The Impact Of Tariffs On IPO Activity: A Comprehensive Analysis

Table of Contents

H2: Tariffs and Increased Uncertainty in the Market

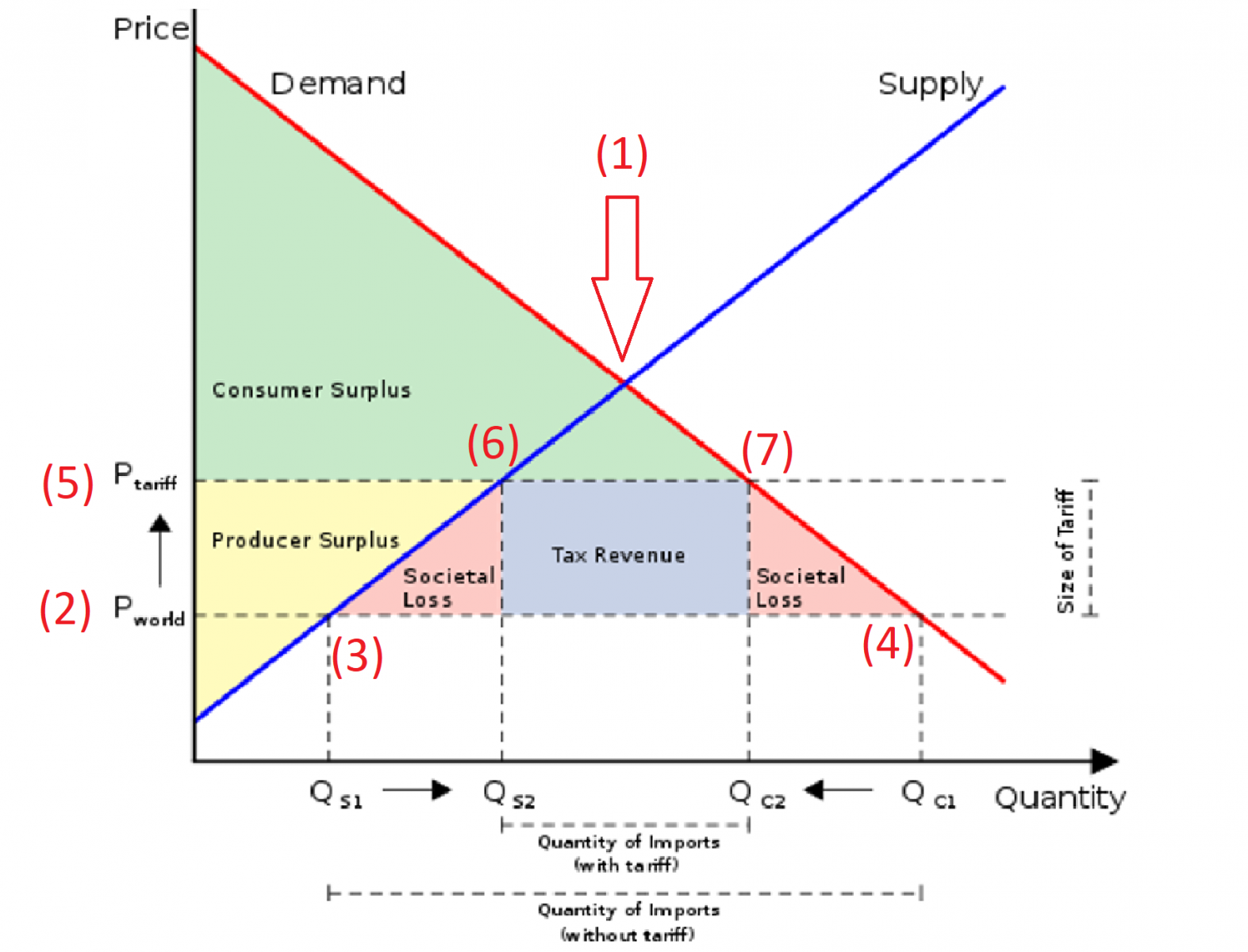

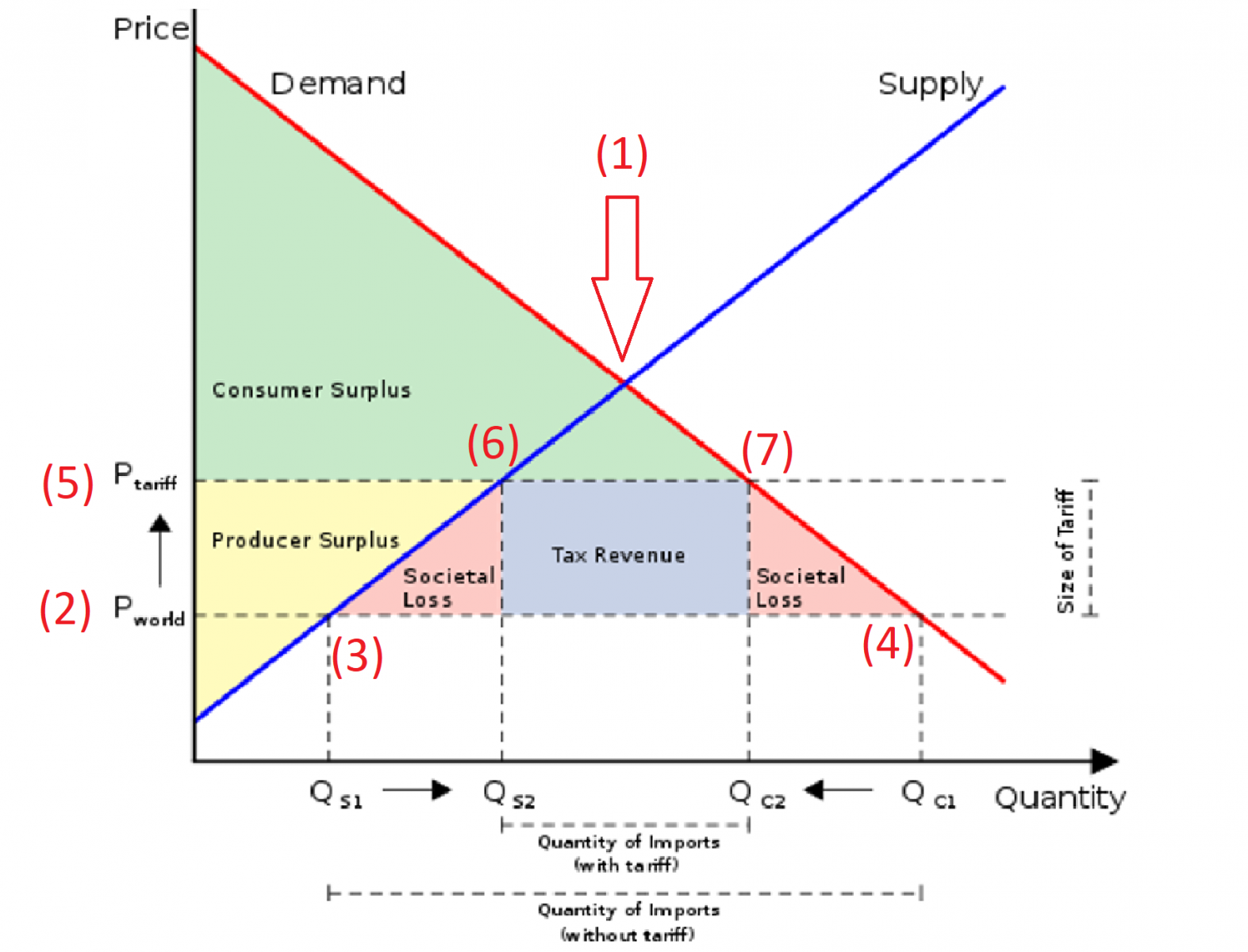

Tariffs introduce significant uncertainty into the market, impacting both businesses considering an IPO and investors considering investing in them. This uncertainty stems from several key factors.

