Broadcom's Proposed VMware Price Increase: AT&T Reports A 1050% Jump

Table of Contents

AT&T's 1050% Price Increase: A Case Study

AT&T's experience serves as a stark warning regarding the potential cost implications of Broadcom's VMware acquisition. This dramatic price increase highlights the significant financial burden that businesses may face as a result of this merger.

The Scale of the Increase:

While the precise financial details remain largely undisclosed by AT&T, the reported 1050% increase represents a monumental surge in licensing fees. This translates to potentially millions of dollars in added expenditure for AT&T, a leading telecommunications company. The lack of precise figures underlines the need for transparency from both Broadcom and VMware regarding their future pricing strategies. The scale of this increase is unprecedented and raises serious concerns about the future cost of VMware products for all users.

AT&T's Services Affected:

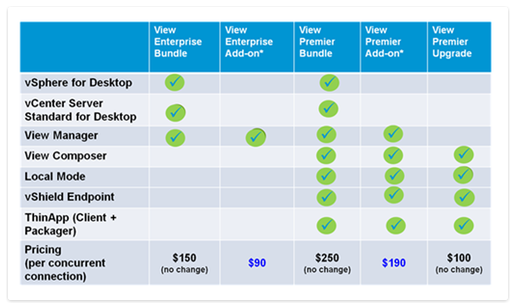

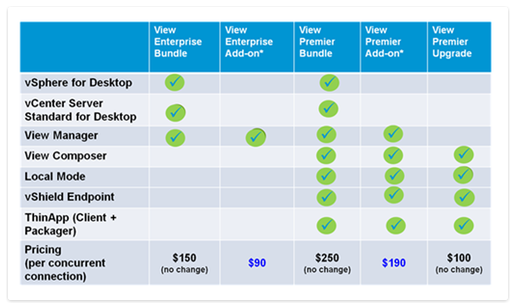

Although AT&T hasn't publicly specified every VMware product affected by the price increase, it's understood that the surge impacted their core virtualization infrastructure. This suggests that businesses relying heavily on VMware's core offerings, such as vSphere, vCenter, and NSX, are particularly vulnerable to substantial price increases.

- Specific VMware products: While not officially confirmed, reports suggest that vSphere, vCenter Server, and potentially NSX-T Data Center experienced the most substantial price hikes.

- AT&T's public statements: AT&T has expressed concerns, although it has yet to release detailed public statements due to ongoing negotiations. The lack of public transparency adds to the uncertainty surrounding the overall impact on other VMware customers.

- Relevant news articles and financial reports: [Insert links to relevant news articles and financial reports here].

Broadcom's Justification for the Price Increase

Broadcom has yet to offer a complete explanation for the reported price increases, but their justification likely centers around achieving synergies and streamlining operations post-merger.

Synergy and Consolidation Arguments:

Broadcom's acquisition strategy often involves consolidating operations to reduce costs and improve efficiency. They may argue that the price increases are necessary to offset acquisition costs and reinvest in product development and innovation. However, the sheer magnitude of the increase raises concerns about whether these justifications are sufficient.

Market Dominance Concerns:

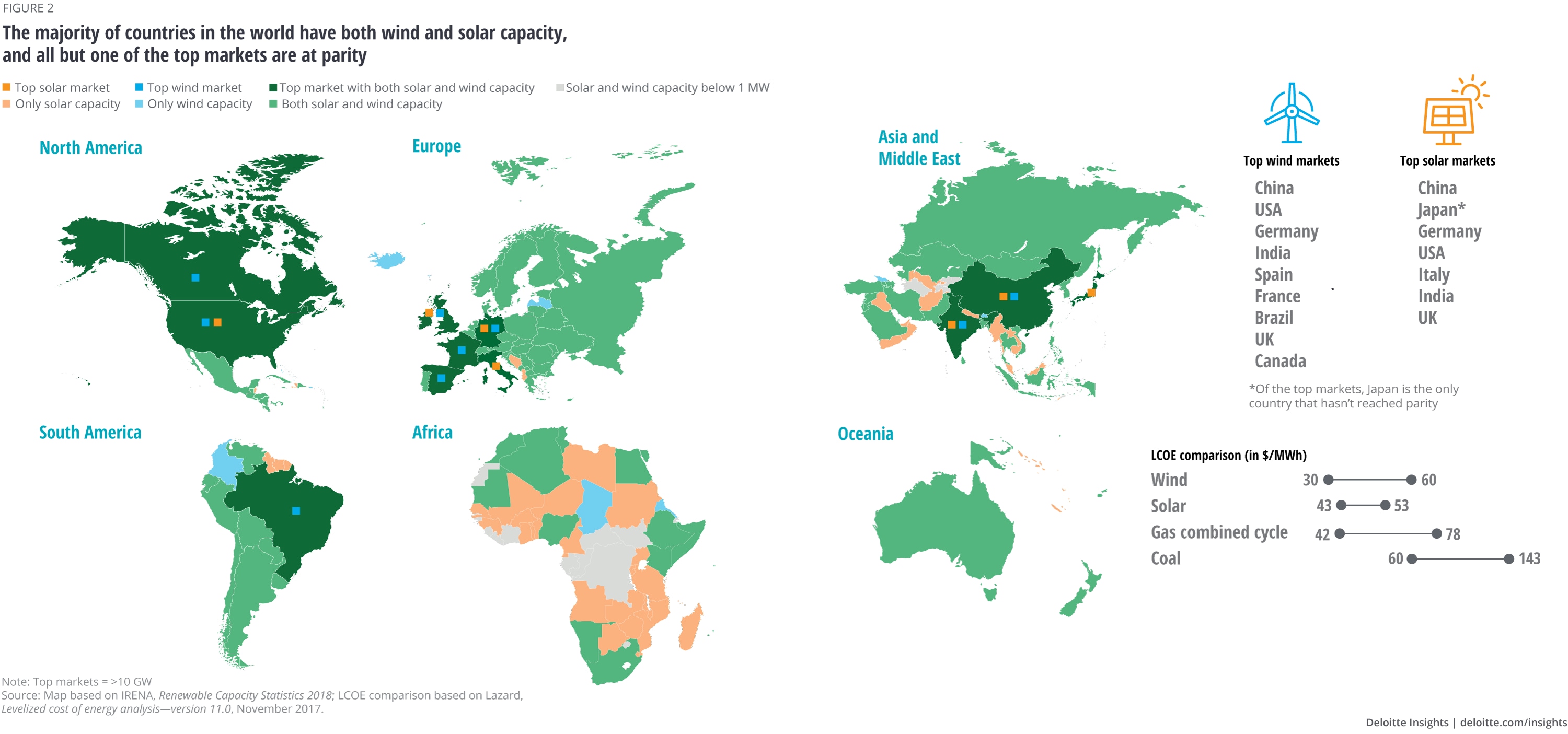

The merger raises significant concerns about market dominance. With Broadcom controlling both VMware and its existing portfolio of networking and infrastructure solutions, the potential for anti-competitive behavior becomes a significant issue. This could lead to less choice, innovation, and ultimately, higher prices for consumers.

- Broadcom's official statements: Broadcom's official statements regarding pricing have been limited, focusing instead on the strategic benefits of the acquisition. This lack of clarity fuels concerns among customers and competitors.

- Potential antitrust concerns: Regulatory bodies like the FTC and the EU are likely to scrutinize the merger closely for potential antitrust violations. The 1050% price increase reported by AT&T will certainly fuel these investigations.

- Industry analyst quotes: [Insert quotes from relevant industry analysts here, citing their sources.]

Impact on Businesses and Consumers

The Broadcom VMware price increase will have far-reaching implications for businesses and consumers alike.

Increased IT Costs for Businesses:

Businesses of all sizes, from small startups to large enterprises, will likely experience significantly increased IT costs. This could impact budget allocation, forcing companies to re-evaluate their IT spending and potentially delay or cancel other projects. Smaller businesses may be particularly vulnerable, facing a disproportionate burden.

