Understanding High Stock Market Valuations: BofA's Investor Guidance

Table of Contents

BofA's Assessment of Current Market Valuations

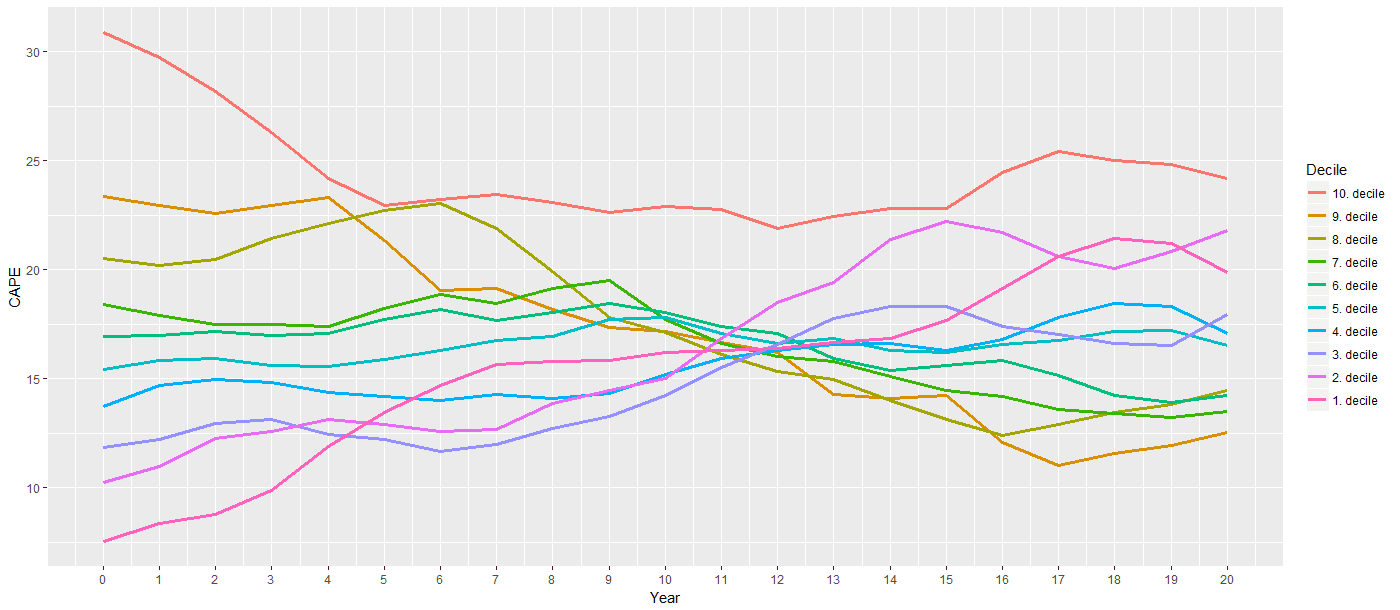

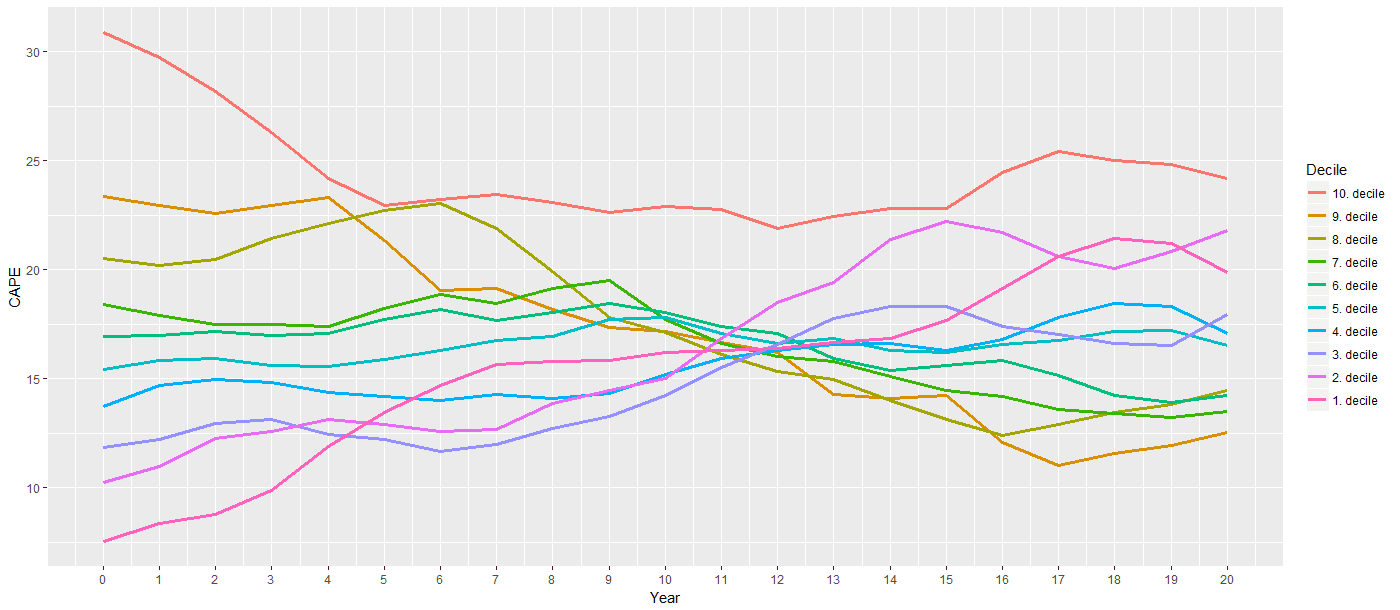

BofA's recent reports on market valuations utilize various key metrics to assess the market's health. These include the widely used price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller P/E), and other valuation multiples which provide a relative measure of market capitalization against earnings. By analyzing these, BofA provides crucial context for interpreting the current market landscape.

-

BofA's Stance on Valuation Justification: BofA's analysts carefully consider whether current valuations are justified by underlying fundamentals. This involves examining factors such as projected earnings growth, prevailing interest rates, and overall economic conditions. A high P/E ratio, for instance, might be deemed acceptable if supported by strong future earnings expectations. Conversely, high valuations without robust fundamental support may signal potential overvaluation.

-

Overvalued and Undervalued Sectors: BofA's analyses often pinpoint specific sectors or asset classes they believe are either overvalued or undervalued relative to their intrinsic worth. For example, certain technology stocks might be deemed overvalued while sectors exhibiting strong earnings growth and reasonable valuation multiples could be viewed more favorably. Staying abreast of these sector-specific assessments is crucial for strategic portfolio adjustments.

-

