Palantir Stock Forecast Revised: A Deep Dive Into The Market Shift

Table of Contents

Analyzing Palantir's Recent Financial Performance and Key Metrics

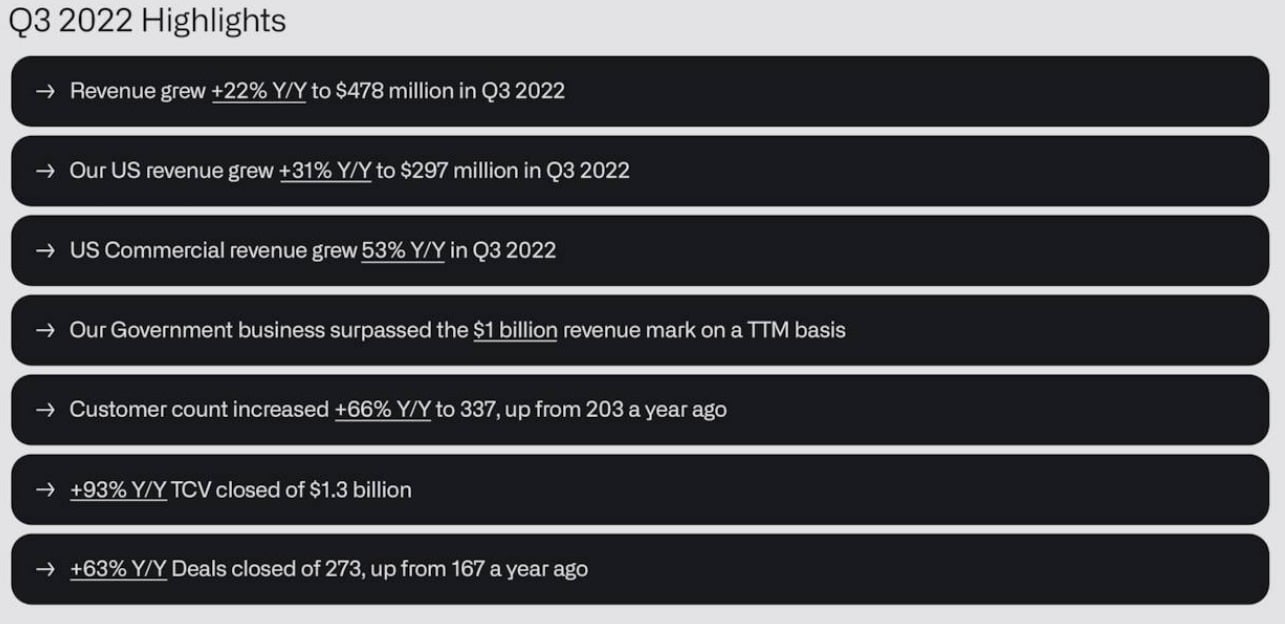

Analyzing Palantir's recent financial performance is essential for any accurate Palantir stock forecast. We need to look beyond headline numbers and delve into the key performance indicators (KPIs) that reveal the true health of the business. Recent quarterly earnings reports have shown a mixed bag, highlighting the need for a nuanced assessment.

- Revenue Growth: While Palantir has demonstrated consistent revenue growth, the rate of growth has fluctuated. Analyzing the composition of this growth (government vs. commercial) is critical.

- Profitability: Palantir is still working towards consistent profitability. Examining the margins and the path to profitability is key to understanding long-term value.

- Key Metrics: Tracking metrics like customer acquisition cost (CAC), average revenue per user (ARPU), and customer churn provides insights into the sustainability of their business model.

For example:

- Q3 2023 Revenue: [Insert Actual Data] (Growth/Decline of X%)

- Net Income/Loss: [Insert Actual Data]

- Customer Growth: [Insert Actual Data] new customers

[Insert relevant chart visualizing revenue growth over time]

Assessing the Impact of Macroeconomic Factors on Palantir's Stock

Macroeconomic factors significantly influence Palantir's stock price. The current environment of rising interest rates, potential recessionary pressures, and global geopolitical uncertainty creates a complex backdrop.

- Inflation and Interest Rates: Higher interest rates can impact investor sentiment towards growth stocks like Palantir, potentially leading to lower valuations.

- Recessionary Fears: Economic downturns can lead to reduced government spending, affecting Palantir's government contracts, a significant portion of its revenue.

- Geopolitical Events: Global instability can create uncertainty and impact investor confidence in technology stocks.

