RTL Group's Streaming Revenue: Growth And Profitability Projections

Table of Contents

The media landscape is undergoing a seismic shift, with streaming rapidly becoming the dominant form of entertainment consumption. RTL Group, a major European media company, is strategically positioned to capitalize on this growth. This article analyzes and projects the growth and profitability of RTL Group's streaming revenue, exploring key factors driving its success and potential challenges ahead. We'll delve into current performance, future growth drivers, and offer profitability projections based on market trends and financial analysis.

<h2>Analyzing RTL Group's Current Streaming Performance</h2>

<h3>Key Streaming Platforms and Their Contributions</h3>

RTL Group's streaming strategy centers around its flagship platform, RTL+. This platform offers a diverse range of content, attracting a substantial subscriber base across various European markets. While precise subscriber numbers are often kept confidential by the company, analysts estimate significant growth year-on-year.

- Market Penetration: RTL+ has achieved notable market penetration in key territories like Germany and the Netherlands, competing effectively with established global players like Netflix and local streaming services.

- Content Library: The platform's success is driven by a diverse content library, including popular local dramas, international series, movies, and documentaries. This mix caters to a broad audience, maximizing subscriber acquisition.

- Competitive Analysis: RTL+’s competitive advantage lies in its focus on local content, which resonates strongly with audiences and differentiates it from global streaming giants. However, competition remains fierce, requiring continuous investment in content and platform improvements.

<h3>Revenue Streams and Monetization Strategies</h3>

RTL Group generates streaming revenue through a dual strategy: subscription fees and advertising.

- Subscription Model: The core revenue stream comes from direct-to-consumer subscriptions, offering various tiers with different features and content.

- Advertising Revenue: A freemium model, including ad-supported tiers, helps attract a broader audience and generates additional revenue streams.

- ARPU (Average Revenue Per User): RTL Group's focus is on balancing subscriber acquisition with increasing ARPU through premium content offerings and additional features.

- Future Monetization: Future strategies might explore partnerships, exclusive content deals, and potentially introducing transactional video-on-demand (TVOD) options for specific content.

<h2>Factors Driving Future Growth of RTL Group's Streaming Revenue</h2>

<h3>Expansion into New Markets and Territories</h3>

RTL Group's international expansion plans are crucial for future streaming revenue growth.

- Geographic Expansion: Expanding into new European markets and potentially beyond presents significant opportunities for subscriber growth.

- Market-Specific Strategies: Success will depend on tailoring content and marketing strategies to suit the specific tastes and preferences of each new market.

- Regulatory Landscape: Navigating varying regulations and licensing agreements in different territories will be a key challenge.

<h3>Investment in Original Content and Programming</h3>

Original programming is a vital differentiator in the crowded streaming landscape.

- Investment Strategy: RTL Group is increasingly investing in the production of original series and films, both locally produced and internationally co-produced.

- Content Success: The success of existing original content directly impacts subscriber growth and retention. Data analysis on viewership and audience engagement is vital to inform future content strategies.

- Future Productions: Continued investment in high-quality, engaging original programming is essential to maintain a competitive edge.

<h3>Technological Advancements and Innovation</h3>

Technological advancements play a significant role in enhancing the user experience and driving growth.

- Improved User Interface: A seamless and intuitive user interface is critical for user satisfaction and retention.

- Personalized Recommendations: Advanced algorithms providing personalized content recommendations enhance user engagement.

- Technological Innovation: Exploring new technologies like VR/AR or interactive storytelling can create unique and engaging experiences that differentiate RTL+ from competitors.

