Dax Performance: Analyzing The Impact Of Bundestag Elections And Business Data

Table of Contents

The Impact of Bundestag Elections on DAX Performance

Bundestag elections introduce considerable uncertainty into the German economy, directly affecting DAX performance. This impact manifests in two key phases: pre-election volatility and post-election market reactions.

Pre-Election Volatility

The period leading up to a Bundestag election is often characterized by increased volatility in the DAX. Investor sentiment fluctuates dramatically based on pre-election polls, the tone of political debates, and the perceived economic platforms of the competing parties. This uncertainty can lead to significant market swings, as investors adjust their portfolios based on their expectations of the future government's policies.

- Pre-election polls: Closely contested races with unpredictable outcomes can amplify volatility.

- Policy proposals: Announcements of potentially disruptive economic policies (e.g., tax increases, significant regulatory changes) can trigger market reactions.

- Coalition talks: The formation of a coalition government after the election can be a prolonged and uncertain process, further impacting DAX performance.

For example, the lead-up to the 2017 Bundestag election saw significant DAX fluctuations due to concerns about the potential rise of populist parties and their economic policies.

Post-Election Market Reactions

The DAX's reaction to election results is highly dependent on the winning party or coalition and their stated economic agendas. A clear mandate for a fiscally conservative government might lead to increased investor confidence and sustained DAX growth. Conversely, a victory for a party proposing significant economic restructuring could cause short-term corrections or volatility as investors assess the potential implications.

- Fiscal policy: A government committed to fiscal austerity might initially negatively impact the DAX, while expansionary fiscal policies could boost it.

- Regulatory changes: Changes to environmental regulations or labor laws can affect specific sectors, impacting their component stocks within the DAX.

- Foreign policy: A government’s stance on international trade and relations can influence the overall global economic climate and, subsequently, DAX performance.

The 2005 election, which saw Angela Merkel's CDU/CSU assume power, resulted in a period of relative stability and growth for the DAX, reflecting investor confidence in her government's economic policies.

The Role of Business Data in Shaping DAX Performance

Beyond political factors, DAX performance is heavily influenced by a range of business data and economic indicators. Understanding these indicators is vital for predicting DAX movements.

Key Economic Indicators

Several key economic indicators significantly influence the DAX. Positive data releases generally boost investor confidence, leading to increased trading activity and higher stock prices. Conversely, negative data can trigger sell-offs and DAX declines.

- GDP Growth: Strong GDP growth indicates a healthy economy, positively impacting the DAX.

- Inflation: Moderate inflation is generally positive; high inflation can erode purchasing power and negatively affect the DAX.

- Unemployment Rate: Low unemployment signifies a strong labor market, bolstering investor confidence and the DAX.

For instance, strong GDP growth figures released in 2018 contributed to a period of positive DAX performance.

Corporate Earnings and Company Performance

The performance of individual DAX companies and their earnings reports directly affect the index's overall performance. Strong earnings generally lead to higher stock prices, while weak earnings can trigger declines.

- Company-specific news: Positive news regarding a major DAX component can boost the overall index.

- Sector performance: Strong performance in specific sectors (e.g., automotive, technology) positively impacts the DAX.

- Earnings surprises: Unexpectedly strong or weak earnings can cause significant short-term volatility.

The strong performance of automotive giants like Volkswagen and BMW often significantly influences the DAX.

Interplay Between Political Landscape and Business Data

The impact of political developments and business data on DAX performance is not independent; they are intricately intertwined.

Government Policies and Business Confidence

Government policies significantly affect business confidence, which, in turn, influences DAX performance. Fiscal stimulus measures, for example, can boost economic activity and investor sentiment, positively impacting the DAX. Conversely, restrictive fiscal policies might dampen growth and negatively affect the index.

- Tax reforms: Tax cuts can stimulate business investment and boost the DAX; tax increases can have the opposite effect.

- Regulatory environment: A stable and predictable regulatory environment fosters business investment and positively affects DAX performance.

- Infrastructure spending: Government investment in infrastructure projects can stimulate economic growth and support the DAX.

Germany's substantial investment in renewable energy has positively influenced related sectors and, to some extent, the overall DAX.

Global Economic Factors and their Influence

The German economy is deeply integrated into the global marketplace. Global economic events—such as international trade disputes, global recessions, or geopolitical instability—can significantly impact DAX performance, often interacting with domestic business data and political developments.

- Global trade wars: Trade disputes can disrupt supply chains and negatively affect export-oriented German companies, impacting the DAX.

- Global recessions: Global economic downturns usually negatively impact the German economy and the DAX.

- Geopolitical risks: Political instability in key trading partners or regions can create uncertainty and negatively affect investor sentiment and the DAX.

The 2008 global financial crisis significantly impacted the DAX, highlighting the interconnectedness of the German and global economies.

