Tesla Stock Slump Drives Elon Musk's Net Worth Below $300 Billion

Table of Contents

The Plunge in Tesla's Stock Price

Tesla's stock price has experienced a considerable downturn in recent months, plummeting by [insert percentage]% over the past [insert timeframe, e.g., six months]. This significant drop represents a substantial loss in market capitalization, directly impacting investor confidence and the overall perception of the electric vehicle (EV) market leader. Several factors have contributed to this slump:

- Increased Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants launching competitive models. This heightened competition is squeezing Tesla's market share and impacting profitability.

- Economic Slowdown: Global economic uncertainty, including inflation and rising interest rates, has dampened consumer spending and investor sentiment, affecting demand for luxury goods, including Tesla vehicles.

- Production Issues: Reports of production bottlenecks and challenges in meeting delivery targets have added to investor concerns about Tesla's ability to maintain its growth trajectory.

- Negative Investor Sentiment: Concerns surrounding Elon Musk's involvement with Twitter and other ventures have also negatively impacted investor confidence in Tesla's stock.

[Insert chart or graph visually representing the decline in Tesla's stock price over the specified period.]

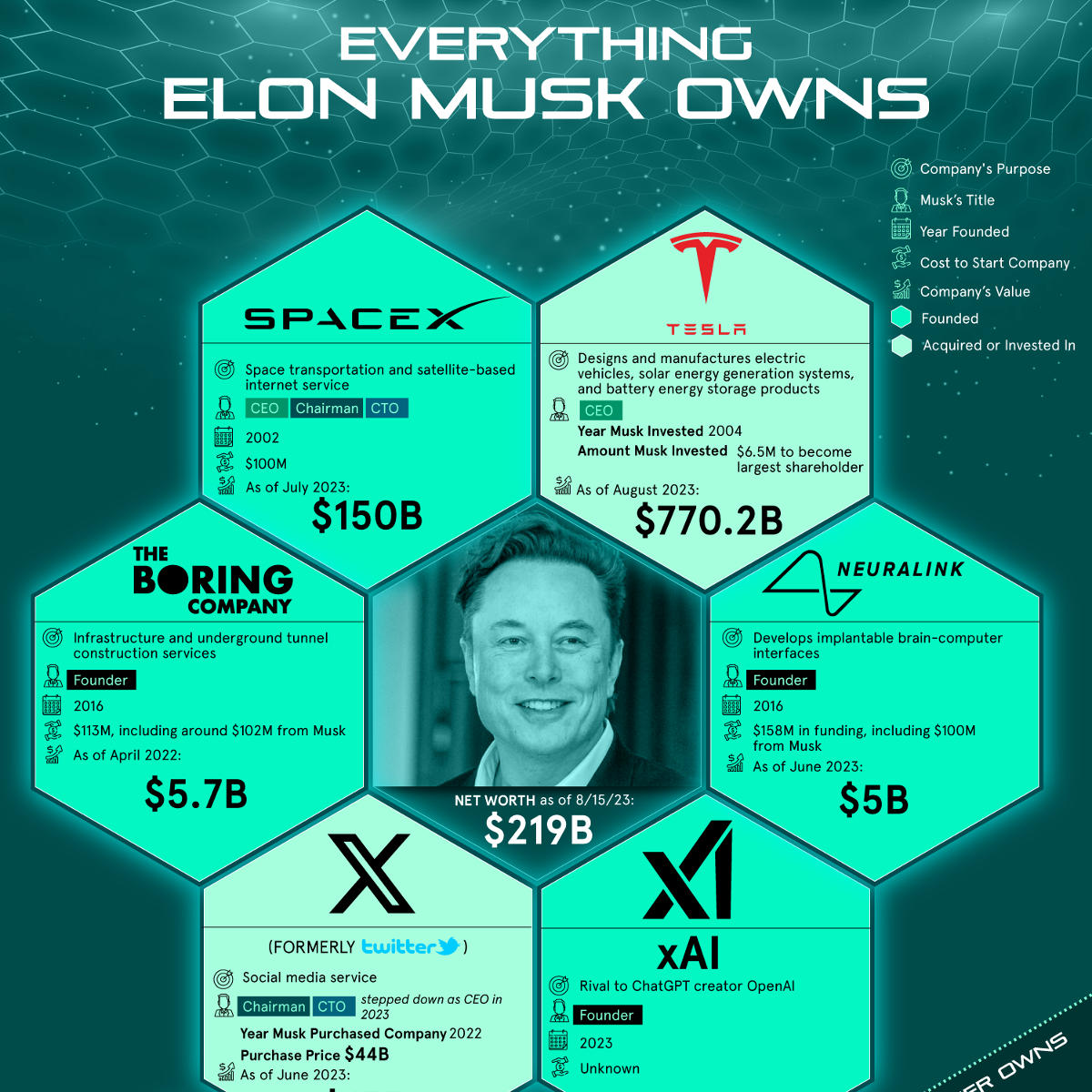

Impact on Elon Musk's Net Worth

The decline in Tesla's stock price has directly translated into a significant reduction in Elon Musk's net worth. His wealth, heavily tied to his substantial Tesla ownership, has fallen by an estimated [insert dollar amount], dropping his net worth below $300 billion. This represents a considerable decrease from his previous peak net worth of [insert previous high net worth]. Consequently, his ranking among the world's wealthiest individuals has also shifted downwards. This highlights the inherent risk associated with a significant portion of one's wealth being tied to a single asset, especially in a volatile market like the stock market.

Factors Contributing to the Tesla Stock Slump

Several interconnected factors have contributed to the recent Tesla stock slump:

Increased Competition in the EV Market

The EV market is no longer Tesla's sole domain. Established automakers like Ford, General Motors, and Volkswagen, along with emerging players like Rivian and Lucid, are aggressively pursuing market share with increasingly competitive models and technologies. This increased competition is putting pressure on Tesla's pricing strategy and profitability.