<h2>Profitability Projections and Financial Analysis</h2>

<h3>Forecasting Revenue Growth Based on Market Trends</h3>

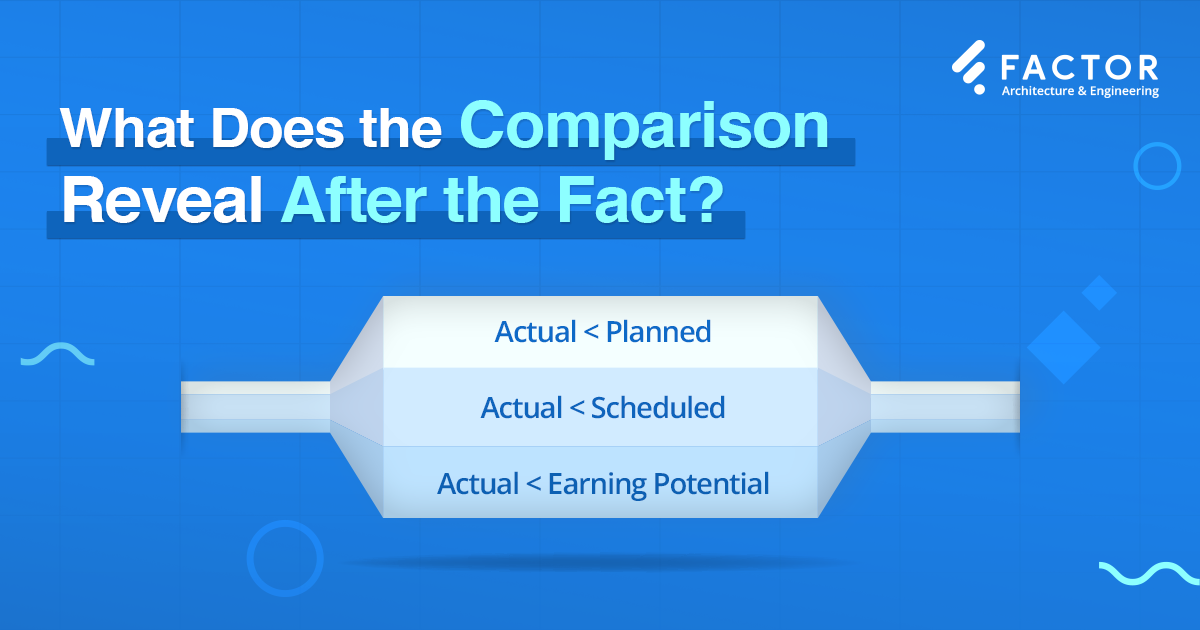

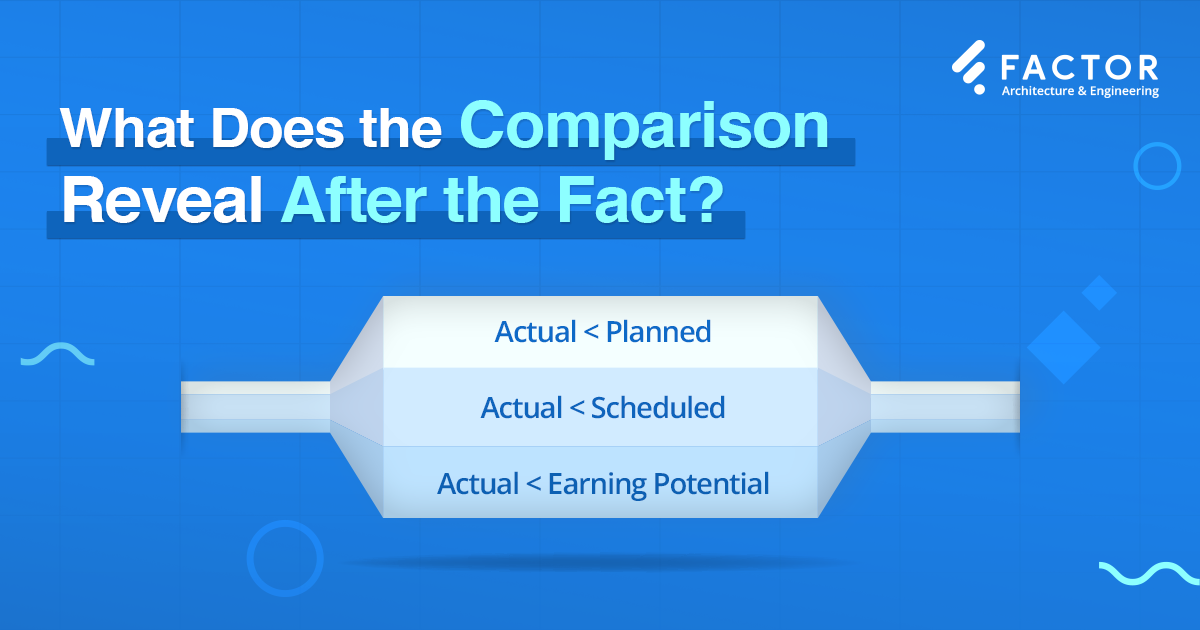

Based on current market trends and RTL Group's strategic initiatives, we project a significant increase in streaming revenue over the next 3-5 years. (Illustrative chart/graph would be inserted here showing projected revenue growth).

- Market Saturation: While market saturation is a potential concern, RTL Group's focus on local content and strategic expansion into new territories mitigates this risk.

- Competitive Landscape: Intense competition requires continuous innovation and investment to maintain market share and subscriber growth.

- Economic Factors: Macroeconomic factors, such as inflation and consumer spending, will also influence revenue projections.

<h3>Analyzing Profit Margins and Cost Efficiency</h3>

Achieving profitability requires careful management of costs and efficient operations.

- Content Costs: Managing content acquisition and production costs is a key challenge. Optimizing licensing agreements and focusing on cost-effective production models is crucial.

- Technology Infrastructure: Investment in technology infrastructure, while necessary, needs to be balanced against cost efficiency.

- Marketing Expenses: Effective marketing campaigns are essential for subscriber acquisition, but optimizing marketing spend for maximum ROI is vital.

- Profit Margin Comparison: Comparing RTL Group's profit margins with competitors will provide valuable insights into operational efficiency and pricing strategies.

<h2>Conclusion</h2>