Risks Associated with High Valuations: High stock market valuations inherently carry risks. BofA typically highlights the potential for market corrections, particularly if interest rates rise unexpectedly or economic growth slows down. Inflation, another significant factor, can significantly impact valuations and profitability, potentially leading to a downward pressure on stock prices. Understanding these risks is paramount for effective risk management.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to periods of high stock market valuations. Understanding these factors is key to interpreting market dynamics and forming appropriate investment strategies.

-

Impact of Low Interest Rates: Low interest rates are often a significant catalyst for high valuations. When borrowing costs are low, investors are incentivized to invest in riskier assets like stocks, driving up demand and consequently prices. This phenomenon is amplified when central banks engage in quantitative easing (QE).

-

The Role of Quantitative Easing (QE): QE, a monetary policy tool where central banks inject liquidity into the financial system by purchasing assets, can significantly impact stock prices. By increasing the money supply, QE can lower interest rates and stimulate demand for stocks. However, the long-term effects of QE on market valuations remain a subject of ongoing debate.

-

Influence of Economic Growth Projections and Inflation Expectations: Positive economic growth forecasts and moderate inflation typically support higher stock valuations. However, unexpectedly high inflation can erode corporate profits and lead to a reassessment of valuations. BofA’s analysis closely considers these interconnected factors.

