Analysis Of ING Group's 2024 Annual Report (Form 20-F)

Table of Contents

ING Group's Financial Highlights: Revenue, Profitability, and Key Metrics

This section examines the core financial performance of ING Group as reported in its 2024 20-F filing. We will analyze revenue growth, profitability, and key financial ratios to assess the overall financial health of the company.

Revenue Analysis:

ING Group's revenue performance in 2024 will be analyzed across its major business segments. This will include a detailed examination of:

- Wholesale Banking Revenue: Growth rates and contributing factors, focusing on specific areas such as trading, lending, and advisory services. Geographic breakdown of revenue contributions.

- Retail Banking Revenue: Analysis of revenue from mortgages, consumer lending, and other retail banking products. Comparison to previous years and market trends.

- Other Business Segments: Revenue generated from other activities and their contribution to overall growth.

Expected figures (replace with actual data from the 20-F upon its release):

- Total Revenue: [Insert Projected Figure] - showing a [Insert Percentage]% year-over-year change.

- Wholesale Banking Revenue Growth: [Insert Projected Figure]%

- Retail Banking Revenue Growth: [Insert Projected Figure]%

The revenue growth rate will be calculated and compared to industry benchmarks to gauge ING Group's performance relative to its competitors. Key geographic regions contributing significantly to revenue will be highlighted.

Profitability Assessment:

A thorough assessment of ING Group's profitability in 2024 will include:

- Net Income: Analyzing net income figures and their year-over-year change. Comparison to industry averages.

- Operating Income: Examination of operating income, highlighting key drivers and influencing factors.

- Profit Margins: Analyzing various profit margins (e.g., net interest margin, operating margin) to gauge efficiency and profitability.

Key ratios will be presented, including:

- Return on Equity (ROE): [Insert Projected Figure]%

- Net Interest Margin (NIM): [Insert Projected Figure]%

Factors influencing profitability, such as interest rate changes and loan losses, will be discussed. The impact of macroeconomic conditions will be considered.

Key Financial Ratios and Indicators:

This section will present a summary table of crucial financial ratios derived from the ING Group 2024 20-F filing. These ratios will provide insights into ING's liquidity, solvency, and capital adequacy.

| Ratio | Value (Projected) | Implication |

|---|---|---|

| Return on Assets (ROA) | Measures profitability relative to assets. | |

| Debt-to-Equity Ratio | Indicates the level of financial leverage. | |

| Current Ratio | Shows the company's ability to meet short-term obligations. | |

| Capital Adequacy Ratio | Measures the bank's capital strength relative to risk-weighted assets. | |

| Loan Loss Provision Ratio | Indicates the level of loan loss provisions relative to total loans. |

The implications of these ratios will be analyzed, offering a comprehensive view of ING Group's financial standing and future prospects.

Risk Management and Regulatory Compliance in ING Group's 20-F

Effective risk management is critical for financial institutions. This section analyzes ING Group's approach to various risks as detailed in its 2024 20-F filing.

Credit Risk Assessment:

ING Group's credit risk management strategies will be evaluated, including:

- Loan Loss Provisions: Analysis of the amount of loan loss provisions made and their impact on profitability.

- Macroeconomic Factors: The effect of macroeconomic conditions, such as economic downturns or rising interest rates, on credit risk will be assessed.

- Credit Risk Mitigation: Examination of the strategies implemented to mitigate credit risk, such as diversification and credit scoring models.

Operational Risk Management:

This section examines ING Group's approach to managing operational risks:

- Cybersecurity: Assessment of the cybersecurity measures in place to protect against cyber threats.

- Fraud Prevention: Analysis of fraud prevention strategies and their effectiveness.

- Operational Incidents: Any significant operational incidents reported in the 20-F will be discussed, along with the company's response.

Regulatory Compliance and Reporting:

ING Group's adherence to relevant regulations and reporting requirements will be examined, including:

- Regulatory Changes: Discussion of any significant regulatory changes that have impacted ING Group's operations.

- ESG Factors: Analysis of the company's approach to environmental, social, and governance (ESG) factors and their reporting.

Strategic Initiatives and Outlook: ING Group's Future Plans

This section explores ING Group's strategic plans and outlook for the future as outlined in the 20-F.

- Strategic Initiatives: Any major strategic initiatives, including mergers, acquisitions, or divestments, will be analyzed.

- Future Growth: ING Group's projections for future growth and profitability will be examined.

- Management Commentary: Key insights from management's commentary on future challenges and opportunities will be highlighted.

Conclusion: Key Takeaways from the ING Group 2024 Annual Report (20-F) Analysis

This analysis of the ING Group 2024 Annual Report (20-F) reveals [summarize key findings regarding revenue growth, profitability, risk management, and future outlook – replace bracketed information with actual data from the report once available]. The ING 20-F filing provides valuable insights into the financial performance and strategic direction of this significant global banking institution. While this analysis provides a summary, downloading the full ING Group 2024 Annual Report (20-F) is recommended for a comprehensive understanding. Subscribe to our newsletter for future analyses of ING Group's financial reports and stay updated on the evolving landscape of the global financial markets.

