Stock Market Warning: Jeanine Pirro's Prediction And What It Means

Table of Contents

Jeanine Pirro's Stock Market Prediction: A Deep Dive

While the exact details of Jeanine Pirro's stock market prediction may not be readily and consistently available across all sources, it's crucial to understand the context surrounding any such pronouncements. It is important to note that interpretations of her statements may vary across different media outlets. Therefore, it's vital to consult multiple credible sources for a comprehensive understanding of her perspective, if publicly released. (Note: This section requires specific information about Pirro's prediction to be fully fleshed out. Without that information, the analysis below is hypothetical.)

- Key Elements of the Prediction: Let's assume, hypothetically, that Pirro's prediction involved concerns about a potential downturn in the technology sector, coupled with broader market volatility within a 6-12 month timeframe.

- Reasoning Behind the Prediction: Hypothetically, Pirro might have based her prediction on concerns about rising interest rates, increasing inflation, and geopolitical uncertainties, potentially referencing specific economic indicators like the Consumer Price Index (CPI) or the Producer Price Index (PPI).

- Credibility Assessment: It's crucial to acknowledge that Jeanine Pirro's background is primarily in law and media, not finance. Therefore, her prediction should be considered alongside other analyses from established financial experts and economists. Investors should critically evaluate the basis for her claims and not solely rely on her statement for investment decisions.

Analyzing the Potential Impact of Pirro's Prediction

Pirro's warning, regardless of its specific details, highlights the inherent uncertainties within the stock market. Several factors can amplify or mitigate the potential impact.

Macroeconomic Factors and Market Volatility

Several macroeconomic factors can contribute to market instability, potentially exacerbating concerns raised by Pirro's prediction.

- Alignment with Pirro's Prediction: Rising interest rates, for instance, could negatively affect certain sectors, particularly those with high debt levels like technology companies, potentially aligning with a hypothetical prediction of a technology sector downturn.

- Influence of Economic Data: Current economic data releases and expert analyses from organizations like the Federal Reserve and the International Monetary Fund (IMF) are crucial in assessing the overall economic outlook and its potential impact on the stock market.

Investor Sentiment and Market Behavior

Pirro's prediction, even if perceived as less credible by some, can significantly influence investor sentiment and market behavior.

- Potential for Panic Selling: Negative predictions can trigger fear and uncertainty, potentially leading to panic selling and increased market volatility.

- Impact on Investment Strategies: Short-term investors may react more drastically than those with long-term investment horizons. Long-term investors typically focus less on short-term market fluctuations.

The Role of Political Factors

Geopolitical events and political policies often exert a powerful influence on market confidence.

- Political Risks and Market Impact: International conflicts, policy changes, and election cycles can all create uncertainty and trigger market fluctuations.

- Political Uncertainty and Investor Confidence: A lack of political stability can decrease investor confidence, potentially leading to capital flight and market instability.

Strategies for Navigating Market Uncertainty

Navigating market uncertainty requires a well-defined strategy that emphasizes prudence and adaptability.

Diversification and Risk Management

Effective risk management and portfolio diversification are crucial for mitigating potential losses.

- Protecting Portfolios: Diversification across different asset classes (stocks, bonds, real estate, etc.) helps reduce the impact of any single market downturn.

- Risk Profiles: Understanding the risk tolerance of individual investors is crucial in determining the appropriate asset allocation within their portfolios.

Staying Informed and Adapting Your Investment Plan

Staying abreast of market trends and economic indicators is essential.

- Reliable Sources: Regularly monitor news from reputable financial sources and economic data releases.

- Adaptability: Be prepared to adjust your investment strategy based on evolving market conditions and new information.

Seeking Professional Financial Advice

Working with a qualified financial advisor can provide invaluable support.

- Tailored Investment Plans: A financial advisor helps create a personalized investment plan aligned with your individual financial goals and risk tolerance.

- Informed Decisions: Professional guidance can greatly aid in making well-informed decisions, particularly during periods of market uncertainty.