-

Investor Sentiment and Market Psychology: Market psychology and investor sentiment play a critical role. Periods of high investor optimism and confidence can drive valuations to unsustainable levels. Conversely, periods of uncertainty or fear can lead to sharp market corrections, regardless of underlying fundamentals.

BofA's Recommendations for Investors

BofA's investor guidance during periods of high valuations emphasizes a prudent and strategic approach.

-

Portfolio Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. BofA frequently stresses the importance of spreading investments across various sectors and geographies to minimize exposure to sector-specific downturns.

-

Risk Management Strategies: In high-valuation environments, BofA usually recommends strategies like value investing (identifying undervalued companies), focusing on defensive stocks (those less sensitive to market fluctuations), or employing hedging techniques to protect against potential losses.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is essential. Short-term market volatility shouldn’t dictate long-term investment decisions. BofA advises investors to focus on their long-term financial goals and avoid impulsive reactions to short-term market fluctuations.

-

Specific Investment Recommendations: While specific recommendations can change frequently, BofA's reports may suggest particular sectors or companies that appear attractively valued based on their analysis. Always refer to the most current reports for up-to-date information.

Alternative Investment Strategies During High Valuations

When stock market valuations are high, exploring alternative investment strategies can be prudent.

-

Real Estate, Bonds, and Commodities: Real estate can offer diversification and potential for income generation. Bonds, particularly government bonds, offer relative stability during market uncertainty. Commodities, while volatile, can provide inflation hedges. Each has its own risk profile and requires careful consideration.

-

Hedge Funds: Hedge funds employ a variety of sophisticated strategies to generate returns regardless of market direction. However, they often come with higher fees and complexity, requiring thorough due diligence.

-

Due Diligence: Before committing to any alternative investment, thorough due diligence is paramount. Understand the associated risks, fees, and liquidity considerations before investing.

Conclusion

Understanding high stock market valuations is crucial for making informed investment decisions. BofA's investor guidance highlights the importance of analyzing key valuation metrics, considering macroeconomic factors, and adopting a well-diversified and risk-managed investment strategy. By carefully considering BofA's insights and adapting your approach accordingly, you can better navigate the complexities of the current market and potentially achieve your long-term financial goals. Stay informed about ongoing analyses of high stock market valuations and adjust your approach as needed. Regularly reviewing BofA's market outlook and adjusting your investment strategy to reflect changing valuations is key to long-term success.

