Stocks Power Global Risk Rally Amidst U.S.-China Truce

Table of Contents

The U.S.-China Truce and its Impact on Market Sentiment

The recent easing of trade tensions between the U.S. and China is the primary catalyst for the current global risk rally. This "phase one" trade deal, while not resolving all points of contention, has significantly altered market sentiment.

Easing Trade Tensions

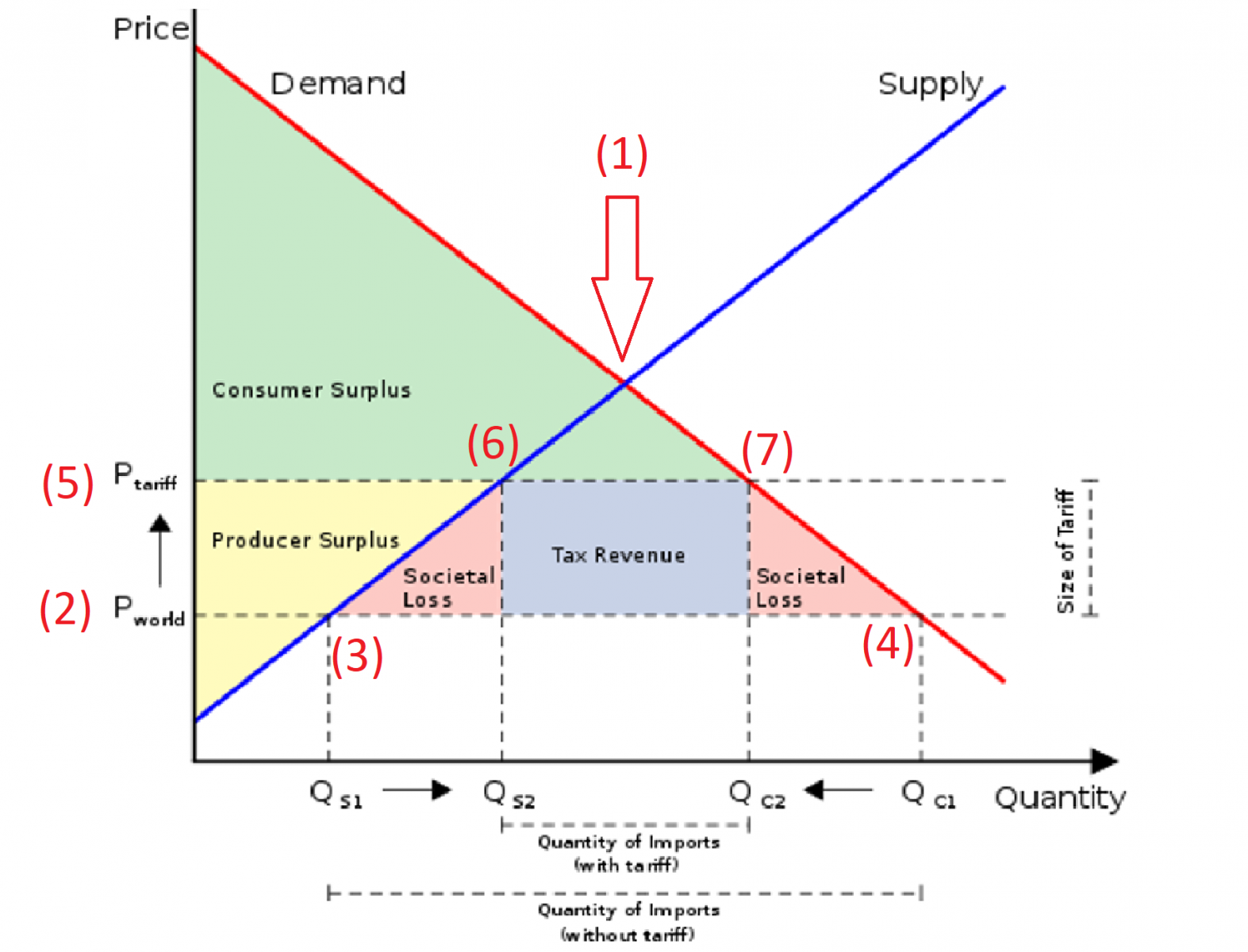

The agreement includes key concessions and reduced tariffs, injecting a much-needed dose of certainty into the global economy.