Featured Posts

-

A Britons Grueling Australian Run Overcoming Pain Insects And Accusations

May 22, 2025

A Britons Grueling Australian Run Overcoming Pain Insects And Accusations

May 22, 2025 -

Exploring Rums Cultural Significance In Stabroek News Kartel Coverage

May 22, 2025

Exploring Rums Cultural Significance In Stabroek News Kartel Coverage

May 22, 2025 -

Honest Review Watercolor Script By A Young Playwright

May 22, 2025

Honest Review Watercolor Script By A Young Playwright

May 22, 2025 -

Abn Amro Sterke Stijging Occasionverkopen Door Toenemend Autobezit

May 22, 2025

Abn Amro Sterke Stijging Occasionverkopen Door Toenemend Autobezit

May 22, 2025 -

Self Guided Walking Holiday In Provence Mountains To The Sea

May 22, 2025

Self Guided Walking Holiday In Provence Mountains To The Sea

May 22, 2025

Latest Posts

-

Investigating Thames Water Executive Bonuses Performance And Reward

May 22, 2025

Investigating Thames Water Executive Bonuses Performance And Reward

May 22, 2025 -

Thames Water Executive Bonuses A Failure Of Leadership

May 22, 2025

Thames Water Executive Bonuses A Failure Of Leadership

May 22, 2025 -

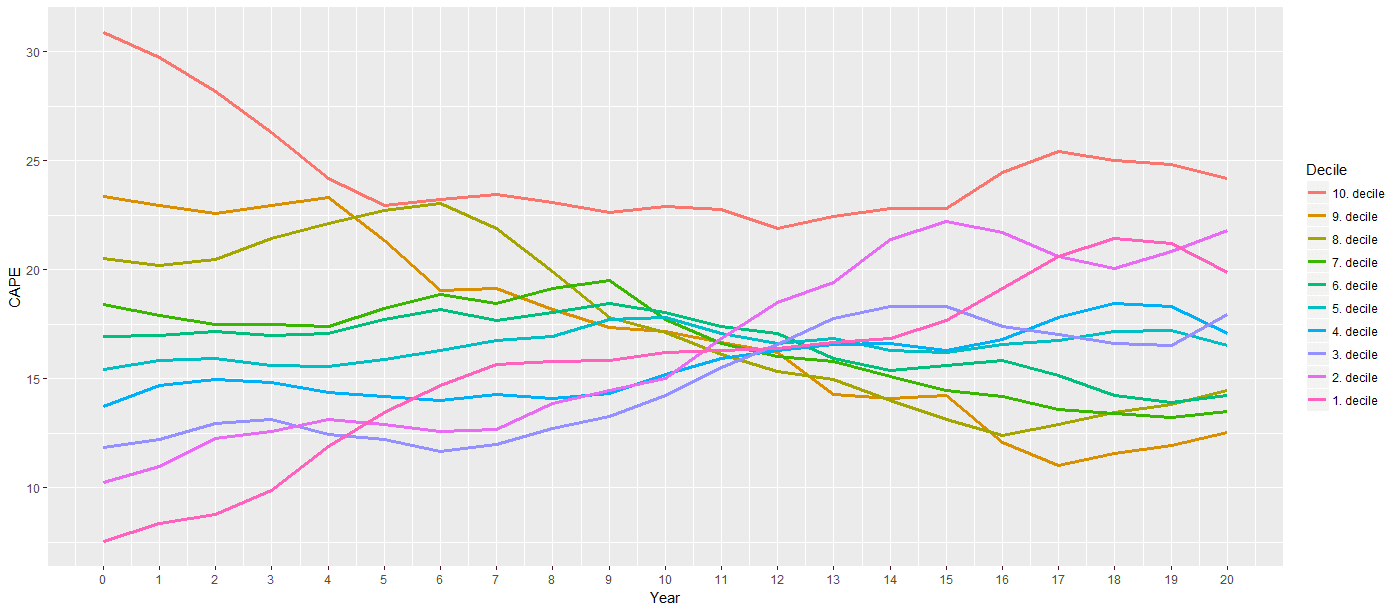

Navigating High Stock Market Valuations Insights From Bof A

May 22, 2025

Navigating High Stock Market Valuations Insights From Bof A

May 22, 2025 -

Should Investors Worry About Elevated Stock Market Valuations Bof As Take

May 22, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As Take

May 22, 2025 -

The Thames Water Bonus Scandal A Case Study In Corporate Governance

May 22, 2025

The Thames Water Bonus Scandal A Case Study In Corporate Governance

May 22, 2025