Understanding the correlation between these macroeconomic indicators and Palantir's performance is crucial for a realistic Palantir stock forecast. For example, a potential recession could negatively impact government spending, leading to slower growth for Palantir.

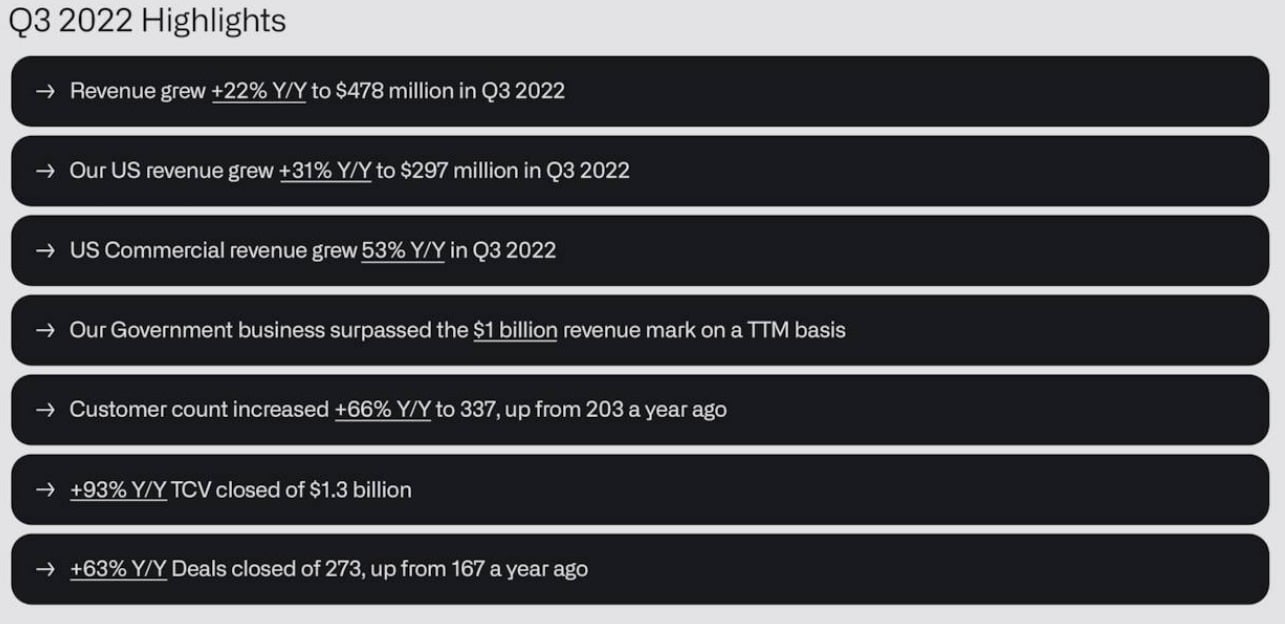

Evaluating Palantir's Competitive Landscape and Future Growth Prospects

Palantir operates in a competitive big data and analytics market. Assessing its competitive position is vital for any accurate Palantir stock forecast.

