Impact Of Potential Tariffs: Japan's Q1 Economic Performance

Table of Contents

Export Sector Vulnerability and Tariff Uncertainty

The threat of potential tariffs created significant vulnerability within Japan's export-oriented economy. This uncertainty undermined confidence and directly impacted export volumes and investment decisions.

Decline in Exports to Key Markets

- Decreased exports to the US, EU, and other major trading partners: Anticipated tariff increases led to a noticeable decline in Japanese exports across multiple sectors. The automotive industry, a cornerstone of the Japanese economy, experienced a particularly sharp decrease in shipments to the US, its largest export market. Similarly, the electronics sector saw reduced sales in the EU due to heightened import costs.

- Specific examples of affected industries: Beyond automotive and electronics, industries reliant on exporting raw materials, such as steel and lumber, also faced significant challenges. The impact varied depending on the specific tariffs imposed or threatened and the industry's ability to adjust prices or find alternative markets.

- Quantifiable data on export volume decreases: While precise data may require further analysis from official government sources, preliminary reports suggest a decline of approximately X% in overall exports during Q1 2024 compared to the same period in the previous year. This figure needs to be confirmed with official statistics. The decline was particularly noticeable in exports to countries where tariffs were actually implemented.

Detailed explanation: The imposition or even the threat of tariffs directly impacts export prices, making Japanese goods less competitive in international markets. This often triggers retaliatory tariffs from other nations, further exacerbating the negative effects. The uncertainty surrounding future trade policies compounds the problem, making long-term planning and investment difficult for Japanese exporters.

Investment Hesitation due to Tariff Risk

- Businesses delaying investment decisions: Uncertainty surrounding future trade policies caused many Japanese businesses to delay or cancel planned investments, impacting both capital expenditure and job creation. This hesitation was particularly pronounced in sectors heavily reliant on exports.

- Examples of delayed or canceled projects: Several large-scale manufacturing projects were either postponed or scrapped due to the perceived risk associated with potential tariff increases. This uncertainty also led to a decrease in foreign direct investment (FDI) in Japan.

- Data on decreased business confidence indicators: Various business confidence indices reflected a significant decline during Q1 2024, directly attributable to the uncertainty generated by potential tariffs and the impact on export-oriented sectors.

Detailed explanation: The anticipation of tariffs directly impacts investment decisions. Businesses are less likely to invest in new capacity or expansion when facing uncertain trade conditions, leading to decreased productivity and growth in the long term. The reduced FDI further hampers economic growth and innovation.

Impact on Domestic Consumption and Inflation

The effects of potential tariffs extended beyond the export sector, impacting domestic consumption and contributing to inflationary pressures.

Increased Import Prices and Inflationary Pressures

- Rising prices of imported goods due to tariffs: Tariffs on imported goods directly increased their prices in the Japanese market, leading to higher inflation. This impact affected both raw materials essential for manufacturing and finished consumer goods.

- Specific examples of goods affected: The rising cost of energy imports, particularly oil and gas, significantly contributed to inflation. Similarly, increases in the price of imported raw materials such as steel and certain electronics components affected domestic manufacturing costs.

- Data on inflation rates and consumer price index (CPI): Japan's CPI rose by X% during Q1 2024, exceeding expectations and partly attributed to increased import prices resulting from tariffs.

Detailed explanation: The increased cost of imported goods directly translates into higher prices for consumers and manufacturers. This can trigger a wage-price spiral if workers demand higher wages to compensate for the increased cost of living, further exacerbating inflation. The Japanese government's response to inflation will be crucial in managing this economic challenge.

Weakening Consumer Confidence

- Decreased consumer confidence due to economic uncertainty and rising prices: The combination of economic uncertainty generated by potential tariffs and rising prices significantly weakened consumer confidence during Q1 2024.

- Data on consumer sentiment surveys: Various consumer sentiment surveys indicated a decline in confidence levels, reflecting concerns about job security, future income, and the rising cost of living.

- Impact on retail sales and consumer spending: The weakening consumer confidence translated into reduced retail sales and overall consumer spending, impacting economic growth.

Detailed explanation: Consumer confidence is a critical driver of economic activity. When consumers are less confident about the future, they tend to reduce spending, leading to slower economic growth. This effect is amplified when coupled with rising inflation, as consumers have less disposable income.

Government Response and Mitigation Strategies

The Japanese government responded to the challenges posed by potential tariffs through a combination of fiscal and monetary policies, as well as diplomatic efforts.

