High Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Argument: Low Interest Rates Support High Valuations

The inverse relationship between interest rates and stock valuations is a cornerstone of financial theory. Low interest rates make stocks comparatively more attractive than bonds. This is because:

- Lower discount rates used in valuation models: When interest rates are low, the discount rate applied to future cash flows in valuation models decreases. This results in higher present values for stocks, thus supporting higher valuations.

- Increased borrowing capacity for companies, fueling growth: Low interest rates make it cheaper for companies to borrow money, allowing them to invest in expansion, research & development, and acquisitions – all factors that contribute to earnings growth and higher stock prices.

- Reduced opportunity cost of investing in equities: With bond yields low, the opportunity cost of investing in equities – potentially higher-return, higher-risk assets – is reduced, making stocks a more appealing investment.

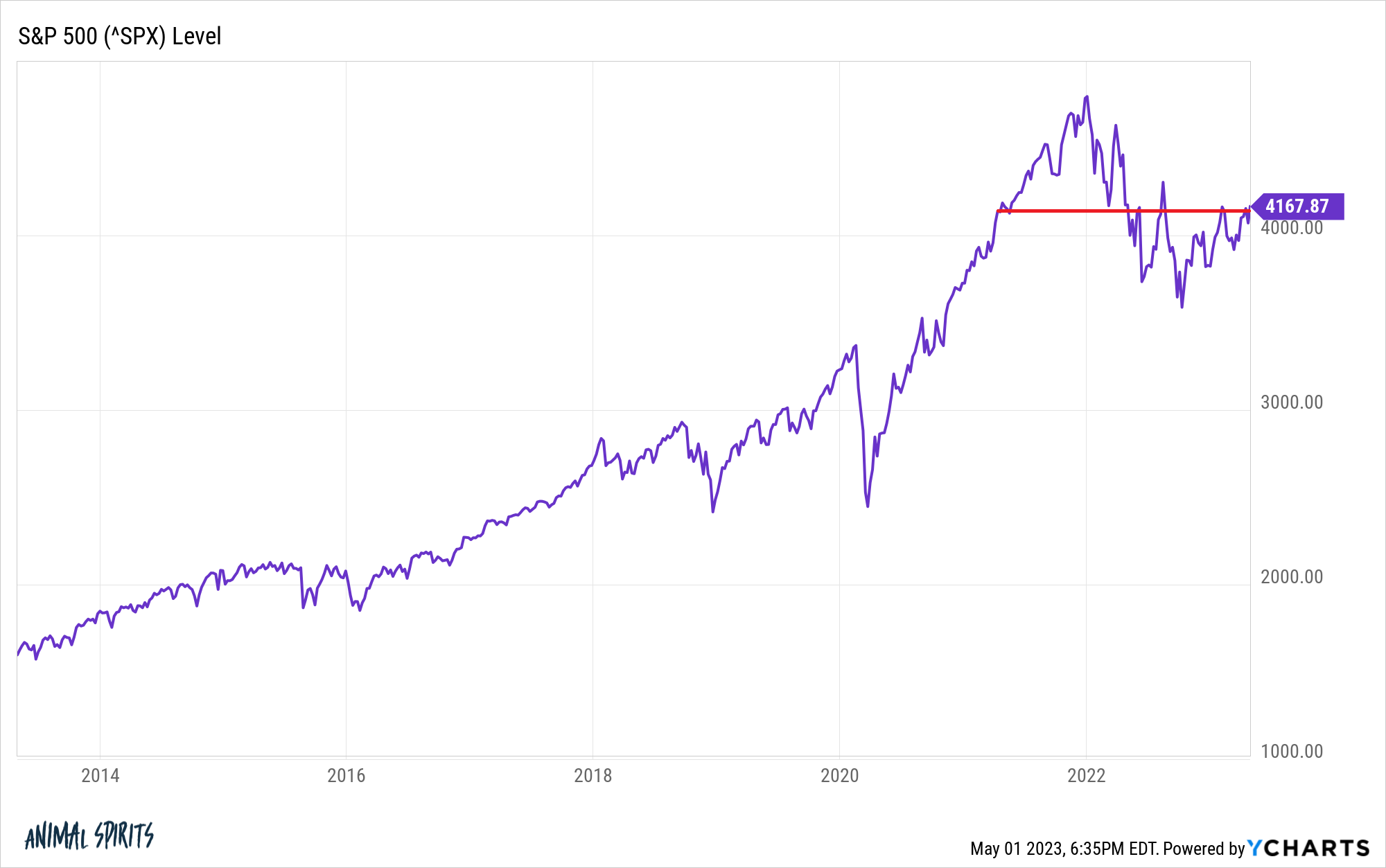

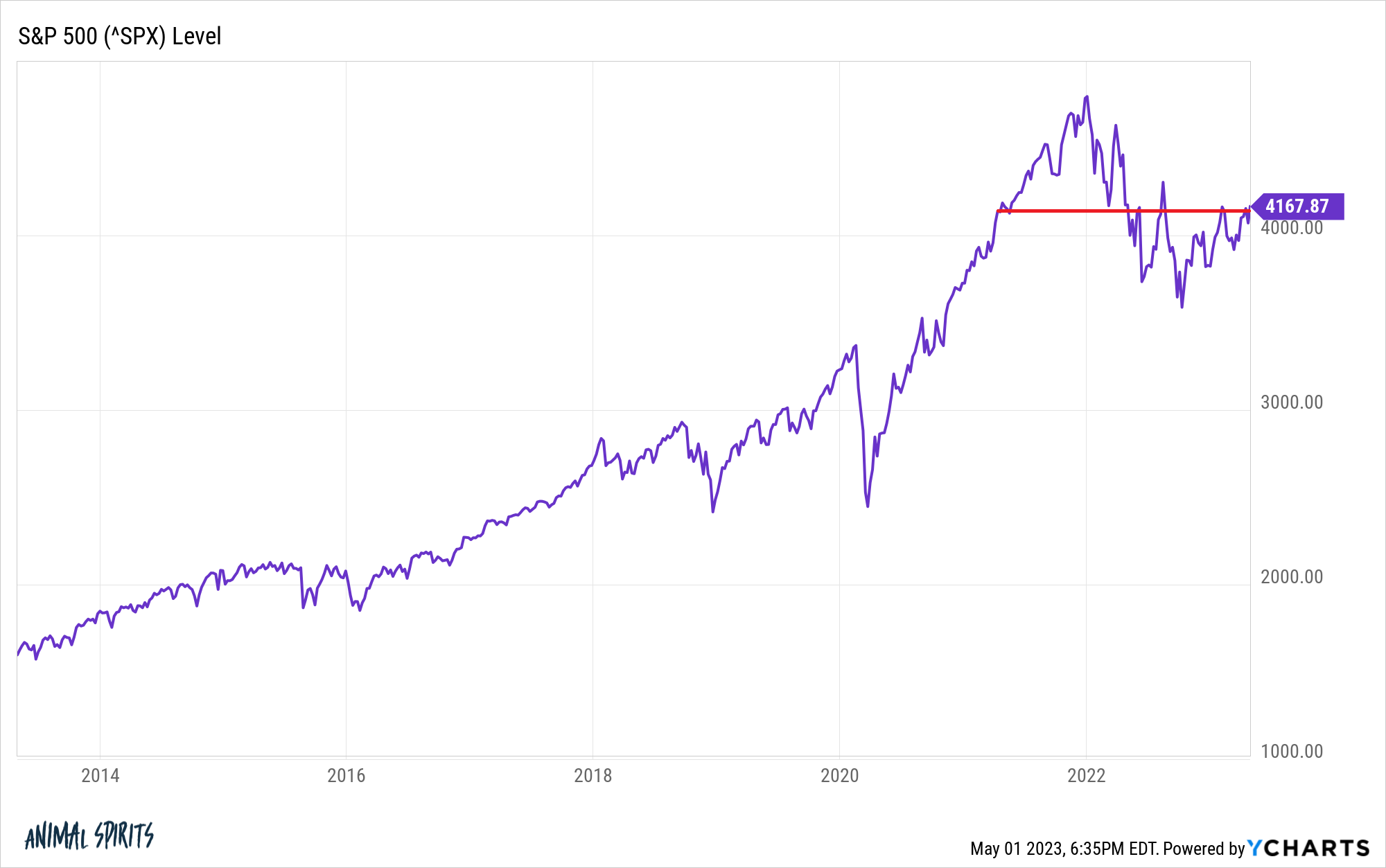

BofA's research often highlights this correlation. For example, their analyses frequently show a strong inverse relationship between 10-year Treasury yields (a benchmark for interest rates) and the Price-to-Earnings (P/E) ratio of the S&P 500 – a key indicator of overall stock market valuation. (Insert hypothetical chart or data point here illustrating this correlation). This low interest rate environment significantly impacts stock valuation models and overall market sentiment.

