£3 Billion Slash To SSE Spending: Details Of The Revised Plan

Table of Contents

Reasons Behind the £3 Billion Reduction in SSE Spending

The £3 billion reduction in SSE's spending reflects a confluence of factors impacting the energy market and the company's strategic outlook. The decision wasn't made lightly and stems from a complex interplay of economic realities and strategic reevaluation.

-

Increased Competition: The energy market is increasingly competitive, with new players and technologies challenging established companies like SSE. This heightened competition necessitates a more focused and efficient approach to investment.

-

Economic Headwinds: Soaring inflation and rising interest rates have significantly impacted the viability of large-scale energy projects. The increased cost of borrowing makes financing ambitious renewable energy schemes considerably more challenging. Analysts predict a 15% decrease in renewable energy investment across the UK due to these rising interest rates alone.

-

Regulatory Uncertainty: Changes in government policy regarding renewable energy subsidies and regulatory frameworks have introduced uncertainty, affecting the long-term profitability of certain projects. This makes careful planning and risk assessment crucial.

-

Strategic Re-Prioritization: SSE appears to be strategically shifting its focus, prioritizing projects with a higher probability of success and faster returns in the current economic climate. This involves a reassessment of its existing portfolio and a redirection of resources.

Details of the Revised SSE Investment Plan

The revised investment plan involves a complex reshuffling of priorities, affecting several key projects across SSE's portfolio. While the company hasn't disclosed granular details for all projects, some key adjustments are becoming clear.

-

Cancelled Projects: Specific projects that have been completely cancelled haven't been publicly named yet, though speculation centers around some less profitable offshore wind initiatives. Further announcements are expected in the coming weeks.

-

Delayed Projects: Several projects are anticipated to face significant delays. This delay allows SSE to reassess project viability, secure more favorable financing terms, and potentially integrate technological advancements to improve efficiency.

-

Scaled-Down Projects: A number of projects will proceed, but on a smaller scale, with reduced budgets and revised timelines. This approach aims to mitigate risk while still delivering on key objectives, albeit at a slower pace.

-

New Priorities: SSE is likely to increase investment in projects with shorter development cycles and quicker returns, such as smaller-scale onshore wind farms and energy storage solutions. This reflects a shift towards more immediate and less capital-intensive opportunities.

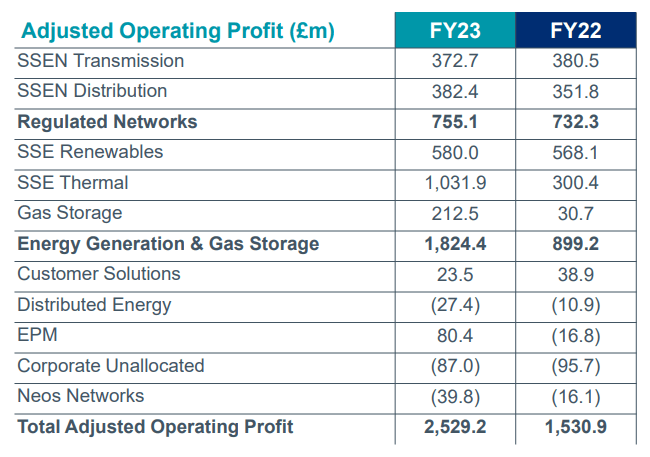

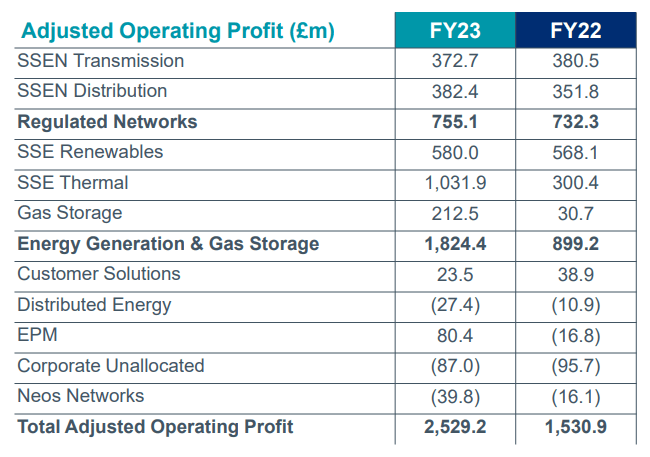

(Insert chart or graph here illustrating the changes in investment allocation across different project types.)