H3: Reduced Investor Confidence

Tariffs create a climate of unpredictability, making investors hesitant to commit capital to new ventures.

- Market Volatility: Tariff announcements often lead to immediate market volatility, creating a challenging environment for IPOs. The uncertainty surrounding future trade relations can significantly impact investor sentiment.

- Earnings Predictability: For companies planning an IPO, tariffs make predicting future earnings much harder. Fluctuating import and export costs introduce significant risk into financial projections.

- Increased Risk Aversion: In uncertain times, investors tend to become more risk-averse, making them less likely to invest in higher-risk ventures like many IPOs. This reduced appetite for risk directly impacts the success rate of IPOs.

The increased uncertainty affects the valuation of IPOs, often leading to lower valuations and a reduced likelihood of successful offerings. Companies may delay their IPOs indefinitely, waiting for a clearer market outlook.

H3: Disrupted Supply Chains

Tariffs disrupt global supply chains, leading to increased costs and potential delays for companies planning IPOs. This impacts both production and distribution.

- Industry-Specific Disruptions: Industries heavily reliant on international trade, such as manufacturing and technology, are particularly vulnerable. The automotive and electronics sectors, for instance, have experienced significant supply chain disruptions due to tariffs.

- Increased Production Costs: Tariffs directly increase the cost of imported raw materials and components, leading to higher production costs and squeezed profit margins for companies planning IPOs.

- Delays in Product Launches: Supply chain bottlenecks caused by tariffs can delay product launches, impacting revenue projections and investor confidence. This further complicates the already intricate process of launching an IPO.

The disruption of supply chains translates directly into decreased profitability and a negative impact on investor perception, making it more difficult for companies to secure favorable IPO valuations.

H2: Sector-Specific Impacts of Tariffs on IPO Activity

The impact of tariffs on IPO activity isn't uniform across all sectors. Some industries are far more vulnerable than others.

H3: Industries Heavily Reliant on Imports/Exports

Sectors such as manufacturing, technology, and agriculture are disproportionately affected by tariffs.

- Postponed IPOs: Many companies in these sectors have postponed their IPOs due to tariff-related headwinds, opting to wait for a more stable economic climate.

- Analysis of IPO Filings: A comparison of IPO filing numbers in these sectors before and after the implementation of significant tariffs reveals a clear downward trend, illustrating the negative impact. This data clearly supports the impact of tariffs on these sectors.

The mechanisms through which tariffs affect these sectors vary, but the common thread is increased cost and reduced predictability.

H3: Industries Less Affected by Tariffs

Conversely, some sectors show resilience to tariff pressures. These often include domestically focused businesses or those with diversified supply chains.

- Domestic Focus: Companies primarily serving the domestic market are less exposed to the direct impact of tariffs on import/export costs.

- Resilience to Tariffs: The relative stability of IPO activity in these sectors indicates a lesser degree of sensitivity to tariff fluctuations.

Their resilience highlights the varying degrees of vulnerability within the broader economy.

H2: The Role of Government Policy and Regulations

Government policies and regulations play a crucial role in mitigating or exacerbating the impact of tariffs on IPO activity.

H3: Government Interventions and their Impact

Governments often intervene to mitigate the negative effects of tariffs on businesses.

- Government Subsidies: Some governments offer subsidies or tax incentives to help companies offset the increased costs associated with tariffs.

- Effectiveness of Interventions: The effectiveness of these interventions varies greatly depending on their design and implementation. Some prove highly successful, while others have limited impact.

These interventions aim to lessen the burden on businesses and encourage continued investment and IPO activity.

H3: Regulatory Changes and their Implications for IPOs

Regulatory changes, often a response to market fluctuations caused by tariffs, can also impact the IPO process.

- Changes in IPO Filings: Regulatory changes can affect the requirements for IPO filings, increasing compliance costs and complexity.

- Investor Protection: Changes in investor protection regulations can impact investor confidence and the overall attractiveness of the IPO market.