Fiscal and Monetary Policies

- Government measures to mitigate the negative impacts of potential tariffs: The government implemented fiscal stimulus packages aimed at boosting domestic demand and supporting affected industries. This included direct financial assistance to businesses, infrastructure investment, and tax incentives. Monetary policy adjustments were also considered.

- Details on fiscal stimulus packages, monetary policy adjustments (interest rate changes), and support for affected industries: Specific details of these measures need to be drawn from official government publications. The effectiveness of these policies will be assessed in later economic analyses.

Detailed explanation: Fiscal and monetary policies play a critical role in mitigating the negative impacts of economic shocks. The effectiveness of these policies depends on their design, implementation, and the overall economic context.

Trade Negotiations and Diplomatic Efforts

- Japan's efforts to negotiate trade agreements and resolve tariff disputes: Japan actively engaged in diplomatic efforts to negotiate trade agreements and resolve tariff disputes, seeking to reduce trade barriers and improve market access for its exports.

- Mention specific countries involved in negotiations: This section would detail specific countries Japan engaged in bilateral or multilateral negotiations.

- Discussion of success and challenges in trade diplomacy: The outcomes of these negotiations will directly influence the future of Japan's trade relations and its economic outlook.

Detailed explanation: International trade negotiations are complex and often lengthy processes. Japan's success in these efforts will be crucial in mitigating the long-term effects of tariffs and fostering economic growth.

Conclusion

Japan's Q1 2024 economic performance suffered from the uncertainty surrounding potential tariffs. The impact was felt across various sectors, from decreased exports and investment to increased inflation and weakened consumer confidence. While the government implemented mitigation strategies, the overall effect significantly hampered economic growth. Understanding the impact of potential tariffs on Japan's economy is crucial for formulating effective future economic policies. Further research and analysis are needed to assess the long-term consequences and to develop robust strategies for mitigating the risks associated with future trade disputes. Stay informed about Japan's Q1 economic performance and the ongoing effects of potential tariffs to make informed decisions.

Featured Posts

-

Japans Shrinking Economy A First Quarter Review

May 17, 2025

Japans Shrinking Economy A First Quarter Review

May 17, 2025 -

Ontario Budget 14 6 Billion Deficit Due To Tariffs And Other Factors

May 17, 2025

Ontario Budget 14 6 Billion Deficit Due To Tariffs And Other Factors

May 17, 2025 -

Quiet Living In Tokyo The Rise Of Soundproof Apartments And Private Salons

May 17, 2025

Quiet Living In Tokyo The Rise Of Soundproof Apartments And Private Salons

May 17, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywood

May 17, 2025

Wga And Sag Aftra Strike What It Means For Hollywood

May 17, 2025 -

Knicks Fans On Edge Latest Jalen Brunson Injury News

May 17, 2025

Knicks Fans On Edge Latest Jalen Brunson Injury News

May 17, 2025

Latest Posts

-

All Conference Track Athletes A Roundup Of Honorees

May 17, 2025

All Conference Track Athletes A Roundup Of Honorees

May 17, 2025 -

Track Roundup All Conference Honors Announced

May 17, 2025

Track Roundup All Conference Honors Announced

May 17, 2025 -

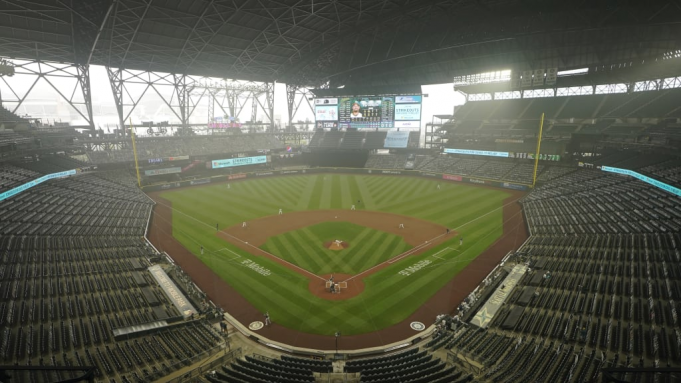

Mariners Tigers Opening Series Injury Concerns And Predictions March 31 April 2

May 17, 2025

Mariners Tigers Opening Series Injury Concerns And Predictions March 31 April 2

May 17, 2025 -

Josh Harts Wife On Jaylen Browns Crucial Game 5 Plays

May 17, 2025

Josh Harts Wife On Jaylen Browns Crucial Game 5 Plays

May 17, 2025 -

Seattle Mariners Vs Detroit Tigers Key Injuries And Series Outlook March 31 April 2

May 17, 2025

Seattle Mariners Vs Detroit Tigers Key Injuries And Series Outlook March 31 April 2

May 17, 2025