BofA's Reassuring View: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale Behind Their Positive Market Outlook

BofA's optimistic stance on the market, despite high valuations, rests on several key pillars. Their analysts point to a confluence of factors that suggest continued growth potential, mitigating the risks typically associated with high price levels.

-

Strong Corporate Earnings Growth Projections: BofA projects robust earnings growth for many sectors in the coming quarters. This positive outlook stems from continued economic recovery and strong consumer spending. This expectation of future earnings growth helps to justify current valuations.

-

Positive Economic Indicators: Several key economic indicators support BofA's optimism. For instance, recent employment data shows a strong labor market, and consumer confidence remains relatively high, despite inflationary pressures. These factors point towards sustained economic growth.

-

Low Interest Rates (or a supportive interest rate environment): While interest rates have risen, they remain relatively low in a historical context. This low-rate environment supports higher valuations, as the cost of borrowing remains manageable for businesses and consumers.

-

Credible Sources: BofA's outlook is not based on speculation. Their positive projections are backed by detailed research and reports from leading analysts like [insert analyst name if available], adding weight to their arguments.

Addressing the Concerns of High Price-to-Earnings Ratios (P/E)

High Price-to-Earnings (P/E) ratios are a common cause of investor concern. They often signal that a stock or market is overvalued. However, BofA's analysis suggests that the current high P/E ratios might be justifiable:

-

Low Interest Rates Justifying Higher Valuations: The low interest rate environment significantly impacts investor behavior. With lower returns from traditional fixed-income investments, investors are willing to accept higher P/E ratios for stocks offering the potential for higher growth.

-

Future Earnings Growth: BofA's projections of strong future earnings growth indicate that current high P/E ratios may be sustainable. As earnings increase, the P/E ratio will naturally decline, making current prices appear more reasonable in hindsight.

-

Relative Valuation: It's crucial to consider relative valuations. While P/E ratios might be high compared to historical averages, they might be in line with or lower than those of other asset classes, suggesting they are not necessarily excessive in the current market context.

The Role of Innovation and Technological Advancements

Innovation plays a crucial role in justifying higher valuations, particularly within specific sectors. The rapid pace of technological advancements fuels significant growth potential, making some companies appear justifiably expensive:

-

High-Growth Sectors: Sectors like technology and renewable energy are leading examples. These sectors are experiencing rapid innovation and expansion, justifying higher valuations due to their significant growth potential.

-

Disruptive Technologies: Emerging disruptive technologies constantly redefine industries and create entirely new markets. The potential for these innovations to generate substantial future returns justifies higher present-day valuations.

-

Long-Term Investment Perspective: BofA's positive outlook reflects a long-term investment perspective. The potential for significant growth driven by innovation makes accepting higher valuations in the present day sensible for patient investors with a long-term horizon.

Managing Risk in a High-Valuation Market

While BofA's outlook is positive, it's crucial to acknowledge the risks associated with high valuations. A cautious approach is essential:

-

Diversification: Diversification is key to mitigate risk. Spreading investments across different sectors and asset classes can reduce the impact of potential market downturns.

-

High-Quality Companies: Focusing investments on high-quality companies with strong fundamentals is crucial. These companies are better equipped to withstand economic headwinds and outperform their peers during periods of uncertainty.

-

Long-Term Investment Horizon: A long-term investment horizon helps reduce the impact of short-term market fluctuations. Focusing on long-term growth prospects allows investors to weather short-term volatility.

-

Potential Downside Risks: Despite the positive outlook, risks remain. Inflation, geopolitical instability, and unexpected economic slowdowns could impact the market negatively. Careful monitoring of these factors and adjusting investment strategies accordingly is crucial.

BofA's Reassuring View: A Call to Action for Investors

In summary, BofA's positive market outlook, driven by strong earnings projections, positive economic indicators, and the transformative power of innovation, suggests that high stock market valuations shouldn't trigger immediate panic selling. However, a balanced approach is crucial. Understanding high stock market valuations involves careful consideration of risks and opportunities. By focusing on diversification, selecting high-quality companies, and adopting a long-term perspective, investors can navigate this market environment effectively. We encourage you to conduct further research into BofA's reports and consider consulting a financial advisor before making any investment decisions related to managing high stock market valuations or understanding high stock market valuations in greater depth.

