Lower UK Inflation: Impact On BOE Interest Rate Decisions And The Pound Sterling

Table of Contents

The Bank of England (BOE) and its Response to Lower Inflation

The Bank of England's primary mandate is to maintain price stability and support sustainable economic growth. The BOE's Monetary Policy Committee (MPC) sets interest rates to achieve these goals. Lower UK inflation significantly impacts the BOE's interest rate decisions. Historically, high inflation has led to interest rate hikes to cool down the economy and curb rising prices. However, with lower inflation, the pressure to raise rates diminishes.

- Lower inflation may lead to interest rate cuts or a pause in rate hikes. This could stimulate economic activity by making borrowing cheaper for businesses and consumers.

- The BOE considers other economic indicators alongside inflation. These include unemployment rates, wage growth, and consumer spending. A holistic view is essential before making policy changes.

- Potential for a divergence in monetary policy from other major central banks. The UK's unique economic circumstances might lead to different policy choices compared to the US Federal Reserve or the European Central Bank.

- Analysis of recent BOE statements and forecasts reveals a cautious approach, with the MPC carefully assessing the persistence of lower inflation before making any significant shifts in interest rates. Their statements often highlight the ongoing uncertainty in the global economy.

Impact of Lower Inflation on the Pound Sterling (£)

Inflation and currency value are intrinsically linked. Lower UK inflation, relative to other countries, can influence the Pound Sterling's exchange rate.

- Lower inflation can make UK exports more competitive. This is because goods and services produced in the UK become relatively cheaper compared to those in countries with higher inflation. Increased export demand can bolster the Pound.

- Impact of lower interest rates on investment flows into the UK. Lower interest rates may reduce the attractiveness of the UK for foreign investment, potentially leading to a weakening of the Pound. Conversely, a perceived strengthening of the UK economy may attract investment, supporting the Pound.

- Potential for Pound appreciation or depreciation depending on global economic factors. Global economic conditions, geopolitical events, and shifts in investor sentiment significantly impact currency exchange rates. The Pound's movement will depend on how UK lower inflation compares to global trends.

- Potential for "flight to safety" if UK economic outlook improves. If lower inflation signals improved economic stability, investors might increase their holdings of Pound Sterling assets, leading to appreciation.

Factors Influencing the BOE's Decision Beyond Inflation

The BOE's decisions are not solely based on inflation figures. Several other key economic indicators and uncertainties influence their monetary policy choices.

- Unemployment rates and wage growth: Sustained low unemployment with robust wage growth could indicate inflationary pressures, even with lower overall inflation.

- Global economic conditions and geopolitical risks: Global economic slowdowns or geopolitical instability can significantly affect the UK economy and the BOE's response.

- Energy price volatility and its impact on inflation: Fluctuations in energy prices can cause significant short-term inflation spikes and uncertainty in the economic outlook.

- Supply chain disruptions and their lingering effects: Ongoing supply chain issues can continue to put upward pressure on prices, even if overall inflation is trending downwards.

Forecasting the Future: Predictions for UK Inflation, Interest Rates, and the Pound

Forecasting the future is inherently challenging, but various economic forecasts provide insights into potential scenarios.

- Consensus forecasts from leading economists and financial institutions: These forecasts offer a range of predictions for UK inflation, interest rates, and the Pound's exchange rate. These are widely available from reputable sources.

- Potential scenarios: Continued decline in inflation, a period of stagnation, or even a resurgence of inflationary pressures are all possibilities.

- Impact of different scenarios on interest rates and the Pound: Each scenario would have distinct implications for BOE policy and the Pound's value. A continued decline in inflation might lead to lower interest rates and a weaker Pound; a resurgence might necessitate higher rates and a stronger Pound.

- Mention the importance of monitoring economic data releases: Regularly reviewing economic data releases from the Office for National Statistics (ONS) and the BOE is crucial for staying informed about the evolving economic situation.

Conclusion: Lower UK Inflation – Implications and Future Outlook

Lower UK inflation has significant implications for the Bank of England's interest rate decisions and the value of the Pound Sterling. The interconnectedness of inflation, interest rates, and currency value is undeniable. However, significant uncertainties and potential risks remain. The BOE's response will be multifaceted, considering various economic indicators alongside inflation. The Pound's future movement depends on a complex interplay of domestic and global factors.

