European Energy Market: Solar Energy Oversupply Causes Price Collapse

Table of Contents

The Surge in Solar Energy Production in Europe

The current situation of solar energy oversupply in Europe is a result of several converging factors. The rapid increase in solar energy production is unprecedented, creating a complex market dynamic.

Increased Government Incentives and Subsidies

Numerous European governments have implemented ambitious policies to promote solar energy adoption. These incentives have significantly accelerated the growth of the solar sector.

- Germany's Energiewende: Germany's ambitious energy transition policy has been a major driver of solar energy growth, leading to substantial installations over the past decade.

- Spain's Feed-in Tariffs: Spain's earlier feed-in tariff programs spurred massive solar installations, although subsequent policy changes have impacted market stability.

- Italy's Renewable Energy Incentives: Italy has also invested heavily in solar energy, with various incentive programs boosting installations.

Specific subsidy types have played a crucial role:

- Tax credits: Reducing the upfront cost of solar panel installations.

- Feed-in tariffs: Guaranteeing a fixed price for the electricity generated by solar panels.

- Grants and subsidies: Direct financial support for solar projects.

Technological Advancements and Cost Reductions

Significant technological advancements have dramatically reduced the cost of solar energy. This affordability has been a primary factor in the rapid expansion of solar capacity.

- Improved panel efficiency: Modern solar panels are significantly more efficient than their predecessors, generating more electricity from the same surface area.

- Reduced manufacturing costs: Economies of scale and technological innovations in manufacturing have driven down the cost of solar panels.

- Longer panel lifespans: Increased durability means lower replacement costs over the long term.

Key technological improvements include:

- Perovskite solar cells: Offering higher efficiency potential than traditional silicon cells.

- Bifacial solar panels: Capturing sunlight from both sides.

- Improved energy storage solutions: Making solar energy more reliable and consistent.

Increased Private Investment in Solar Energy

The solar energy sector has attracted significant private investment, further contributing to the oversupply. This investment reflects growing confidence in the long-term viability of solar energy.

- Venture capital and private equity: Large investments have fueled the growth of solar energy companies.

- Corporate sustainability goals: Many corporations are investing in solar energy to meet their sustainability targets and reduce their carbon footprint.

- Institutional investors: Pension funds and other institutional investors are increasingly allocating funds to renewable energy projects, including solar.

Major investment trends include:

- Utility-scale solar farms: Large-scale solar power plants are becoming increasingly common.

- Distributed generation: Smaller solar installations on rooftops and in communities.

- Solar-plus-storage projects: Combining solar panels with battery storage systems.

The Consequences of Solar Energy Oversupply

The rapid increase in solar energy production has led to several significant consequences for the European energy market.

Price Collapse in Solar Energy

The oversupply has resulted in a sharp decline in solar energy prices. This price collapse impacts various stakeholders across the value chain.

- Reduced profitability for manufacturers: Lower prices squeeze profit margins for solar panel manufacturers.

- Increased competition among installers: Installation companies face pressure to lower their prices to remain competitive.

- Lower returns for investors: Investors in solar projects may experience lower than anticipated returns due to reduced energy prices.

Price trends show a significant downward pressure across different solar panel types:

- Monocrystalline silicon panels: Experiencing the most significant price drops.

- Polycrystalline silicon panels: Also showing significant price reductions.

- Thin-film solar panels: Facing increased competitive pressure.

Impact on Energy Market Competition

The increased availability of solar energy is reshaping the competitive landscape within the European energy market.

- Increased competition among solar energy producers: Leading to a more dynamic and competitive market.

- Impact on other renewable energy sources: Increased solar energy production may impact the competitiveness of other renewable energy sources like wind and hydro.

- Pressure on fossil fuel energy providers: The cost advantage of solar energy is putting pressure on traditional fossil fuel providers.

Comparing energy sources reveals solar’s rising dominance:

- Cost competitiveness: Solar energy is now cost-competitive with traditional energy sources in many regions.

- Environmental impact: Solar energy offers a cleaner alternative to fossil fuels.