The Role of Strong Corporate Earnings in Justifying High Valuations

Robust corporate earnings growth can also help justify high price-to-earnings (P/E) ratios. Even with high stock prices, if earnings are growing at a commensurate or faster rate, the P/E ratio might not be considered excessively high.

- Examples of sectors exhibiting strong earnings growth: Technology, healthcare, and certain consumer staples sectors have demonstrated impressive earnings growth in recent periods.

- Impact of technological advancements on corporate profitability: Technological advancements often drive efficiency gains and create new revenue streams, boosting profitability and supporting higher valuations.

- BofA forecasts: BofA regularly publishes earnings forecasts, and these projections often play a significant role in their assessment of whether current stock market valuations are justified. (Insert hypothetical data point here referencing a BofA earnings forecast).

Addressing Inflation Concerns and their Impact on Stock Market Valuations

Inflation is a legitimate concern for investors, as it can erode purchasing power and negatively affect stock valuations. However, BofA's perspective often emphasizes the importance of distinguishing between transitory and persistent inflation. They often argue that:

- BofA's inflation predictions: (Insert hypothetical BofA inflation prediction here, e.g., "BofA predicts inflation will remain relatively contained in the medium term").

- Strategies companies might employ to mitigate inflation's impact: Companies can implement strategies like raising prices or improving efficiency to offset inflationary pressures.

- Discussion of inflation-resistant sectors: Certain sectors, such as consumer staples and healthcare, tend to be more resilient to inflation.

BofA's analysis typically incorporates a thorough examination of monetary policy and its potential influence on inflation. This detailed consideration of the interplay between inflation, interest rate hikes, and monetary policy contributes to their overall assessment of the market.

Long-Term Growth Potential and Future Market Outlook (According to BofA)

Despite current high stock market valuations, BofA often maintains a relatively positive long-term outlook for the stock market. This optimistic view is often supported by:

- Key drivers of future market growth identified by BofA: (Insert hypothetical examples here, such as technological innovation, demographic trends, or global economic growth).

- BofA's predictions for future market performance: (Insert hypothetical data points from BofA's market forecasts).

- Potential risks and opportunities: BofA's analysis typically includes a discussion of potential risks, such as geopolitical instability or unexpected economic slowdowns, as well as opportunities presented by emerging markets or technological breakthroughs. (Insert a hypothetical example here, like mentioning the potential growth of renewable energy sectors). These factors are crucial for investors navigating high stock market valuations.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's analysis suggests that while high stock market valuations are a valid concern, they shouldn't necessarily trigger panic selling. Factors like low interest rates, strong corporate earnings, and manageable inflation all play a role in supporting current valuations. Importantly, BofA often stresses the importance of considering the long-term growth potential of the market and the benefits of diversification.

While understanding high stock market valuations is crucial, remember to consult with a financial advisor before making any investment decisions. Learn more about managing your portfolio in a period of high stock market valuations by exploring further resources and conducting thorough research tailored to your individual risk tolerance and investment goals.

