Stock Market Valuation Concerns: BofA's Rationale For Investor Calm

Table of Contents

Recent market volatility has sparked concerns about stock market valuation. High valuations often precede market corrections, leaving investors anxious. However, Bank of America (BofA) offers a compelling counter-argument, suggesting reasons for maintaining a calm and considered approach to current market conditions. This article explores BofA's rationale and examines the key factors supporting their perspective on current stock market valuations. We will delve into the details of their analysis, addressing common concerns and outlining their strategic recommendations for investors navigating this complex landscape.

BofA's Key Arguments for a Less Bearish Outlook:

BofA's analysts argue against excessive pessimism surrounding current valuations, citing several key factors pointing towards a more optimistic outlook. Their analysis suggests that while valuations are high in some areas, a balanced perspective considers several positive economic indicators.

-

Strong corporate earnings growth, despite inflationary pressures: Despite persistent inflation, many companies have demonstrated impressive earnings growth, indicating resilience and adaptability within the current economic climate. This robust performance suggests that underlying economic strength continues to support corporate profitability.

-

Resilient consumer spending and a robust labor market: Consumer spending remains relatively strong, fueled by a robust labor market with low unemployment. This indicates continued economic momentum and supports the argument that high valuations are not entirely unjustified.

-

Potential for future interest rate cuts to stimulate the economy: BofA's analysts anticipate a potential shift in monetary policy, with future interest rate cuts designed to stimulate economic growth. Lower interest rates typically lead to higher stock valuations, offsetting some concerns.

-

Attractive valuations in specific sectors, offering potential for long-term growth: Specific sectors, such as technology and healthcare, are showing attractive valuations, presenting opportunities for long-term growth despite overall market concerns about stock market valuation. The technology sector, for instance, continues to innovate and disrupt, driving future growth potential. Healthcare, driven by an aging global population, is another area with significant long-term potential.

-

Historically low inflation-adjusted valuations compared to previous market cycles: When compared to historical market cycles, adjusted for inflation, current valuations are relatively low in some segments, suggesting that current concerns may be overblown. This long-term perspective helps contextualize present valuations.

Analyzing the Factors Contributing to High Valuations:

While BofA presents a less bearish outlook, it acknowledges the legitimate concerns surrounding high stock market valuations. Several factors contribute to this perceived overvaluation:

-

Impact of low interest rates on equity valuations: Historically low interest rates have made equities more attractive compared to bonds, pushing up valuations across the board. This has artificially inflated some prices, leading to concerns about overvaluation.

-

Influence of quantitative easing on market liquidity: Quantitative easing programs injected significant liquidity into the market, further influencing asset prices, including equities. This increased liquidity supported higher valuations, but also increased the risk of asset bubbles.

-

The role of technological advancements driving growth in specific sectors: Rapid technological advancements have driven substantial growth in certain sectors, justifying higher valuations in those specific areas. However, this growth is not uniform across all sectors, making a broad assessment of stock market valuation more complex.

-

Geopolitical uncertainties and their effect on investor sentiment: Geopolitical events and uncertainties often impact investor sentiment and market volatility, influencing valuations. These unpredictable events introduce significant risk and contribute to the complexity of assessing stock market valuations.

-

Potential risks associated with high inflation and interest rate hikes: High inflation and subsequent interest rate hikes pose significant risks. Higher interest rates increase borrowing costs for businesses, potentially impacting earnings and negatively affecting stock market valuation.

Addressing the Concerns about High Price-to-Earnings Ratios (P/E):

Price-to-Earnings (P/E) ratios are a key metric used to assess stock market valuation. While high P/E ratios can signal overvaluation, BofA argues against relying solely on this metric.

-

Explain the limitations of solely relying on P/E ratios for valuation: P/E ratios are just one factor and don't consider future growth potential, industry-specific factors, or the overall economic environment. Relying solely on this metric provides an incomplete picture of valuation.

-

Analyze the impact of industry-specific factors on P/E ratios: Different industries have different growth trajectories and risk profiles. Comparing P/E ratios across industries without considering these variations can be misleading.

-

Highlight BofA's counterarguments about the current P/E ratios considering future growth projections: BofA suggests that current P/E ratios are justified when considering future growth projections. Their analysts believe that projected earnings growth will eventually bring P/E ratios in line with historical averages.

-

Compare current P/E ratios to historical averages for context: Comparing current P/E ratios to historical averages helps provide context and perspective. This historical context assists in determining whether current levels are truly excessive or within a reasonable range.

BofA's Strategic Recommendations for Investors:

Given their assessment of the market, BofA recommends a strategic approach to investing:

-

Diversification across different asset classes: Diversification minimizes risk and protects against significant losses in any single asset class. This is especially crucial in times of uncertainty regarding stock market valuation.

-

Focus on companies with strong fundamentals and long-term growth prospects: Prioritizing companies with solid financial health and long-term growth potential mitigates the risk associated with overvalued sectors.

-

Strategic allocation to specific sectors identified as undervalued by BofA: BofA suggests allocating funds to sectors they believe are currently undervalued, offering potential for above-average returns.

-

Maintaining a long-term investment horizon: A long-term perspective minimizes the impact of short-term market fluctuations and allows investors to ride out periods of volatility.

