exchange Slump

The consequences of the Amsterdam Stock Exchange slump extend beyond the exchange itself, impacting the Dutch economy and individual investors.

Impact on Dutch Economy

The downturn has broader implications for the Dutch economy:

- Effect on investor confidence and future investments: The slump shook investor confidence, potentially reducing future investments and hindering economic growth.

- Potential impact on employment and economic growth: Reduced business activity and investment could lead to job losses and slower economic growth in the Netherlands.

- Government response and potential policy interventions: The Dutch government may need to implement economic stimulus measures or policy interventions to mitigate the negative effects of the Amsterdam Stock Exchange slump.

Impact on Individual Investors

Individual investors holding shares on the Amsterdam Stock Exchange felt the direct impact of the slump:

- Loss of investment value and portfolio diversification strategies: Many investors experienced a loss of investment value, highlighting the importance of portfolio diversification.

- Advice for managing risk during market volatility: Diversification and risk management strategies are crucial during periods of market volatility, like this Amsterdam Stock Exchange slump.

- Importance of long-term investment strategies: Maintaining a long-term investment perspective can help investors weather short-term market fluctuations.

Future Outlook for the Amsterdam Stock Exchange

While the recent Amsterdam Stock Exchange slump was significant, understanding the potential for recovery and employing appropriate investment strategies are crucial.

Potential for Recovery

The market's history suggests a potential for recovery:

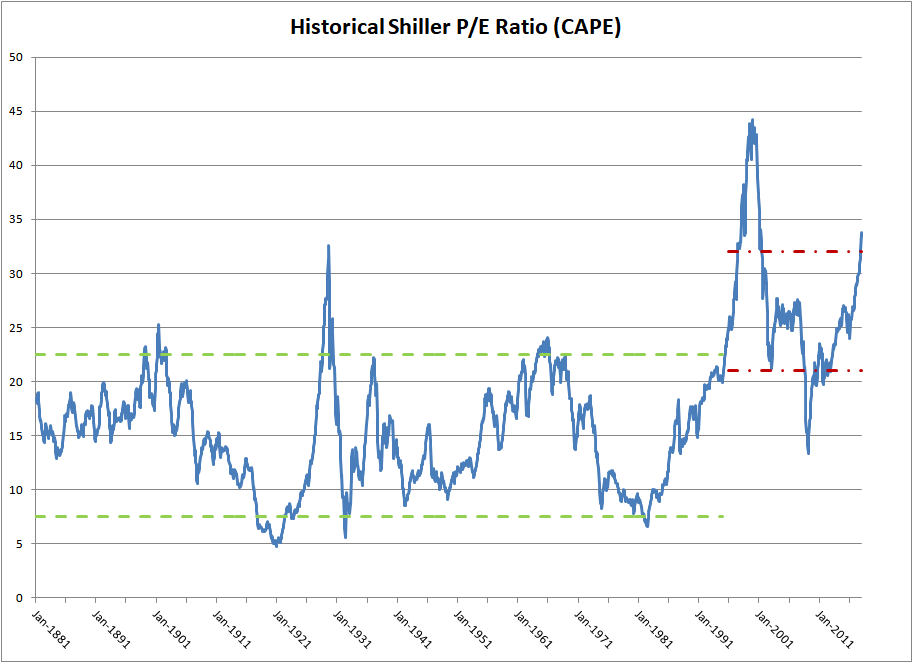

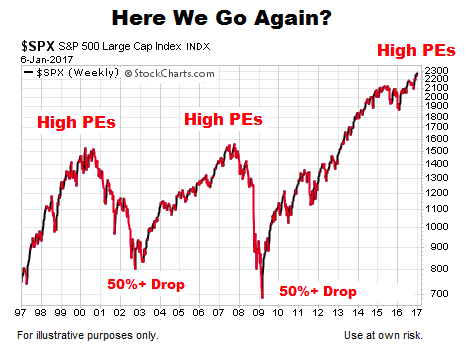

- Analysis of historical market recoveries from similar slumps: Studying past market corrections can offer insights into the potential timeline and factors influencing a rebound.

- Discussion of potential catalysts for market recovery: Positive economic news, easing geopolitical tensions, or sector-specific positive developments could act as catalysts for a market recovery.

- Predictions on the short-term and long-term performance of the AEX index: While predicting the future is impossible, analyzing current trends and historical data can provide a reasoned outlook on the AEX index's performance.

Strategies for Investors

Navigating this uncertain market requires careful consideration:

- Importance of diversification: Diversifying investments across different asset classes and sectors can mitigate risk.

- Risk management strategies: Employing risk management strategies, such as stop-loss orders, is crucial during periods of volatility.

- Long-term investment strategies: Focusing on long-term investment goals can help investors avoid making impulsive decisions based on short-term market fluctuations.

Conclusion

The three-day slump on the Amsterdam Stock Exchange highlights the inherent volatility of the market and the complex interplay of global and sector-specific factors. While the immediate future remains uncertain, understanding the causes and potential consequences of this Amsterdam Stock Exchange slump is crucial for both individual investors and the Dutch economy. By carefully analyzing market trends and employing sound investment strategies, investors can navigate this volatility and potentially capitalize on future opportunities. Stay informed about the ongoing developments surrounding this Amsterdam Stock Exchange slump and adapt your investment strategies accordingly.

Featured Posts

-

Borsa Italiana Scenari Europei E Impatto Decisioni Fed Focus Su Italgas E Banche

May 24, 2025

Borsa Italiana Scenari Europei E Impatto Decisioni Fed Focus Su Italgas E Banche

May 24, 2025 -

Complete List Celebrities Affected By The Devastating La Palisades Fires

May 24, 2025

Complete List Celebrities Affected By The Devastating La Palisades Fires

May 24, 2025 -

Ex French Prime Minister Expresses Reservations About Macrons Decisions

May 24, 2025

Ex French Prime Minister Expresses Reservations About Macrons Decisions

May 24, 2025 -

Serious Car Crash Leads To Road Closure And Hospitalization

May 24, 2025

Serious Car Crash Leads To Road Closure And Hospitalization

May 24, 2025 -

Konchita Vurst Ee Prognoz Na Chetyrekh Pobediteley Evrovideniya 2025

May 24, 2025

Konchita Vurst Ee Prognoz Na Chetyrekh Pobediteley Evrovideniya 2025

May 24, 2025

Latest Posts

-

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025

Should Investors Worry About High Stock Market Valuations Bof As Take

May 24, 2025 -

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025

Bof As View Why Stretched Stock Market Valuations Shouldnt Deter Investors

May 24, 2025 -

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025

High Stock Market Valuations A Bof A Analysis And Investor Guidance

May 24, 2025 -

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025

Investigating Thames Water The Impact Of Executive Bonuses On Customers

May 24, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

May 24, 2025