Fluctuations In Elon Musk's Net Worth: Correlation With US Economic Policy

Table of Contents

The Impact of Fiscal Policy on Tesla's Stock Price and Musk's Net Worth

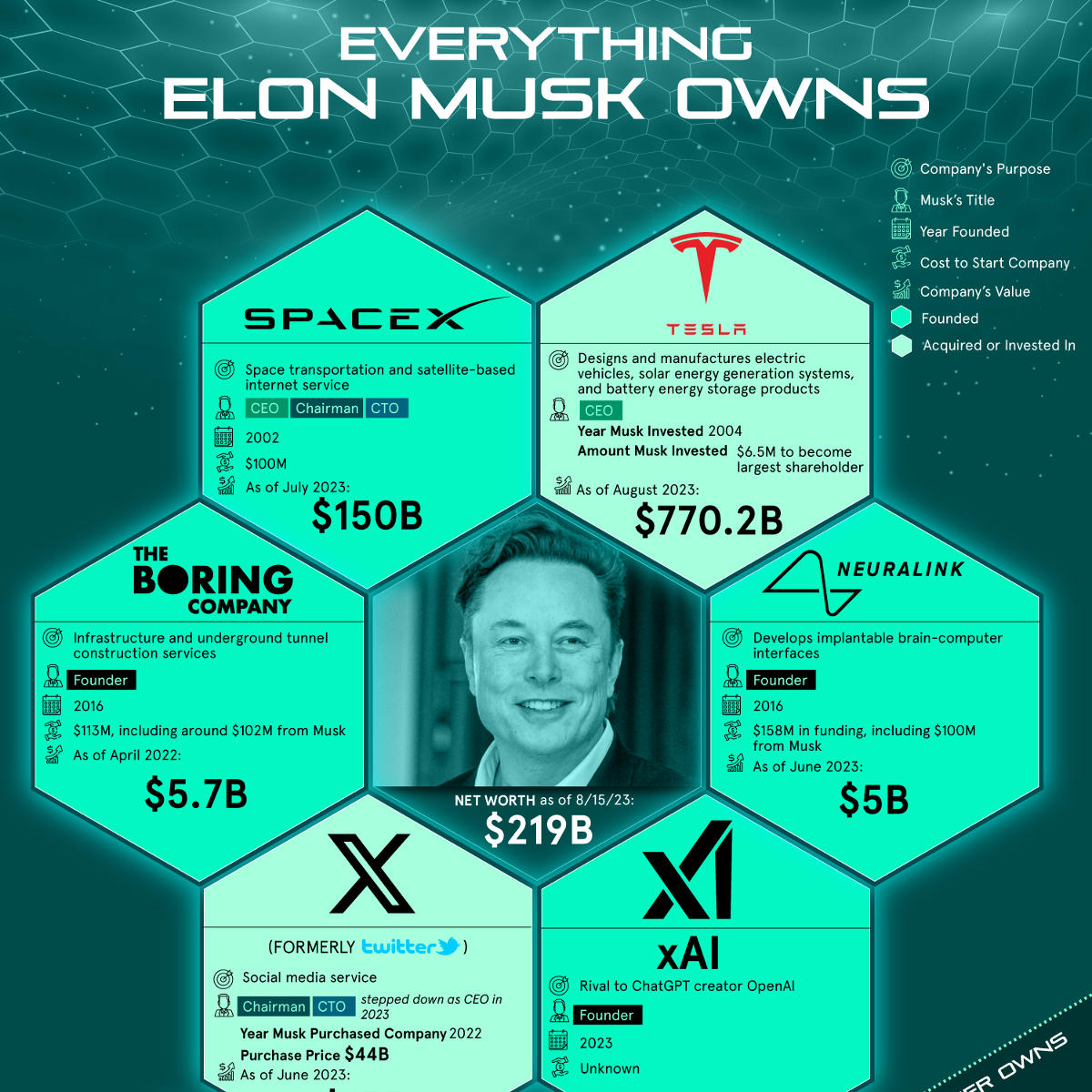

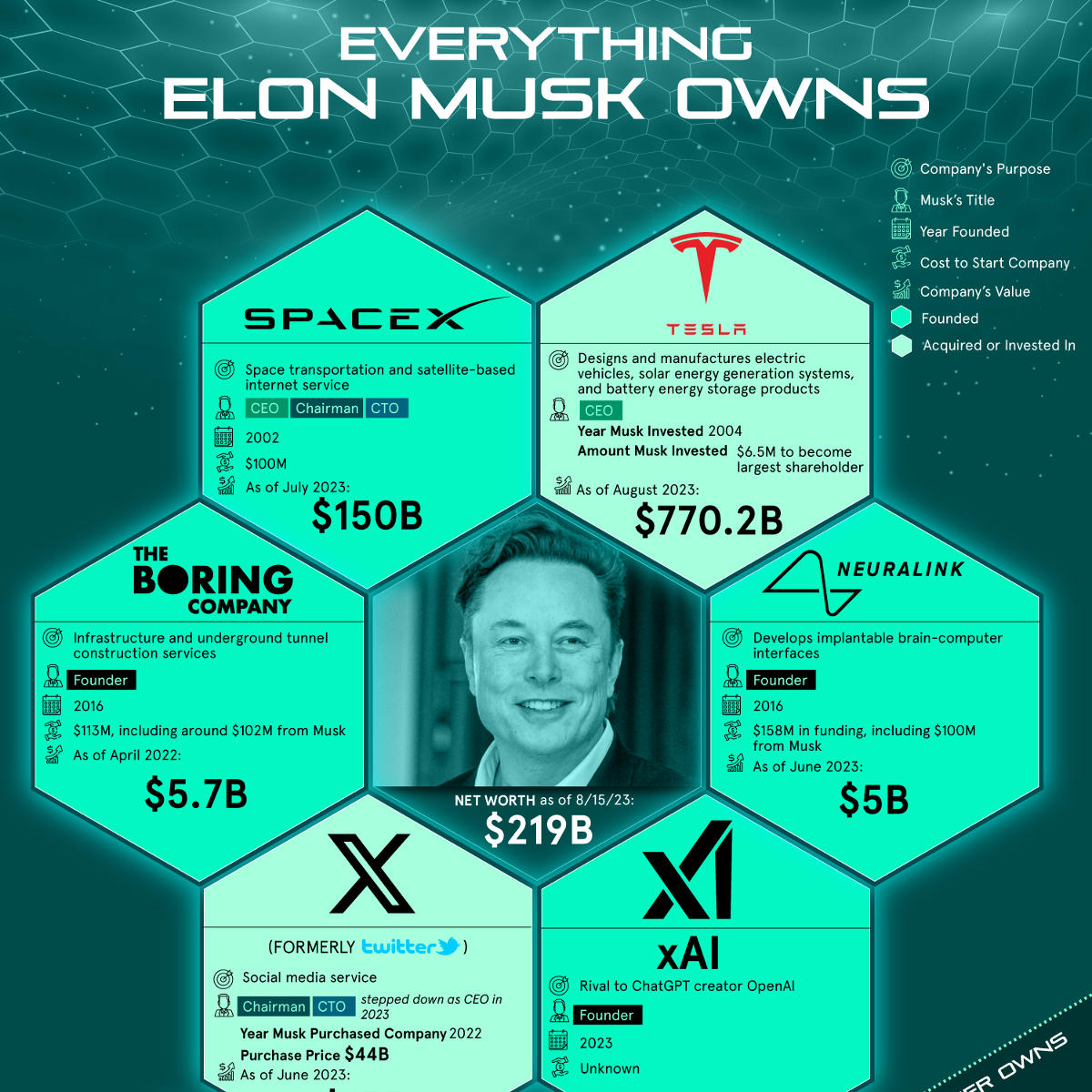

US fiscal policy, encompassing government spending, taxation, and borrowing, significantly influences consumer spending and investment. These actions directly impact the automotive industry and, consequently, Tesla's performance, which is intrinsically linked to Elon Musk's net worth.

-

Impact of stimulus packages on consumer demand for electric vehicles: Government stimulus packages, like those enacted during economic downturns, can boost consumer spending, including on electric vehicles. Increased demand positively impacts Tesla's sales and, in turn, its stock price, directly affecting Musk's net worth.

-

Effect of tax credits and incentives on Tesla sales: Tax credits and other incentives offered by the government for purchasing electric vehicles can make them more affordable, further stimulating demand and benefiting Tesla's bottom line and Musk's wealth. The extension or reduction of these incentives can lead to noticeable shifts in Tesla's stock performance.

-

Influence of interest rate hikes on borrowing costs for Tesla's expansion projects: Increased interest rates make borrowing more expensive, potentially hindering Tesla's ambitious expansion plans, including factory construction and research & development. Higher borrowing costs can negatively affect Tesla's profitability and, consequently, its stock price and Musk's net worth.

-

Analysis of Tesla stock performance in relation to specific fiscal policy changes: A historical analysis reveals a correlation between periods of increased government spending or favorable tax policies and periods of strong Tesla stock performance, positively impacting Musk's net worth. Conversely, periods of fiscal tightening often coincide with decreased stock valuations.

Monetary Policy's Role in Shaping Market Sentiment and Musk's Wealth

The Federal Reserve's monetary policy plays a pivotal role in shaping overall market sentiment and investor confidence. Actions such as interest rate adjustments and quantitative easing (QE) or tightening (QT) significantly impact the value of Tesla and SpaceX, and subsequently, Elon Musk's wealth.

