China's Steel Production Cuts: Implications For The Iron Ore Market

Table of Contents

Decreased Iron Ore Demand: The Direct Impact of Steel Production Cuts

The relationship between steel production and iron ore demand is intrinsically linked. Iron ore is the primary raw material used in steelmaking; therefore, a reduction in steel output directly translates to lower iron ore consumption. China's recent production cuts have already demonstrated this correlation. Data from major steel mills show a considerable decline in output, leading to decreased imports of iron ore. For example, [cite specific data source and figures, e.g., "According to the China Iron and Steel Association, steel production fell by X% in Q[Quarter] [Year], resulting in a Y% decrease in iron ore imports during the same period"].

This decreased demand isn't uniform across all iron ore grades. Higher-grade iron ore, preferred for its higher iron content and efficiency in steelmaking, is experiencing the most significant drop in demand.

- Lower demand for high-grade iron ore: Steel mills are prioritizing cost-effectiveness, leading to a shift away from premium grades.

- Potential price reductions for lower-grade iron ore: The surplus of lower-grade iron ore may lead to price adjustments to stimulate demand.

- Increased inventory levels for iron ore producers: Reduced consumption leaves producers with higher stockpiles, adding pressure to prices.

Price Volatility and Market Fluctuations in the Iron Ore Market

The impact of China's steel production cuts on iron ore prices is undeniable. We've witnessed significant price volatility in the market following the announcements. While reduced demand is the primary driver, other factors contribute to the fluctuations.

- Global economic conditions: A global recession or slowdown could further dampen demand for steel and iron ore.

- Supply chain disruptions: Geopolitical tensions and logistical bottlenecks can exacerbate price swings.

Several price scenarios are possible:

- Short-term price drops: The immediate impact of reduced demand is a downward pressure on prices.

- Potential for price stabilization: As the market adjusts to the new reality, prices might find a temporary equilibrium.

- Uncertainty in long-term price forecasts: The long-term outlook remains unclear, dependent on various economic and geopolitical factors.

These fluctuations impact all market players:

- Producers: Facing lower prices and potentially reduced profits.

- Traders: Navigating increased risk and uncertainty in their transactions.

- Consumers: Potentially benefitting from lower iron ore costs in the short term.

Strategic Responses of Iron Ore Producers to Reduced Demand

Major iron ore producers are responding to the reduced demand in various ways. Strategies range from production adjustments to diversification.

- Production cutbacks by major iron ore companies: Several companies have already announced production reductions to align with market demand.

- Increased focus on operational efficiency and cost reduction: Producers are streamlining operations to maintain profitability in a challenging market.

- Exploration of alternative markets and product diversification: Producers are seeking new markets and exploring alternative uses for iron ore to reduce reliance on the Chinese steel industry.

Mergers and acquisitions might become more prevalent as companies seek to consolidate their position and optimize resources.

Geopolitical Implications and Future Outlook of the Iron Ore Market

China's steel production cuts have significant geopolitical ramifications, altering trade relationships between China and major iron ore exporters like Australia and Brazil.

- Shifting trade dynamics between China and iron ore suppliers: The reduced demand could impact trade volumes and agreements.

- Potential for increased competition among iron ore exporters: Companies will compete more aggressively for market share in the face of reduced Chinese demand.

- Long-term implications for the sustainability of the iron ore industry: The industry might need to adapt to a potentially lower-growth environment.

The future outlook for the iron ore market depends heavily on how quickly the global economy recovers, the extent of China's long-term steel production adjustments, and the emergence of new demand sources.

Conclusion: Navigating the Shifting Sands of the Iron Ore Market Following China's Steel Production Cuts

China's steel production cuts have created significant uncertainty in the iron ore market, impacting prices, producer strategies, and geopolitical dynamics. Understanding these implications is crucial for investors, producers, and consumers. The long-term effects remain to be seen, with the future shaped by global economic growth, geopolitical factors, and the adaptability of the iron ore industry. To stay abreast of the evolving situation surrounding China's steel production cuts and their influence on the iron ore market, we encourage you to subscribe to reputable industry news sources, diligently follow market analyses, and consult with experts in the field. Continued research into the evolving dynamics between Chinese steel production and the iron ore market is vital for navigating this period of transition.