Featured Posts

-

The Release Of Joy Crookes New Single Carmen

May 25, 2025

The Release Of Joy Crookes New Single Carmen

May 25, 2025 -

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostanni 10 Rokiv

May 25, 2025

Kudi Podilisya Peremozhtsi Yevrobachennya Za Ostanni 10 Rokiv

May 25, 2025 -

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Concerns

May 25, 2025

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Concerns

May 25, 2025 -

Flood Alerts A Comprehensive Guide To Safety And Preparedness

May 25, 2025

Flood Alerts A Comprehensive Guide To Safety And Preparedness

May 25, 2025 -

Demnas Appointment At Gucci Expectations And Impact

May 25, 2025

Demnas Appointment At Gucci Expectations And Impact

May 25, 2025

Latest Posts

-

Shooting At Popular Southern Vacation Spot Prompts Safety Review And Debate

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review And Debate

May 25, 2025 -

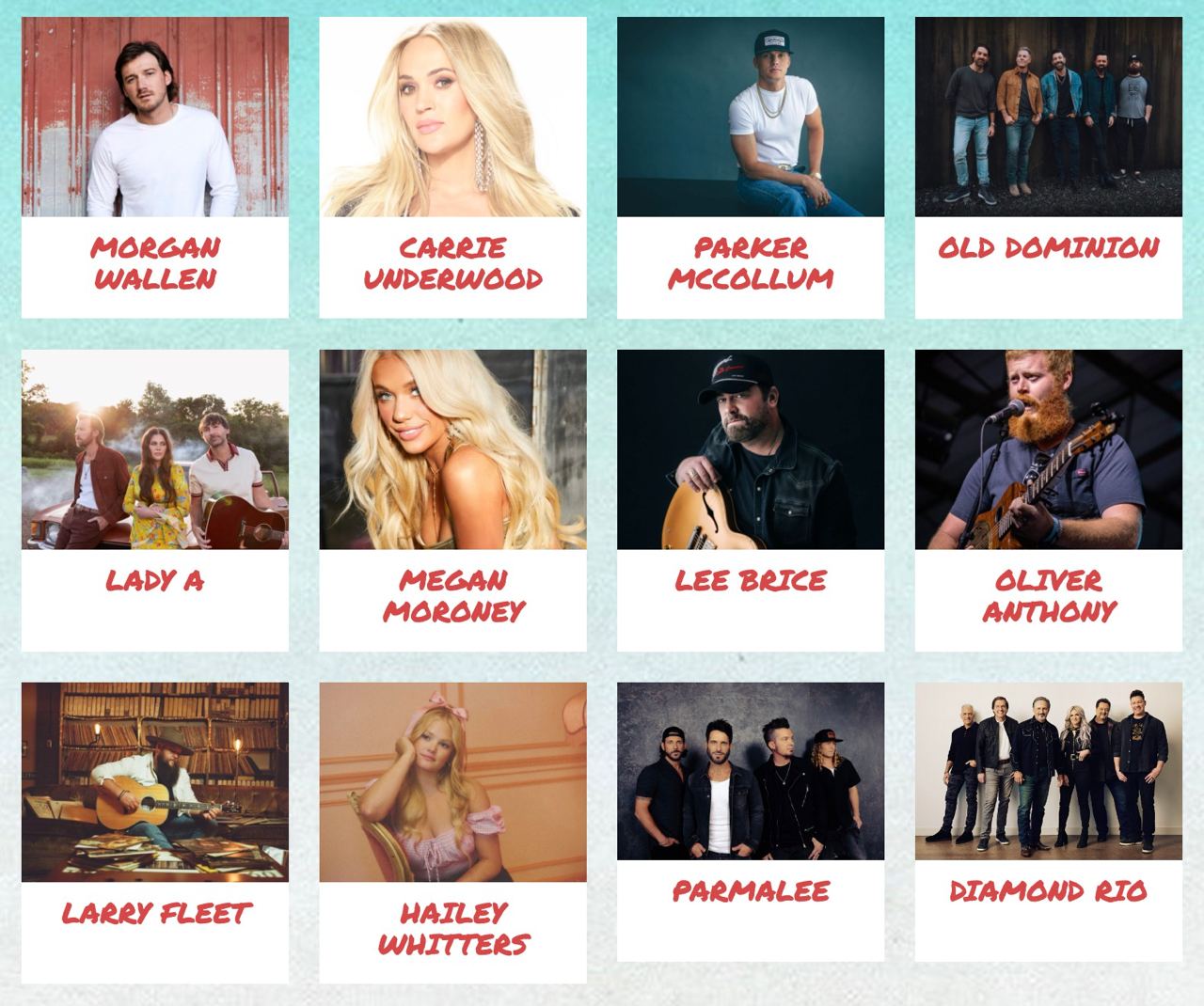

2025 Carolina Country Music Fest Tickets No Longer Available

May 25, 2025

2025 Carolina Country Music Fest Tickets No Longer Available

May 25, 2025 -

Southern Vacation Destination Disputes Safety Concerns Following Shooting Incident

May 25, 2025

Southern Vacation Destination Disputes Safety Concerns Following Shooting Incident

May 25, 2025 -

Popular Southern Vacation Area Responds To Criticism After Shooting

May 25, 2025

Popular Southern Vacation Area Responds To Criticism After Shooting

May 25, 2025 -

Dispute Over Safety Rating Southern Vacation Spot Rebuts Claims Following Shooting

May 25, 2025

Dispute Over Safety Rating Southern Vacation Spot Rebuts Claims Following Shooting

May 25, 2025