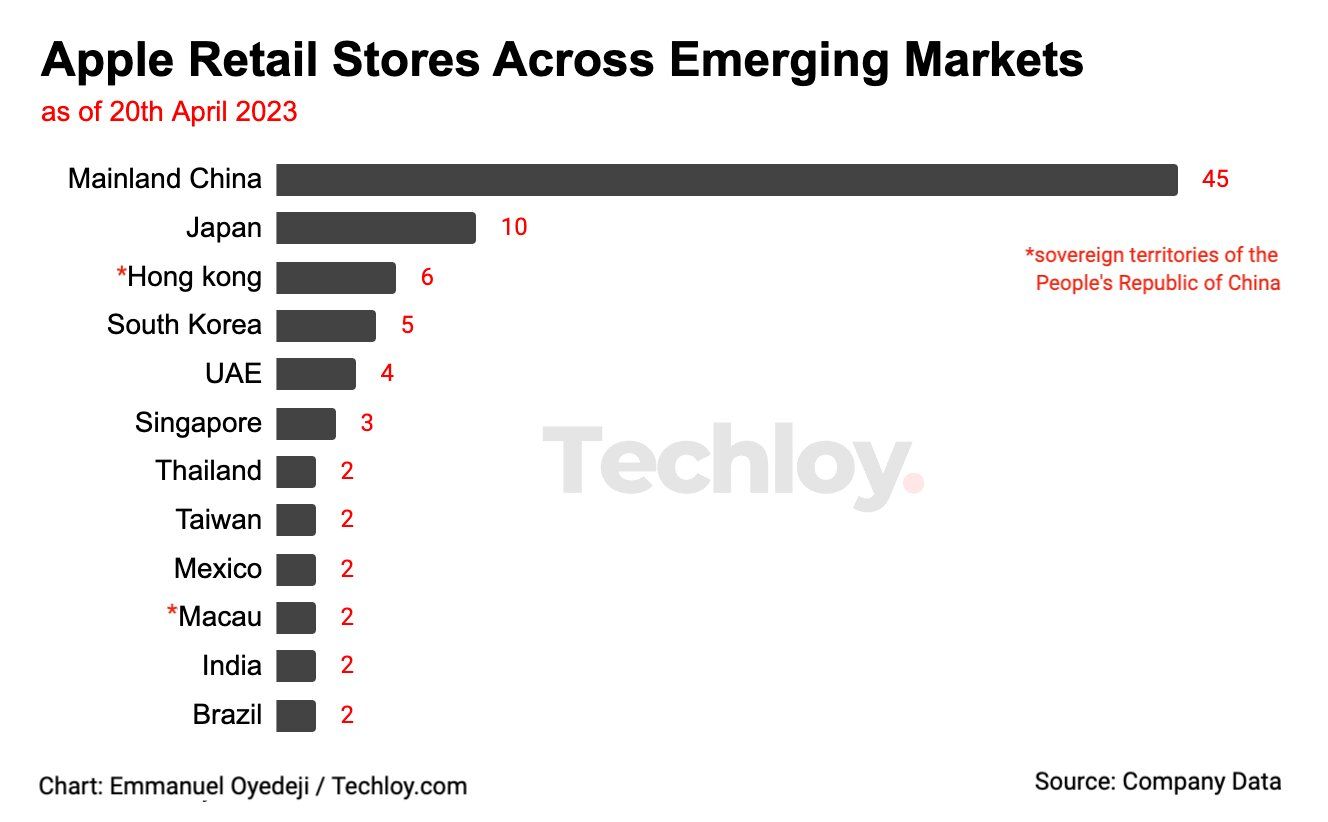

- Key Competitors: Palantir faces competition from established players like AWS, Microsoft Azure, and Google Cloud, as well as emerging analytics companies.

- Competitive Advantages: Palantir's strengths lie in its specialized software for government and intelligence agencies, its strong customer relationships, and its focus on data integration and analysis.

- Future Growth Prospects: Palantir's future growth depends on its ability to expand into new commercial markets, enhance its product offerings, and maintain its technological edge.

[Insert a table comparing Palantir with its key competitors]

The Revised Palantir Stock Forecast: Predictions and Potential Scenarios

Based on the analysis above, our revised Palantir stock forecast considers various scenarios:

- Bullish Scenario: Stronger-than-expected revenue growth, successful expansion into new markets, and positive macroeconomic shifts could lead to significantly higher stock prices.

- Bearish Scenario: Slower-than-expected revenue growth, increased competition, and negative macroeconomic conditions could result in lower stock prices.

- Neutral Scenario: Moderate growth and stable macroeconomic conditions point towards a relatively flat stock price trajectory.

[Insert a chart visualizing the potential price trajectories for each scenario]

Assumptions: Our forecast assumes [list key assumptions, e.g., stable government spending, successful product launches, etc.].

Risk Assessment and Investment Considerations for Palantir Stock

Investing in Palantir stock carries inherent risks:

- Volatility: Palantir's stock price is known for its volatility, influenced by market sentiment and company performance.

- Competition: Intense competition in the big data and analytics market poses a significant challenge.

- Regulatory Hurdles: Government regulations and compliance requirements can impact Palantir's operations and growth.

Investors should consider these risks and develop a comprehensive risk management strategy before investing.

Conclusion: A Final Look at the Revised Palantir Stock Forecast

This revised Palantir stock forecast highlights the importance of considering both Palantir's internal performance and the external macroeconomic and competitive landscape. While Palantir shows promise, potential investors must acknowledge the inherent risks. Thorough due diligence and a well-defined investment strategy are crucial before making any investment decisions. Stay informed about the evolving Palantir stock forecast and conduct your own thorough research before investing.