These regulatory shifts indirectly influence the attractiveness and feasibility of IPOs.

3. Conclusion

The relationship between tariffs and IPO activity is complex and multifaceted. While tariffs introduce uncertainty and increase costs for many businesses, their impact varies greatly depending on the specific sector and government responses. Industries heavily reliant on international trade are most vulnerable, experiencing reduced investor confidence, disrupted supply chains, and postponed IPOs. Conversely, domestically focused industries often demonstrate greater resilience. Government interventions, such as subsidies and regulatory changes, can influence the overall impact, but their effectiveness is variable.

Key Takeaways: Understanding the impact of tariffs is crucial for both investors and businesses considering an IPO. The level of exposure to international trade significantly influences a company's vulnerability to tariff-related disruptions. Analyzing the specific impact on your industry and staying informed about tariff developments is essential for making informed decisions.

Call to Action: To better understand the impact of tariffs on IPO activity within your specific industry, conduct further research and consult with financial advisors specializing in IPOs and international trade. Stay informed about future tariff developments and their potential influence on your investment strategies and business planning. Subscribe to reputable financial news sources to remain updated on the latest developments in international trade and their implications for the IPO market.

Featured Posts

-

Kanye West And Bianca Censori Examining Power Dynamics And Public Concern

May 14, 2025

Kanye West And Bianca Censori Examining Power Dynamics And Public Concern

May 14, 2025 -

Lindt Opens Central London Chocolate Shop A Luxurious New Experience

May 14, 2025

Lindt Opens Central London Chocolate Shop A Luxurious New Experience

May 14, 2025 -

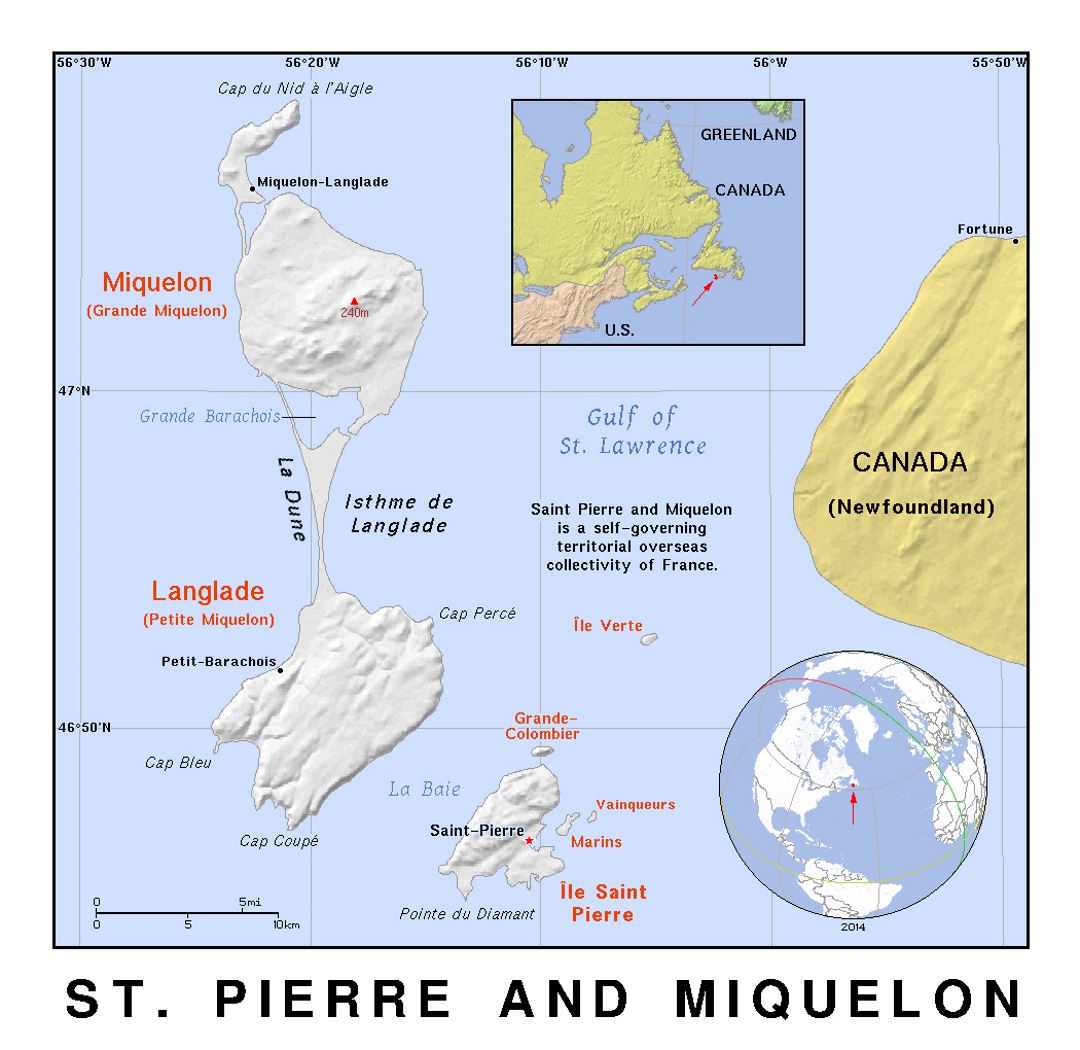

Saint Pierre Et Miquelon Humour Et Reponse Aux Oqtf De Wauquiez

May 14, 2025

Saint Pierre Et Miquelon Humour Et Reponse Aux Oqtf De Wauquiez

May 14, 2025 -

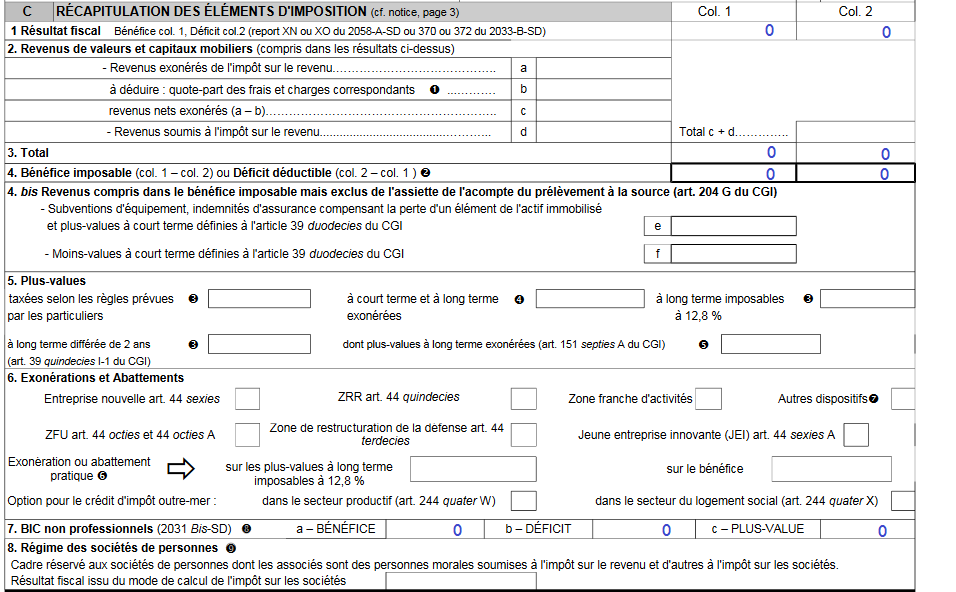

Previsions 2024 D Eramet Baisse Des Benefices Et Prudence Sur Le Marche

May 14, 2025

Previsions 2024 D Eramet Baisse Des Benefices Et Prudence Sur Le Marche

May 14, 2025 -

Haiti Plus D Un Enfant Deplace Sur Trois A Moins De 5 Ans

May 14, 2025

Haiti Plus D Un Enfant Deplace Sur Trois A Moins De 5 Ans

May 14, 2025