BBAI Stock: Analyst Downgrade Sparks Growth Uncertainty

Table of Contents

Analyst Downgrade and its Rationale

Several prominent analyst firms, including [Insert Analyst Firm 1] and [Insert Analyst Firm 2], recently downgraded BBAI stock, adjusting their target prices from [Previous Target Price] to [New Target Price]. The rationale behind these downgrades centers on several key concerns. [Analyst Firm 1] cited slowing revenue growth as a primary factor, projecting a [Percentage]% decrease in year-over-year revenue for the next quarter, compared to their previous forecast of [Percentage]%. [Analyst Firm 2] expressed concerns about increased competition in the [Industry Sector] market, specifically citing [Competitor Name]'s recent product launch as a significant threat to BBAI's market share.

- Concerns regarding competition: Intensified competition from established players and new entrants is squeezing profit margins.

- Concerns about revenue growth: Slower-than-expected revenue growth raises questions about the sustainability of BBAI's business model.

- Concerns about profitability: Declining profit margins and reduced earnings per share (EPS) are major causes for concern.

- Concerns about the overall market: A potential economic downturn or shifts in market sentiment could further impact BBAI's performance.

BBAI Stock Performance and Financial Health

BBAI's recent financial performance reveals a mixed picture. While the company reported [Revenue Figure] in revenue for the [Time Period], representing a [Percentage]% year-over-year growth, this figure falls short of analyst expectations. Earnings per share (EPS) stood at [EPS Figure], a [Percentage]% decrease compared to the same period last year. The debt-to-equity ratio currently sits at [Ratio], indicating [Interpretation of the ratio - e.g., a manageable level of debt or a concerning level of leverage]. Compared to its main competitors, [Competitor A] and [Competitor B], BBAI's revenue growth has lagged, raising concerns about its long-term competitiveness.

- Recent revenue figures and year-over-year growth: [Insert specific data points, e.g., Q3 2023 revenue: $X Billion, representing a 5% YoY increase.]

- EPS and profitability trends: [Insert data showing EPS trends and profitability margins.]

- Key financial ratios and their implications: [Analyze key ratios like current ratio, quick ratio, and debt-to-equity ratio.]

- Debt levels and their impact on the company’s financial health: [Discuss the level of debt and potential risks associated with high debt levels.]

Competitive Landscape and Future Outlook for BBAI

BBAI operates in a highly competitive market dominated by [List Major Competitors]. While BBAI possesses strengths in [List Strengths, e.g., technological innovation, strong brand recognition], it faces challenges from competitors offering similar products at lower prices or with superior features. The emergence of [New Technology/Trend] presents both an opportunity and a threat, requiring BBAI to adapt and innovate to maintain its market position. Future growth hinges on successful execution of its strategic initiatives, including [List Strategic Initiatives, e.g., product diversification, market expansion into new regions].

- Major competitors and their market share: [Provide data on market share held by key competitors.]

- BBAI's competitive strengths and weaknesses: [Detailed SWOT analysis of BBAI’s competitive position.]

- Potential future growth drivers (new products, market expansion, etc.): [Discuss potential growth catalysts for BBAI.]

- Potential risks and challenges (economic downturn, regulatory changes, etc.): [Highlight potential headwinds facing BBAI.]

Investor Sentiment and Trading Activity Surrounding BBAI Stock

Following the analyst downgrade, investor sentiment towards BBAI has shifted noticeably towards bearishness. Trading volume has [Increased/Decreased] significantly, reflecting increased volatility. The stock price has experienced [Percentage]% fluctuations since the downgrade. News reports and social media discussions highlight growing investor uncertainty. Analyst ratings are largely negative, with a consensus forecast suggesting [Consensus Forecast].

- Trading volume changes after the downgrade: [Quantify the changes in trading volume.]

- Price fluctuations since the downgrade: [Detail the price movements post-downgrade.]

- Overall investor sentiment (bullish, bearish, or neutral): [Summarize overall investor sentiment based on available data.]

- Analyst ratings and consensus forecast: [Provide a summary of analyst ratings and the consensus forecast for BBAI stock.]

Conclusion: Navigating Uncertainty in the BBAI Stock Market

The analyst downgrade of BBAI stock highlights significant concerns regarding its future growth prospects. Slowing revenue growth, increased competition, and declining profitability are key factors contributing to investor uncertainty. While BBAI possesses some competitive advantages, the challenges it faces are substantial. Investors should carefully weigh the risks and potential rewards before making any investment decisions related to BBAI stock. Monitor BBAI stock closely, stay informed about BBAI’s progress, and consider the risks before investing in BBAI. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Vybz Kartels Historic New York City Performance Date Venue And Ticket Info