Featured Posts

-

Fatal Wichita Black Hawk Crash Pilots Failed Turn Investigated

Apr 29, 2025

Fatal Wichita Black Hawk Crash Pilots Failed Turn Investigated

Apr 29, 2025 -

Manufacturing In America Obstacles And Opportunities

Apr 29, 2025

Manufacturing In America Obstacles And Opportunities

Apr 29, 2025 -

Cleveland Fan Ejected For Heckling Jarren Duran After Suicide Attempt Revelation

Apr 29, 2025

Cleveland Fan Ejected For Heckling Jarren Duran After Suicide Attempt Revelation

Apr 29, 2025 -

Hagia Sophia Architectural Marvel Across Empires

Apr 29, 2025

Hagia Sophia Architectural Marvel Across Empires

Apr 29, 2025 -

Nyt Spelling Bee Answers For March 13 2025

Apr 29, 2025

Nyt Spelling Bee Answers For March 13 2025

Apr 29, 2025

Latest Posts

-

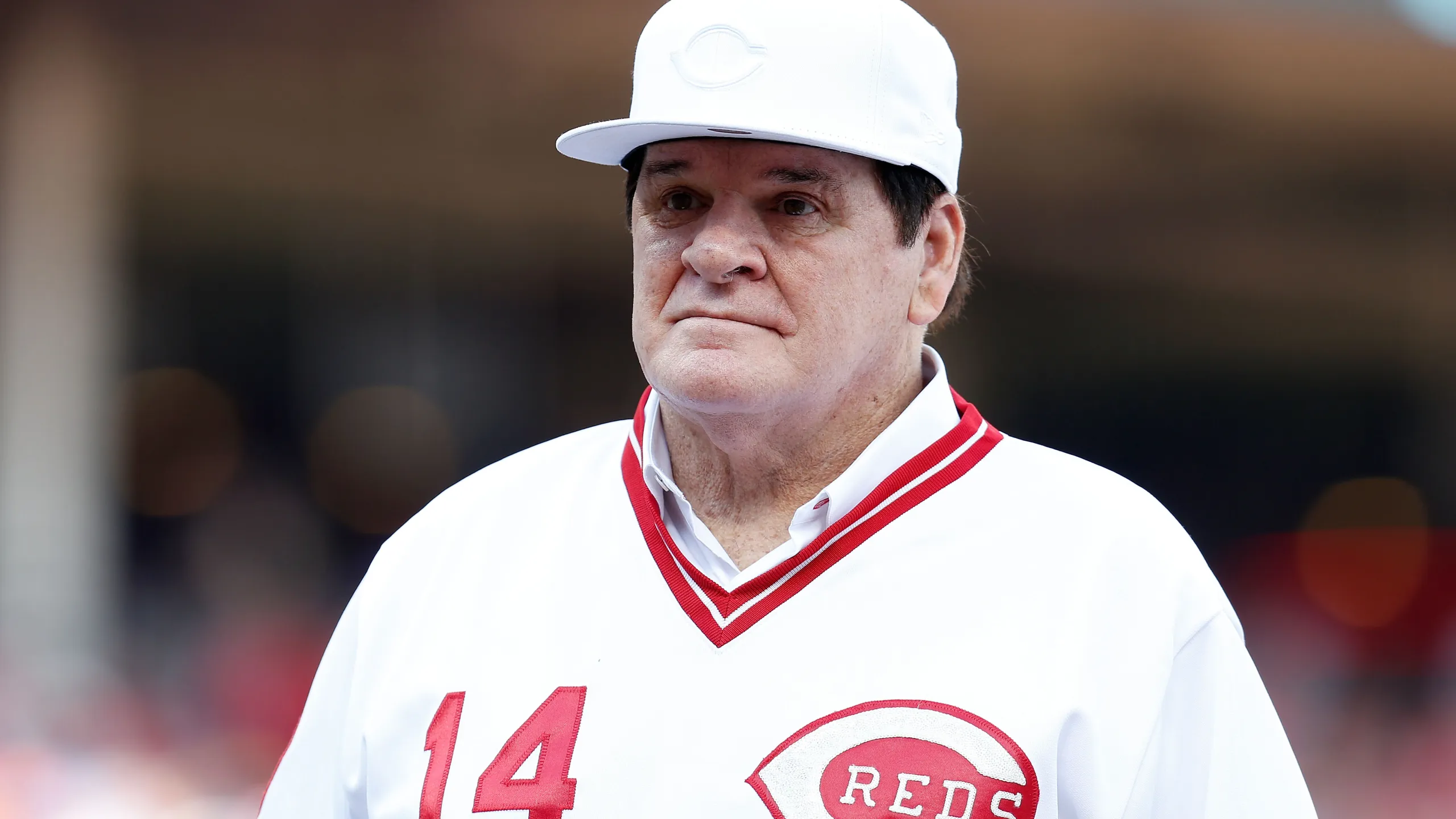

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025

Donald Trump Calls For Pete Rose Pardon And Hall Of Fame Induction

Apr 29, 2025 -

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025

The Pete Rose Pardon Donald Trumps Presidential Gamble

Apr 29, 2025 -

Will Trump Pardon Pete Rose The Impact On Baseball And Sports Betting

Apr 29, 2025

Will Trump Pardon Pete Rose The Impact On Baseball And Sports Betting

Apr 29, 2025 -

Trump Promises Pete Rose A Posthumous Pardon Following Mlb Criticism

Apr 29, 2025

Trump Promises Pete Rose A Posthumous Pardon Following Mlb Criticism

Apr 29, 2025 -

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon Of Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025