ING's 2024 Annual Report: Key Highlights From Form 20-F

Table of Contents

Main Points: Unpacking ING's Financial Performance in 2024

Revenue and Profitability: A Deep Dive into ING's Financial Results

Revenue Growth Analysis:

ING's overall revenue growth in 2024 needs to be analyzed in detail once the official Form 20-F is released. However, we can anticipate analyzing the contributions of various segments. We expect to find data broken down by:

- Wholesale Banking: Revenue generated from institutional clients, including corporate lending, trading, and investment banking activities. Expect figures on growth percentages within this sector compared to 2023.

- Retail Banking: Revenue from personal banking services, such as mortgages, deposits, and consumer lending. Data on growth in this segment, considering any changes in interest rates, will be crucial.

- Other Business Units: Revenue from other ING operations that can be revealed and analysed once the report is available.

We will closely examine the ING revenue figures to understand the drivers behind this growth (or contraction) and compare them against previous years’ performance and industry benchmarks. We'll be looking for insights into market share, successful product launches, or any strategic initiatives that propelled (or hindered) revenue growth. Key terms like "ING revenue" and "revenue growth" will be used to interpret the data.

Profitability Metrics:

Once the ING 2024 Form 20-F is available, a detailed analysis of profitability will follow. Key metrics, such as net income, operating income, and return on equity (ROE), will be examined and compared to previous periods and industry averages. We will be looking for:

- Net Income: The bottom line – the profit remaining after all expenses. We will compare this figure to previous years and investigate any significant changes.

- Operating Income: Profit from core operations, providing insight into the efficiency of ING's business model. Analysis of its trends will be key.

- Return on Equity (ROE): A measure of how effectively ING uses shareholder investments to generate profits.

Understanding these "profitability" metrics is crucial for assessing ING's financial health and overall success.

Key Financial Ratios and Indicators: Assessing ING's Financial Strength

Liquidity and Capital Adequacy:

The ING 2024 Form 20-F will be crucial for assessing its liquidity and capital adequacy. Key ratios to examine include:

- CET1 Ratio (Common Equity Tier 1 Ratio): A crucial measure of a bank's capital strength. We will analyze the number reported to understand ING's resilience to potential losses.

- Liquidity Coverage Ratio (LCR): This ratio assesses ING's ability to meet short-term liquidity needs. We'll examine the provided data and analyze its implications for ING's short-term financial stability.

- Net Stable Funding Ratio (NSFR): A longer-term measure of funding stability, providing insights into ING’s ability to manage its long-term liabilities.

These "liquidity ratio" and "capital adequacy" metrics will reveal the extent to which ING can meet its financial obligations and withstand unexpected shocks.

Debt and Leverage:

Analysis of ING's debt levels and leverage will be performed upon release of the Form 20-F. Key aspects to consider include:

- Debt-to-Equity Ratio: The proportion of debt financing compared to equity financing. This metric reveals ING's reliance on borrowed funds and its associated financial risk.

- Overall Debt Levels: The total amount of debt held by ING and any trends in debt levels compared to previous years.

Understanding ING's "debt levels" and "leverage" will indicate the extent of its financial risk and its ability to manage its capital structure effectively.

Risk Factors and Outlook: Navigating the Challenges and Opportunities

Significant Risk Factors:

The ING 2024 Form 20-F will detail significant risk factors faced by the company. These could include:

- Macroeconomic Risks: Risks stemming from global economic conditions, such as inflation, recession, or geopolitical instability.

- Credit Risk: The risk of borrowers defaulting on loans. Analysis of the management’s handling of credit risk will be crucial.

- Operational Risk: Risks associated with internal processes, systems, or people.

Understanding these "risk management" strategies and the identified risks is essential for investors.

Management's Outlook and Guidance:

Management's commentary on ING's future prospects will be crucial, including:

- Growth Prospects: ING's predictions for future revenue and profit growth.

- Strategic Initiatives: Key strategies ING intends to implement to achieve its objectives.

- Market Outlook: ING's assessment of prevailing market conditions and their potential impact on future performance.

This "management guidance" and "future outlook" are vital for assessing ING’s strategic direction and the potential for future success.

Conclusion: Key Takeaways and Next Steps for Understanding ING's 2024 Form 20-F

This analysis highlights the importance of carefully reviewing the ING 2024 Annual Report (Form 20-F) for a comprehensive understanding of its financial performance, including its revenue, profitability, key financial ratios, risk factors, and management's outlook. Once the official report is released, a deeper dive will follow, covering all aspects in detail. For a complete understanding of ING's financial performance, access the full ING 2024 Annual Report (Form 20-F) and stay tuned for further analysis. Keep an eye out for updated articles and analyses as soon as the ING 2024 Annual Report becomes available.

