New X Financials: Debt Sale Impacts And Company Restructuring

Table of Contents

Understanding the Debt Sale

New X Financials' debt sale involved the issuance of [Specify amount] in [Type of debt, e.g., senior unsecured notes] to [Specify buyer(s), e.g., a consortium of institutional investors]. This significant debt restructuring move addresses the company's current financial distress and aims to optimize its capital structure. The primary reasons behind this sale include:

- Reducing the Debt Burden: The sale significantly lowers New X Financials' overall debt levels, alleviating the pressure of high-interest payments and improving its debt-to-equity ratio.

- Improving Liquidity: The influx of cash from the debt sale enhances the company's short-term liquidity, providing a buffer against unexpected expenses and operational challenges.

- Refinancing High-Interest Debt: The sale allows New X Financials to replace existing high-cost debt with lower-cost financing, thus reducing its overall interest expense.

Impact on Creditworthiness

The impact of this debt sale on New X Financials' credit rating remains to be seen. Credit rating agencies will carefully analyze the company's improved financial position, considering factors like its debt-to-equity ratio, interest coverage ratio, and overall financial health. A successful restructuring could lead to an upgrade in the credit rating, resulting in lower borrowing costs in the future. Conversely, if the restructuring doesn't meet expectations, a downgrade is possible, potentially increasing future borrowing costs and limiting access to capital.

Short-Term Financial Relief

The immediate impact of the debt sale is a significant improvement in New X Financials' short-term financial outlook. The influx of capital provides immediate relief from pressing debt obligations, enabling the company to focus on operational improvements and strategic initiatives without the constant pressure of looming debt payments. This short-term financial relief is crucial for stabilizing the company and paving the way for long-term recovery.

Company Restructuring Strategies

The debt sale is just one component of a broader company restructuring strategy aimed at improving operational efficiency, reducing costs, and optimizing asset utilization. New X Financials' restructuring plan encompasses various strategic initiatives, including:

- Layoffs or Workforce Reduction: This painful but necessary measure aims to reduce labor costs and streamline operations.

- Divestment of Non-Core Assets: Selling non-essential assets can generate cash and improve the company's overall financial health.

- Reorganization of Business Units: Restructuring business units can enhance efficiency and focus resources on profitable areas.

- Negotiation with Creditors: New X Financials may be negotiating with creditors to amend existing loan agreements, potentially reducing repayment obligations or extending repayment schedules.

Operational Efficiency Improvements

The restructuring plan is designed to significantly enhance operational efficiency. By streamlining processes, eliminating redundancies, and improving productivity, New X Financials aims to reduce operating costs and increase profitability. This includes implementing new technologies, improving supply chain management, and optimizing resource allocation.

Long-Term Financial Stability

The success of New X Financials' restructuring will depend on its ability to achieve long-term financial stability. The goal is to create a leaner, more efficient, and profitable organization capable of generating sustainable cash flow and weathering future economic challenges. This requires careful execution of the restructuring plan and ongoing monitoring of key financial metrics.

Potential Risks and Challenges

While the debt sale and restructuring offer potential benefits, several risks and challenges remain. These include:

- Negative Impact on Employee Morale: Layoffs and other restructuring measures can negatively impact employee morale and productivity.

- Disruption to Customer Relationships: Restructuring efforts may disrupt customer relationships, particularly if service levels are affected.

- Difficulties in Attracting New Investments: Investors may be hesitant to invest in a company undergoing significant restructuring.

- Unforeseen Legal or Regulatory Hurdles: Unexpected legal or regulatory issues could complicate the restructuring process.

Managing Stakeholder Relations

Effective communication and transparency are crucial for managing stakeholder relations during the restructuring process. New X Financials must keep employees, investors, and other stakeholders informed about the progress of the restructuring and address their concerns openly and honestly.

Mitigating Risks

To minimize potential risks, New X Financials should develop and implement a comprehensive risk mitigation strategy. This strategy should include proactive communication, careful planning, and contingency plans to address unforeseen challenges.

Conclusion

The debt sale represents a significant step in New X Financials' company restructuring efforts. While the sale provides short-term financial relief and improves liquidity, the long-term success hinges on the successful implementation of the broader restructuring plan. Both positive aspects, such as improved operational efficiency and reduced debt burden, and potential negative impacts, including employee morale and customer relationship disruptions, need careful management. Achieving long-term financial stability will require diligent execution, transparent communication, and effective risk mitigation.

Call to Action: Stay informed on the developments at New X Financials and the ongoing restructuring efforts. Follow our blog for future updates on New X Financials' debt sale and company restructuring progress. Learn more about [Link to related resource/further analysis]. Understanding the intricacies of New X Financials' financial maneuvers is crucial for navigating the complexities of the current market.

