PwC's Withdrawal From Nine Sub-Saharan African Countries: Implications And Analysis

Table of Contents

The Scope of PwC's Withdrawal: Which Countries are Affected?

PwC's decision impacts nine Sub-Saharan African countries: Angola, Burundi, Cameroon, Central African Republic, Chad, Democratic Republic of Congo, Gabon, Republic of the Congo, and Equatorial Guinea. These countries represent a diverse range of economies and levels of development within the region. Before the withdrawal, PwC held significant market share in these countries, offering a broad spectrum of services including auditing, tax advisory, consulting, and assurance services. The specific reasons cited by PwC for the withdrawal haven't been publicly detailed, fueling speculation about the underlying factors. A map visualizing these affected countries would provide a clearer picture of the geographical scope of this significant development. [Insert map here]. The lack of transparency around the precise reasoning behind the decision adds another layer of complexity to the analysis.

Economic Implications for Affected Countries

The withdrawal of a major player like PwC will undoubtedly have cascading economic implications for the affected nations.

Impact on the Audit and Accounting Sector

The immediate impact is felt within the audit and accounting sector. The departure of PwC creates a substantial gap in expertise and capacity.

- Increased workload for remaining firms: Existing firms will face a significant increase in workload, potentially impacting service quality and delivery timelines.

- Potential rise in audit fees: Reduced competition could lead to a rise in audit fees, increasing costs for businesses.

- Potential skill shortages: PwC's withdrawal might create skill shortages, as its departure takes with it a significant pool of trained professionals. This poses a long-term challenge for the development of the accounting sector.

Impact on Foreign Investment

Investor confidence is a fragile asset, and PwC's withdrawal could negatively impact foreign direct investment (FDI).

- Potential decrease in FDI: The perception of increased risk associated with the withdrawal might deter potential foreign investors.

- Challenges for attracting new investors: The departure of a globally recognized firm might signal a less stable or less attractive business environment to international investors.

- Impact on business growth: Reduced FDI can hinder the growth of businesses within these affected countries, limiting their expansion potential.

Impact on Government Revenue and Regulation

PwC played a significant role in advising governments on tax compliance and regulatory frameworks. Its departure could present challenges for several countries:

- Challenges in tax collection: The withdrawal might create difficulties in effective tax collection, potentially impacting government revenues.

- Potential need for increased government capacity building: Governments may need to invest in capacity building initiatives to fill the void left by PwC's expertise.

- Impacts on regulatory frameworks: PwC’s departure could cause a temporary disruption to the regulatory frameworks it helped to establish and maintain.

Potential Reasons Behind PwC's Decision

PwC's decision is likely a result of a complex interplay of factors. While the firm hasn't publicly detailed its reasons, several potential explanations warrant consideration:

- Reduced profitability in specific markets: Some markets might have become less profitable due to various economic or political factors.

- Increased regulatory scrutiny: Increased regulatory requirements and compliance costs could have played a role.

- Security concerns: Security risks and political instability in certain regions might have made operations unsustainable.

- Changing business environment: The changing global landscape and increased competition in the professional services industry likely influenced the strategic decision.

Future Outlook and Alternatives for Sub-Saharan Africa

The withdrawal presents both challenges and opportunities. Other global accounting firms are likely to explore expansion opportunities in these markets. Moreover, local firms have the potential to grow and expand their service offerings.

- Opportunities for local firm growth: Local firms can capitalize on the increased demand for auditing and consulting services.

- Need for international collaboration: International collaboration and knowledge-sharing initiatives will be vital to bridge the skill gap.

- Importance of skills development: Investing in skills development programs for local professionals is crucial for strengthening the region's accounting capacity.

- Long-term implications for business environment: The long-term implications for the business environment will depend heavily on how effectively the affected countries adapt and respond to the changed landscape.