Featured Posts

-

Is Young Thugs Back Outside Album Imminent A Look At The Rollout

May 10, 2025

Is Young Thugs Back Outside Album Imminent A Look At The Rollout

May 10, 2025 -

Summer Walker Opens Up About Life Threatening Childbirth Complications

May 10, 2025

Summer Walker Opens Up About Life Threatening Childbirth Complications

May 10, 2025 -

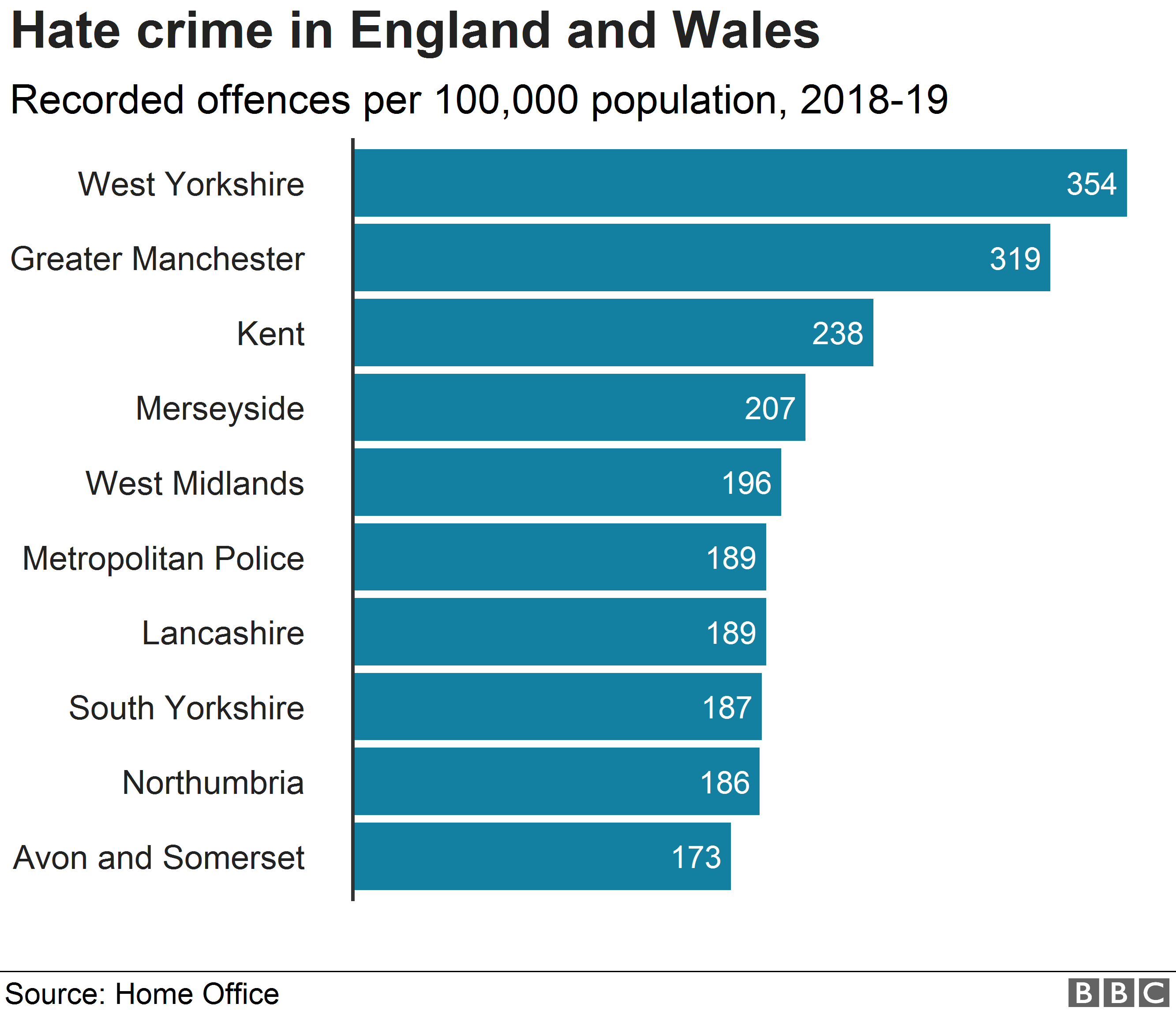

Broken Family The Devastating Impact Of A Racist Hate Crime

May 10, 2025

Broken Family The Devastating Impact Of A Racist Hate Crime

May 10, 2025 -

Elon Musks Net Worth Fluctuations During Trumps First 100 Days In Office

May 10, 2025

Elon Musks Net Worth Fluctuations During Trumps First 100 Days In Office

May 10, 2025 -

Elon Musk Net Worth Below 300 Billion After Tesla Stock Drop

May 10, 2025

Elon Musk Net Worth Below 300 Billion After Tesla Stock Drop

May 10, 2025