Power Finance Corporation (PFC) Dividend 2025: Fourth Cash Reward Announcement On March 12th

Table of Contents

Understanding the PFC Dividend Announcement of March 12th

The March 12th announcement will detail the PFC dividend for 2025. While the exact amount remains to be officially declared, anticipation is high among investors given PFC's consistent dividend payout history. Whether it's an interim dividend or a final dividend will be clarified in the official announcement. Speculation currently ranges from [Insert range of speculated dividend percentages or amounts based on research, if available. If not, remove this sentence and replace with something like "Investors eagerly await the official declaration of the dividend amount."].

Key dates to remember:

- Announcement Date: March 12th, 2024 (This date may need updating depending on the actual announcement date)

- Record Date (Ex-Dividend Date): [To be announced] - This is the crucial date determining which shareholders are eligible for the dividend.

- Payment Date: [To be announced] - The date when the dividend will be credited to shareholders' accounts.

This dividend announcement will significantly influence investor sentiment towards PFC. A substantial dividend payout could boost investor confidence and potentially drive up the share price. Conversely, a lower-than-expected dividend could lead to a negative market reaction.

PFC's Dividend History and Future Outlook

PFC boasts a history of relatively consistent dividend payouts. Analyzing this history provides valuable insights into the company's financial health and future dividend potential. [Insert a table here showing PFC's dividend history for the past few years, including the year, dividend amount (per share or as a percentage), and payment date. Source the data appropriately].

Several factors influence PFC's dividend policy:

- Financial Performance: PFC's profitability, earnings growth, and overall financial strength are key drivers of dividend decisions. Strong performance usually translates to higher payouts.

- Debt Levels: High levels of debt can constrain PFC's ability to distribute dividends. The company needs to maintain a healthy balance sheet to ensure sustainable dividend payments.

- Government Regulations: Government policies and regulations in the Indian power sector can impact PFC's financial performance and, consequently, its dividend policy.

- Competition: Competition within the power sector can influence PFC's profitability and its capacity to distribute dividends.

Analyst predictions regarding future PFC dividends vary. [Insert information about analyst predictions and forecasts, citing reputable sources if available]. However, the factors listed above will significantly impact the future trajectory of PFC's dividend payments.

How to Claim Your PFC Dividend

Claiming your PFC dividend is a straightforward process. The precise steps might vary slightly depending on your broker or registrar.

Steps to Claim Your Dividend:

- Verification of Shareholding: Ensure your shareholding details are accurate and up-to-date with your broker or registrar.

- Updating Bank Details: Make sure your bank account details registered with your broker or registrar are correct to facilitate electronic transfer of the dividend.

- Contacting Your Broker/Registrar: If you encounter any issues, don't hesitate to contact your broker or registrar for assistance.

Most likely, you'll receive your dividend through electronic transfer directly to your bank account. However, check with your broker or registrar to confirm the payment method. Meeting deadlines is crucial; missing the deadline may result in delays or inability to claim your dividend. Check with your broker for the specific deadlines.

Tax Implications of the PFC Dividend

The tax implications of receiving the PFC dividend depend on your tax residency status and applicable tax laws. For domestic investors in India, dividends are subject to tax as per the prevailing income tax rates. Foreign investors may face additional withholding taxes, depending on applicable tax treaties. Consult a qualified tax professional for personalized advice tailored to your individual circumstances.

Conclusion: Investing Wisely with Power Finance Corporation (PFC) Dividends

The Power Finance Corporation (PFC) dividend announcement on March 12th is a significant event for shareholders and prospective investors. While the exact dividend amount remains to be officially announced, understanding PFC's dividend history, future outlook, and the process of claiming your dividend are crucial for making informed investment decisions. Stay updated on the latest news regarding Power Finance Corporation (PFC) dividends and optimize your investment strategy. Remember to consult with financial and tax professionals for personalized guidance.