-

Correlation between inflation rates and Tesla stock volatility: High inflation rates often lead to increased interest rates, impacting investor sentiment and potentially causing volatility in Tesla’s stock price. This volatility directly affects Musk’s net worth.

-

Impact of monetary policy on the overall stock market and its effect on Musk's portfolio: Monetary policy affects the overall stock market. A bullish market generally benefits high-growth companies like Tesla, positively impacting Musk's holdings. Conversely, a bearish market can significantly reduce his net worth.

-

Analysis of market trends during periods of monetary easing or tightening: Periods of monetary easing, such as QE, often lead to increased liquidity and higher stock valuations, benefiting Musk's net worth. Conversely, monetary tightening, involving interest rate hikes, can lead to a decline in stock prices and a decrease in his net worth.

-

How changes in investor sentiment affect the valuation of high-growth companies like Tesla: Investor confidence is crucial for high-growth companies like Tesla. Positive sentiment drives up valuations, while negative sentiment can lead to significant drops, directly impacting Musk's net worth.

Regulatory Changes and Their Influence on Musk's Businesses and Net Worth

Regulatory changes at both the federal and state levels significantly impact the business environment for Tesla, SpaceX, and other Musk-owned companies. These changes can affect production costs, market access, and innovation, ultimately influencing his net worth.

-

Impact of environmental regulations on Tesla's production costs and market competitiveness: Stringent environmental regulations can increase Tesla's production costs, impacting its profitability and competitiveness. Conversely, favorable regulations can give Tesla a market advantage.

-

Influence of trade wars on the global supply chain of Tesla and SpaceX: Trade wars and tariffs can disrupt Tesla and SpaceX's global supply chains, increasing production costs and impacting their profitability and, consequently, Musk's wealth.

-

Effect of technological regulations on innovation and development within Musk's companies: Regulations governing technological development can either stifle or encourage innovation within Musk's companies. Restrictive regulations can hinder growth, while supportive ones can accelerate it.

-

Analysis of stock market reactions to significant regulatory announcements impacting Musk's businesses: Regulatory announcements often cause immediate market reactions, impacting Tesla's stock price and, consequently, Musk's net worth. Positive announcements generally lead to increases, while negative ones often result in decreases.

Geopolitical Events and Their Ripple Effect on Musk's Net Worth

Geopolitical events, such as wars, pandemics, and political instability, can indirectly affect Musk's net worth through their impact on global markets and investor sentiment.

-

Impact of global supply chain disruptions on Tesla's production: Global events can disrupt supply chains, leading to production delays and increased costs for Tesla, negatively impacting its performance and Musk's net worth.

-

Influence of geopolitical tensions on investor confidence in technology stocks: Geopolitical instability often leads to risk aversion in the market, particularly affecting high-growth technology stocks like Tesla, and thus impacting Musk’s net worth.

-

Analysis of market reactions to major global events and their correlation with changes in Musk's net worth: Analysis shows a correlation between periods of geopolitical uncertainty and volatility in Tesla's stock price, reflecting the impact on Musk’s net worth.

-

Specific examples of geopolitical events and their effect on Tesla's stock price: Events like the war in Ukraine have demonstrably impacted global supply chains and investor sentiment, leading to fluctuations in Tesla's stock price and Musk's net worth.

Conclusion: Understanding the Interplay Between Elon Musk's Net Worth and US Economic Policy

Fluctuations in Elon Musk's net worth are intricately linked to US economic policy. Fiscal and monetary policies directly impact consumer demand, investment, and market sentiment, influencing Tesla's performance and Musk's wealth. Regulatory changes and geopolitical events add further complexity, creating a dynamic interplay. Understanding this relationship requires ongoing analysis of various economic indicators and their influence on Tesla's stock performance. Stay informed about US economic policy and its impact on Elon Musk's net worth and the broader market. Further research into the correlation between specific economic indicators and Tesla's stock performance is encouraged. Analyzing the impact of future fiscal and monetary policies on Elon Musk's net worth will be crucial in understanding future market trends.

Featured Posts

-

Cologne Climbs Above Hamburg In Bundesliga 2 Matchday 27

May 10, 2025

Cologne Climbs Above Hamburg In Bundesliga 2 Matchday 27

May 10, 2025 -

Harry Styles Responds To A Truly Bad Snl Impression

May 10, 2025

Harry Styles Responds To A Truly Bad Snl Impression

May 10, 2025 -

Bear Market Bets Backfire Wall Streets Unexpected Comeback And What It Means

May 10, 2025

Bear Market Bets Backfire Wall Streets Unexpected Comeback And What It Means

May 10, 2025 -

Abcs High Potential A Ballsy Season 1 Finale

May 10, 2025

Abcs High Potential A Ballsy Season 1 Finale

May 10, 2025 -

New Uk Immigration Policy Impacts On Visa Applications

May 10, 2025

New Uk Immigration Policy Impacts On Visa Applications

May 10, 2025