Conclusion

PwC's withdrawal from nine Sub-Saharan African countries carries significant economic, regulatory, and business consequences. The implications extend beyond the immediate loss of a major professional services firm; they impact investor confidence, government revenue, and the development of local accounting capacity. Understanding the ramifications of PwC's withdrawal from Sub-Saharan Africa is crucial for policymakers, businesses, and investors alike. Further analysis of PwC’s Sub-Saharan Africa strategy is needed to fully understand the intricacies of this decision and its potential long-term impact on the region. What are the longer-term implications of PwC’s departure from Sub-Saharan Africa? This necessitates further research and discussion to inform effective responses and mitigate potential negative consequences.

Featured Posts

-

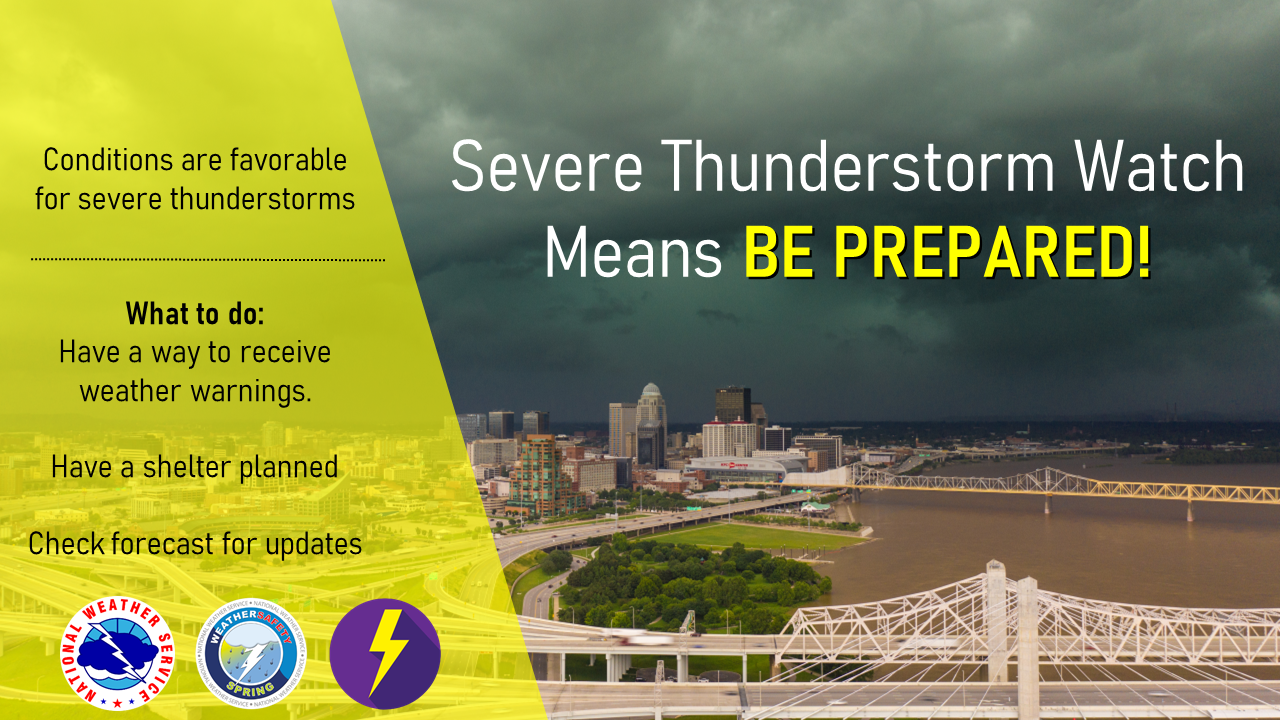

Kentucky Severe Weather Awareness Week Nws Preparedness

Apr 29, 2025

Kentucky Severe Weather Awareness Week Nws Preparedness

Apr 29, 2025 -

Heckling Incident At Cleveland Leads To Fan Ejection After Jarren Duran Reveals Past Suicide Attempt