- Energy security: Increased solar energy production enhances energy independence.

Challenges for Solar Energy Investors

The current market situation presents several challenges for investors in the solar energy sector.

- Price volatility: Fluctuations in solar energy prices create uncertainty for investors.

- Overcapacity risks: Excess capacity in the market can lead to reduced profitability.

- Policy uncertainty: Changes in government policies can significantly impact investment returns.

Risks and challenges facing investors include:

- Market saturation: The potential for reduced demand in the future.

- Technological disruption: The emergence of new technologies that could make existing solar technologies obsolete.

- Geopolitical risks: Factors such as trade wars and political instability can impact the solar energy market.

Future Outlook for the European Solar Energy Market

The future of the European solar energy market will depend on several factors, including market stabilization and the role of policy.

Potential for Market Stabilization

The market may stabilize as demand catches up with supply. Several factors could contribute to this stabilization:

- Growing energy demand: Increased electricity consumption will drive demand for solar energy.

- Energy storage solutions: Battery storage technology will help to address the intermittency of solar energy.

- Expansion into new markets: The development of solar energy projects in emerging markets will create new opportunities.

Factors leading to market stabilization include:

- Increased grid integration: Improved infrastructure for connecting solar power to the electricity grid.

- Smart grid technologies: Optimizing energy distribution and reducing waste.

- Technological innovation: Further cost reductions and efficiency improvements in solar technology.

The Importance of Long-Term Planning and Policy

Effective long-term planning and policy are crucial for ensuring the sustainable growth of the solar energy sector in Europe.

- Sustainable energy policies: Policies promoting balanced growth and avoiding future oversupply issues.

- Coordination of energy production and consumption: Efficient management of energy resources.

- Smart grid infrastructure: Modernizing the electricity grid to accommodate increased renewable energy generation.

Key policy recommendations include:

- Strategic planning for solar energy deployment: Avoiding future oversupply situations.

- Investment in energy storage technologies: Addressing the intermittency of solar energy.

- Support for research and development: Driving innovation and cost reductions in solar technology.

Conclusion

The current solar energy oversupply in the European energy market presents both challenges and opportunities. While the price collapse has negatively impacted some stakeholders, it also signifies the remarkable success of renewable energy deployment. Looking ahead, strategic planning, smart grid integration, and continued technological advancements are crucial for stabilizing the market and ensuring the continued growth of solar energy as a key component of Europe's sustainable energy future. Understanding the dynamics of solar energy oversupply Europe is critical for both investors and policymakers to navigate this evolving energy landscape. To stay informed about the latest developments in the European solar energy market, continue to follow industry news and reports.

Featured Posts

-

Chinas Huawei Unveils New Ai Chip Technology Closing The Gap On Nvidia

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Technology Closing The Gap On Nvidia

