Trump's Tariffs: A Roadblock For Fintech IPOs? Examining Affirm (AFRM)

Table of Contents

The Impact of Tariffs on Global Supply Chains and Fintech Infrastructure

The Trump administration's tariffs created significant headwinds for fintech companies, primarily by disrupting global supply chains and increasing the cost of essential infrastructure.

Increased Costs of Hardware and Software

Fintech companies heavily rely on imported technology components for their operations. Servers, networking equipment, and specialized software licenses often originate from overseas manufacturers. Tariffs imposed during this period increased the cost of these essential inputs. For instance, tariffs on certain types of semiconductors, crucial for data processing and storage, could have increased significantly. Data from the Office of the United States Trade Representative (USTR) could be referenced here to provide specific tariff rates for relevant tech imports during the Trump administration. These hardware costs and software costs directly impacted profitability and could have influenced investment decisions. The tariff impact on fintech infrastructure was undeniably significant.

- Increased costs for cloud computing services due to tariffed server components.

- Higher prices for specialized software licenses, potentially impacting development budgets.

- Potential delays in project timelines due to supply chain disruptions.

Difficulty in Securing International Partnerships

The uncertainty surrounding trade policies created a challenging environment for cross-border collaborations. Establishing international payment systems and ensuring seamless data transfer between countries became significantly more complex. The trade barriers erected by tariffs made it harder for fintech companies to expand into new markets or forge strategic partnerships abroad. For example, a fintech company aiming to launch a cross-border payment platform might have faced considerable hurdles due to increased regulatory complexities and unpredictable tariff changes. The tariff impact on international partnerships and global fintech resulted in considerable supply chain disruptions.

- Increased complexity in establishing international payment processing agreements.

- Challenges in navigating data privacy regulations across multiple jurisdictions.

- Increased legal and compliance costs associated with cross-border operations.

Affirm (AFRM)'s IPO and the Tariffs' Potential Influence

Affirm (AFRM), a prominent buy now, pay later (BNPL) company, went public during a period marked by significant trade tensions. Examining the timing of its IPO and its reliance on global supply chains allows us to assess the potential influence of Trump tariffs on its market performance.

