Trump Tariffs And The Fintech IPO Freeze: The Affirm Holdings Case Study (AFRM)

Table of Contents

The Trump Tariff Impact on the US Economy and Investor Sentiment

Trump's tariffs, implemented as part of his "America First" trade policy, significantly impacted the US economy. The increased costs of imported goods led to higher prices for businesses and consumers, fueling inflation and dampening economic growth. This uncertainty created a chilling effect on investor sentiment, leading to market volatility and reduced risk appetite. The broader stock market felt the impact, and the Fintech sector, often considered more sensitive to economic shifts, was particularly vulnerable.

- Increased Inflation: Tariffs directly increased the cost of imported goods, contributing to higher inflation rates.

- Slower GDP Growth: Reduced consumer spending and business investment, partially due to tariff-related uncertainties, hampered GDP growth.

- Reduced Consumer Spending: Higher prices for goods and services led to decreased consumer purchasing power, affecting various sectors including Fintech.

- Market Volatility: The uncertainty surrounding the trade war created significant volatility in the stock market, making investors hesitant to commit capital.

The Fintech Sector and its Vulnerability to Macroeconomic Factors

The Fintech sector, with its reliance on consumer spending, access to capital, and innovative business models, is inherently sensitive to macroeconomic shifts. The Trump tariffs exacerbated existing challenges. The increased cost of goods and services directly impacted Fintech companies' operational costs, squeezing profit margins. Securing funding became significantly more difficult during this period of heightened economic uncertainty.

- Increased Borrowing Costs: Higher interest rates, partly a response to inflationary pressures caused by tariffs, made borrowing more expensive for Fintech startups.

- Reduced Consumer Spending: As consumers tightened their belts, the demand for many Fintech services, particularly those dependent on discretionary spending, declined.

- Difficulty in Securing Venture Capital: Investors became more risk-averse, leading to a decrease in venture capital funding for Fintech companies, making IPOs harder to achieve.

Affirm Holdings (AFRM) – A Case Study in Navigating the IPO Freeze

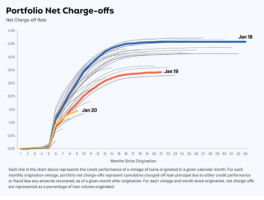

Affirm Holdings (AFRM), a prominent player in the Buy Now Pay Later (BNPL) sector, provides a valuable case study. Affirm's business model, heavily reliant on consumer spending and credit access, made it vulnerable to the economic headwinds created by the Trump tariffs. While Affirm ultimately completed its IPO, the timing and market conditions were undoubtedly impacted by the prevailing economic uncertainty. The company's stock performance in the period surrounding its IPO and in the following months reflects this challenging environment.

- IPO Timing: Affirm's IPO coincided with a period of increased market volatility and reduced investor confidence, creating a challenging environment for its market debut.

- AFRM Stock Price: Initial stock performance reflected the overall market sentiment, underscoring the challenges of navigating an IPO during a period of economic uncertainty driven partly by tariff-related issues.

- Financial Performance: Affirm's financial performance during the period leading up to and following its IPO showcased the company’s resilience in the face of a difficult macroeconomic climate.

The Post-Trump Era: Lessons Learned and Future Implications for Fintech IPOs

The post-Trump economic landscape saw a shift in investor sentiment and market conditions. The experience of companies like Affirm highlights the importance of macroeconomic factors in shaping the success of Fintech IPOs. The evolving investor landscape demands a greater focus on resilience and sustainable business models. The long-term effects of the Trump tariffs, though gradually diminishing, continue to subtly influence the Fintech sector's trajectory and its access to capital.

- IPO Market Recovery: While the IPO market has seen some recovery, lingering effects of the trade war's economic impact continue to shape investor decisions.

- Fintech Future: The future of Fintech hinges on adaptability and a keen understanding of macroeconomic factors influencing investor confidence and market volatility.

- Investor Landscape: Investors remain more discerning, prioritizing profitability and sustainable growth over rapid expansion in the post-Trump era.

Conclusion: Understanding the Long-Term Effects of Trump Tariffs on Fintech IPOs – Looking Beyond Affirm (AFRM)

This analysis demonstrates a clear link between Trump's tariffs, the subsequent economic uncertainty, and the challenges faced by Fintech companies navigating the IPO process. Affirm Holdings (AFRM) serves as a powerful illustration of the broader impact of trade policies on the financial markets and the Fintech sector. Understanding this interplay is crucial for future Fintech companies considering an IPO. Further research into the effects of trade policies on the broader economic climate and subsequent implications for financial technology companies is vital. Dive deeper into the impact of Trump tariffs on Fintech IPOs and conduct your own economic analysis to better understand the intricacies of Affirm Holdings (AFRM) and the broader Fintech landscape.

Featured Posts

-

Post Split Speeding Ticket For Tommy Fury

May 14, 2025

Post Split Speeding Ticket For Tommy Fury

May 14, 2025 -

Pokemon Go May 2025 Events Raids Spotlight Hours Community Days And More

May 14, 2025

Pokemon Go May 2025 Events Raids Spotlight Hours Community Days And More

May 14, 2025 -

Lindt Opens A Chocolate Paradise In Central London

May 14, 2025

Lindt Opens A Chocolate Paradise In Central London

May 14, 2025 -

Frueherkennung Von Waldbraenden Sachsenforst Erprobt Neue Sensoren In Der Saechsischen Schweiz

May 14, 2025

Frueherkennung Von Waldbraenden Sachsenforst Erprobt Neue Sensoren In Der Saechsischen Schweiz

May 14, 2025 -

Epl News Awoniyi Passes Fitness Test Ahead Of Newcastle Game

May 14, 2025

Epl News Awoniyi Passes Fitness Test Ahead Of Newcastle Game

May 14, 2025

Latest Posts

-

Custom Lego Gen 3 Starter Pokemon Builds

May 14, 2025

Custom Lego Gen 3 Starter Pokemon Builds

May 14, 2025 -

The Best Starter Pokemon From Each Generation A Comprehensive Guide

May 14, 2025

The Best Starter Pokemon From Each Generation A Comprehensive Guide

May 14, 2025 -

Pokemon Go May 2025 Events Raids Spotlight Hours Community Days And More

May 14, 2025

Pokemon Go May 2025 Events Raids Spotlight Hours Community Days And More

May 14, 2025 -

Top 10 Strongest Female Pokemon Trainers

May 14, 2025

Top 10 Strongest Female Pokemon Trainers

May 14, 2025 -

Ahmed Musa On Nigerias World Cup Future A Nations Footballing Destiny

May 14, 2025

Ahmed Musa On Nigerias World Cup Future A Nations Footballing Destiny

May 14, 2025