Conclusion: Understanding DAX Performance for Informed Investment Decisions

DAX performance is shaped by a complex interplay of Bundestag elections, business data, and broader global economic factors. Analyzing both political and economic indicators is crucial for predicting DAX movements and making informed investment decisions. Investors need to adopt a holistic approach, considering a wide range of factors—from pre-election uncertainty to key economic data releases and global events—to develop effective investment strategies. Stay informed on DAX performance by regularly reviewing relevant economic data and political developments to navigate this dynamic market successfully.

Featured Posts

-

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025

Juliette Binoche To Lead Cannes Film Festival Jury

Apr 27, 2025 -

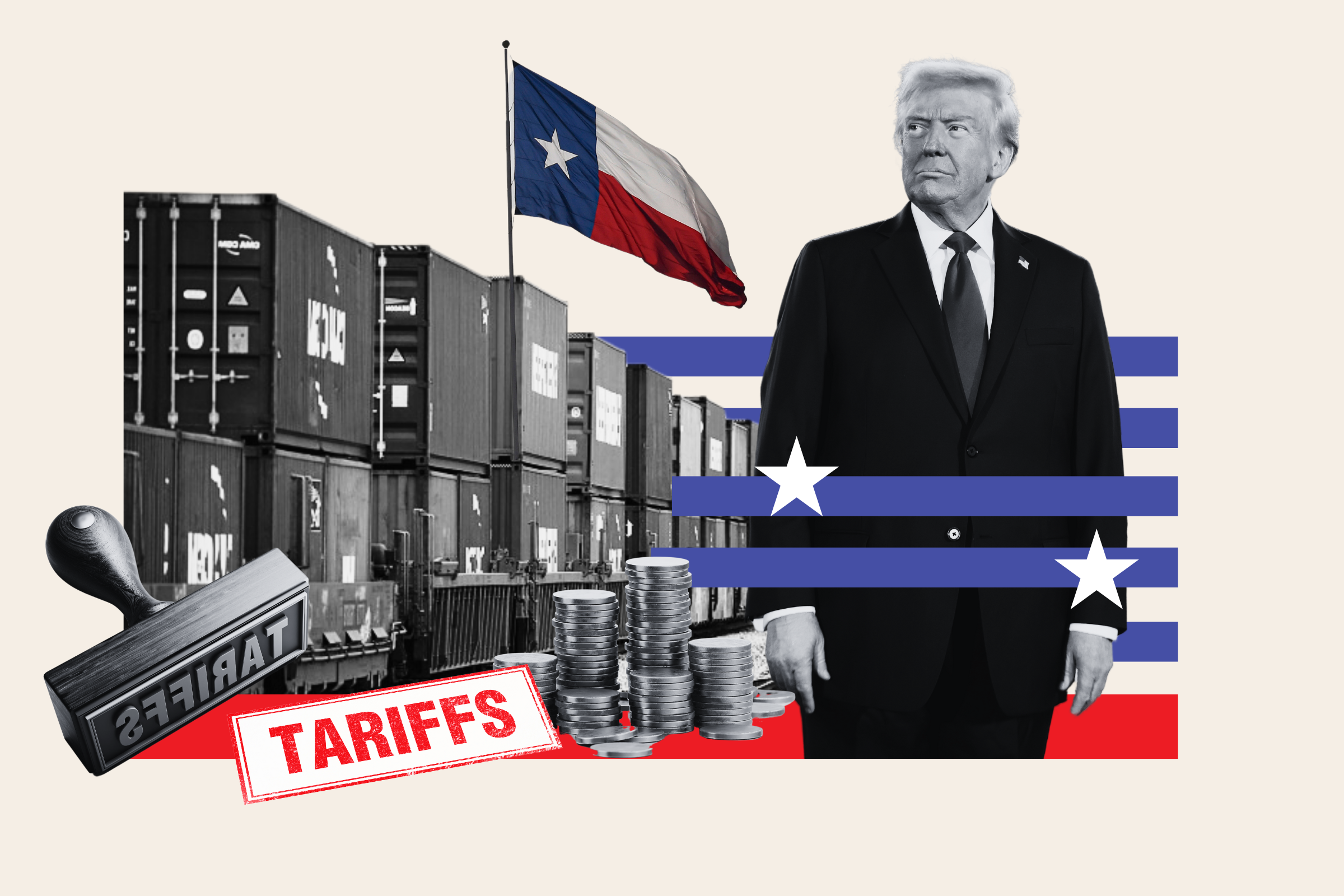

Trumps Tariff Threat Inevitable Job Cuts In Canadas Auto Industry

Apr 27, 2025

Trumps Tariff Threat Inevitable Job Cuts In Canadas Auto Industry

Apr 27, 2025 -

Jannik Sinners Doping Case Concludes

Apr 27, 2025

Jannik Sinners Doping Case Concludes