Apr 29, 2025 -

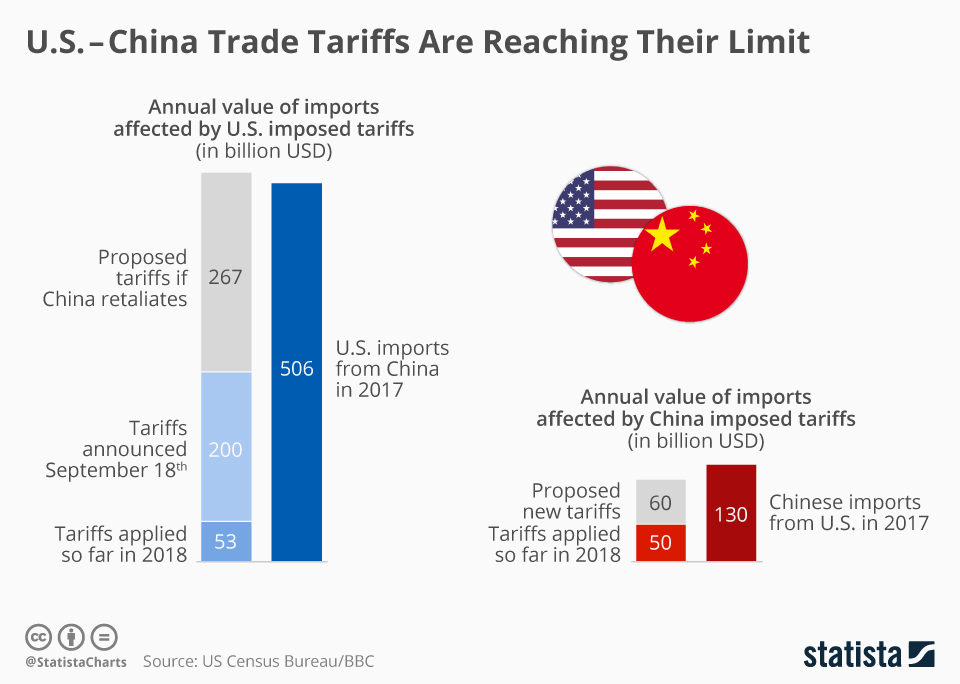

The Economic Impact Of Trumps China Tariffs Higher Costs And Scarcity

Apr 29, 2025

The Economic Impact Of Trumps China Tariffs Higher Costs And Scarcity

Apr 29, 2025 -

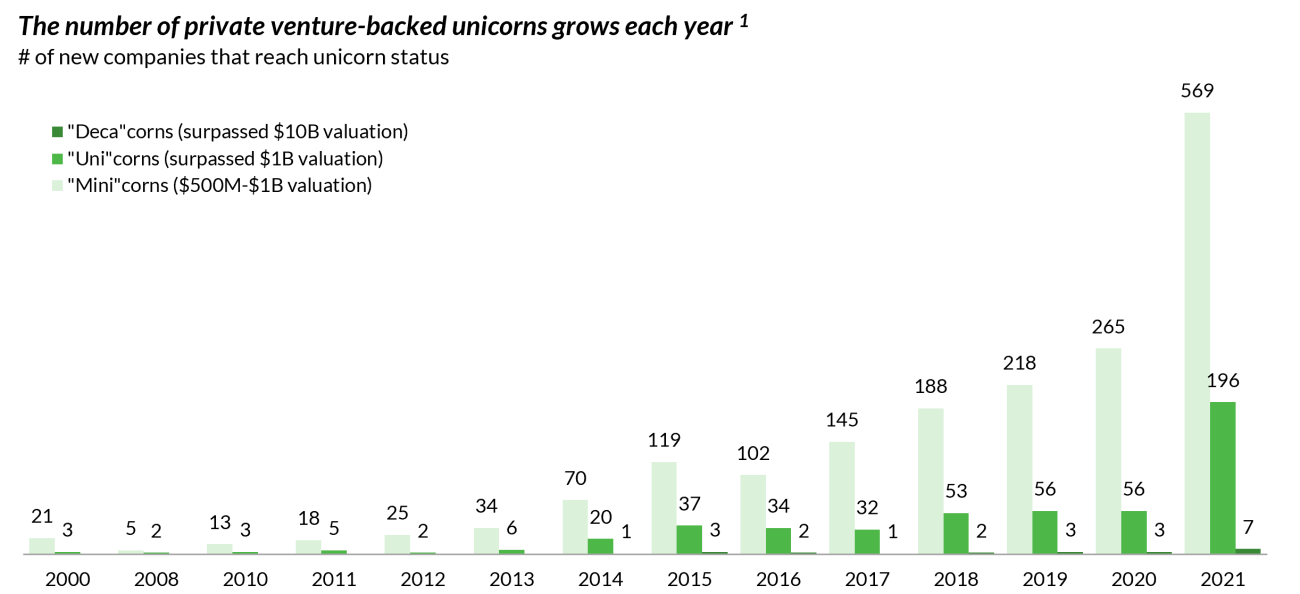

Is The Venture Capital Secondary Market Overheated A Current Analysis

Apr 29, 2025

Is The Venture Capital Secondary Market Overheated A Current Analysis

Apr 29, 2025 -

What We Learned About Treasuries On April 8th

Apr 29, 2025

What We Learned About Treasuries On April 8th

Apr 29, 2025 -

The Reliance Effect How Strong Earnings Impact Indias Top Companies

Apr 29, 2025