To stay abreast of developments regarding lower UK inflation and its implications, diligently follow economic news and analysis from reputable sources. Further research into BOE monetary policy and foreign exchange markets will provide a more comprehensive understanding of these interconnected dynamics. Stay informed to make sound financial decisions in this evolving economic landscape.

Featured Posts

-

Significant M56 Traffic Disruption Cheshire Deeside Border Incident

May 25, 2025

Significant M56 Traffic Disruption Cheshire Deeside Border Incident

May 25, 2025 -

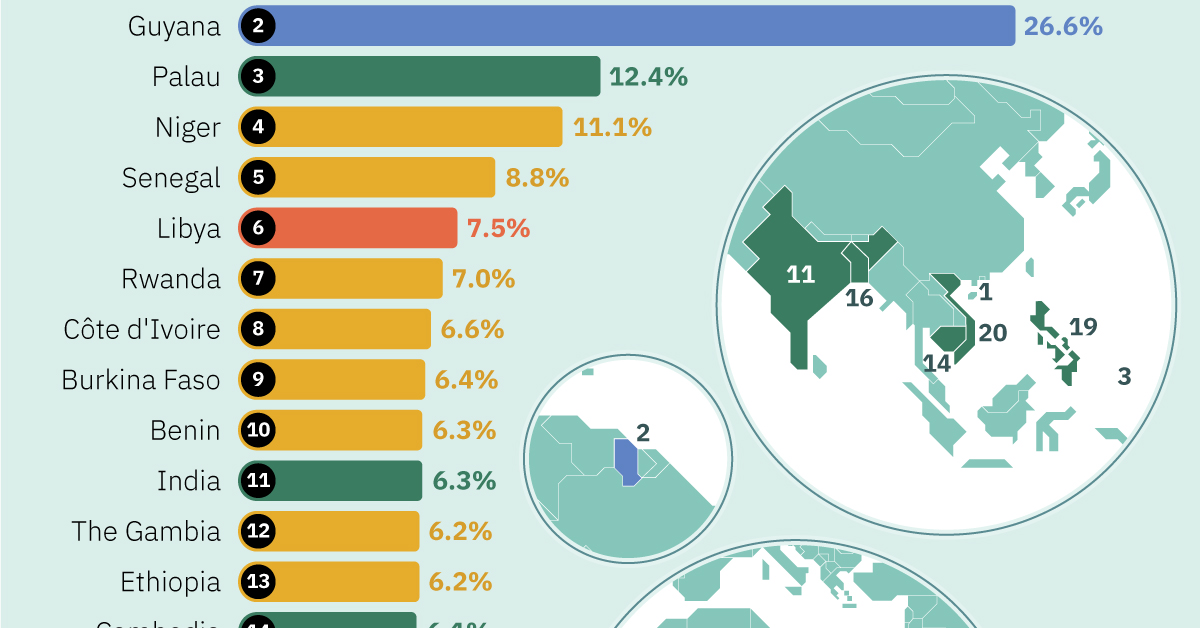

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025

The Countrys Fastest Growing Business Markets A Geographic Analysis

May 25, 2025 -

Carolina Country Music Fest 2025 Tickets Sold Out

May 25, 2025

Carolina Country Music Fest 2025 Tickets Sold Out

May 25, 2025 -

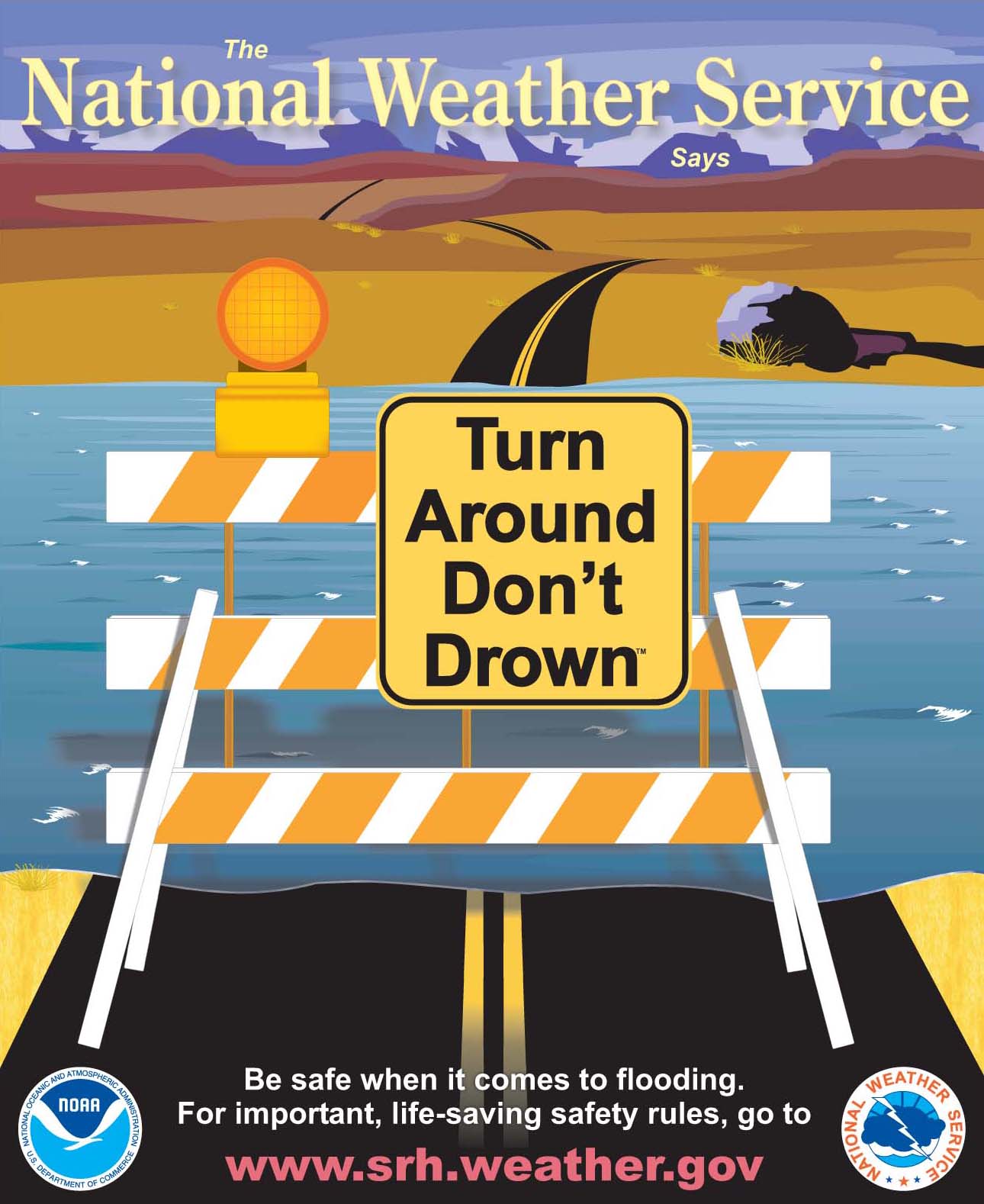

How To Recognize And Respond To A Flash Flood Emergency

May 25, 2025

How To Recognize And Respond To A Flash Flood Emergency

May 25, 2025 -

900 Million Tariff Bite Apple Stock Takes A Hit

May 25, 2025

900 Million Tariff Bite Apple Stock Takes A Hit

May 25, 2025

Latest Posts

-

Wolff Speaks More Hints On Russells Long Term Future With Mercedes

May 25, 2025

Wolff Speaks More Hints On Russells Long Term Future With Mercedes

May 25, 2025 -

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025 -

Mercedes Driver George Russell Settles 1 5m Debt Contract Implications Analyzed

May 25, 2025

Mercedes Driver George Russell Settles 1 5m Debt Contract Implications Analyzed

May 25, 2025 -

The George Russell Contract Situation What Mercedes Needs To Do

May 25, 2025

The George Russell Contract Situation What Mercedes Needs To Do

May 25, 2025 -

Mercedes And George Russell Contract Renewal Hinges On This

May 25, 2025

Mercedes And George Russell Contract Renewal Hinges On This

May 25, 2025