Overcoming Student Loan Debt To Buy Your Dream Home

Table of Contents

Developing a Robust Student Loan Repayment Plan

Successfully buying a home while tackling student loan debt requires a well-defined repayment strategy. This involves understanding your loans, employing aggressive repayment tactics, and maintaining strong financial discipline.

Understanding Your Loan Types and Interest Rates

Knowing the specifics of your student loans is paramount. Federal student loans and private student loans differ significantly in their repayment options and interest rates. Understanding these differences is crucial for effective debt management.

- Different Repayment Plans: Explore options like standard repayment, extended repayment, and income-driven repayment plans (IDR) like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Each plan offers different monthly payment amounts and total repayment periods.

- Interest Capitalization: Be aware of interest capitalization, where accrued interest is added to your principal loan balance, increasing your total debt. Understanding this can help you strategize for more effective repayment.

- Loan Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment. However, carefully weigh the pros and cons, as it might extend your repayment timeline and impact your interest rate. Seek professional financial advice to determine if consolidation is right for you.

- Keywords: Student loan repayment plan, federal student loans, private student loans, interest rate, loan consolidation, income-driven repayment, IBR, PAYE, REPAYE.

Aggressive Debt Reduction Strategies

Accelerating your repayment efforts is key to freeing up funds for a down payment. Two popular methods are the debt snowball and debt avalanche methods.

- Debt Snowball Method: This method focuses on paying off the smallest debt first, regardless of interest rate, to build momentum and motivation. Once the smallest debt is paid, you roll the payment amount into the next smallest debt.

- Debt Avalanche Method: This strategy prioritizes paying off the debt with the highest interest rate first to minimize total interest paid over time. This often results in faster overall debt reduction, but may require more initial discipline.

- Extra Payments: Making extra payments whenever possible, even small amounts, significantly reduces your principal and accelerates the repayment process. Consider automating extra payments to ensure consistency.

- Keywords: Debt snowball, debt avalanche, extra payments, accelerated repayment, debt reduction strategies.

Budgeting and Financial Discipline

Creating a detailed budget is fundamental to success. It helps identify areas for savings and ensures funds are allocated towards both debt repayment and future homeownership.

- Track Your Expenses: Use budgeting apps or spreadsheets to track your spending habits meticulously. Identify unnecessary expenses you can cut back on.

- Create a Realistic Budget: Allocate a specific portion of your income towards debt repayment and savings for a down payment. Be realistic and adjust your budget as needed.

- Automate Savings: Set up automatic transfers from your checking account to a savings account to ensure consistent savings progress.

- Keywords: Budgeting, financial discipline, savings plan, expense tracking, financial planning, homeownership budget.

Improving Your Credit Score for Mortgage Approval

A strong credit score is crucial for securing a mortgage at favorable interest rates. Understanding your credit score and actively improving it is vital.

Understanding Credit Scores and Reports

Your credit score is a numerical representation of your creditworthiness. Mortgage lenders use it to assess your risk.

- Credit Score Calculation: Your credit score is calculated using several factors, including your payment history (35%), credit utilization (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

- Factors Affecting Scores: Late payments, high credit utilization (using a large portion of your available credit), and frequent new credit applications negatively impact your score.

- Free Credit Reports: Obtain your free credit reports annually from AnnualCreditReport.com to monitor your credit history and identify any errors.

- Keywords: Credit score, credit report, credit history, FICO score, credit utilization, payment history, mortgage interest rate.

Strategies to Improve Your Credit Score

Improving your credit score takes time and discipline. Here are some effective strategies:

- Pay Bills on Time: Consistent on-time payments are crucial. Set up automatic payments to avoid late payments.

- Lower Credit Utilization: Keep your credit utilization below 30% to demonstrate responsible credit management.

- Avoid New Credit Applications: Opening multiple new accounts in a short period can negatively impact your score.

- Dispute Errors: Review your credit reports regularly and dispute any inaccurate information.

- Maintain a Healthy Credit Mix: Having a variety of credit accounts (credit cards, loans) in good standing can positively influence your score.