The Reliance Effect How Strong Earnings Impact Indias Top Companies

Apr 29, 2025

Latest Posts

-

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025 -

Older Viewers Rediscovering Favorite Shows On You Tube

Apr 29, 2025

Older Viewers Rediscovering Favorite Shows On You Tube

Apr 29, 2025 -

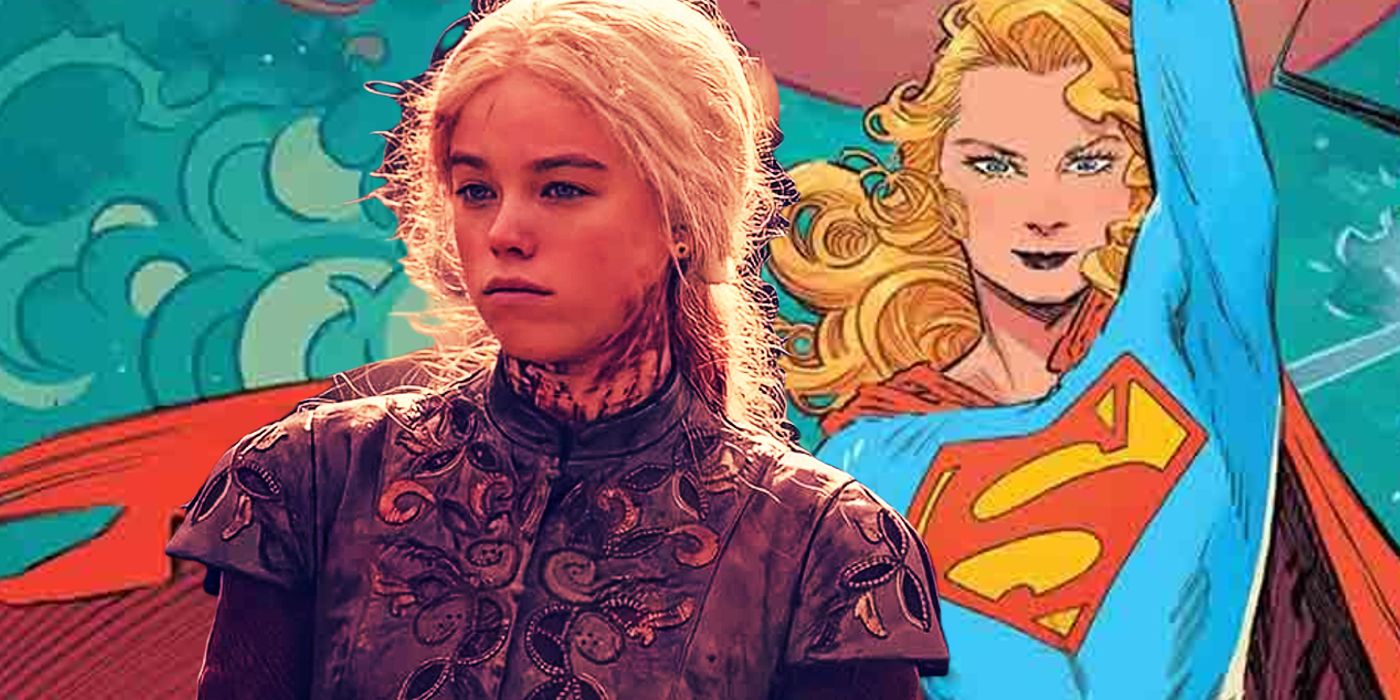

Milly Alcock As Supergirl In Netflixs Sirens A Look At The New Trailer

Apr 29, 2025

Milly Alcock As Supergirl In Netflixs Sirens A Look At The New Trailer

Apr 29, 2025 -

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025

Tremor 2 Netflix Series Kevin Bacons Potential Return Explored

Apr 29, 2025