Potential for Service Price Increases:

Many businesses will likely pass these increased costs onto consumers, leading to higher prices for goods and services. This effect could ripple throughout various industry sectors, impacting consumers across the board.

- Impacts on various industry sectors: The impact will vary across sectors, but industries heavily reliant on VMware virtualization will be most affected.

- Switching to alternative solutions: Businesses may start exploring alternative virtualization solutions like Citrix, Microsoft Hyper-V, or open-source options like Proxmox. This transition, however, can be costly and time-consuming.

- Long-term implications: The long-term impact will depend on the regulatory response, the success of alternative virtualization technologies, and the overall market dynamics.

Regulatory Scrutiny and Future Outlook

The significant price increase reported by AT&T has increased the likelihood of regulatory intervention and will undoubtedly shape the future outlook of VMware pricing.

Antitrust Investigations and Regulatory Response:

Regulatory bodies around the world are likely to launch thorough investigations into the potential anti-competitive implications of the merger and the subsequent price increases. The 1050% jump is a significant red flag that will necessitate a detailed examination.

Predictions for VMware Pricing in the Future:

Predicting future VMware pricing under Broadcom's ownership is challenging, but based on the AT&T case, substantial increases seem likely. The extent of these increases will depend on regulatory pressure and market competition.

- Ongoing investigations: [Mention any ongoing investigations by the FTC, EU, or other relevant regulatory bodies.]

- Expert opinions: [Summarize expert opinions on the future price outlook, citing their sources.]

- Potential legal challenges: The acquisition might face legal challenges, potentially leading to changes in pricing strategies or even blocking the deal entirely.

Conclusion

AT&T's reported 1050% VMware price increase following Broadcom's acquisition serves as a stark warning of the potential financial consequences for businesses. The lack of transparency, the potential for increased market dominance, and the ensuing regulatory scrutiny raise significant concerns. Understanding the potential cost implications of this merger is crucial for strategic planning and budget allocation. Businesses should proactively assess their reliance on VMware products and consider alternative solutions to mitigate potential financial risks. Further research into alternative virtualization solutions may also be necessary. Stay informed about the ongoing developments surrounding the Broadcom-VMware acquisition and its impact on VMware pricing. Follow this blog for updates on the Broadcom VMware price increase and its implications for your business.

Featured Posts

-

Investment Opportunities Mapping The Countrys Business Hotspots

Apr 28, 2025

Investment Opportunities Mapping The Countrys Business Hotspots

Apr 28, 2025 -

Frieds Yankee Debut A Success As Offense Explodes Against Pirates

Apr 28, 2025

Frieds Yankee Debut A Success As Offense Explodes Against Pirates

Apr 28, 2025 -

Millions Lost Inside The Office 365 Executive Inbox Hacking Scheme

Apr 28, 2025

Millions Lost Inside The Office 365 Executive Inbox Hacking Scheme

Apr 28, 2025 -

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025 -

Hollywood Production At A Halt The Combined Writers And Actors Strike

Apr 28, 2025

Hollywood Production At A Halt The Combined Writers And Actors Strike

Apr 28, 2025

Latest Posts

-

Series Saving Win For Yankees Thanks To Judge And Goldschmidt

Apr 28, 2025

Series Saving Win For Yankees Thanks To Judge And Goldschmidt

Apr 28, 2025 -

Yankees Win Judge And Goldschmidts Impact On The Series

Apr 28, 2025

Yankees Win Judge And Goldschmidts Impact On The Series

Apr 28, 2025 -

Aaron Judge Paul Goldschmidt Crucial To Yankees Hard Fought Win

Apr 28, 2025

Aaron Judge Paul Goldschmidt Crucial To Yankees Hard Fought Win

Apr 28, 2025 -

Key Contributions From Judge And Goldschmidt Prevent Yankees Series Loss

Apr 28, 2025

Key Contributions From Judge And Goldschmidt Prevent Yankees Series Loss

Apr 28, 2025 -

Judge And Goldschmidts Performances Secure A Win For The Yankees

Apr 28, 2025

Judge And Goldschmidts Performances Secure A Win For The Yankees

Apr 28, 2025