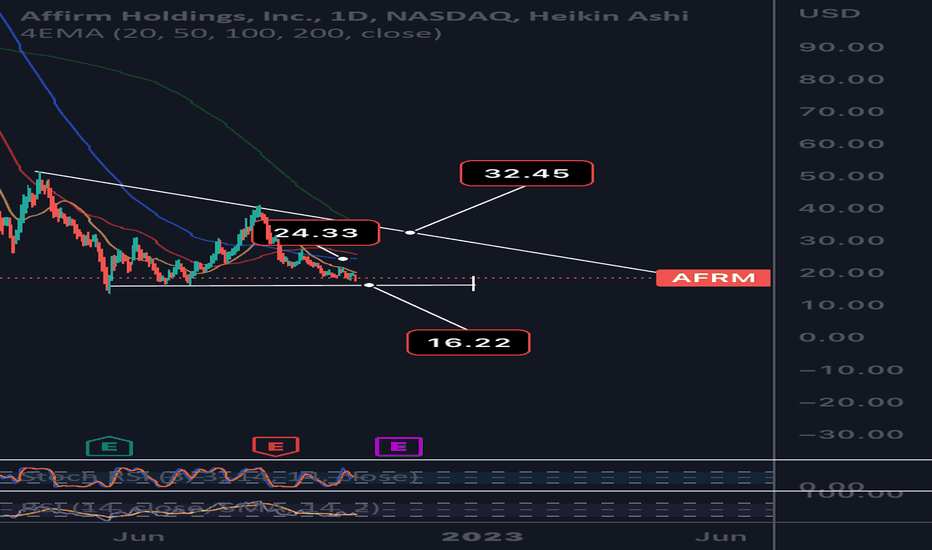

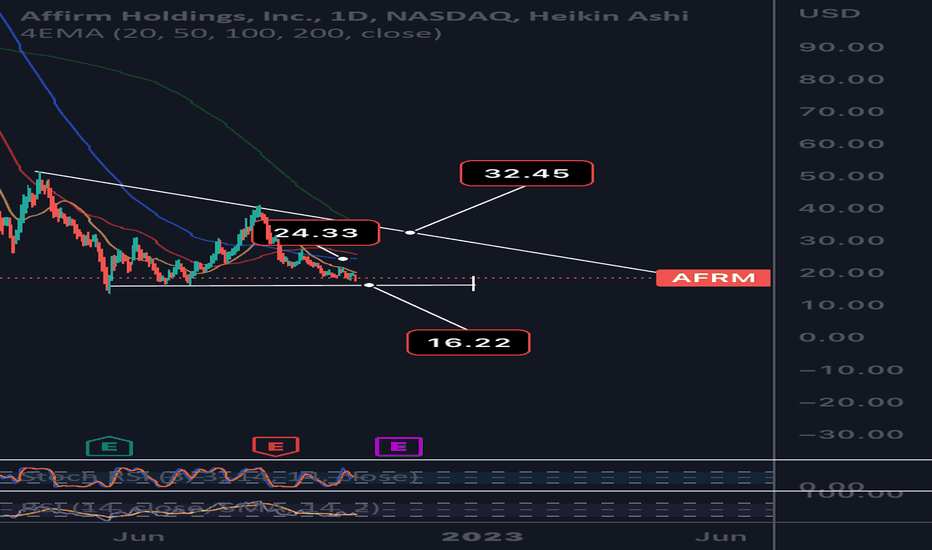

Timing of Affirm's IPO

Affirm's IPO timing coincided with the peak of the Trump-era tariffs. Analyzing Affirm IPO data, we need to consider whether the market volatility and uncertainty around investor sentiment stemming from these tariffs might have influenced the company's valuation or the overall success of its public offering. Studying AFRM stock performance around and after the IPO date, accounting for other market factors, can provide insights into the potential tariff impact.

- Comparison of Affirm's IPO valuation with those of other fintech companies during the same period.

- Analysis of investor reactions and stock market performance following the IPO.

- Assessment of the impact of any delays or adjustments to Affirm's IPO plans due to trade uncertainties.

Affirm's Dependence on Global Supply Chains

Evaluating Affirm's supply chain and its dependence on imported goods or services is vital in determining the potential impact of tariffs. While Affirm’s core business is a digital service, assessing their reliance on international cloud services, software platforms, or specialized hardware reveals potential tariff-related cost increases. Analyzing their publicly available financial reports helps ascertain how they may have employed strategies for cost management and risk mitigation, perhaps including tariff avoidance measures.

- Identifying Affirm’s key suppliers and their geographic locations.

- Assessing the proportion of imported goods and services in Affirm's operational costs.

- Analyzing Affirm’s strategies for mitigating tariff-related risks.

Long-Term Effects on Fintech and Future IPOs

The Trump-era tariffs had long-term consequences, extending beyond direct cost increases.

Increased Regulatory Scrutiny

Trade tensions often lead to increased government scrutiny of businesses, and fintech companies were no exception. Heightened regulatory uncertainty around global trade and data security added complexity to operating within the international fintech space. Increased compliance costs and unpredictability in government oversight may have impacted the attractiveness of fintech investments.

- Examples of new regulations impacting fintech operations in response to trade tensions.

- Analysis of how regulatory uncertainty may have impacted investment decisions in the fintech sector.

- Discussion of the increased burden of compliance for fintech companies operating internationally.

Lessons Learned for Future Fintech IPOs

The experience of Affirm and other fintech companies during this period offers valuable insights for future IPOs. A robust risk management strategy, encompassing detailed market analysis and accounting for potential trade policy changes, becomes essential. Fintech investment decisions must include a thorough evaluation of global trade strategy to navigate the inherent complexities of international commerce.

- Importance of diversifying supply chains to mitigate the risks of trade disruptions.

- Strategies for proactive engagement with regulatory bodies to ensure compliance.

- Importance of thorough due diligence related to international trade policies and potential risks.

Conclusion: Navigating the Trade Landscape for Fintech Success: The Affirm (AFRM) Case Study

Trump's tariffs demonstrably impacted the global economic landscape and, consequently, the fintech sector. While the direct impact on Affirm (AFRM)'s IPO remains a complex matter requiring further analysis, the broader context reveals how trade wars and related Trump tariffs significantly affect Fintech IPOs. Understanding the interplay between global trade policies and the success of fintech companies, including the strategic implications for fintech investment, is paramount. Future fintech companies must proactively assess and incorporate potential global trade risks into their long-term strategies. Learning from the experiences of companies like Affirm is crucial for navigating the trade landscape and ensuring successful growth. Learn more about how to navigate the complexities of international trade and its impact on your fintech business. Understanding the effects of Trump tariffs and other trade policies is crucial for successful Fintech IPOs, as highlighted by the Affirm (AFRM) case study. Stay informed on global trade and its effects on fintech investment.

Featured Posts

-

Nottingham Forests Awoniyi Suffers Setback Surgery Confirms Absence

May 14, 2025

Nottingham Forests Awoniyi Suffers Setback Surgery Confirms Absence

May 14, 2025 -

Eden Golan Israels Eurovision Spokesperson For The Grand Final

May 14, 2025

Eden Golan Israels Eurovision Spokesperson For The Grand Final

May 14, 2025 -

Tommy Fury Receives Fine Following Post Split Speeding Offense

May 14, 2025

Tommy Fury Receives Fine Following Post Split Speeding Offense

May 14, 2025 -

Solidarite A Bourg En Bresse Une Meilleure Consideration Pour Les Demandeurs D Asile

May 14, 2025

Solidarite A Bourg En Bresse Une Meilleure Consideration Pour Les Demandeurs D Asile

May 14, 2025 -

Disney 2 D Style Sam Wilson And Red Hulk Reimagined In Captain America Brave New World

May 14, 2025

Disney 2 D Style Sam Wilson And Red Hulk Reimagined In Captain America Brave New World

May 14, 2025