Elon Musk's Billions Increase: Tesla Rally Fuels Wealth Growth Post-Dogecoin Departure

Table of Contents

Tesla Stock Performance as the Primary Driver

Analyzing Tesla's Recent Stock Market Success

Tesla's stock price has seen significant growth, largely contributing to Elon Musk's increased net worth. Several key factors have fueled this success:

- Strong Q3 2023 Earnings: Tesla reported record-breaking earnings for the third quarter of 2023, exceeding analysts' expectations and boosting investor confidence. This translated to a significant jump in the stock price.

- New Product Announcements: The anticipated release of the Cybertruck and other upcoming vehicle models has generated considerable excitement and positive market sentiment. This anticipation fuels investment and drives up stock valuation.

- Positive Investor Sentiment: Despite challenges, Tesla maintains strong investor support driven by its pioneering position in electric vehicles and innovative technology. This confidence directly impacts stock price.

- Improved Production Output: Increased production efficiency and expansion of Gigafactories worldwide have contributed to increased vehicle deliveries, furthering investor confidence.

- Expansion into New Markets: Tesla's strategic expansion into new international markets has broadened its revenue streams and market reach, showcasing robust growth potential.

Data reveals a substantial percentage increase in Tesla's stock price over the past [Insert timeframe, e.g., quarter, six months], with market capitalization reaching [Insert current market cap figure]. These figures highlight the direct correlation between Tesla’s performance and Musk’s wealth. Reports from [cite reputable financial news sources] further support these claims.

Correlation Between Tesla's Success and Musk's Net Worth

Elon Musk's substantial ownership stake in Tesla directly translates to significant wealth growth with every increase in the company's stock price. He holds a large number of Tesla shares and stock options. These options grant him the right to buy Tesla shares at a predetermined price, allowing him to profit significantly from price increases. Any rise in Tesla's share price directly increases the value of his holdings, exponentially boosting his net worth. Further, any positive news or developments related to Tesla, such as successful product launches or expansions, immediately impacts his personal wealth.

The Impact of Dogecoin Departure and Diversification

Dogecoin Volatility and its Effect on Musk's Overall Portfolio

Musk's past endorsements of Dogecoin introduced significant volatility into his portfolio. While his tweets influenced Dogecoin's price dramatically, this volatility carries inherent risks. By seemingly distancing himself from direct Dogecoin promotion, Musk may have reduced the impact of such fluctuations on his overall financial stability, contributing to a more predictable growth trajectory. His past endorsements, however, undeniably played a role in shaping his overall financial picture at that time.

Diversification Across Multiple Ventures

Musk's wealth isn't solely reliant on Tesla. His diversified portfolio includes significant holdings and leadership roles in other ventures, which contribute to his overall net worth.

- SpaceX: SpaceX's continued success in space exploration and satellite launches contributes positively to Musk's overall financial health. Recent achievements, such as successful Starlink deployments, significantly impact the company’s value and, consequently, Musk's wealth.

- Neuralink: While still in its early stages, Neuralink’s advancements in brain-computer interfaces represent a potentially lucrative long-term investment. Positive developments and milestones in this sector could significantly influence Musk's future wealth.

- The Boring Company: This infrastructure and tunnel construction company, though less prominent than SpaceX or Tesla, represents another avenue for potential future growth and wealth accumulation.

Future Projections and Market Outlook

Predicting Future Growth Based on Current Trends

Several factors will influence Tesla's stock price and, subsequently, Musk's net worth in the future:

- Technological Advancements: Tesla's ongoing innovation in battery technology, autonomous driving, and other technological advancements will significantly impact its market position and future growth.

- Competition: Increased competition in the electric vehicle market will present challenges and opportunities. Tesla's ability to maintain its innovative edge will determine its future success.

- Regulatory Changes: Government regulations and policies related to electric vehicles and autonomous driving will influence market dynamics and Tesla's growth trajectory.

Predicting future growth with absolute certainty is impossible. The market remains inherently unpredictable. However, by analyzing current trends and potential future scenarios, we can gain insight into potential factors influencing Musk's future net worth.

