Japan's Shrinking Economy: A First Quarter Review

Table of Contents

GDP Contraction and its Magnitude

Japan's GDP contracted by 0.6% in the first quarter of 2024, marking a significant slowdown compared to the previous quarter's modest growth. This decline fuels recession fears and underscores the urgency of addressing underlying economic weaknesses.

-

Comparison to Previous Quarters and Yearly Growth: This contraction follows a period of relatively weak growth in 2023, suggesting a potential longer-term trend of economic stagnation rather than a temporary blip. Annual growth projections have been revised downwards significantly.

-

Impact on Key Economic Sectors: The manufacturing sector experienced a particularly sharp downturn, reflecting global supply chain disruptions and weakened export demand. The services sector, while more resilient, also showed signs of slowing growth.

-

Government Response and Economic Forecasts: The Japanese government has responded with promises of fiscal stimulus packages, but their effectiveness remains to be seen. Economic forecasts for the following quarters remain cautious, with many analysts predicting continued slow growth or even further contraction.

-

Detail: According to data released by the Cabinet Office, the decline in GDP was primarily driven by a decrease in private investment and weak consumer spending. [Insert relevant chart or graph here showing GDP decline]. The economic slowdown is further exacerbated by persistent challenges such as economic stagnation and anxieties surrounding recession fears.

Impact of Declining Consumer Spending

Weak consumer confidence and declining spending played a crucial role in the first-quarter GDP contraction. This reflects a confluence of factors weighing on household budgets and impacting overall economic activity.

-

Factors Affecting Consumer Spending: Wage stagnation, despite a tight labor market in certain sectors, coupled with rising prices (inflation) and anxieties about the future are squeezing disposable income and reducing consumer willingness to spend.

-

Changes in Consumer Sentiment Indices: Consumer sentiment indices have fallen to multi-year lows, indicating a pessimistic outlook and a reluctance to make significant purchases.

-

Government Policies to Stimulate Consumption: The government has implemented various policies to boost consumption, including cash handouts and tax breaks, but their efficacy has been limited.

-

Detail: Retail sales figures corroborate this trend, showing a significant decline in spending on durable goods and discretionary items. The declining consumer sentiment, coupled with stagnant disposable income, paints a bleak picture for near-term recovery. The government's attempts to boost retail sales remain largely ineffective.

The Role of External Factors

Global economic conditions significantly influenced Japan's economic performance in the first quarter of 2024. External headwinds added to the domestic challenges, compounding the pressure on growth.

-

Effects of Global Inflation and Supply Chain Disruptions: Global inflation and persistent supply chain disruptions impacted both production and import costs, squeezing profit margins and hindering business investment.

-

Impact of the Weakening Yen: The weakening yen, while offering a short-term boost to exports, also increased the cost of imports, contributing to inflationary pressures and eroding consumer purchasing power.

-

Geopolitical Situation and Potential Effects: The ongoing geopolitical uncertainties, including the war in Ukraine and heightened tensions in the region, created further uncertainty and negatively impacted investor confidence.

-

Detail: The interconnection between Japan's economy and global trends is undeniable. The impact of global inflation and persistent supply chain issues cannot be overlooked. Moreover, geopolitical risks contribute to uncertainty and hinder investment decisions.

The Aging Population and Shrinking Workforce

Japan's demographic challenges, characterized by an aging population and a shrinking workforce, continue to exert a significant drag on economic growth. This long-term structural issue requires sustained attention and innovative solutions.

-

Impact of a Shrinking Workforce on Productivity and Growth: The declining working-age population leads to labor shortages, reduced productivity, and constraints on economic expansion.

-

Government Efforts to Address this Demographic Issue: The government has implemented policies to encourage immigration and improve working conditions for older workers, but these efforts have yet to yield significant results.

-

Detail: Japan's aging society and declining birth rate are leading to a severe labor shortage, impacting overall economic productivity. Addressing these demographic challenges is crucial for long-term economic sustainability.

Government Policy Response and Future Outlook

The Japanese government is actively working to address the shrinking economy through a combination of fiscal and monetary policies, alongside structural reforms.