Featured Posts

-

Tam Krwz Ka Ayk Mdah Ke Ghyr Memwly Eml Pr Rdeml

May 17, 2025

Tam Krwz Ka Ayk Mdah Ke Ghyr Memwly Eml Pr Rdeml

May 17, 2025 -

4 Cursos Com Nota Maxima Do Mec No Vale Do Nome Do Vale Veja Quais Sao

May 17, 2025

4 Cursos Com Nota Maxima Do Mec No Vale Do Nome Do Vale Veja Quais Sao

May 17, 2025 -

Angel Reese On Potential Wnba Player Strike Over Pay

May 17, 2025

Angel Reese On Potential Wnba Player Strike Over Pay

May 17, 2025 -

Univision Gobierno Intensifica La Recuperacion De Prestamos Estudiantiles

May 17, 2025

Univision Gobierno Intensifica La Recuperacion De Prestamos Estudiantiles

May 17, 2025 -

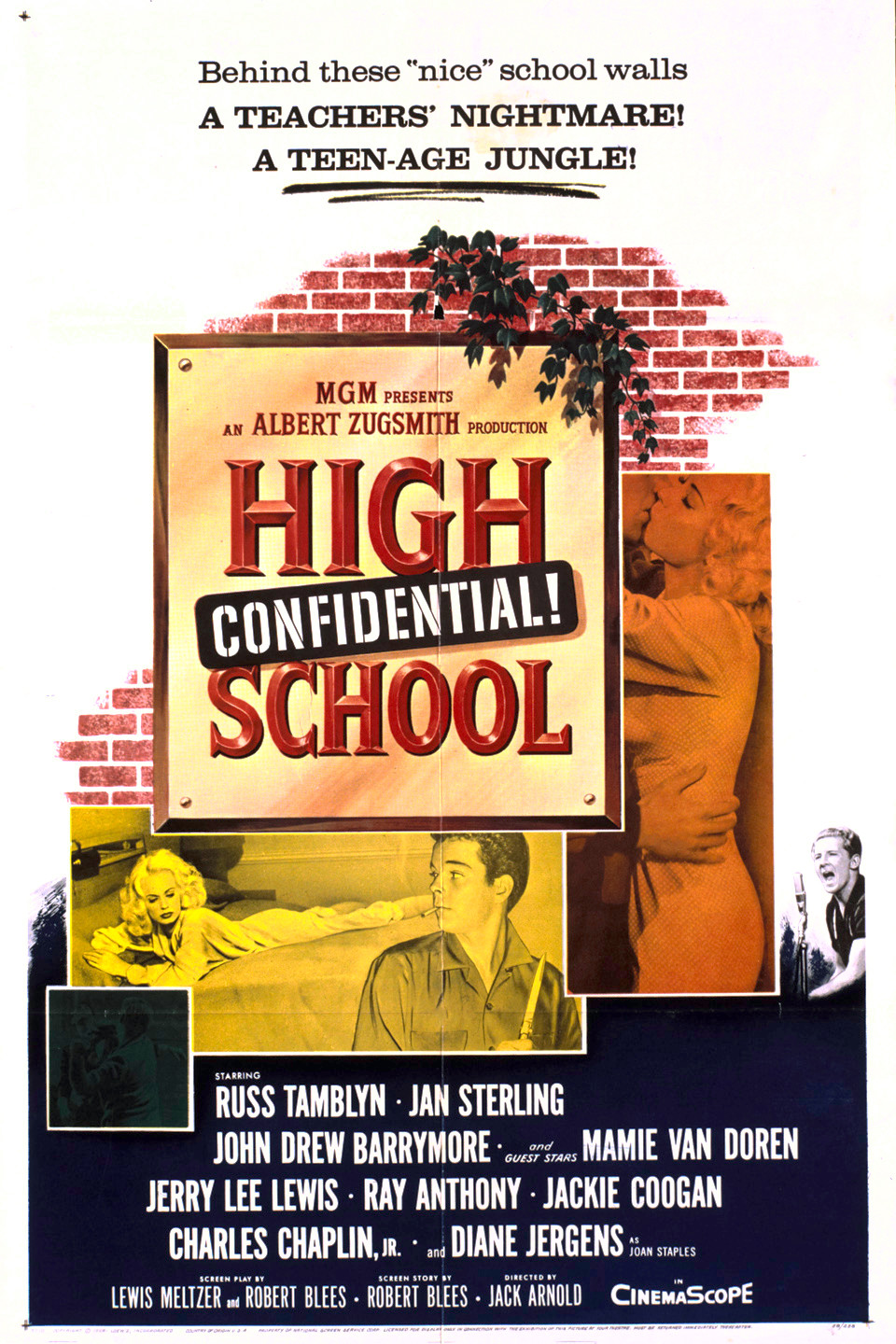

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025

2024 25 High School Confidential Key Events Of Week 26

May 17, 2025

Latest Posts

-

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025 -

Avaliacao Mec 4 Cursos Do Vale E Regiao Recebem Nota Maxima Descubra Quais

May 17, 2025

Avaliacao Mec 4 Cursos Do Vale E Regiao Recebem Nota Maxima Descubra Quais

May 17, 2025 -

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025

North Dakotas Richest Receives Msum Honorary Degree

May 17, 2025 -

Making The Decision To Refinance Federal Student Loans Or Not

May 17, 2025

Making The Decision To Refinance Federal Student Loans Or Not

May 17, 2025 -

Ensino Superior Apenas 4 Cursos Alcancam Nota Maxima Do Mec Na Regiao Do Vale

May 17, 2025

Ensino Superior Apenas 4 Cursos Alcancam Nota Maxima Do Mec Na Regiao Do Vale

May 17, 2025