Maintaining Wealth Through Strategic Decision-Making

Musk’s business strategies, including a focus on innovation, long-term vision, and calculated risk-taking, have significantly contributed to his wealth. His ability to identify and capitalize on emerging market opportunities, while managing risk effectively, is a key factor in maintaining his substantial net worth. This strategic decision-making, along with a commitment to diversification, helps cushion his wealth against potential market downturns in any single venture.

Conclusion

Elon Musk's recent wealth surge is largely due to Tesla's exceptional stock performance, emphasizing the profound impact a company's success has on its CEO's net worth. While his involvement with Dogecoin introduced volatility, his diversified portfolio and strategic decision-making contribute to his ongoing financial success. His ventures beyond Tesla offer additional avenues for future wealth growth.

Call to Action: Stay informed about Elon Musk's business ventures and the ever-evolving stock market dynamics to understand the factors influencing his billions and the potential for future growth in his net worth. Follow our blog for continuous updates on Elon Musk’s wealth and related investment news.

Featured Posts

-

Kimbal Musk A Look At Elons Brothers Life Career And Activism

May 10, 2025

Kimbal Musk A Look At Elons Brothers Life Career And Activism

May 10, 2025 -

Elon Musks Fortune Explodes Teslas Success And Dogecoin Distance

May 10, 2025

Elon Musks Fortune Explodes Teslas Success And Dogecoin Distance

May 10, 2025 -

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025 -

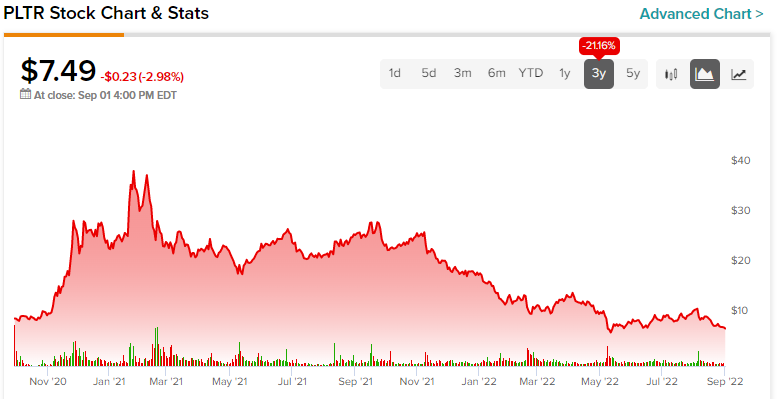

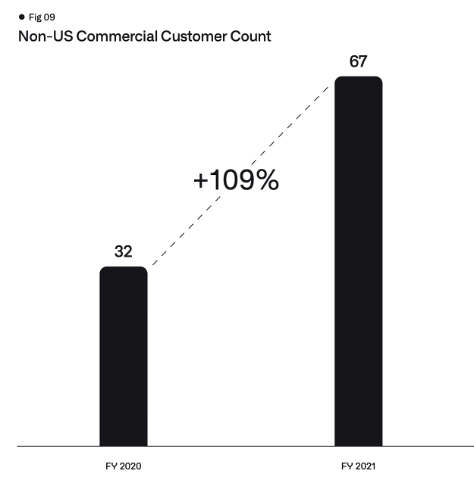

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 10, 2025

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 10, 2025 -

Indiana High School Athletic Association Bans Transgender Girls Following Trump Order

May 10, 2025

Indiana High School Athletic Association Bans Transgender Girls Following Trump Order

May 10, 2025

Latest Posts

-

Should You Invest In Palantir Stock Before The May 5th Earnings Release

May 10, 2025

Should You Invest In Palantir Stock Before The May 5th Earnings Release

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Data Driven Approach

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Data Driven Approach

May 10, 2025 -

Palantir Stock Investment Analysis Before May 5th Earnings Report

May 10, 2025

Palantir Stock Investment Analysis Before May 5th Earnings Report

May 10, 2025 -

Palantir Stock Before May 5th Is It A Buy Or Sell

May 10, 2025

Palantir Stock Before May 5th Is It A Buy Or Sell

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th Expert Analysis

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Expert Analysis

May 10, 2025