Macroeconomic Factors

The current macroeconomic environment presents significant headwinds for Tesla. High inflation, rising interest rates, and fears of a potential recession are all dampening consumer demand and impacting investor sentiment, leading to a broader sell-off in the stock market, including Tesla.

Elon Musk's Controversies

Elon Musk's controversial actions, particularly his acquisition of Twitter and subsequent management decisions, have created uncertainty and negatively impacted investor confidence in Tesla. This has led to increased scrutiny of his leadership and Tesla's corporate governance.

Production Challenges and Supply Chain Issues

Tesla has faced various production challenges and supply chain disruptions that have impacted its ability to meet demand and maintain its production targets. These logistical hurdles have added to the negative sentiment surrounding the company's stock performance.

Future Outlook for Tesla Stock and Elon Musk's Net Worth

Predicting the future of Tesla's stock price and Elon Musk's net worth is inherently challenging. However, several factors will likely play a crucial role: the success of new Tesla models, the overall performance of the EV market, the resolution of macroeconomic uncertainties, and the management of any future controversies. A positive outlook would involve successful new product launches, increased market share, and a stabilizing global economy. Conversely, continued competition, economic downturn, and further controversies could potentially lead to further declines.

Conclusion: Analyzing the Tesla Stock Slump's Effect on Elon Musk's Billions

The recent Tesla stock slump has resulted in a significant decrease in Elon Musk's net worth, highlighting the interconnectedness between individual wealth and market performance. The decline stems from a confluence of factors: intensified competition in the EV market, macroeconomic headwinds, controversies surrounding Elon Musk, and production challenges. While predicting the future is impossible, monitoring Tesla's performance and understanding the interplay of these factors is crucial for anyone interested in the future of the electric vehicle industry and the world's wealthiest individuals. To stay informed about the latest developments concerning Tesla stock and Elon Musk's net worth, monitor Tesla stock and track Elon Musk’s net worth regularly by following [link to your website/relevant news source].

Featured Posts

-

Chinas Steel Production Cuts Implications For The Iron Ore Market

May 10, 2025

Chinas Steel Production Cuts Implications For The Iron Ore Market

May 10, 2025 -

Otsutstvie Makrona Starmera Mertsa I Tuska V Kieve 9 Maya Prichiny I Posledstviya

May 10, 2025

Otsutstvie Makrona Starmera Mertsa I Tuska V Kieve 9 Maya Prichiny I Posledstviya

May 10, 2025 -

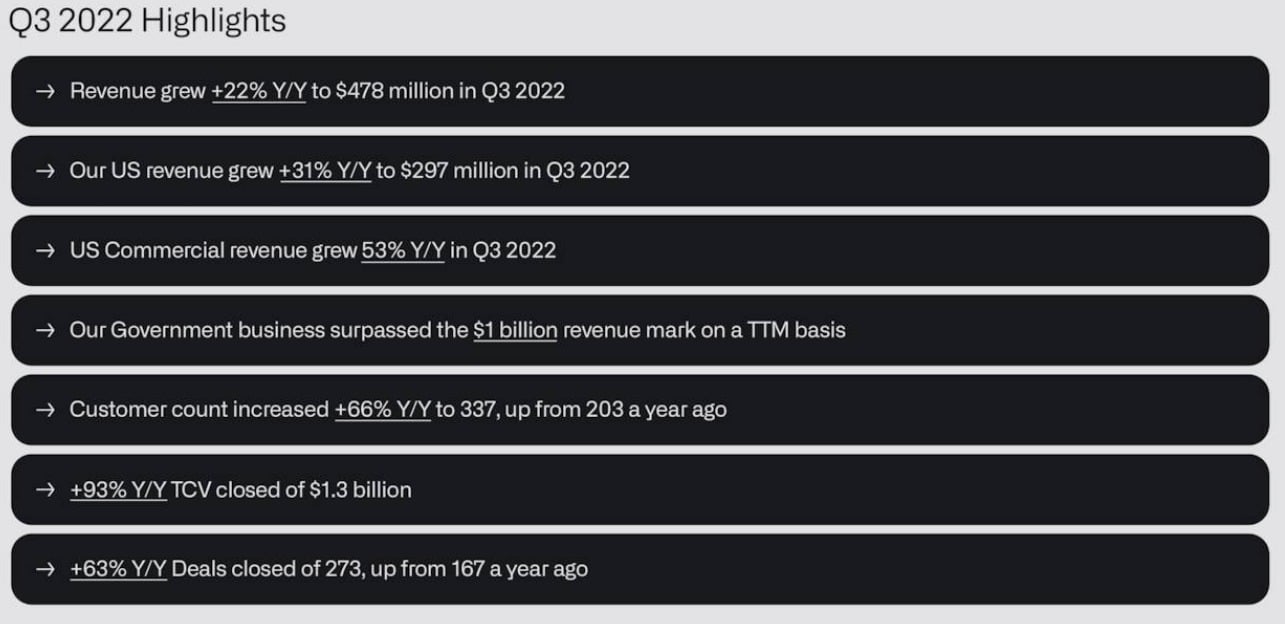

Palantir Stock Forecast Revised A Deep Dive Into The Market Shift

May 10, 2025

Palantir Stock Forecast Revised A Deep Dive Into The Market Shift

May 10, 2025 -

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Policy

May 10, 2025

Fluctuations In Elon Musks Net Worth Correlation With Us Economic Policy

May 10, 2025 -

Elon Musk Net Worth 2024 The Influence Of Us Power

May 10, 2025

Elon Musk Net Worth 2024 The Influence Of Us Power

May 10, 2025