Conclusion

Jeanine Pirro's stock market prediction, regardless of its specifics, serves as a reminder of the inherent volatility in financial markets. Macroeconomic factors, investor sentiment, and political events all play significant roles in shaping market trends. By diversifying portfolios, actively monitoring market conditions, and potentially seeking professional financial advice, investors can better position themselves to navigate market uncertainty. Remember to conduct your own thorough research and consider this information alongside expert opinions before making any investment decisions. Stay informed about stock market warnings and develop a robust investment strategy based on your risk tolerance and financial goals. Consult with a financial professional for personalized advice regarding your investment portfolio in light of recent stock market warnings.

Featured Posts

-

Sensex Today Live Stock Market Updates Nifty Above 23 800

May 09, 2025

Sensex Today Live Stock Market Updates Nifty Above 23 800

May 09, 2025 -

Joanna Page Calls Out Wynne Evans On Bbc Show You Re So Trying

May 09, 2025

Joanna Page Calls Out Wynne Evans On Bbc Show You Re So Trying

May 09, 2025 -

Police Make Arrest Following Elizabeth City Weekend Shooting

May 09, 2025

Police Make Arrest Following Elizabeth City Weekend Shooting

May 09, 2025 -

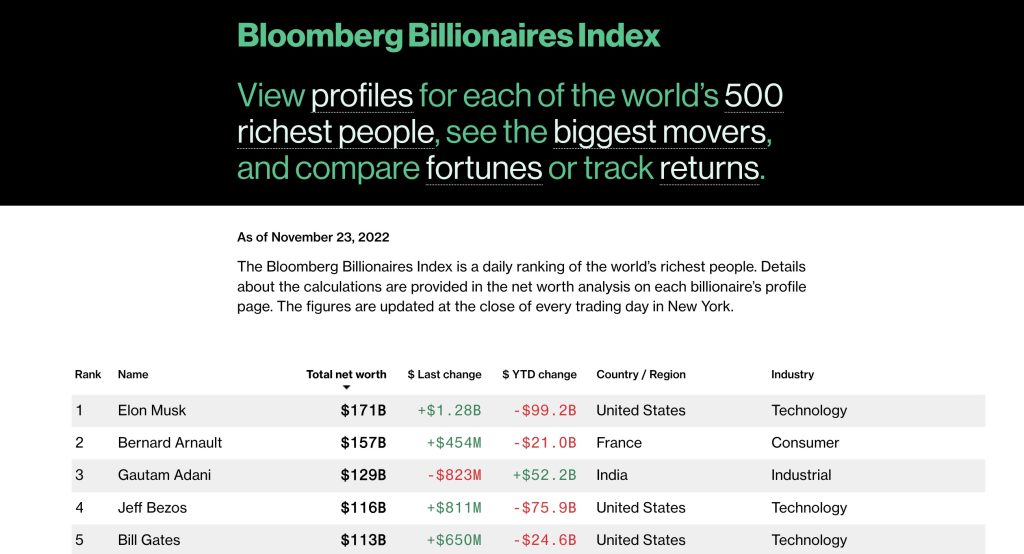

Elon Musks Net Worth A Look At Us Economic Impacts

May 09, 2025

Elon Musks Net Worth A Look At Us Economic Impacts

May 09, 2025 -

I Control You Analyzing Briatores Dominance Over Doohan On Netflix

May 09, 2025

I Control You Analyzing Briatores Dominance Over Doohan On Netflix

May 09, 2025

Latest Posts

-

Elon Musks Fortune Explodes Teslas Success And Dogecoin Distance

May 10, 2025

Elon Musks Fortune Explodes Teslas Success And Dogecoin Distance

May 10, 2025 -

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 10, 2025

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 10, 2025 -

Post Trump Inauguration Assessing The Billions Lost By Musk Bezos And Zuckerberg

May 10, 2025

Post Trump Inauguration Assessing The Billions Lost By Musk Bezos And Zuckerberg

May 10, 2025 -

Elon Musks Billions Increase Tesla Rally Fuels Wealth Growth Post Dogecoin Departure

May 10, 2025

Elon Musks Billions Increase Tesla Rally Fuels Wealth Growth Post Dogecoin Departure

May 10, 2025 -

The Financial Impact Of The Trump Presidency Losses For Musk Bezos And Zuckerberg

May 10, 2025

The Financial Impact Of The Trump Presidency Losses For Musk Bezos And Zuckerberg

May 10, 2025