- Specific examples of tariff reductions: The U.S. has reduced tariffs on certain Chinese goods, while China has committed to purchasing a substantial amount of American agricultural products.

- Agreements on intellectual property: China has agreed to strengthen intellectual property protection for American companies, addressing a major point of contention in the trade dispute.

- Other concessions: Both sides have made concessions on various other issues, including currency manipulation and market access.

These actions alleviate investor uncertainty, fostering confidence and encouraging investment in riskier assets. The reduction in tariffs directly lowers the cost of goods, benefiting consumers and businesses alike, leading to increased consumer spending and corporate profits.

Increased Investor Confidence

The shift in investor sentiment is palpable. We've seen a clear transition from a "risk-off" environment, characterized by investors seeking safe havens like government bonds, to a "risk-on" environment where investors are embracing riskier assets like stocks.

- Data on stock market indices: The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite have all experienced significant gains since the announcement of the trade deal.

- Increased trading volumes: Higher trading volumes indicate increased investor activity and participation in the market.

- Changes in investor surveys: Investor confidence indices show a marked improvement, reflecting a more positive outlook on the global economy.

The psychological impact of a de-escalated trade war is substantial. Reduced uncertainty allows investors to focus on fundamental economic factors, leading to higher valuations and increased market activity.

Global Economic Implications of the Risk Rally

The global risk rally driven by the U.S.-China truce has significant implications for the global economy, impacting growth prospects and emerging markets in distinct ways.

Boost in Global Growth Prospects

Reduced trade barriers between the world's two largest economies are expected to provide a significant boost to global growth.

- Projected GDP growth rates for key economies: Economists have revised upwards their GDP growth projections for many countries, reflecting the positive impact of the trade deal.

- Potential for increased trade: Lower tariffs and improved trade relations are expected to lead to increased bilateral trade between the U.S. and China, and stimulate global commerce more broadly.

- Positive impacts on specific industries: Certain industries, such as agriculture and technology, are likely to benefit significantly from the easing of trade tensions.

The interconnectedness of the global economy means that improved U.S.-China relations have a ripple effect, positively impacting countries across the globe. Increased trade and investment flow through supply chains and global markets.

Impact on Emerging Markets

Emerging markets are particularly sensitive to changes in global economic conditions. The U.S.-China truce presents both opportunities and challenges for these economies.

- Examples of emerging markets that benefit from the truce: Countries heavily reliant on exports to the U.S. or China are likely to experience positive effects.

- Potential challenges they still face: Emerging markets may still face challenges related to domestic economic policies, political instability, and other factors.

- Opportunities for investment: The increased global growth and investor confidence resulting from the trade deal could attract significant foreign direct investment into emerging markets.

Increased foreign direct investment and capital flows are vital for driving growth and development in these markets, and the truce creates a more favorable environment for such investment.

Analyzing the Sustainability of the Stock Market Rally

While the current risk rally is encouraging, it's crucial to acknowledge potential risks and develop sound investment strategies accordingly.

Potential Risks and Challenges

Several factors could potentially derail the ongoing rally and trigger a market correction.

- Lingering trade disputes: The "phase one" deal doesn't resolve all trade issues between the U.S. and China, leaving room for future conflicts.

- Geopolitical risks: Other geopolitical events, such as conflicts in the Middle East or tensions in Europe, could negatively impact market sentiment.

- Economic slowdowns in specific regions: Economic slowdowns in key regions could dampen global growth and trigger a sell-off in the stock market.

- Potential for renewed trade tensions: The fragile nature of the current truce means that renewed trade tensions remain a significant risk.

The fragility of the current market optimism demands a cautious approach, acknowledging the potential for volatility and market corrections.

Strategic Investment Considerations

Given the current market conditions, investors should consider a range of strategic approaches.

- Recommendations for diversification: Diversifying across asset classes and geographic regions can help mitigate risk.

- Sector-specific investment strategies: Identifying sectors poised to benefit from the global economic recovery can yield higher returns.

- Risk management techniques: Implementing risk management strategies, such as stop-loss orders, is crucial in a volatile market.

A long-term investment strategy, coupled with realistic expectations regarding market fluctuations, is paramount for navigating this evolving geopolitical landscape.

Conclusion

The global stock market rally fueled by the U.S.-China truce represents a significant shift in investor sentiment, driven by easing trade tensions and increased confidence in global growth prospects. However, the sustainability of this rally depends on several factors, including the continued de-escalation of trade disputes and the absence of other significant geopolitical risks. Understanding the interplay between geopolitical events and market performance is crucial for successful investment.

