Tesla Stock Rally Propels Elon Musk's Net Worth To New Heights

Table of Contents

Tesla's Stock Performance: The Driving Force Behind the Rally

The dramatic rise in Tesla's stock price can be attributed to a confluence of positive catalysts that have boosted investor confidence and fueled significant market gains.

Recent Positive Catalysts

Several key events have contributed to the recent Tesla stock rally:

- Strong Q4 2023 Earnings Report: Tesla exceeded expectations with its fourth-quarter earnings, reporting record vehicle deliveries and revenue growth. This demonstrated the company's resilience and strong market position. The stock price jumped significantly following the announcement.

- Successful New Product Launches: The introduction of new models and features, including software updates and technological advancements, has generated considerable excitement and positive media coverage, further driving investor optimism.

- Positive Industry Sentiment: Growing global demand for electric vehicles and positive industry trends have created a favorable environment for Tesla's continued growth and success. This positive market outlook has increased investor confidence in the company's long-term prospects.

- Expansion into New Markets: Tesla's continued expansion into new international markets has broadened its revenue streams and enhanced its global reach. This strategic move signals strong future growth potential.

The impact of these catalysts has been substantial. For example, the Q4 earnings report alone resulted in a double-digit percentage increase in Tesla's stock price within days of its release. This positive momentum has been further amplified by the positive industry sentiment and Tesla's sustained innovation.

Market Analysis and Investor Confidence

The Tesla stock rally isn't solely a result of company-specific factors; the broader market context also plays a significant role. Positive overall market trends, coupled with a growing belief in the long-term potential of electric vehicles, have contributed to increased investor confidence in Tesla.

- Positive Macroeconomic Indicators: Favorable economic indicators, such as declining inflation and stable interest rates, have created a more positive investment climate, encouraging investors to allocate capital towards growth stocks like Tesla.

- Competitor Performance: While competition in the EV market is intensifying, Tesla maintains a significant lead in terms of technology, brand recognition, and market share. This competitive advantage reassures investors.

- Long-term Growth Potential: Analysts predict significant growth in the EV market in the coming years, positioning Tesla as a key beneficiary of this anticipated expansion. This long-term outlook fuels investor confidence and drives further investment.

Investor sentiment toward Tesla remains largely positive, further fueled by the belief in the company's ability to maintain its competitive edge and capitalize on the growing global demand for electric vehicles.

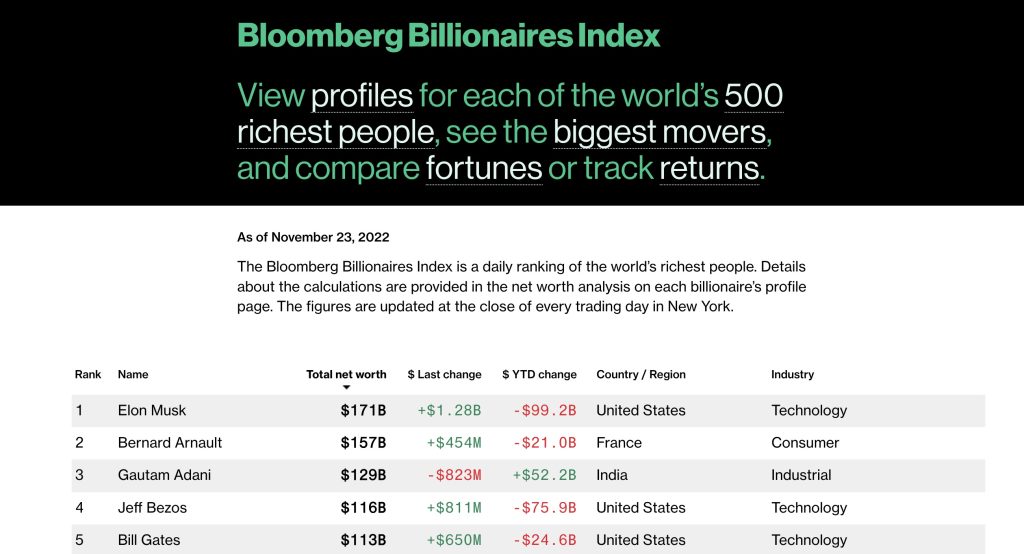

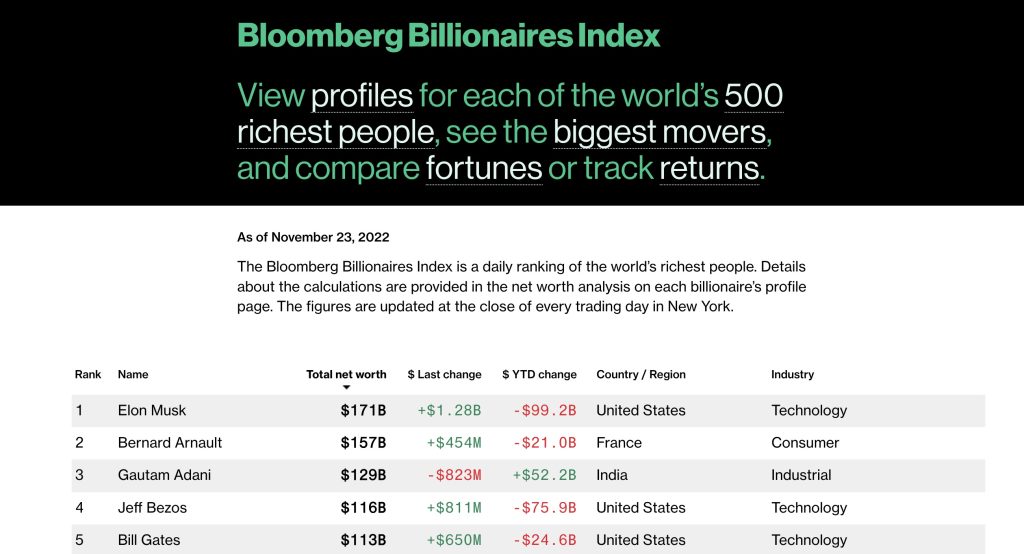

The Impact on Elon Musk's Net Worth

Elon Musk's substantial net worth is heavily tied to his significant ownership stake in Tesla. Therefore, the recent stock rally has had a dramatic effect on his personal wealth.

