The Financial Impact Of The Trump Presidency: Losses For Musk, Bezos, And Zuckerberg

Table of Contents

Trade Wars and Tariffs: Impact on Musk, Bezos, and Zuckerberg

The Trump administration's aggressive trade policies, characterized by tariffs on imported goods, created significant ripples across various sectors, directly affecting the bottom lines of these tech giants.

-

Elon Musk and Tesla: Tariffs on steel and aluminum, key components in Tesla vehicle manufacturing, directly increased production costs. This impacted profitability and forced Tesla to potentially raise vehicle prices, impacting competitiveness and sales. Increased trade tensions also disrupted global supply chains, leading to production delays and hindering Tesla's ambitious expansion plans into new international markets. Musk's public criticisms of certain Trump policies further complicated the situation, potentially impacting investor sentiment.

-

Jeff Bezos and Amazon: Amazon, with its extensive global supply chains and reliance on international trade for both retail and AWS (Amazon Web Services), faced substantial challenges. Tariffs on imported goods increased operational costs, affecting product pricing and profitability. The impact extended to AWS, which relies on global infrastructure and experienced increased expenses due to trade disruptions. Changes in international trade relationships also complicated Amazon's complex logistics and delivery networks, impacting efficiency and potentially customer satisfaction.

-

Mark Zuckerberg and Facebook: While less directly affected by tariffs on physical goods, Facebook faced indirect consequences. The Trump era saw increased regulatory scrutiny over data privacy and antitrust issues, creating a challenging environment. This heightened regulatory pressure, partly fueled by the political climate and amplified by Trump's rhetoric, potentially impacted Facebook's stock valuation and investment decisions, influencing future growth strategies.

Regulatory Changes and their Financial Repercussions

The Trump administration's approach to deregulation and its impact on these tech giants was complex and multifaceted.

-

Deregulation efforts: While some deregulation might have offered short-term cost savings in specific areas, the overall effect was far from straightforward. For instance, reduced environmental regulations could have lowered operational costs, but potentially increased reputational risk and exposure to criticism from environmental groups and consumers increasingly concerned about sustainability.

-

Antitrust scrutiny: Despite the push for deregulation in some sectors, the tech giants still faced significant antitrust investigations and concerns throughout the Trump presidency, particularly regarding monopolistic practices. This uncertainty surrounding potential regulatory actions affected stock prices, investor confidence, and long-term strategic planning.

-

Tax policy changes: The Tax Cuts and Jobs Act of 2017 initially boosted corporate profits due to lower tax rates. However, the long-term effects were debated, impacting investment decisions and financial strategies. The complexities of the tax reform and its potential consequences on future growth created an environment of uncertainty for these companies.

The Impact of Geopolitical Uncertainty

Trump's unpredictable foreign policy and shifting alliances created significant geopolitical uncertainty, influencing market stability and investment decisions for these tech giants.

-

International trade disputes: The trade wars initiated by the Trump administration significantly impacted global economic sentiment, creating volatility and impacting the financial performance of these companies. Uncertainty surrounding trade policy affected investment planning and risk assessment.

-

Shifting alliances and sanctions: Changes in international relations affected global supply chains and the overall business environment, contributing to market volatility and increased risk assessment for these multinational corporations. The unpredictability of foreign policy made long-term strategic planning more challenging.

-

Impact on consumer confidence: Geopolitical uncertainty often translates into consumer uncertainty, affecting spending habits. This influenced the demand for products and services offered by these companies, potentially impacting revenue streams and growth projections.

Conclusion:

The Trump presidency's financial impact on Elon Musk, Jeff Bezos, and Mark Zuckerberg was multifaceted and far-reaching. Trade wars, regulatory changes, and geopolitical uncertainty presented significant challenges, leading to potential losses in various areas. However, a comprehensive understanding requires deeper analysis, acknowledging the interplay of numerous factors influencing each company's individual performance. Further research into the financial impact of the Trump presidency is essential to gain a more complete understanding of this transformative period. For a detailed analysis, we recommend consulting individual company financial reports and economic analyses from reputable sources. Understanding the Trump presidency's financial impact remains crucial for comprehending the complexities of the modern global economy.