Featured Posts

-

Abn Amro Sterke Stijging Occasionverkopen Door Toenemend Autobezit

May 22, 2025

Abn Amro Sterke Stijging Occasionverkopen Door Toenemend Autobezit

May 22, 2025 -

Googles Ai Investment A Realistic Assessment

May 22, 2025

Googles Ai Investment A Realistic Assessment

May 22, 2025 -

Ea Fc 24 Fut Birthday Best Player Cards And Tier List

May 22, 2025

Ea Fc 24 Fut Birthday Best Player Cards And Tier List

May 22, 2025 -

India Makes History 19 Paddlers At Wtt Star Contender Chennai

May 22, 2025

India Makes History 19 Paddlers At Wtt Star Contender Chennai

May 22, 2025 -

Experience Hellfest Au Noumatrouff Mulhouse

May 22, 2025

Experience Hellfest Au Noumatrouff Mulhouse

May 22, 2025

Latest Posts

-

Investigating Thames Water Executive Bonuses Performance And Reward

May 22, 2025

Investigating Thames Water Executive Bonuses Performance And Reward

May 22, 2025 -

Thames Water Executive Bonuses A Failure Of Leadership

May 22, 2025

Thames Water Executive Bonuses A Failure Of Leadership

May 22, 2025 -

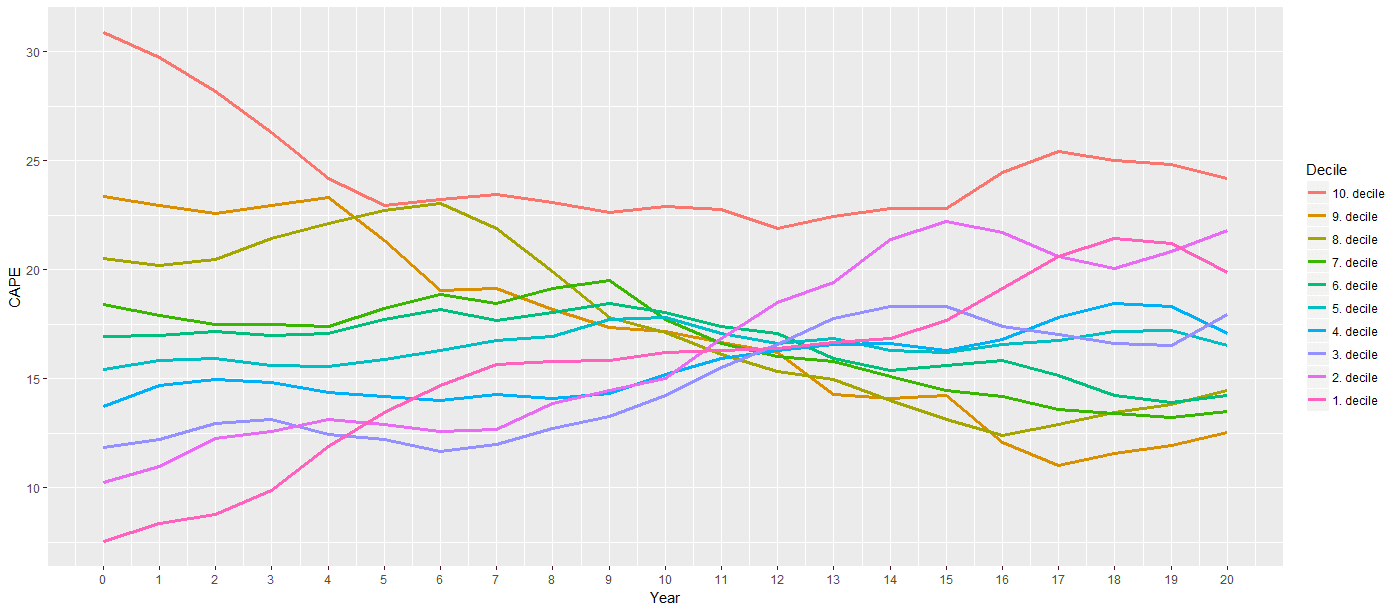

Navigating High Stock Market Valuations Insights From Bof A

May 22, 2025

Navigating High Stock Market Valuations Insights From Bof A

May 22, 2025 -

Should Investors Worry About Elevated Stock Market Valuations Bof As Take

May 22, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As Take

May 22, 2025 -

The Thames Water Bonus Scandal A Case Study In Corporate Governance

May 22, 2025

The Thames Water Bonus Scandal A Case Study In Corporate Governance

May 22, 2025