Featured Posts

-

The Cost Of Celebrity Style Ariana Grandes Hair And Tattoo Professionals

Apr 27, 2025

The Cost Of Celebrity Style Ariana Grandes Hair And Tattoo Professionals

Apr 27, 2025 -

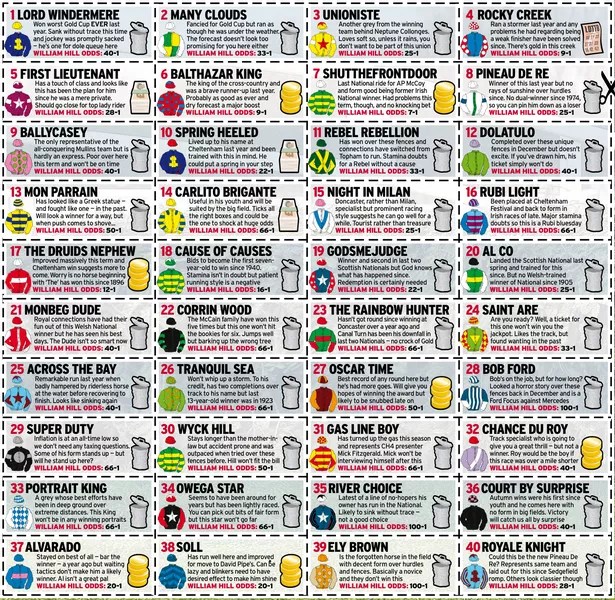

Grand National 2025 A Complete Guide To The Runners At Aintree

Apr 27, 2025

Grand National 2025 A Complete Guide To The Runners At Aintree

Apr 27, 2025 -

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025 -

Chainalysis And Alterya Merge A New Era In Blockchain Technology

Apr 27, 2025

Chainalysis And Alterya Merge A New Era In Blockchain Technology

Apr 27, 2025 -

Dax Performance Analyzing The Impact Of Bundestag Elections And Business Data

Apr 27, 2025

Dax Performance Analyzing The Impact Of Bundestag Elections And Business Data

Apr 27, 2025

Latest Posts

-

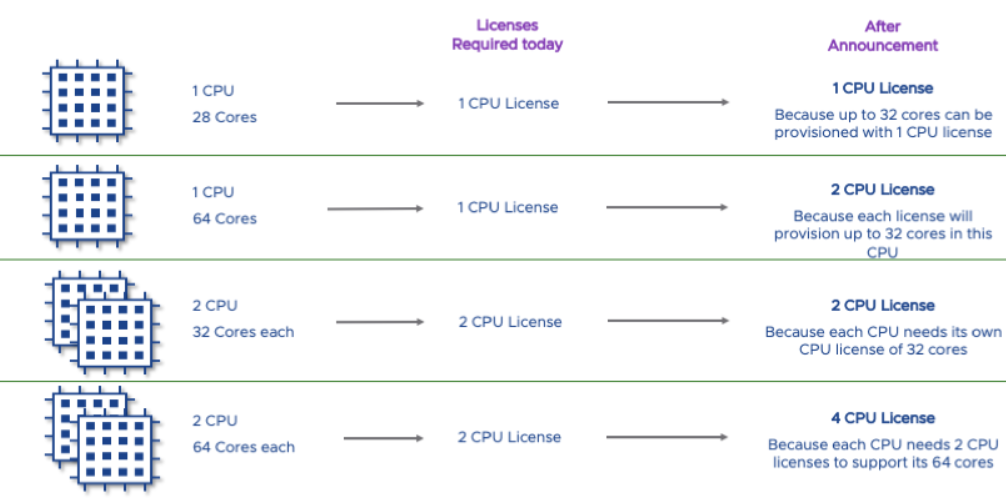

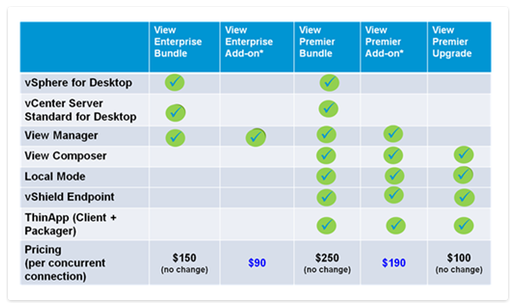

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025

Broadcoms V Mware Deal An Extreme Price Surge Of 1050 Claims At And T

Apr 28, 2025 -

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025

At And T Sounds Alarm Extreme Price Hike On V Mware After Broadcom Acquisition

Apr 28, 2025 -

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025

Broadcoms Proposed V Mware Price Increase At And T Reports A 1050 Jump

Apr 28, 2025 -

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025

1050 Price Hike Projected At And T On Broadcoms V Mware Deal

Apr 28, 2025