April 8th Treasury Market Update: Important Lessons Learned

Table of Contents

Yield Curve Shifts and Their Implications

The yield curve, representing the relationship between Treasury yields at different maturities, underwent notable changes on April 8th. Understanding these shifts is paramount for effective Treasury investment strategies.

Steepening Yield Curve

On April 8th, we observed a steepening yield curve, indicating a widening spread between short-term and long-term Treasury yields.

- Economic Factors: This steepening was primarily driven by increasing inflation expectations and anticipation of continued Federal Reserve rate hikes. The market was pricing in a more aggressive monetary policy response to combat inflation.

- Investor Implications: The steepening curve presented opportunities for investors seeking higher yields on longer-term bonds. However, it also increased the risk associated with short-term investments, which may be more vulnerable to interest rate fluctuations.

- Specific Yield Data: For instance, the yield on the 2-year Treasury note might have been around 4.5%, while the 10-year Treasury note yielded closer to 3.5%, resulting in a significant spread. The 30-year Treasury bond's yield offered even further potential but with increased duration risk.

Impact on Bond Strategies

The yield curve shift significantly impacted various bond investment strategies:

- Duration Matching: Investors employing duration matching strategies needed to adjust their portfolio durations to account for the changing yield curve, potentially shifting towards longer-term bonds to maintain their target duration.

- Yield Curve Trading: Yield curve traders saw opportunities to profit from the steepening curve by adopting strategies that involve buying long-term bonds and selling short-term bonds.

- Barbell Strategies: Investors using barbell strategies (holding both short- and long-term bonds) had to carefully reassess their allocations, balancing the risk of short-term rate hikes against the potential returns of long-term bonds. This April 8th Treasury market shift presented a unique challenge and opportunity for this strategy.

Inflationary Pressures and Treasury Prices

Inflationary pressures and expectations played a significant role in shaping Treasury market activity on April 8th.

Inflationary Data Release

Any significant inflation data released around April 8th, such as the Consumer Price Index (CPI) or Producer Price Index (PPI), would have directly impacted Treasury prices.

- Inflation and Yields: Higher-than-expected inflation typically leads to increased expectations of future interest rate hikes, pushing Treasury yields upward and prices downward. Conversely, lower-than-expected inflation can have the opposite effect.

- Inverse Relationship: Remember, bond prices and yields move inversely. When yields rise, prices fall, and vice versa.

- Specific Data: For example, if the April CPI data showed a higher-than-anticipated inflation rate, we'd expect to see Treasury prices decrease on April 8th as investors anticipated further Fed tightening.

Fed Policy Expectations

Market participants closely watch Federal Reserve pronouncements to gauge future monetary policy actions.

- Rate Hike Expectations: Anticipation of future interest rate hikes by the Fed would generally lead to higher Treasury yields and lower prices as investors adjust their portfolios.

- Investor Sentiment: Statements or actions from the Federal Reserve significantly influence investor sentiment and Treasury demand. Positive comments about economic growth could lead to higher yields, while concerns about inflation might cause investors to increase their holdings of Treasuries.

- Fed Actions: Any press releases or speeches from the Fed on or around April 8th would have significantly impacted the market, with clear implications for Treasury yields and investor behavior.

Geopolitical Events and Their Influence

Geopolitical events can significantly impact investor risk aversion and the demand for safe-haven assets like Treasuries.

Global Uncertainty and Safe-Haven Demand

On April 8th, any global geopolitical events could have had a substantial effect on the Treasury market.

- Risk Aversion: Increased global uncertainty often drives investors towards safe-haven assets like U.S. Treasury bonds, leading to increased demand and lower yields.

- Geopolitical Impacts: Conflicts, political instability, or other significant international events can all impact Treasury prices as investors seek the perceived safety of U.S. government debt.

- Specific Examples: For instance, escalating geopolitical tensions in a particular region could have driven investors towards U.S. Treasuries, pushing yields lower on April 8th.

