May 16 Oil Market Report: News And Price Analysis

Table of Contents

Global Supply and Demand Dynamics

The current state of global oil supply and demand is a crucial factor driving oil price analysis. OPEC+ production decisions continue to play a significant role, with their quotas and adherence levels heavily influencing the available supply of crude oil. Geopolitical events, such as sanctions and conflicts, create significant uncertainty and can disrupt established supply chains, leading to oil price volatility. Simultaneously, global energy consumption patterns are shifting, influenced by economic growth forecasts and the ongoing transition towards renewable energy sources. This interplay of supply and demand creates a dynamic and often unpredictable environment for oil prices.

- Analysis of OPEC+ production quotas and adherence: Recent data shows [insert data on OPEC+ production and adherence]. Any deviation from the agreed-upon quotas can significantly impact global oil supply and subsequently affect the price of crude oil.

- Impact of sanctions and geopolitical instability on oil production: The ongoing conflict in Ukraine has significantly disrupted global oil supply chains, particularly impacting Russian oil exports. Sanctions imposed on Russia have further constricted the flow of crude oil into the global market, creating upward pressure on prices.

- Assessment of global oil demand growth, factoring in economic growth forecasts: Global economic growth forecasts remain a key driver of oil demand. [Insert relevant economic data and forecasts]. Stronger economic growth typically leads to increased energy consumption, including higher oil demand.

- Discussion of potential supply disruptions and their impact on prices: Several potential supply disruptions exist, including [mention specific examples, e.g., potential political instability in a major oil-producing region]. Any unexpected disruption can lead to sharp increases in oil prices.

Impact of Geopolitical Events

Geopolitical risk is a major contributor to oil price volatility. The ongoing Russia-Ukraine conflict remains a primary driver of uncertainty in the energy market. Sanctions imposed on Russia have directly affected its oil exports, creating a supply deficit and pushing up prices. Tensions in other oil-producing regions, such as the Middle East, further contribute to market instability. Any escalation of these conflicts can trigger significant price swings. Analyzing these geopolitical factors is critical for accurate oil price prediction.

- Detailed analysis of the ongoing Russia-Ukraine conflict and its continuing influence on the market: The war continues to disrupt supply chains and create uncertainty in the market, leading to sustained price increases. [Include specific data on Russian oil exports and their impact].

- Assessment of the impact of sanctions on Russian oil exports and global supply: Sanctions have reduced Russian oil exports, but the impact is complex and depends on the effectiveness of sanctions and the ability of other producers to compensate for the shortfall.

- Discussion of tensions in the Middle East and their potential effect on oil production: Any instability in the Middle East, a major oil-producing region, can have a significant impact on global oil supply and prices.