Featured Posts

-

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025

Sharing Your Story The Impact Of Trumps Executive Orders On Transgender Lives

May 10, 2025 -

Stephen Kings 2025 Will The Monkey Be His Worst Film Adaptation

May 10, 2025

Stephen Kings 2025 Will The Monkey Be His Worst Film Adaptation

May 10, 2025 -

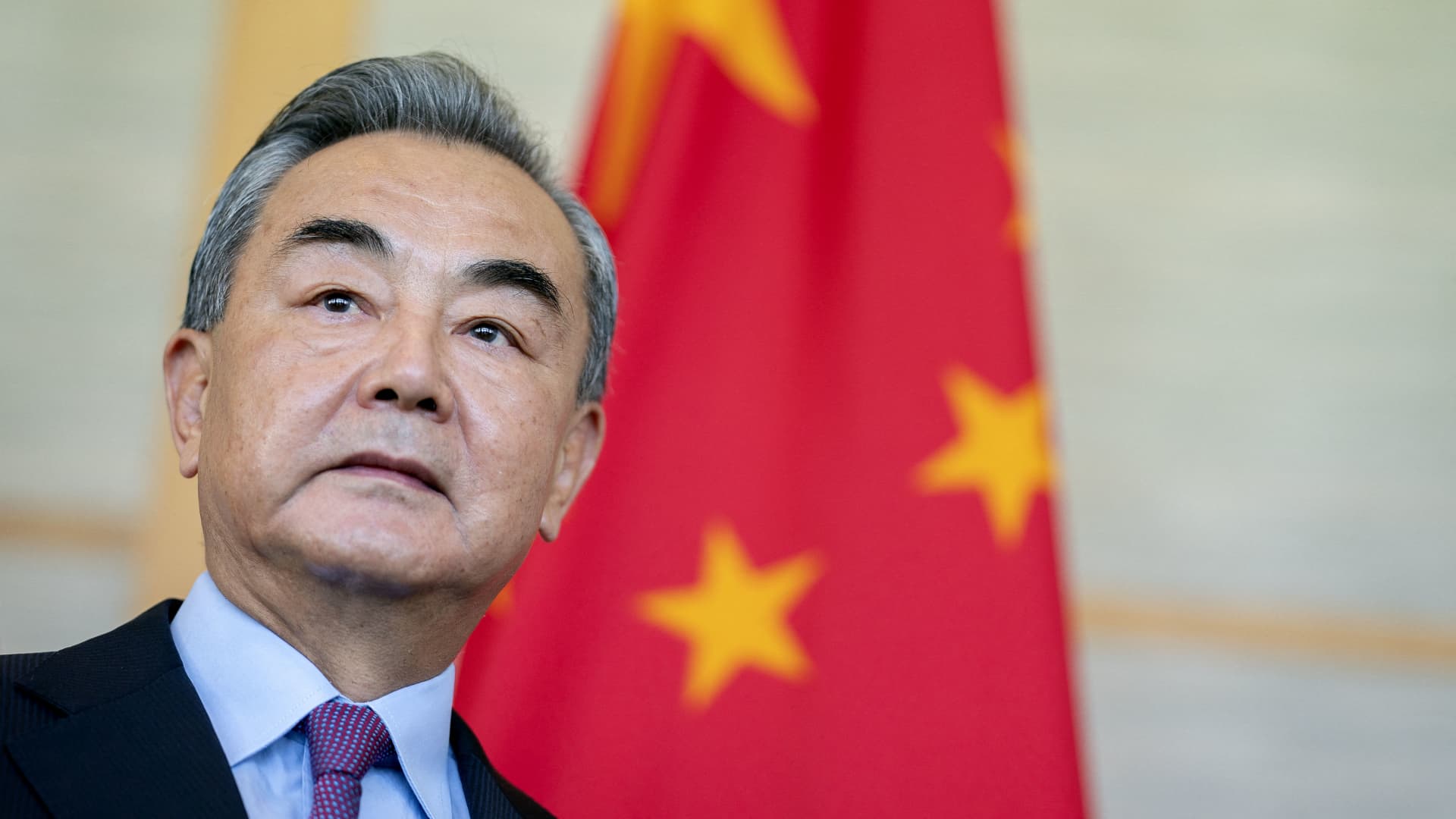

Chinas Exclusive Security Approach In High Stakes Us Trade Talks

May 10, 2025

Chinas Exclusive Security Approach In High Stakes Us Trade Talks

May 10, 2025 -

Legal Battle E Bay Banned Chemicals And The Scope Of Section 230

May 10, 2025

Legal Battle E Bay Banned Chemicals And The Scope Of Section 230

May 10, 2025 -

The Untapped Potential Of Middle Managers A Key To Organizational Success

May 10, 2025

The Untapped Potential Of Middle Managers A Key To Organizational Success

May 10, 2025