Featured Posts

-

Apples Ai Future Leading The Pack Or Falling Behind

May 10, 2025

Apples Ai Future Leading The Pack Or Falling Behind

May 10, 2025 -

Remaining Nhl Regular Season Major Storylines To Track

May 10, 2025

Remaining Nhl Regular Season Major Storylines To Track

May 10, 2025 -

The Future Of Business A Geographic Analysis Of Emerging Markets

May 10, 2025

The Future Of Business A Geographic Analysis Of Emerging Markets

May 10, 2025 -

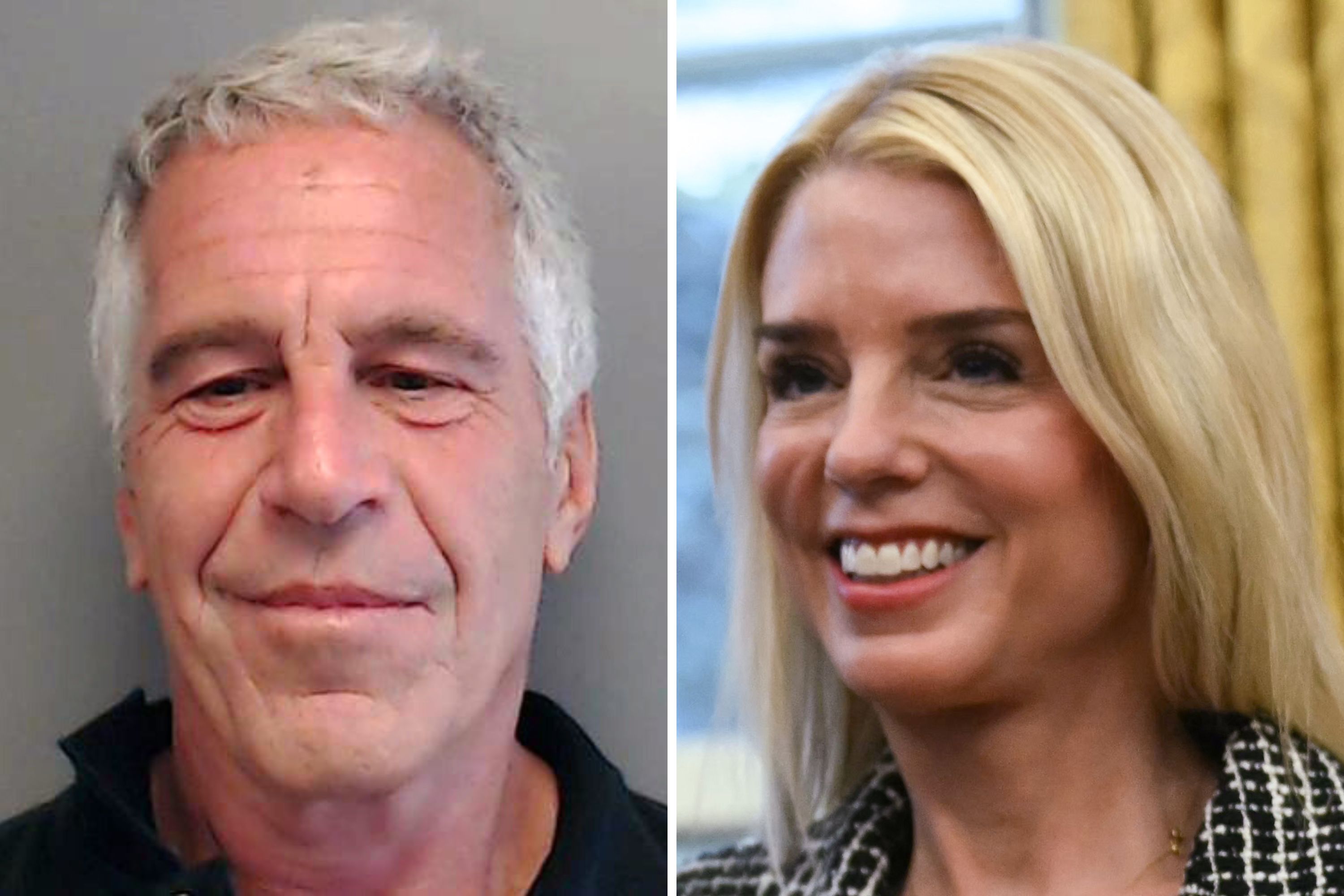

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Decision

May 10, 2025

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Decision

May 10, 2025 -

The Untimely Death Of Americas First Identified Non Binary Individual

May 10, 2025

The Untimely Death Of Americas First Identified Non Binary Individual

May 10, 2025