To capitalize on this evolving situation, monitor global risk rally trends closely, analyze the impact on your stock portfolio, and make informed decisions about your stock investments. Stay informed about developments in the U.S.-China trade relationship and its impact on global stock markets to navigate this dynamic environment effectively. Conduct thorough research on individual stocks and investment strategies to mitigate risks and maximize returns in this period of fluctuating market conditions.

Featured Posts

-

Wegmans Product Recall Action Needed For Braised Beef With Vegetables

May 14, 2025

Wegmans Product Recall Action Needed For Braised Beef With Vegetables

May 14, 2025 -

Is Jobe Bellingham Headed To Borussia Dortmund A Transfer Analysis

May 14, 2025

Is Jobe Bellingham Headed To Borussia Dortmund A Transfer Analysis

May 14, 2025 -

Analyzing Disneys Live Action Strategy Predicting Snow Whites Rotten Tomatoes Score

May 14, 2025

Analyzing Disneys Live Action Strategy Predicting Snow Whites Rotten Tomatoes Score

May 14, 2025 -

Snow White Box Office Bomb A Case Study In Political Controversy

May 14, 2025

Snow White Box Office Bomb A Case Study In Political Controversy

May 14, 2025 -

George Straits Dairy Queen Drive Thru Selfie Country Stars Surprise Visit

May 14, 2025

George Straits Dairy Queen Drive Thru Selfie Country Stars Surprise Visit

May 14, 2025

Latest Posts

-

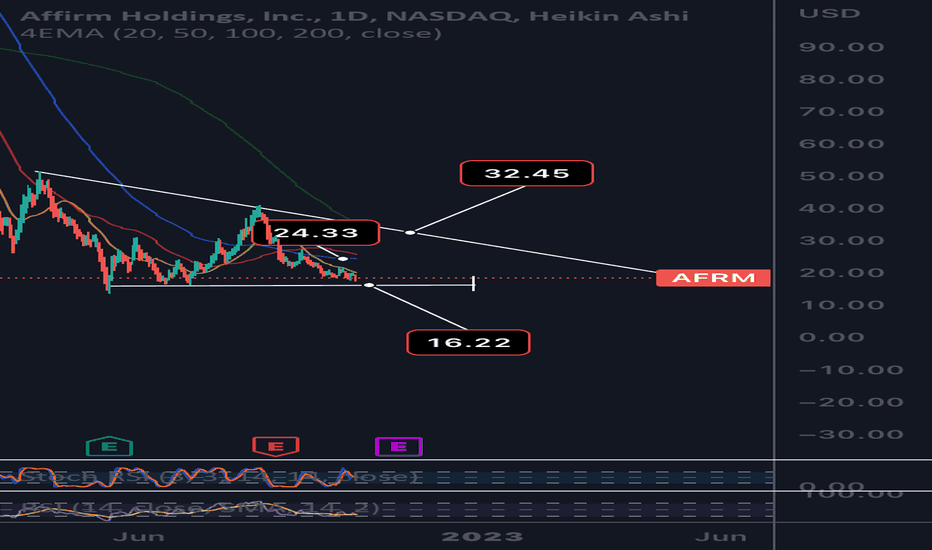

Did Trump Tariffs Kill The Affirm Afrm Ipo A Deep Dive

May 14, 2025

Did Trump Tariffs Kill The Affirm Afrm Ipo A Deep Dive

May 14, 2025 -

Trumps Tariffs A Roadblock For Fintech Ipos Examining Affirm Afrm

May 14, 2025

Trumps Tariffs A Roadblock For Fintech Ipos Examining Affirm Afrm

May 14, 2025 -

How Trump Tariffs Impact Fintech Ipos The Affirm Afrm Example

May 14, 2025

How Trump Tariffs Impact Fintech Ipos The Affirm Afrm Example

May 14, 2025 -

The Impact Of Tariffs On Ipo Activity A Comprehensive Analysis

May 14, 2025

The Impact Of Tariffs On Ipo Activity A Comprehensive Analysis

May 14, 2025 -

Trump Tariffs And The Fintech Ipo Freeze The Affirm Holdings Case Study Afrm

May 14, 2025

Trump Tariffs And The Fintech Ipo Freeze The Affirm Holdings Case Study Afrm

May 14, 2025