Broadcom's VMware Deal: An Extreme Price Surge Of 1050%, Claims AT&T

Table of Contents

AT&T's Allegation of a 1050% Price Increase

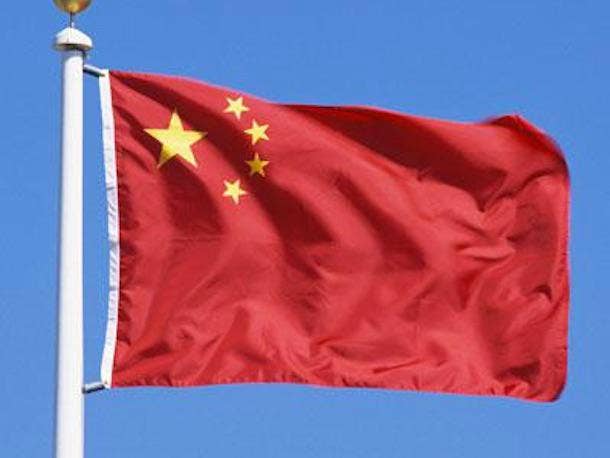

AT&T's claim is nothing short of dramatic. They allege that post-acquisition, the prices of certain crucial VMware products and services have skyrocketed by a mind-boggling 1050%. While the exact details remain somewhat opaque, AT&T's statements point towards a significant increase in licensing fees and support costs. The company hasn't explicitly named all affected products, but industry speculation points towards VMware's virtualization and cloud management solutions being at the heart of the controversy.

- Specific examples: While precise figures remain undisclosed publicly, AT&T reportedly cited examples of specific VMware products experiencing price jumps exceeding 1000%, severely impacting their budget.

- Pre- and post-acquisition comparison: AT&T's claims suggest a stark contrast between the pricing structure before Broadcom's acquisition and the current situation, highlighting the significant disparity.

- Impact on AT&T's operations: Such a drastic price increase could force AT&T to either absorb substantial additional costs, potentially affecting its profitability, or explore potentially disruptive alternatives to VMware's solutions.

Broadcom's Response and Justification

Broadcom, in response to AT&T's accusations, has yet to provide a detailed rebuttal addressing the specific claim of a 1050% price hike. Their official statements generally focus on the benefits of the VMware acquisition, highlighting synergies and efficiencies that would ultimately benefit customers. However, they haven't directly addressed the magnitude of the price increases reported by AT&T.

- Key arguments from Broadcom: Broadcom's statements often emphasize long-term value and innovation, suggesting that any price adjustments are justified by enhanced features and improved services.

- Proposed solutions or discounts: At this stage, no public announcements detail specific solutions or discounts offered to alleviate the concerns raised by AT&T.

- Long-term pricing strategy: Broadcom's long-term pricing strategy remains unclear in the wake of this controversy. The lack of transparency is a key point of contention.

Market Reactions and Regulatory Scrutiny

The allegations surrounding Broadcom's VMware deal have sent ripples through the market. While Broadcom's stock price initially saw a positive reaction to the acquisition, the subsequent controversy surrounding pricing has introduced uncertainty. Other telecommunication companies are watching closely, and industry analysts are expressing concerns about potential anti-competitive practices.

- Stock price fluctuations: Following the initial announcement, Broadcom's stock experienced volatility, reflecting investor uncertainty surrounding the fallout from AT&T's allegations.

- Statements from industry analysts: Several analysts have expressed concerns about the potential for Broadcom to leverage its newly acquired power to inflate prices for VMware products, potentially stifling competition.

- Ongoing investigations or regulatory actions: Given the scale of AT&T’s claim, regulatory scrutiny is a strong possibility. Antitrust investigations could be initiated to examine whether Broadcom's pricing practices are anti-competitive.

Impact on Consumers and Businesses

The potential ramifications of this price surge extend far beyond AT&T. Businesses heavily reliant on VMware's virtualization and cloud solutions face significant challenges. Increased operational costs and potential budget overruns could force companies to re-evaluate their IT strategies.

- Effects on IT budgets and operational costs: A 1050% price increase, even if it applies only to certain products, can severely strain IT budgets, forcing businesses to prioritize spending and potentially cut other crucial initiatives.

- Migration to alternative platforms: The dramatic price increase might trigger a wave of migrations to alternative virtualization and cloud platforms, potentially benefiting competitors like Microsoft Azure, Amazon Web Services, and Google Cloud Platform.

- Long-term effects on the competitive landscape: The controversy could reshape the competitive landscape of the virtualization and cloud computing market, potentially accelerating innovation and fostering the development of alternative solutions.

Conclusion: Analyzing the Future of the Broadcom-VMware Deal

AT&T's claim of a 1050% price increase following Broadcom's acquisition of VMware is a seismic event in the tech industry. While Broadcom hasn't directly addressed the specifics of the alleged price surge, the controversy has raised serious concerns about potential anti-competitive practices and the impact on businesses and consumers. Market reactions and the potential for regulatory scrutiny will define the long-term implications of this deal. The future of the Broadcom-VMware deal remains uncertain, and its impact on the cloud computing ecosystem could be profound.

What are your thoughts on Broadcom's VMware deal and the implications of AT&T's claim? Share your insights and predictions in the comments below! Let’s discuss the future of this impactful acquisition and its ripple effects on the wider technology landscape.

Featured Posts

-

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Navigating Market Volatility Learning From Professional And Individual Investor Behavior

Apr 28, 2025

Navigating Market Volatility Learning From Professional And Individual Investor Behavior

Apr 28, 2025 -

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 28, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 28, 2025 -

Gpu Prices Soar Are They Unreachable Again

Apr 28, 2025

Gpu Prices Soar Are They Unreachable Again

Apr 28, 2025 -

The Overseas Highway A Complete Guide To Driving The Florida Keys

Apr 28, 2025

The Overseas Highway A Complete Guide To Driving The Florida Keys

Apr 28, 2025

Latest Posts

-

Pirates Walk Off Ends Yankees Extra Inning Fight

Apr 28, 2025

Pirates Walk Off Ends Yankees Extra Inning Fight

Apr 28, 2025 -

Dramatic Walk Off Pirates Beat Yankees In Extra Innings

Apr 28, 2025

Dramatic Walk Off Pirates Beat Yankees In Extra Innings

Apr 28, 2025 -

Pirates Walk Off Victory Ends Yankees Extra Innings Battle

Apr 28, 2025

Pirates Walk Off Victory Ends Yankees Extra Innings Battle

Apr 28, 2025 -

Walk Off Win For Pirates Yankees Fall In Extra Innings

Apr 28, 2025

Walk Off Win For Pirates Yankees Fall In Extra Innings

Apr 28, 2025 -

Yankees Lose To Pirates On Walk Off Hit After Extra Innings

Apr 28, 2025

Yankees Lose To Pirates On Walk Off Hit After Extra Innings

Apr 28, 2025