- Keywords: Improve credit score, credit repair, credit building, responsible credit use, credit management.

Navigating the Mortgage Process with Student Loan Debt

Student loan debt impacts your mortgage qualification. Understanding these impacts and preparing accordingly is vital.

Understanding Mortgage Qualification Requirements

Lenders assess your ability to repay a mortgage based on several key factors.

- Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt payments to your gross monthly income. A lower DTI increases your chances of approval. Student loan payments are included in this calculation.

- Loan-to-Value Ratio (LTV): This ratio compares the loan amount to the home's value. A lower LTV often results in better mortgage terms.

- Keywords: Mortgage pre-approval, debt-to-income ratio (DTI), loan-to-value ratio (LTV), mortgage qualification, mortgage lender.

Finding the Right Mortgage Lender and Loan Program

Choosing the right lender and loan program is critical.

- Mortgage Lender: Shop around and compare rates and fees from different lenders. Consider lenders experienced with borrowers carrying student loan debt.

- Loan Programs: Explore different loan options, such as conventional loans, FHA loans (Federal Housing Administration), VA loans (Department of Veterans Affairs), and USDA loans (United States Department of Agriculture). Each program has different eligibility requirements and terms.

- Keywords: Mortgage lender, mortgage loan programs, conventional loans, FHA loans, VA loans, USDA loans.

Preparing for Closing Costs and Down Payment

Saving for a down payment while managing student loan debt requires careful planning.

- Saving Strategies: Develop a dedicated savings plan, automating regular contributions. Explore high-yield savings accounts to maximize returns.

- Down Payment Assistance Programs: Research down payment assistance programs offered by state or local governments or non-profit organizations. These can significantly reduce the upfront costs of home buying.

- Understanding Closing Costs: Budget for closing costs, which include fees paid at the closing of the mortgage.

- Keywords: Down payment, closing costs, down payment assistance, home buying process, saving for a down payment.

Conclusion

Overcoming student loan debt to buy your dream home is achievable with careful planning, discipline, and the right strategies. By implementing a robust student loan repayment plan, improving your credit score, and understanding the mortgage process, you can significantly increase your chances of homeownership. Don't let student loan debt derail your dreams – take control of your finances and start working towards owning your dream home today. Begin your journey to overcome your student loan debt and achieve homeownership by applying the resources and strategies discussed in this article. Remember, owning your dream home is within reach!

Featured Posts

-

Epic Games Hit With New Fortnite Lawsuit In Game Store Practices Under Fire

May 17, 2025

Epic Games Hit With New Fortnite Lawsuit In Game Store Practices Under Fire

May 17, 2025 -

All Conference Track Athletes A Roundup Of Honorees

May 17, 2025

All Conference Track Athletes A Roundup Of Honorees

May 17, 2025 -

Kupovina Stana U Inostranstvu Prednosti I Mane Za Srbe

May 17, 2025

Kupovina Stana U Inostranstvu Prednosti I Mane Za Srbe

May 17, 2025 -

Josh Hart A New Knicks Triple Double Record Holder

May 17, 2025

Josh Hart A New Knicks Triple Double Record Holder

May 17, 2025 -

Impacto De La Reeleccion De Trump En Los Deudores De Prestamos Estudiantiles

May 17, 2025

Impacto De La Reeleccion De Trump En Los Deudores De Prestamos Estudiantiles

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

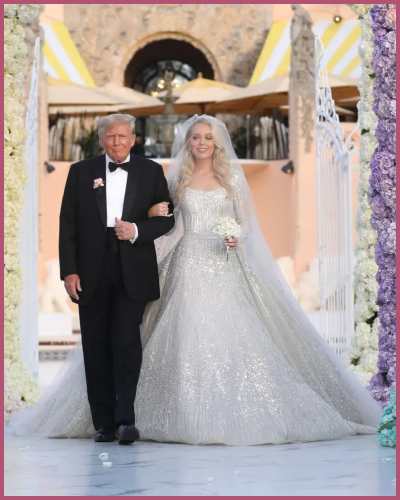

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025