Apr 29, 2025

Heckling Incident At Cleveland Leads To Fan Ejection After Jarren Duran Reveals Past Suicide Attempt

Apr 29, 2025 -

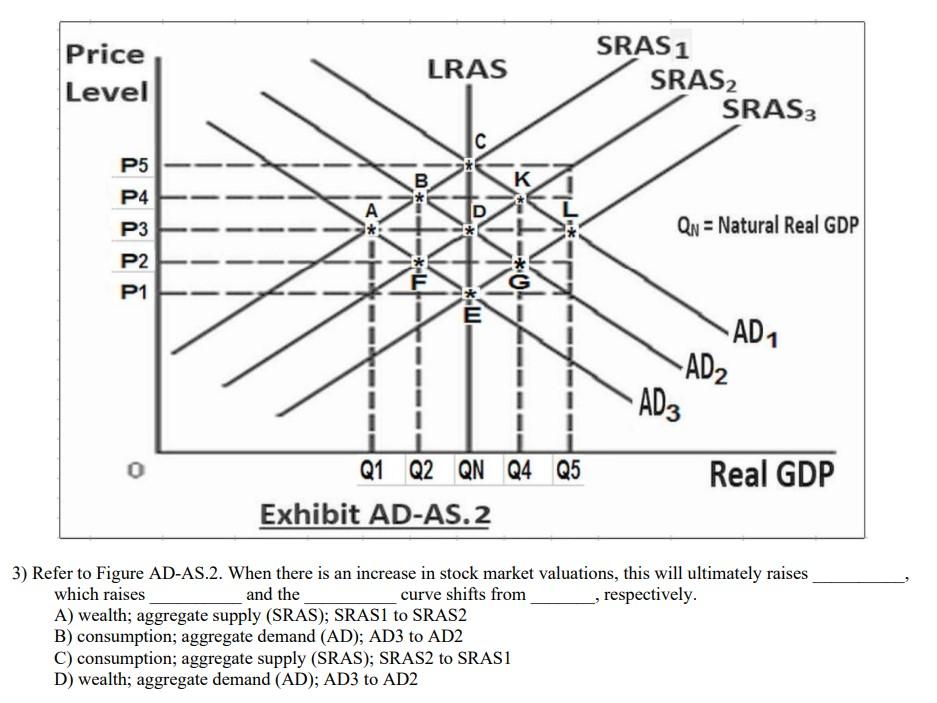

Stock Market Valuations Bof As Reassuring View For Investors

Apr 29, 2025

Stock Market Valuations Bof As Reassuring View For Investors

Apr 29, 2025 -

Alberto Ardila Olivares Estrategia Para El Gol

Apr 29, 2025

Alberto Ardila Olivares Estrategia Para El Gol

Apr 29, 2025 -

Louisvilles Early 2025 Disasters Snow Tornadoes And Catastrophic Flooding

Apr 29, 2025

Louisvilles Early 2025 Disasters Snow Tornadoes And Catastrophic Flooding

Apr 29, 2025

Latest Posts

-

Adult Adhd From Suspicion To Support And Management

Apr 29, 2025

Adult Adhd From Suspicion To Support And Management

Apr 29, 2025 -

Understanding Adult Adhd Diagnosis Treatment And Support

Apr 29, 2025

Understanding Adult Adhd Diagnosis Treatment And Support

Apr 29, 2025 -

Adult Adhd Understanding Your Options After A Potential Diagnosis

Apr 29, 2025

Adult Adhd Understanding Your Options After A Potential Diagnosis

Apr 29, 2025 -

Coping With A Potential Adult Adhd Diagnosis

Apr 29, 2025

Coping With A Potential Adult Adhd Diagnosis

Apr 29, 2025 -

Navigating A Suspected Adult Adhd Diagnosis

Apr 29, 2025

Navigating A Suspected Adult Adhd Diagnosis

Apr 29, 2025