Calculating Net Worth

Elon Musk's net worth is primarily calculated by assessing the value of his Tesla stock holdings, alongside other investments and assets. The significant proportion of his wealth tied to Tesla shares directly links fluctuations in the company's stock price to changes in his overall net worth.

- Tesla Stock Holdings: The vast majority of Elon Musk's net worth is derived from his ownership of Tesla stock.

- Other Investments: While significant, his investments in other ventures represent a smaller portion of his total net worth compared to his Tesla holdings.

Any increase in Tesla's stock price translates to a proportional increase in the value of his holdings, directly impacting his overall net worth. Conversely, a decline in Tesla's stock would negatively impact his net worth.

Comparison to Previous Highs

The recent rally has propelled Elon Musk's net worth to levels significantly exceeding his previous highs. This dramatic increase reflects the unprecedented success of Tesla and the strength of its market position.

- Percentage Increase: Data shows a substantial percentage increase in Musk's net worth over the past [specify time period, e.g., quarter, year], directly correlating with the upward trajectory of Tesla's stock price.

- Rate of Increase: The rate of increase in his net worth is remarkable, highlighting the significant impact of the Tesla stock rally.

This rapid growth is not solely due to the stock rally; it also reflects the increasing valuation of Tesla as a company and the growing global acceptance of electric vehicles.

Future Outlook for Tesla Stock and Elon Musk's Net Worth

Predicting the future is inherently uncertain, but analyzing potential factors can offer insights into the possible trajectories of Tesla's stock and Elon Musk's net worth.

Predictions and Projections

Financial analysts offer diverse projections for Tesla's future performance, ranging from cautiously optimistic to extremely bullish. These predictions often depend on various factors, including the company's ability to sustain its growth rate, navigate increasing competition, and successfully launch new products.

- Analyst Forecasts: Several financial analysts project continued growth for Tesla, citing factors like strong demand, technological innovation, and expansion into new markets. Others are more cautious, highlighting potential risks such as increased competition and economic downturns.

- Market Sentiment: Overall market sentiment toward Tesla remains positive but is subject to fluctuations based on news and events impacting the company and the broader EV market.

These forecasts highlight the inherent uncertainty associated with predicting future stock performance and its impact on Elon Musk's net worth.

Factors that could Influence Future Growth

Several factors could significantly influence Tesla's future stock performance and consequently Elon Musk's net worth:

- Competition: The increasing competition from established automakers and new EV startups could impact Tesla's market share and profitability.

- Regulatory Changes: Government regulations and policies related to electric vehicles and autonomous driving could significantly influence Tesla's operations and profitability.

- Technological Advancements: Tesla's ability to continue innovating and developing cutting-edge technologies will be crucial for maintaining its competitive edge.

- Economic Conditions: Global economic conditions and consumer spending patterns will influence demand for electric vehicles and impact Tesla's sales.

The interplay of these factors will shape the future trajectory of Tesla's stock price and, ultimately, Elon Musk's net worth.

Conclusion

The Tesla stock rally has been a key driver in propelling Elon Musk's net worth to new heights, demonstrating the close correlation between the company's financial performance and its CEO's personal wealth. The rally is a result of strong earnings, successful new product launches, positive market sentiment, and favorable industry trends. While the future remains uncertain, the ongoing success of Tesla and the continued growth of the electric vehicle market strongly suggests that the close relationship between Tesla stock performance and Elon Musk's net worth will continue to be a compelling story to follow.

Key Takeaways:

- Tesla's recent stock rally is driven by strong performance, positive market sentiment, and the growing EV market.

- Elon Musk's net worth is heavily tied to Tesla's stock performance.

- Future growth depends on several factors, including competition, regulation, and technological innovation.

Call to Action: Stay updated on the latest developments in the Tesla stock market and track Elon Musk's net worth by following reputable financial news sources and conducting your own thorough research into Tesla's performance and the electric vehicle market.

Featured Posts

-

Sensex And Nifty 50 End Choppy Trading Session Unchanged Impact Of Bajaj Twins And India Pakistan Relations

May 10, 2025

Sensex And Nifty 50 End Choppy Trading Session Unchanged Impact Of Bajaj Twins And India Pakistan Relations

May 10, 2025 -

Chute Mortelle A Dijon Un Ouvrier Decede Apres Une Chute Du 4e Etage

May 10, 2025

Chute Mortelle A Dijon Un Ouvrier Decede Apres Une Chute Du 4e Etage

May 10, 2025 -

Your Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025

Your Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025 -

Sensex And Nifty Today Market Gains And Key Highlights

May 10, 2025

Sensex And Nifty Today Market Gains And Key Highlights

May 10, 2025 -

Upcoming Release Of Documents Pam Bondis Statements On Epstein Diddy Jfk And Mlk Cases

May 10, 2025

Upcoming Release Of Documents Pam Bondis Statements On Epstein Diddy Jfk And Mlk Cases

May 10, 2025