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas Ist Da

Apr 27, 2025 -

Deloitte Predicts Considerable Slowdown In Us Economic Growth

Apr 27, 2025

Deloitte Predicts Considerable Slowdown In Us Economic Growth

Apr 27, 2025

Latest Posts

-

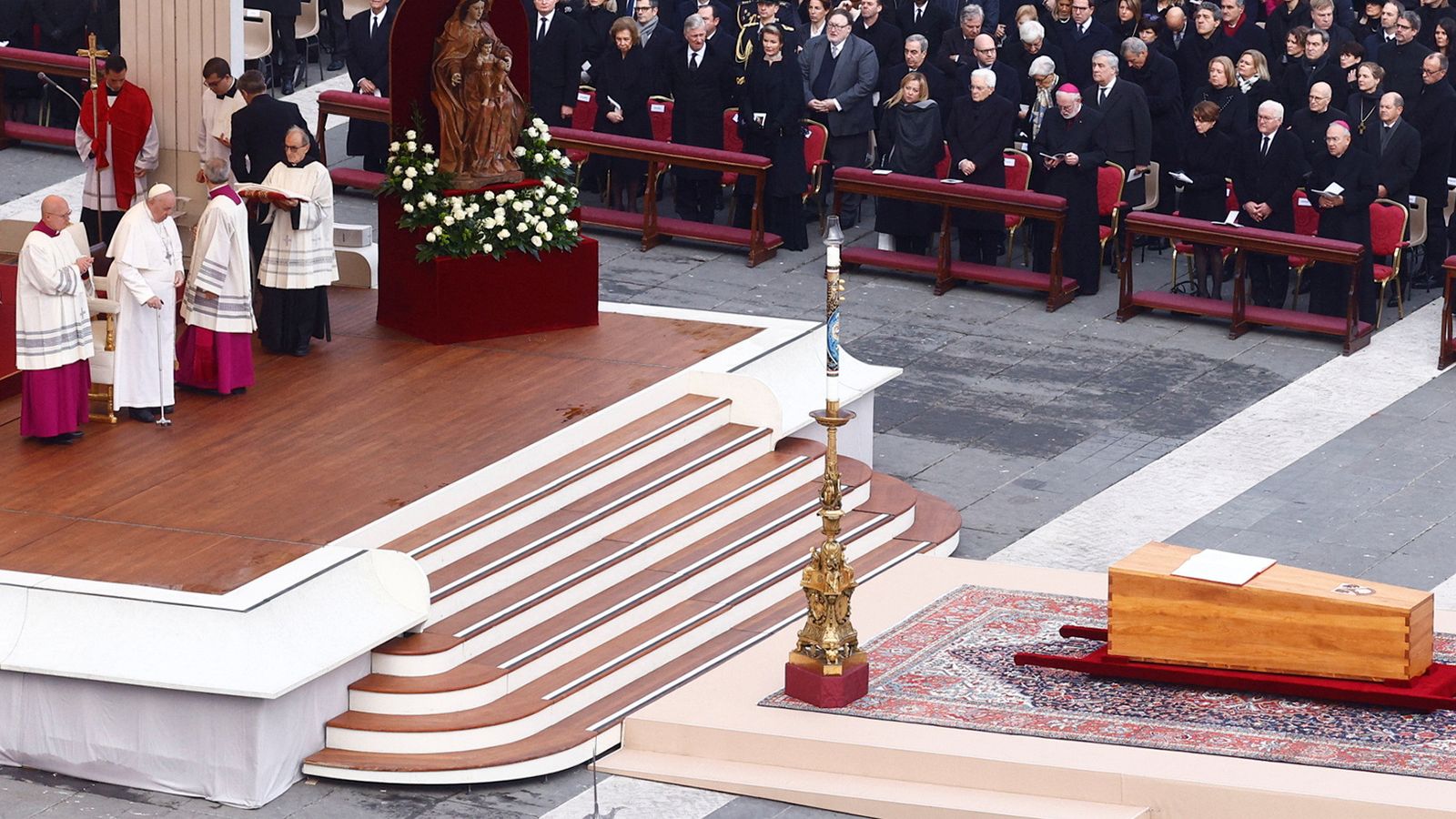

Trump And The Vatican Analyzing His Appearance At Pope Benedicts Funeral

Apr 27, 2025

Trump And The Vatican Analyzing His Appearance At Pope Benedicts Funeral

Apr 27, 2025 -

Politics And Religion Collide Trumps Role At Pope Benedict Xvis Funeral

Apr 27, 2025

Politics And Religion Collide Trumps Role At Pope Benedict Xvis Funeral

Apr 27, 2025 -

Trumps Presence At Pope Benedicts Funeral Politics And Papal Rites Intertwined

Apr 27, 2025

Trumps Presence At Pope Benedicts Funeral Politics And Papal Rites Intertwined

Apr 27, 2025 -

Trump At Pope Benedicts Funeral A Collision Of Politics And Ritual

Apr 27, 2025

Trump At Pope Benedicts Funeral A Collision Of Politics And Ritual

Apr 27, 2025 -

Analysis Teslas Price Adjustments And Pre Tariff Inventory In Canada

Apr 27, 2025

Analysis Teslas Price Adjustments And Pre Tariff Inventory In Canada

Apr 27, 2025