RTL Group’s streaming revenue shows significant potential for growth and profitability. The company's strategic investments in original content, technological innovation, and international expansion position it for success in the competitive streaming market. Continued focus on optimizing cost efficiency, increasing ARPU, and adapting to evolving market trends will be crucial to achieving long-term profitability. Stay informed about RTL Group's future developments in streaming to gain a deeper understanding of its financial performance and the evolving landscape of streaming revenue and profitability projections. Further research into RTL Group’s financial reports and market analysis will provide a more comprehensive understanding of its financial trajectory.

Featured Posts

-

Open Ai Unveils Streamlined Voice Assistant Creation Tools

May 21, 2025

Open Ai Unveils Streamlined Voice Assistant Creation Tools

May 21, 2025 -

Australian Foot Race Man Sets New Speed Record

May 21, 2025

Australian Foot Race Man Sets New Speed Record

May 21, 2025 -

Updated The Trans Australia Run Record Pursuit

May 21, 2025

Updated The Trans Australia Run Record Pursuit

May 21, 2025 -

Bbai Stock Analyst Downgrade Sparks Growth Uncertainty

May 21, 2025

Bbai Stock Analyst Downgrade Sparks Growth Uncertainty

May 21, 2025 -

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 21, 2025

Latest Posts

-

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Dokhodi Ta Analiz Rinku

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini U 2024 Rotsi Dokhodi Ta Analiz Rinku

May 22, 2025 -

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025

Finansoviy Reyting 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025 -

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Analiz Lideriv Finansovogo Rinku Ukrayini Za 2024 Rik

May 22, 2025

Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus Analiz Lideriv Finansovogo Rinku Ukrayini Za 2024 Rik

May 22, 2025 -

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025

Analysis Of Ing Groups 2024 Annual Report Form 20 F

May 22, 2025 -

Ings 2024 Annual Report Key Highlights From Form 20 F

May 22, 2025

Ings 2024 Annual Report Key Highlights From Form 20 F

May 22, 2025