-

Regular portfolio review and rebalancing: Regular review and rebalancing ensure that the portfolio remains aligned with the investor's risk tolerance and long-term goals.

Conclusion:

While concerns regarding stock market valuation are understandable, Bank of America provides a reasoned perspective suggesting that a cautious but not overly bearish approach is warranted. By considering factors such as strong corporate earnings, a resilient economy, and potential for future interest rate adjustments, investors can navigate the current market landscape more effectively. BofA's strategic recommendations emphasize diversification, focusing on strong fundamentals, and maintaining a long-term outlook. Therefore, a thorough understanding of stock market valuation and the latest analysis, like BofA's, is crucial for making informed investment decisions. Remember to conduct your own due diligence and consult a financial advisor before making any investment choices relating to stock market valuation.

Featured Posts

-

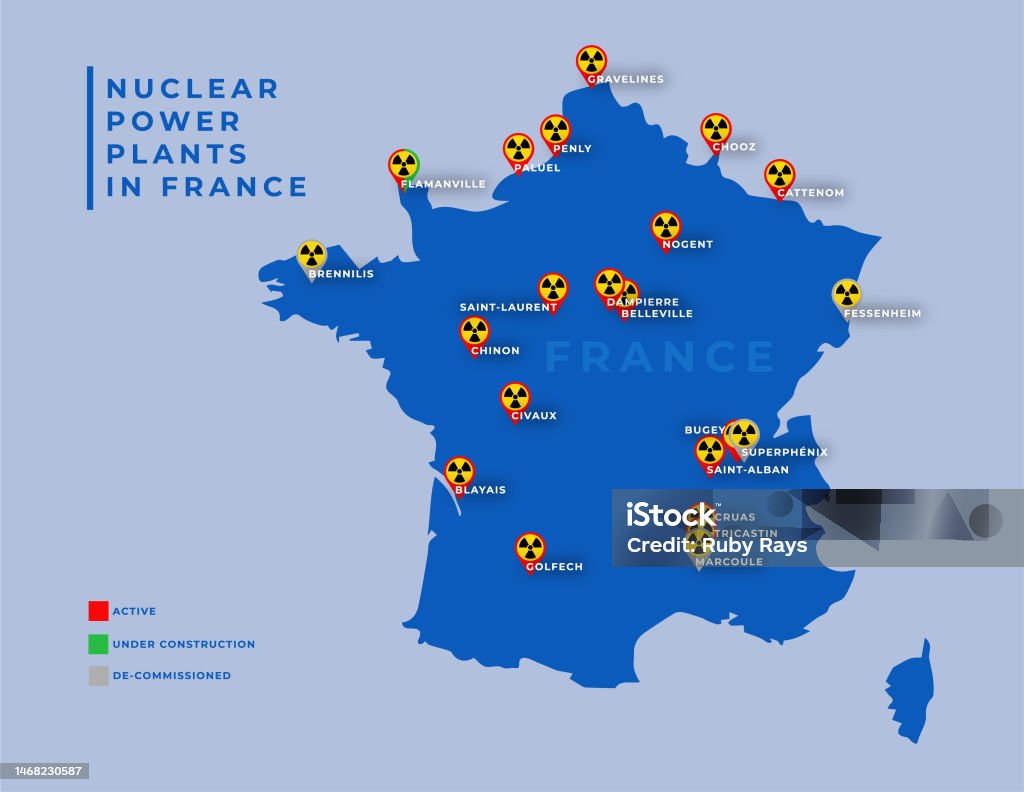

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025

Chinas Nuclear Power Expansion 10 New Reactors Approved

Apr 29, 2025 -

Anchor Brewing Companys Closure A Legacy Concludes After 127 Years

Apr 29, 2025

Anchor Brewing Companys Closure A Legacy Concludes After 127 Years

Apr 29, 2025 -

Attorney Generals Transgender Athlete Ban Implications For Minnesota Schools

Apr 29, 2025

Attorney Generals Transgender Athlete Ban Implications For Minnesota Schools

Apr 29, 2025 -

Top Universities Unite Against Trump Administration An Exclusive Look

Apr 29, 2025

Top Universities Unite Against Trump Administration An Exclusive Look

Apr 29, 2025 -

Akesos Disappointing Trial Results Lead To Significant Stock Decline

Apr 29, 2025

Akesos Disappointing Trial Results Lead To Significant Stock Decline

Apr 29, 2025

Latest Posts

-

Ais Limited Thinking What The Latest Research Reveals

Apr 29, 2025

Ais Limited Thinking What The Latest Research Reveals

Apr 29, 2025 -

The Illusion Of Intelligence Uncovering The Reality Of Ai Thinking

Apr 29, 2025

The Illusion Of Intelligence Uncovering The Reality Of Ai Thinking

Apr 29, 2025 -

Understanding Ais Thought Processes A Surprisingly Simple Explanation

Apr 29, 2025

Understanding Ais Thought Processes A Surprisingly Simple Explanation

Apr 29, 2025 -

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025 -

How Ai Thinks A Look At The Limits Of Artificial Intelligence

Apr 29, 2025

How Ai Thinks A Look At The Limits Of Artificial Intelligence

Apr 29, 2025