May 21, 2025

Vybz Kartels Historic New York City Performance Date Venue And Ticket Info

May 21, 2025 -

Exploring Bangladesh A Deep Dive With Bangladeshinfo Com

May 21, 2025

Exploring Bangladesh A Deep Dive With Bangladeshinfo Com

May 21, 2025 -

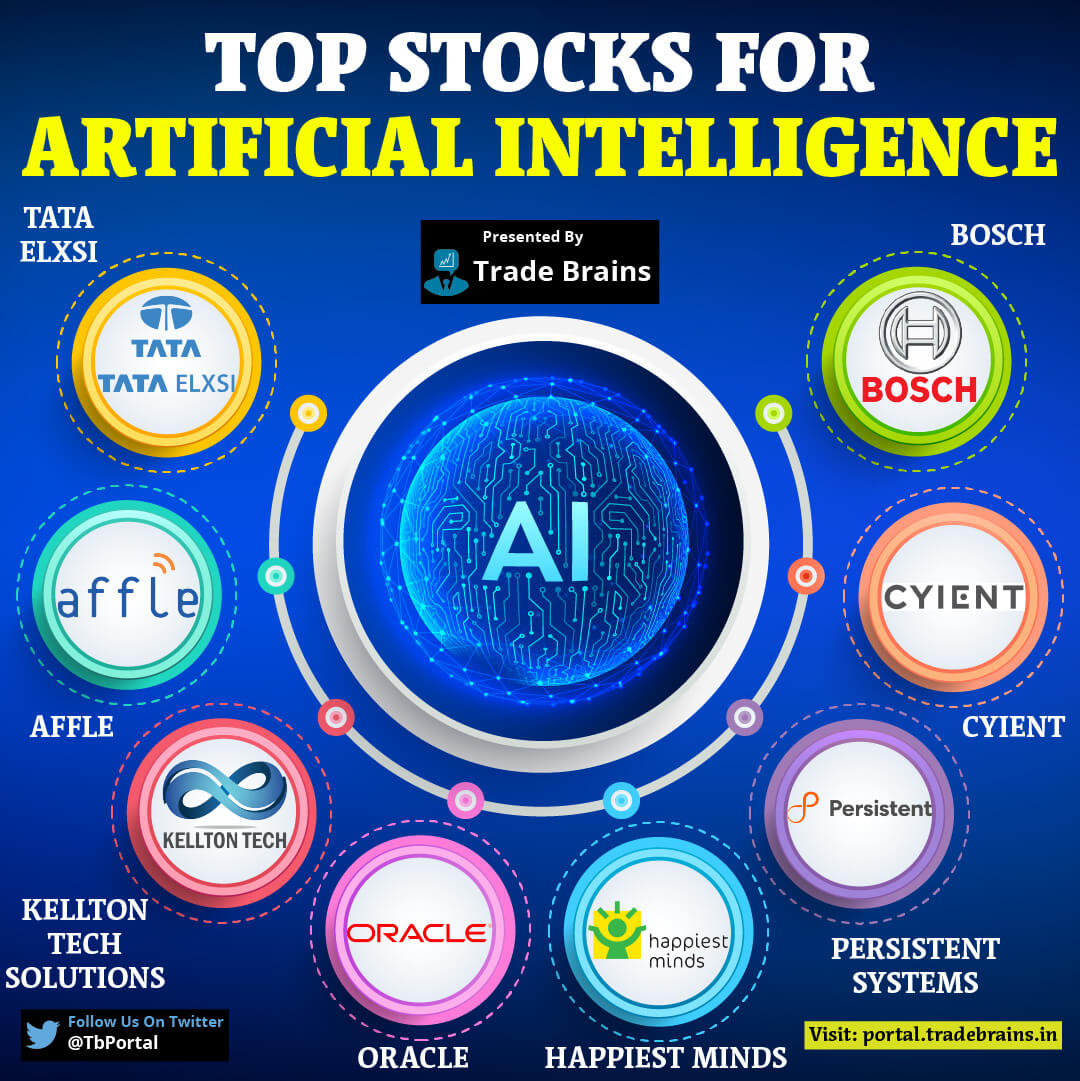

12 Best Ai Stocks To Invest In Reddits Top Picks

May 21, 2025

12 Best Ai Stocks To Invest In Reddits Top Picks

May 21, 2025 -

Lack Of Funds Practical Solutions For Financial Constraints

May 21, 2025

Lack Of Funds Practical Solutions For Financial Constraints

May 21, 2025 -

Wwe News Ripley Perez To Compete In Money In The Bank Ladder Match

May 21, 2025

Wwe News Ripley Perez To Compete In Money In The Bank Ladder Match

May 21, 2025

Latest Posts

-

The Goldbergs Exploring The Shows Lasting Impact On Television

May 22, 2025

The Goldbergs Exploring The Shows Lasting Impact On Television

May 22, 2025 -

Slot Confirms Liverpools Fortune Enrique Analyzes Alissons Performance

May 22, 2025

Slot Confirms Liverpools Fortune Enrique Analyzes Alissons Performance

May 22, 2025 -

The Goldbergs A Nostalgic Look Back At 1980s Family Life

May 22, 2025

The Goldbergs A Nostalgic Look Back At 1980s Family Life

May 22, 2025 -

Liverpools Luck Arne Slot And Luis Enrique Offer Insights

May 22, 2025

Liverpools Luck Arne Slot And Luis Enrique Offer Insights

May 22, 2025 -

Arne Slot Admits Liverpool Fortune Luis Enrique Weighs In On Alisson

May 22, 2025

Arne Slot Admits Liverpool Fortune Luis Enrique Weighs In On Alisson

May 22, 2025