-

Fiscal Stimulus Packages and Their Effectiveness: Past fiscal stimulus packages have shown mixed results, with some economists questioning their effectiveness in stimulating sustainable growth.

-

Monetary Policy Adjustments by the Bank of Japan: The Bank of Japan has maintained its ultra-loose monetary policy, but its impact on stimulating growth and inflation remains debatable.

-

Potential Success of Structural Reforms: Structural reforms aimed at boosting productivity, promoting innovation, and encouraging investment are crucial for long-term sustainable growth.

-

Detail: The success of fiscal policy and monetary policy adjustments hinges on their ability to address the underlying structural issues. The implementation of effective structural reforms is critical for long-term economic health.

Conclusion

The first quarter of 2024 revealed a concerning contraction in Japan's economy, driven by a confluence of factors including declining consumer spending, external economic headwinds, and the persistent challenge of an aging population. Understanding these interconnected issues is crucial to developing effective solutions. The government's response will be key to determining whether this represents a temporary setback or the start of a more prolonged period of economic stagnation. Stay informed on further developments regarding Japan's shrinking economy and its implications for global markets. Further analysis of Japan's shrinking economy is needed to understand the full implications of this downturn.

Featured Posts

-

New York Daily News Back Pages May 2025 Archives

May 17, 2025

New York Daily News Back Pages May 2025 Archives

May 17, 2025 -

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 17, 2025

Ai Digest Transforming Repetitive Scatological Data Into Engaging Podcasts

May 17, 2025 -

Game 4 Controversy Pistons Furious Over Costly Missed Foul Call

May 17, 2025

Game 4 Controversy Pistons Furious Over Costly Missed Foul Call

May 17, 2025 -

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025

Nba Teisejo Klaida Leme Pistons Ir Knicks Rungtyniu Baigti Taip Nutinka Retai

May 17, 2025 -

Angel Reese On Potential Wnba Player Strike Over Pay

May 17, 2025

Angel Reese On Potential Wnba Player Strike Over Pay

May 17, 2025

Latest Posts

-

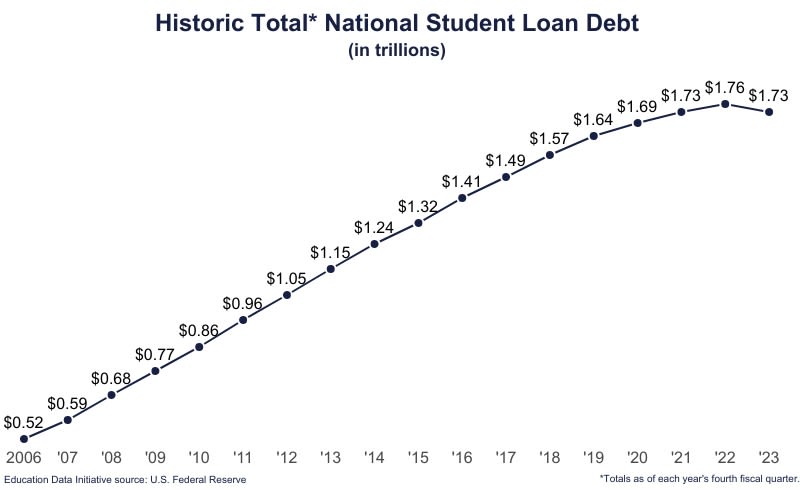

Reduce Your Student Loan Burden Advice From A Financial Planner

May 17, 2025

Reduce Your Student Loan Burden Advice From A Financial Planner

May 17, 2025 -

Navigating Student Loans A Financial Planners Perspective

May 17, 2025

Navigating Student Loans A Financial Planners Perspective

May 17, 2025 -

Post Game 4 Outrage Pistons Slam Referees Over Missed Foul Call

May 17, 2025

Post Game 4 Outrage Pistons Slam Referees Over Missed Foul Call

May 17, 2025 -

Controversial Foul Call Pistons Bitter Game 4 Defeat

May 17, 2025

Controversial Foul Call Pistons Bitter Game 4 Defeat

May 17, 2025 -

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025

Student Loan Debt A Financial Planner Offers Expert Advice

May 17, 2025