Featured Posts

-

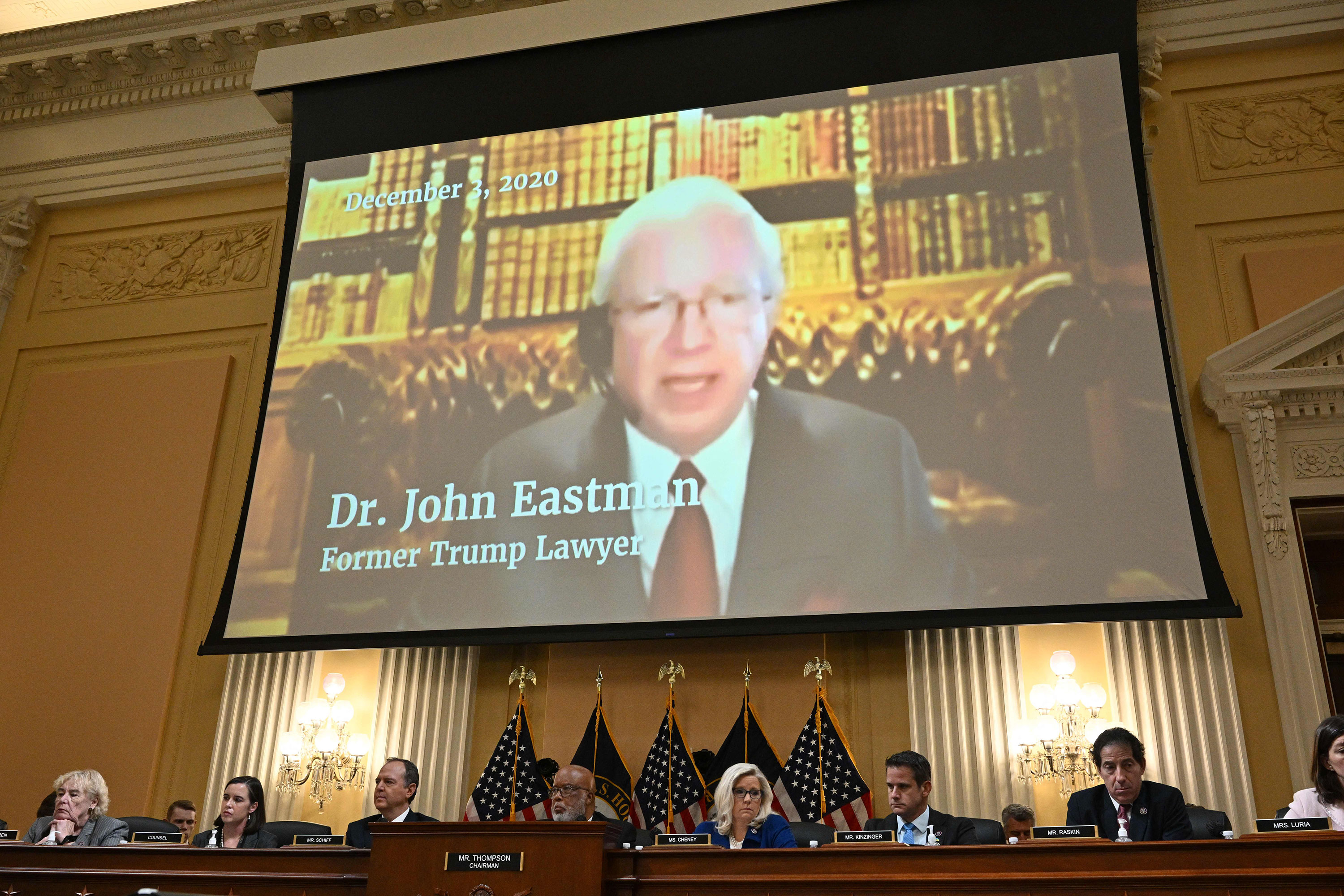

Jan 6 Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 29, 2025

Jan 6 Hearing Star Cassidy Hutchinson To Publish Memoir

Apr 29, 2025 -

Alan Cumming A Look Back At His Favorite Childhood Activity In Scotland

Apr 29, 2025

Alan Cumming A Look Back At His Favorite Childhood Activity In Scotland

Apr 29, 2025 -

Understanding Ais Thought Processes A Surprisingly Simple Explanation

Apr 29, 2025

Understanding Ais Thought Processes A Surprisingly Simple Explanation

Apr 29, 2025 -

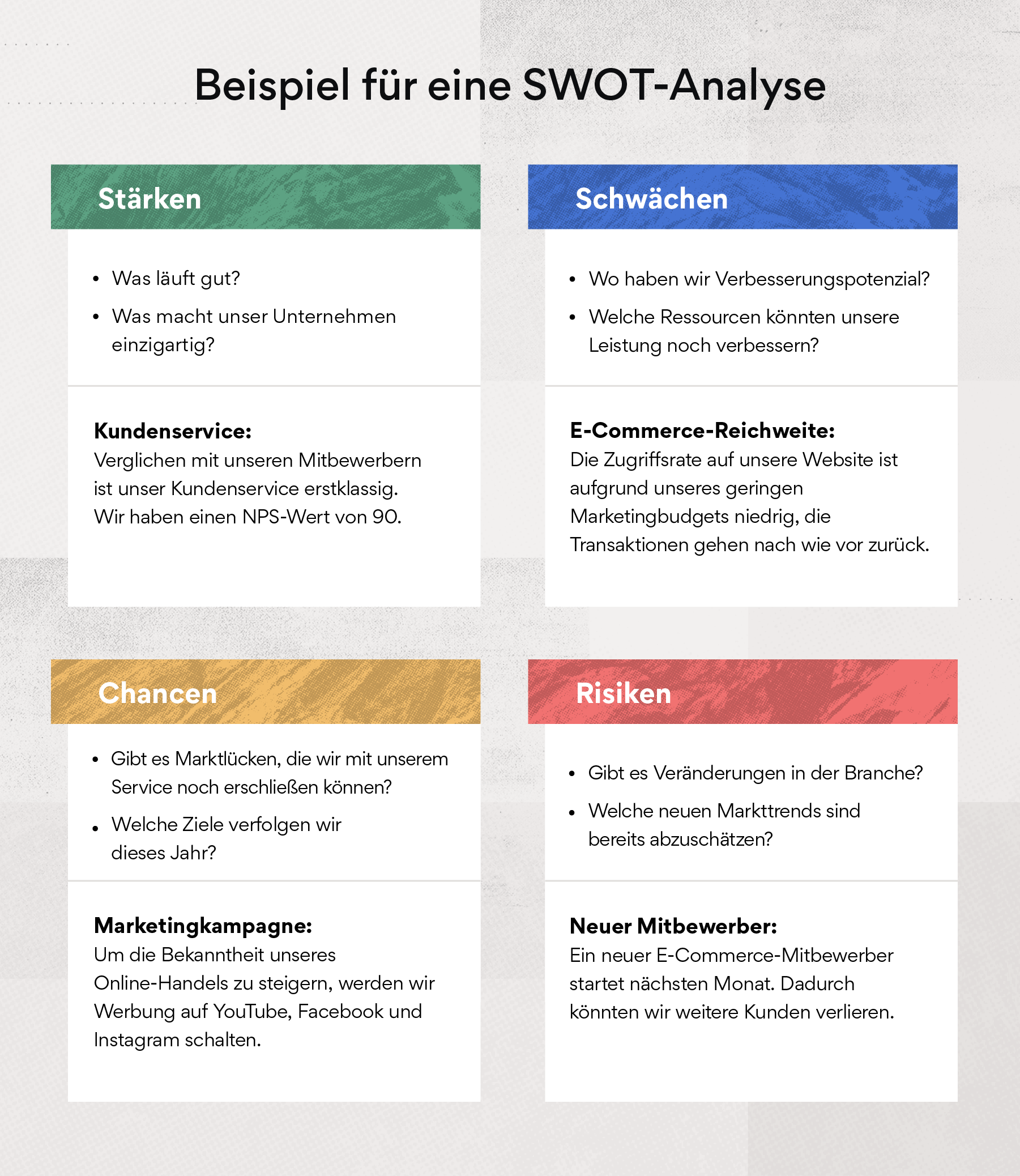

Analyse Deutsche Teams Im Champions League Vergleich

Apr 29, 2025

Analyse Deutsche Teams Im Champions League Vergleich

Apr 29, 2025 -

Market Crash Seven Stocks Lose 2 5 Trillion This Year

Apr 29, 2025

Market Crash Seven Stocks Lose 2 5 Trillion This Year

Apr 29, 2025

Latest Posts

-

Going For Goldblum London Fans Flock To See Jurassic Park Star

Apr 29, 2025

Going For Goldblum London Fans Flock To See Jurassic Park Star

Apr 29, 2025 -

Pw Cs Withdrawal From Nine Sub Saharan African Countries Implications And Analysis

Apr 29, 2025

Pw Cs Withdrawal From Nine Sub Saharan African Countries Implications And Analysis

Apr 29, 2025 -

Parita Sul Posto Di Lavoro Una Battaglia Ancora Da Combattere

Apr 29, 2025

Parita Sul Posto Di Lavoro Una Battaglia Ancora Da Combattere

Apr 29, 2025 -

Verso La Parita Sul Lavoro Analisi Della Situazione Attuale E Prospettive Di Miglioramento

Apr 29, 2025

Verso La Parita Sul Lavoro Analisi Della Situazione Attuale E Prospettive Di Miglioramento

Apr 29, 2025 -

Lavoro E Parita Progressi Lenti Ma Costanti

Apr 29, 2025

Lavoro E Parita Progressi Lenti Ma Costanti

Apr 29, 2025