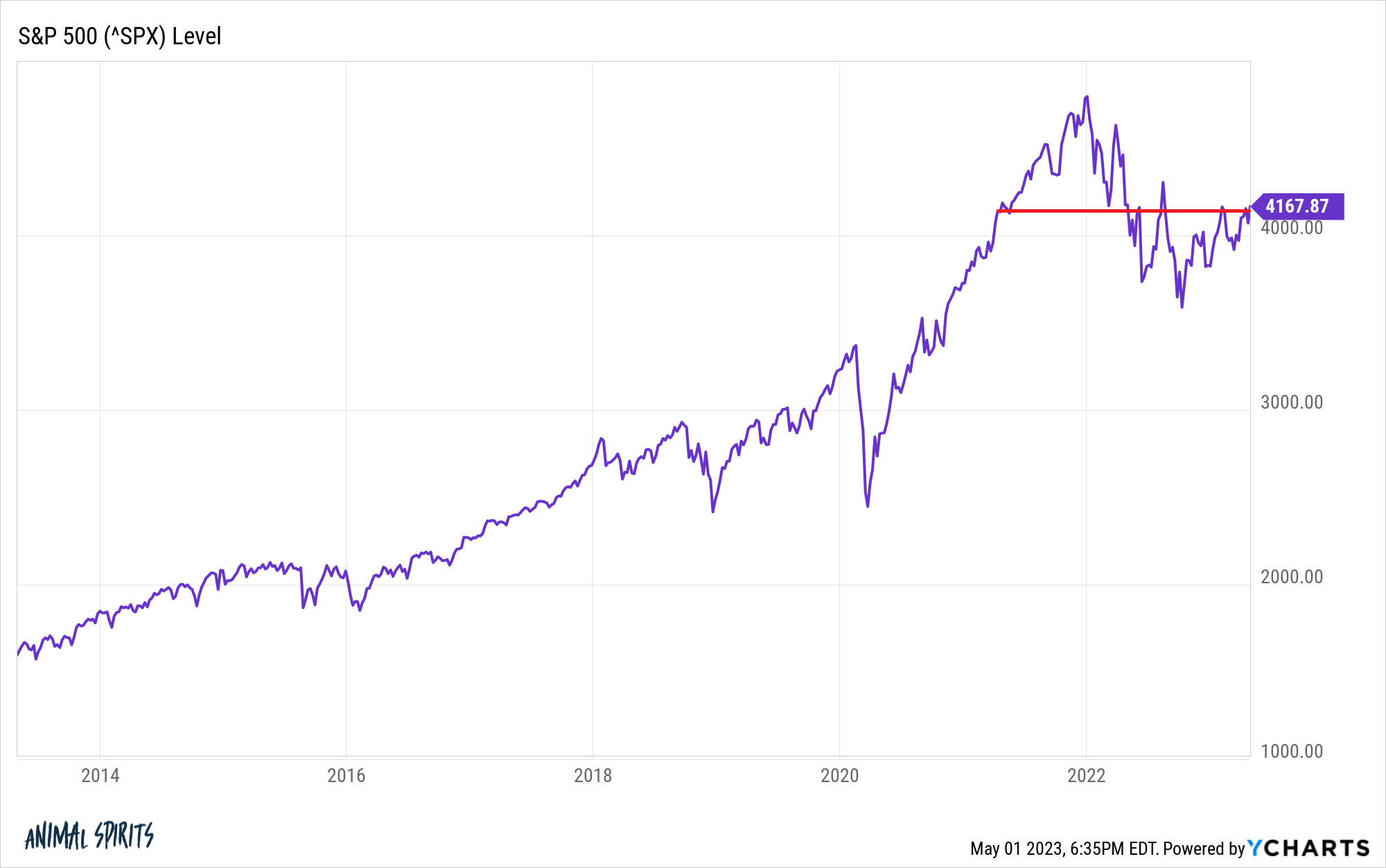

Price Analysis: WTI and Brent Crude

Understanding the current prices of WTI and Brent crude oil is essential for any oil price analysis. As of today, May 16th, WTI crude oil is trading at [insert current WTI price] and Brent crude oil is at [insert current Brent price]. Compared to [mention previous day's or week's prices], this represents a [percentage change]. This price movement is driven by a complex interplay of factors, including the supply and demand dynamics discussed above and overall market sentiment. Analyzing these trends is vital for making accurate oil price forecasts.

- Current WTI and Brent crude prices: [Insert precise current prices from a reliable source].

- Comparison with prices from previous trading sessions: Show a clear comparison, ideally with a chart or table illustrating the price changes over time.

- Analysis of price trends and potential future price movements: Based on current market conditions, [offer a cautious outlook on potential future price movements, avoiding definitive predictions].

- Discussion of factors influencing the price differential between WTI and Brent: The price difference between WTI and Brent crude is influenced by several factors, including supply and demand in specific regions, transportation costs, and quality differences.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior significantly influence oil futures trading and overall oil market outlook. Recent trading activity and volume [insert data on trading volume and activity] reveal [describe the overall sentiment – bullish, bearish, or neutral]. Investor confidence is currently [describe investor confidence level, backed by evidence]. Hedging strategies employed by market participants also play a crucial role in price movements. Understanding these elements is crucial for effective oil price prediction.

- Analysis of recent trading activity and volume: Include data on trading volumes and any significant shifts in trading patterns.

- Assessment of investor sentiment towards the oil market: Are investors bullish or bearish? What factors are driving their sentiment?

- Discussion of the influence of hedging strategies on price movements: How are hedging strategies affecting price stability or volatility?

- Overview of potential future market scenarios based on current sentiment: Based on the current market sentiment, what are the potential future scenarios for oil prices?

Conclusion

This May 16 oil market report has analyzed the key factors influencing crude oil prices, including global supply and demand, geopolitical events, and investor sentiment. The analysis of WTI and Brent crude oil prices highlights the dynamic and often volatile nature of the market. While predicting future oil prices with certainty remains challenging, understanding the current market dynamics is crucial for informed decision-making in oil trading and investment strategies. Stay informed with our regular oil market reports to navigate the complexities of the energy market. Check back tomorrow for our updated May 17 oil market report for continued oil price analysis.

Featured Posts

-

High Stock Market Valuations Bof As Reasons For Investor Calm

May 17, 2025

High Stock Market Valuations Bof As Reasons For Investor Calm

May 17, 2025 -

Josh Harts Historic Triple Double Shattering The Knicks Franchise Record

May 17, 2025

Josh Harts Historic Triple Double Shattering The Knicks Franchise Record

May 17, 2025 -

Competition For Rare Earth Minerals The Next Cold War Battlefield

May 17, 2025

Competition For Rare Earth Minerals The Next Cold War Battlefield

May 17, 2025 -

Overcoming Student Loan Debt To Buy Your Dream Home

May 17, 2025

Overcoming Student Loan Debt To Buy Your Dream Home

May 17, 2025 -

Japans Shrinking Economy A First Quarter Review

May 17, 2025

Japans Shrinking Economy A First Quarter Review

May 17, 2025

Latest Posts

-

Securing A Stem Future Local Students Awarded Scholarships

May 17, 2025

Securing A Stem Future Local Students Awarded Scholarships

May 17, 2025 -

Trumps Student Loan Plan Perspectives From The Black Community

May 17, 2025

Trumps Student Loan Plan Perspectives From The Black Community

May 17, 2025 -

Stem Scholarships Supporting Local Student Achievement

May 17, 2025

Stem Scholarships Supporting Local Student Achievement

May 17, 2025 -

Celebrating Success Local Students Receive Stem Scholarships

May 17, 2025

Celebrating Success Local Students Receive Stem Scholarships

May 17, 2025 -

Local Students Awarded Stem Scholarships Funding Opportunities And Resources

May 17, 2025

Local Students Awarded Stem Scholarships Funding Opportunities And Resources

May 17, 2025