Impact of the Spending Cuts on SSE's Future Growth and Profitability

The £3 billion spending reduction will undoubtedly have a significant impact on SSE's short-term and long-term growth trajectory. While this might lead to lower revenue in the immediate future, it could ultimately lead to greater financial stability and potentially higher long-term profitability.

-

Short-Term Impact: Reduced investment will likely translate to lower revenue growth in the short term. However, it also reduces risk associated with large-scale projects which haven't yet reached financial closure.

-

Long-Term Impact: While potentially slowing down the pace of renewable energy expansion in the short term, the revised plan allows SSE to focus resources on more profitable and less risky ventures.

-

Shareholder Returns: The impact on shareholder returns is complex, potentially leading to short-term decreases but potentially leading to long-term stability and increased returns.

-

Market Position: SSE's market share may be temporarily impacted by slower growth, but a focused approach to profitable projects could improve its competitiveness.

SSE's Response and Communication to Stakeholders

SSE has issued official statements and press releases communicating the revised spending plan to its stakeholders. The company has emphasized the need for a strategic realignment to address the current economic climate and enhance long-term value creation.

-

Official Statements: SSE's communications have highlighted the need for financial prudence in the face of rising inflation and interest rates.

-

Investor Relations: The company has engaged with investors to explain the rationale behind the decision and answer their concerns.

-

Employee Communication: SSE has also communicated with its employees, emphasizing the importance of adaptation and the focus on delivering core objectives with optimized resources.

Conclusion: Understanding the Implications of the £3 Billion SSE Spending Reduction

The £3 billion reduction in SSE's spending represents a significant adjustment in the company's strategic direction, driven by economic headwinds, market dynamics, and a strategic re-evaluation. While the short-term consequences may include slower growth and some project delays, the long-term implications could involve a leaner, more efficient, and ultimately more profitable organization. The revised plan prioritizes financial stability and the delivery of key strategic objectives in a challenging economic landscape. Stay updated on the evolving situation with SSE's revised spending plans by subscribing to our newsletter and following us on social media for the latest news and analysis on SSE spending cuts and future developments in the energy sector.

Featured Posts

-

900 Million Tariff Bite Apple Stock Takes A Hit

May 25, 2025

900 Million Tariff Bite Apple Stock Takes A Hit

May 25, 2025 -

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 25, 2025

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 25, 2025 -

Meregdraga Porsche 911 80 Millio Forint Az Extrak Ara

May 25, 2025

Meregdraga Porsche 911 80 Millio Forint Az Extrak Ara

May 25, 2025 -

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

May 25, 2025

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

May 25, 2025 -

Report Philips Holds Annual General Meeting Of Shareholders

May 25, 2025

Report Philips Holds Annual General Meeting Of Shareholders

May 25, 2025

Latest Posts

-

Recognizing And Responding To A Flash Flood Emergency

May 25, 2025

Recognizing And Responding To A Flash Flood Emergency

May 25, 2025 -

South Florida Braces For Flash Flooding As Heavy Showers Continue

May 25, 2025

South Florida Braces For Flash Flooding As Heavy Showers Continue

May 25, 2025 -

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025

Flash Flood Emergency What To Know And How To Stay Safe

May 25, 2025 -

Understanding Flash Flood Emergencies A Comprehensive Guide

May 25, 2025

Understanding Flash Flood Emergencies A Comprehensive Guide

May 25, 2025 -

Nws Issues Flash Flood Warning For South Florida Amid Heavy Showers

May 25, 2025

Nws Issues Flash Flood Warning For South Florida Amid Heavy Showers

May 25, 2025