Conclusion

This April 8th Treasury market update reveals the intricate interplay between economic data, monetary policy decisions, and geopolitical events. Understanding these dynamics is paramount for successful Treasury investment strategies. By analyzing yield curve shifts, inflationary pressures, and geopolitical influences, investors can refine their approaches and make more informed decisions. To stay abreast of future market movements and enhance your understanding of effective Treasury investment strategies, continue to monitor our regular Treasury market updates. Learn more about effective strategies with our future analyses of the Treasury market. Stay informed and make the most of your Treasury investments.

Featured Posts

-

Dubais Khazna Targets Saudi Market After Silver Lake Partnership

Apr 29, 2025

Dubais Khazna Targets Saudi Market After Silver Lake Partnership

Apr 29, 2025 -

The Rise Of Huawei A New Ai Chip To Take On Nvidia

Apr 29, 2025

The Rise Of Huawei A New Ai Chip To Take On Nvidia

Apr 29, 2025 -

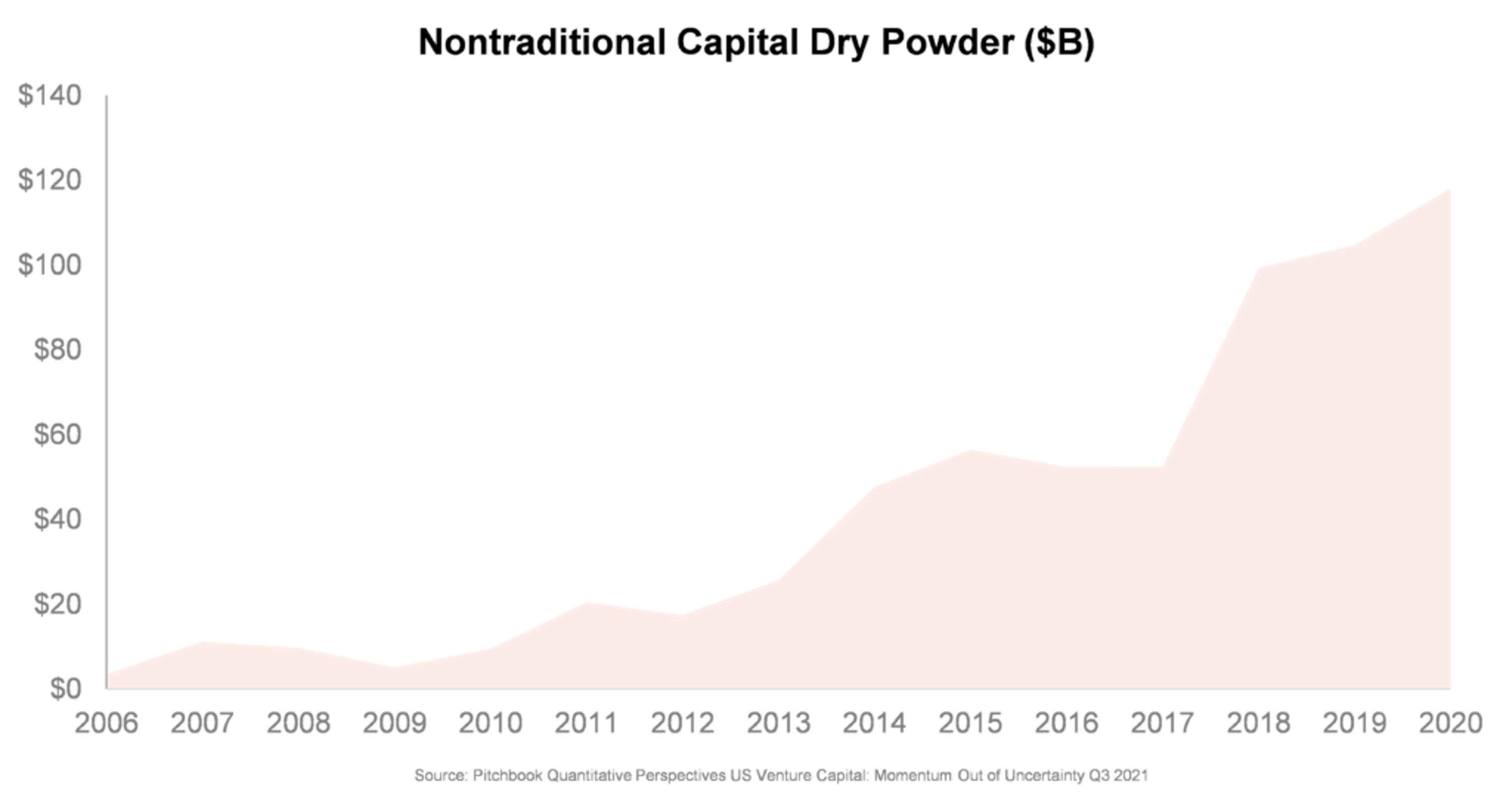

Understanding The Surge In The Venture Capital Secondary Market

Apr 29, 2025

Understanding The Surge In The Venture Capital Secondary Market

Apr 29, 2025 -

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025

Akeso Plunges Cancer Drug Trial Disappoints

Apr 29, 2025 -

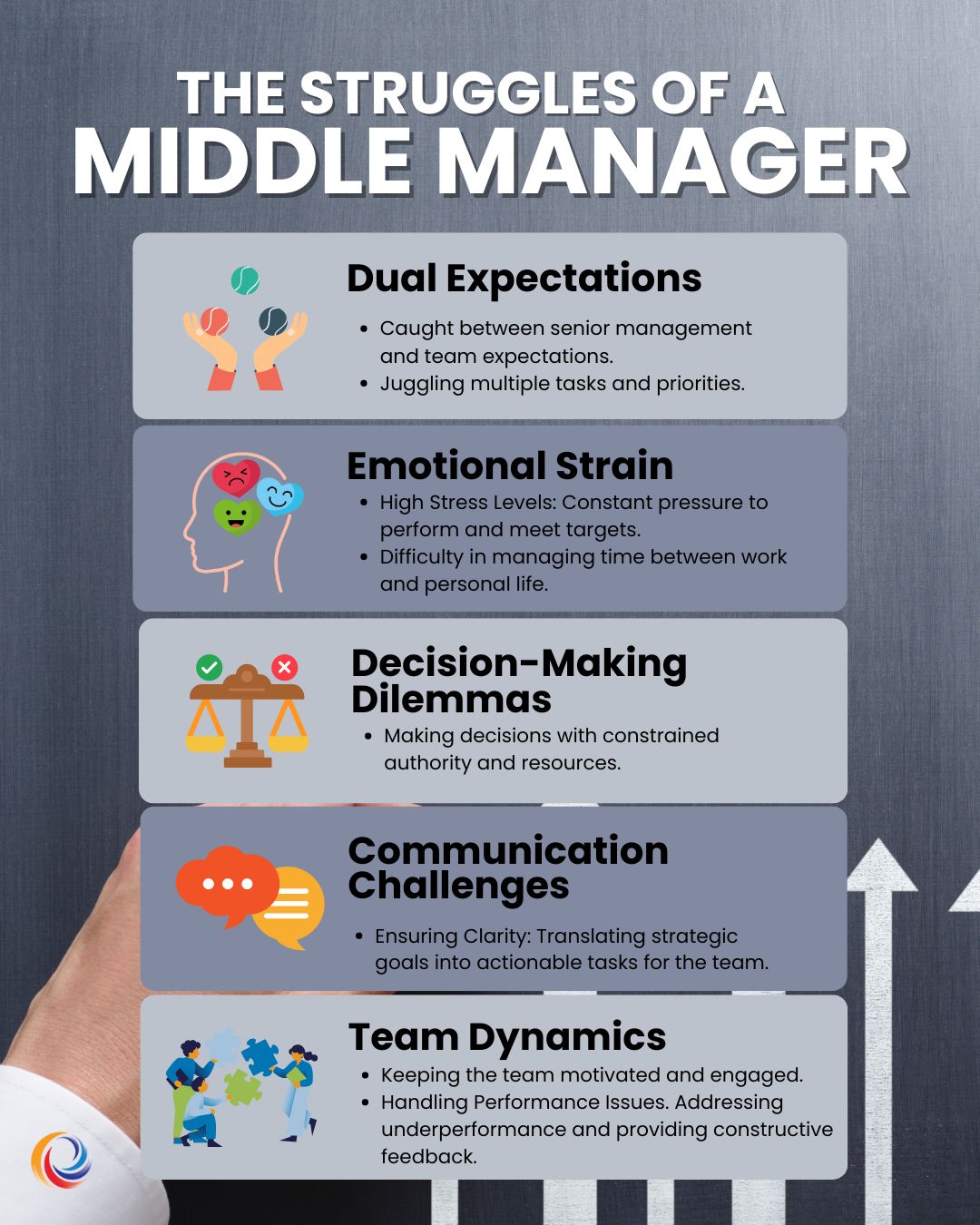

How Middle Management Drives Productivity And Improves Employee Satisfaction

Apr 29, 2025

How Middle Management Drives Productivity And Improves Employee Satisfaction

Apr 29, 2025

Latest Posts

-

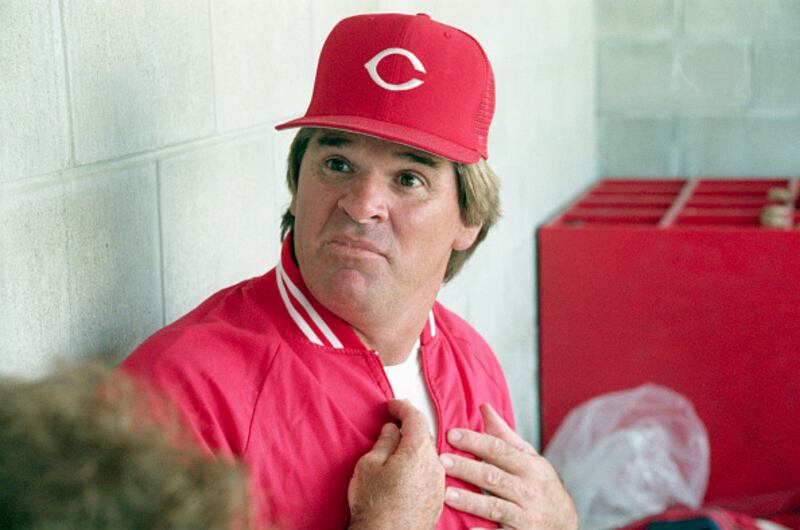

Former Mlb Star Johnny Damon Aligns With Trump On Pete Roses Hall Of Fame Eligibility

Apr 29, 2025

Former Mlb Star Johnny Damon Aligns With Trump On Pete Roses Hall Of Fame Eligibility

Apr 29, 2025 -

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025

Damon Agrees With Trump Believes Pete Rose Deserves Hall Of Fame Spot

Apr 29, 2025 -

Johnny Damon Sides With Trump Advocates For Pete Roses Hall Of Fame Induction

Apr 29, 2025

Johnny Damon Sides With Trump Advocates For Pete Roses Hall Of Fame Induction

Apr 29, 2025 -

Posthumous Pardon For Pete Rose Understanding Trumps Decision

Apr 29, 2025

Posthumous Pardon For Pete Rose Understanding Trumps Decision

Apr 29, 2025 -

Snow Fox Operational Status Tuesday February 11th

Apr 29, 2025

Snow Fox Operational Status Tuesday February 11th

Apr 29, 2025